REET: Issues As Hawks Circle Above

Summary

- REET is not going to be able to escape the higher cost of capital, and the Fed seems determined to keep going with hikes.

- While REET has a lot of exposure to resilient categories that should be able to withstand higher rates, as a global value-weighted REIT, it has a lot of offices.

- We continue to worry about office exposures, especially as investment banks are expecting real estate to be one of the main loci of restructuring activity.

- Real estate REITs should be a safe investment, so prices remain high. If you want to speculate, it makes sense to do it elsewhere when looking for value. REET isn't great.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

ExperienceInteriors

The iShares Global REIT ETF (NYSEARCA:REET) tracks a pretty vanilla portfolio of REITs, which means there's a fair bit of exposure that we don't love. In particular, we remain wary of offices, where WFH has persisted longer than anyone expects despite COVID-19 hysteria fading into the rearview. Investment banks are looking to real estate for a restructuring boom, and even the largest and most premier office locations in cities like Manhattan are seeing REIT CEOs concerned about vacancy rates and risks that clients downsize their office footprint. On the other hand, tougher economic conditions could weaken employee bargaining positions, and there is a chance that employees fold into a return to office regime.

REET Breakdown

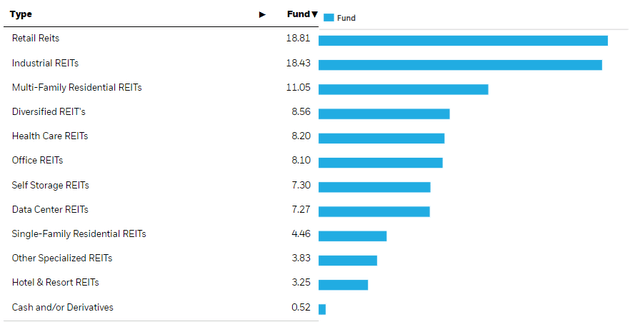

REET is a pretty large and diversified REET ETF that takes value-weighted exposures of the real estate markets based on market values of various listed REITs. Some initial large exposures include some more specialized residential holdings, like Public Storage (PSA) (self-storage REIT) and Welltower (WELL), which cater to the specific markets of residential storage and elderly care homes. Equinix (EQIX) gets a decent 5-6% allocation as a specialty REIT exposure. Otherwise, the sector breakdown is as follows:

Breakdown by Sector (iShares.com)

Before we discuss offices, it's worth mentioning that some of the large holdings are relatively dependent on cost of capital. Equinix, while benefiting from network effects on providing real estate for IX exchanges where peering occurs, which is an important cost-saver for ISP networks and other large networks, also relies on buildouts in order to drive their demand side economics. This interacts poorly with an environment where cost of capital is higher, and Equinix's returns to a low interest rate environment where it is extraordinarily high. Industrial REITs suffer in much the same manner, where industrial footprints are capitally intensive to develop and are more sensitive to economic conditions and the level of economic activity. Residential is also a concern, as this is the first sink of household savings, and households will be under pressure from higher interest rates. Even data center REITs, while a more resilient market, are going to be sensitive to higher rates since their valuations are likely associated with exceptionally long horizons.

Offices

The main issue lies in offices. Investment banks have begun to foresee an imminent recovery in restructuring activity, which has long been in a trough. One of the key areas where they expect activity is in real estate, especially commercial office real estate. Offices have already been the locus of some important bankruptcies, and with a lot of the loans extended to offices coming from regional banks, the assets in the office ecosystem could be subject to fire sale risks, where fire sales of the debt could begin to raise costs of capital for office development in particular. While the fire sale risk is relatively limited given regulatory action to control bankruptcies of regional banks and have their assets moved to larger bank balance sheets, these assets will definitely not be the highest performing ones and may actually be the trigger for issues at regional banks.

As a diversified REET, the plus side is that expense ratios are low at 0.14%, but it's not like real estate has seen discounts consistent with the rest of the markets. Real estate still commands a premium, with P/CF ratios close to 14x despite issues in several subsegments of the real estate market and general sensitivity to the cost of debt. Moreover, REET offers very little actual yield at only 2.45%.

Without the income proposition, and with valuations at risk especially as the Fed continues to give off hawkish signals around monetary policy, REET does not appear to be such a good pick, but mainly because of the relatively large office exposure. In general, we are underweight real estate - some classes of real estate are going to be resilient, and benefit from rent hikes that can be easily paid by solvent tenants, but cost of debt issues, and in REET's case the quite large 8% exposure to offices, where major market like even Manhattan seem at major risk from WFH, make it unappealing compared to other market propositions. Weaker economy and more desperate employees might help to encourage an office return, but it's a risky bet, and if that fails, office values will be permanently impaired as demographics in office districts and those surrounding them will take a major turn for the worse, in addition to redevelopment costs.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.