TAV Havalimanlari Holding: Stock Crashes, Remains A High-Risk Tourism Buy

Summary

- TAV Airports had a solid quarter from an operational perspective.

- One-off earthquake tax has been offputting, due to negative experiences with one-off taxes in the past.

- TAV Airport remains a buy even when taxes will be structurally elevated.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Aleh Varanishcha/iStock via Getty Images

When I covered TAV Havalimanlari Holding, also known as TAV Airports Holding (OTCPK:TAVHY) earlier this year, I marked it a buy as I saw no impact on tourism from the devastating earthquakes in Turkey. However, the buy rating I had might quite easily have had the worst return on any rating I issued so far. The stock lost nearly 25% of its value while the broader markets gained 8%. Since I covered the TAV Airport, the company has reported earnings which seemingly sent its stock prices lower. In this report, I will be analyzing the first quarter results.

How Do Airports Make Money?

So, how do airports make money? Airports have two revenue streams, the first one is aeronautics revenues that include landing and departure fees, passenger charges, terminal space rentals, security and aircraft parking. The second stream is non-aeronautical revenues which include things like car parking, car rental, ground transportation, retail, food and beverages and fast track.

So, there are two revenue streams that are well-suited to capitalize on the travel rebound. On one hand, we have airlines increasing their flight schedules again which benefits the airline via aeronautical revenues. On the other hand, the passengers are returning to the terminal halls and they have money to spend which benefits the commercial revenues which form a big portion of the non-aeronautical revenues.

So, as an airport to make money you have to appeal to airlines providing smooth operations and offer travelers a unique experience.

Why TAV Airports Holding Stock Could Be Attractive

Above I already outlined how airports make money. What potentially makes TAV Airports Holding attractive is the fact that Turkey is a tourist destination for many people. You could say of course that with the recent earthquakes in Turkey, tourism might weaken. That holds true if tourists are fear infused by the earthquakes rather than fact driven. Because the fact is that many tourist destinations are in central and west Turkey and the earthquakes were in the east.

TAV Airports operates or owns five airports in Turkey, all of which are situation in Central Anatolia, the Mediterranean and the Aegean region. Rational thinking would suggest that there shouldn't be a significant adverse impact on tourism if any and particularly for the airports operated by TAV Airports. Beyond that, tourist destination airports in Tunisia are also operated and perhaps the 15% share in the airport of Zagreb could be growth story with the accession to the Schengen Area. Being focused on tourist destinations primarily, seasonality is of course an item but we also saw TAV Airport making its business less seasonally impacted by signing a share purchase agreement in 2020 for Almaty Airport in Kazakhstan in an attempt to cover the loss of the closed airport in Istanbul. Furthermore, with its global exposure the Turkish revenues only account for 37% of the business now.

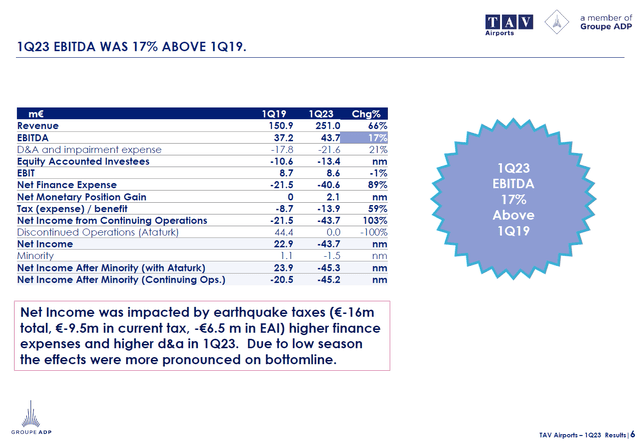

Results Show Earthquake Pressure

In March, I explained that I saw no pressure on demand for air travel to and from Turkey as a result of the earthquakes and I was not wrong there. However, I was wrong equating that to there being no financial pressure. Revenue rose 66% on international pax on comparable basis being 21% higher and EBITDA grew 17% which I believe are strong numbers given inflationary costs pressures that do exist. However, most problematic in the earnings release was the earthquake tax of €16 million. In 1999, after the earthquake in Izmir a so called earthquake tax was introduced which was supposed to be a temporary tax. This then became a permanent tax and following the March earthquakes this year a one-time tax was instated. You can already guess what investors are skeptical about. There are grave concerns that the one-time tax is in fact not a one-time tax and will be more of permanent nature which will hurt shareholder value creation.

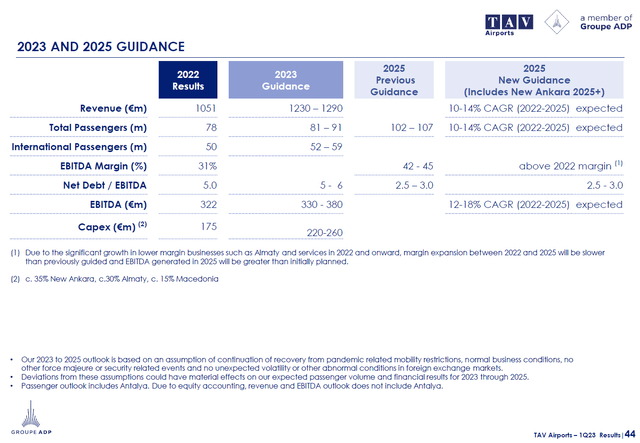

TAV Airport Holdings: Guiding For A Strong 2023

For 2023, the guidance has been maintained. We see that growth is expected in all metrics including negative movement on the leverage, which is driven by the continued expenditures as seen by the CapEx increase. From EBITDA perspective, at the midpoint 10% growth is expected which is below the projected revenue growth. The projections towards 2025 have come down somewhat due to low margin business growth but overall the longer term expectation is that EBITDA growth will start outpacing revenues and we will see some investments such as Almaty Airport come into play as well as the new Antalya Airport concession for which a joint venture of Fraport and TAV has won the concession starting 2027 until 2051 and upgrades to the airport should bolster its capacity and revenue potential.

TAV Airports Holding Stock: Still A Buy?

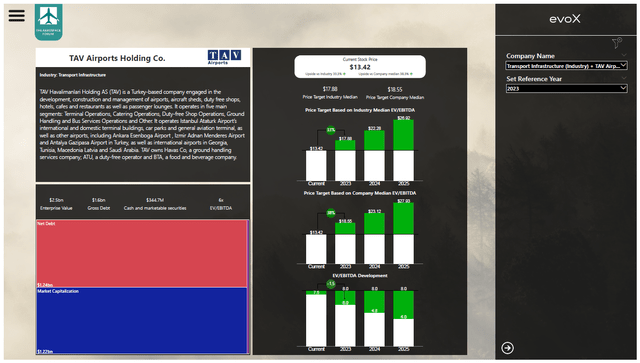

I processed all numbers into the interactive valuation model that we will make available to subscribers of The Aerospace Forum. Based on these numbers, around 33 to 38 percent upside exists. Even if we assume that taxes will pressure the company by 10% in line with the one-off tax rate then 20 to 24 percent exists for this year. So, I would say that the sell off has been somewhat of an overreaction and possibly created an attractive entry point.

Conclusion: TAV Airports Holding Stock Remains A Diversified Airport Buy

While TAV Airports Holding no longer pays a dividend and we have no line of sight on when that dividend might be reinstated, I can appreciate that the dividend is suspended to make investments towards revenue generating initiatives. TAV Airports has to replace the missed results from the closure of Istanbul Atatürk Airport and they are making those investments now, and as air travel grows and the investments start adding more towards the business, we should also see that dividend being reinstated. So, it is not really about an inability to pay a dividend, it is a conscious choice to invest it into airports that should help the business regrow.

The business is focused on tourism and the Almaty airport reduces that a bit, but overall I do like the geographic distribution where TAV services are offered in 108 airport in 29 countries with a reduction of the share of Turkish revenues. In the first quarter, the Almaty Airport accounted for 34% of EBITDA showing that the investment is paying off. The drag on results was the earthquake tax and I think that has impacted the share price because apart from that the results were pretty solid. With President Erdogan running for another things are not boding well for the Turkish economy and that provides a risk, though diversification and continued tourism strength provide some alleviation to said risk.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.