Target: Making Sense Of The Boycott Calls And Q1 Earnings

Summary

- In this article, I take a close look at what's going on with Target. Let's make sense of the boycott call and the most recent earnings.

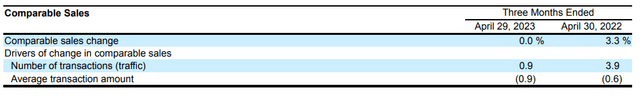

- Target's Q1 was mixed. The increase in traffic is completely offset by the fact that consumers pay less on average - that's why TGT's revenue didn't move.

- Target's buybacks are on pause. The ROIC to fall from 25.3% to 11.4% in Q1. But the inventory situation is improving.

- Target faced controversy and backlash after launching its "PRIDE" collection, described as LGBTQ+-friendly clothing for kids.

- Even with a possible sharp decline in sales in the next 2 years, the TGT stock appears severely undervalued according to my DCF modeling.

- I do much more than just articles at Beyond the Wall Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Introduction

Sundry Photography

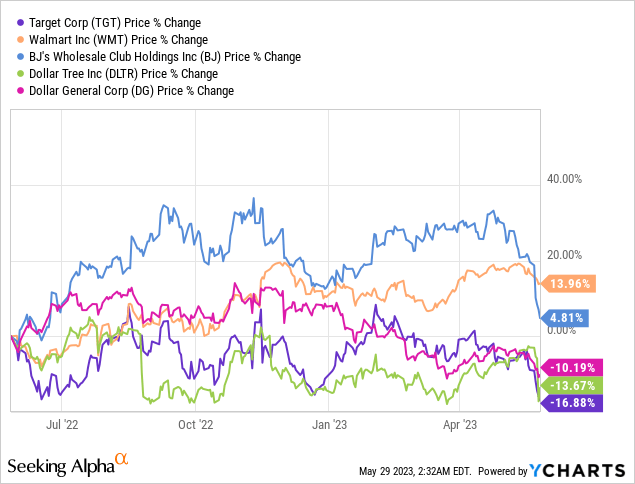

One of my regular readers recently asked me to look at the growth prospects of Target Corporation (NYSE:TGT), and I gladly agreed because this company seemed interesting enough to investigate. First, TGT's stock has lost the most in the last year among companies of roughly the same size in the consumer staples retail category:

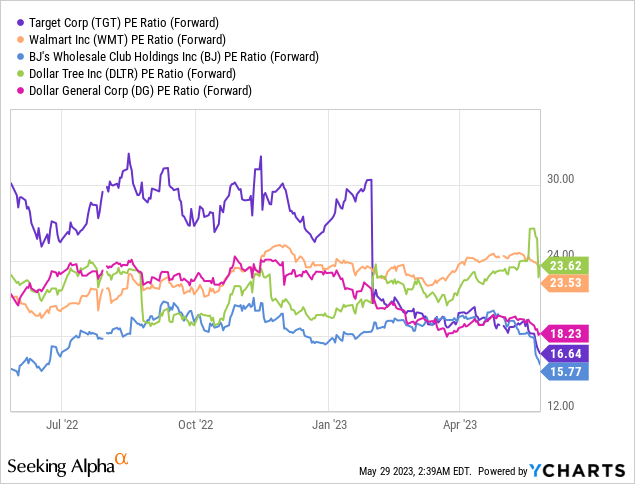

Second, the sell-off we see above led to an apparent undervaluation if we look at the forwarding price/earnings ratios of the group:

However, we know from practice that lower multiples aren't the key to a stock's success. Let's take a deeper look into the recently released quarterly results of TGT and try to figure out the company's growth prospects.

Target's Q1 FY2023 Financials Were Mixed

The TGT stock closed at $160.96 before the report was released on May 17, 2023. However, despite the analysts' findings that the results exceeded the bearish forecasts, TGT is currently trading at $138.93 per share, representing a significant drop of approximately 13.4% at the time of writing.

Target's margins performed better than anticipated, despite dealing with excess inventory and retail theft, according to Wells Fargo analyst Edward Kelly. Morgan Stanley described the quarterly update as neutral in the bull-bear debate but acknowledged Target's potential for profit recovery. JP Morgan took a more bullish stance, emphasizing margin and inventory improvements.

Target Corporation's Q1 FY2023 results showed a 4.8% decrease in EPS to $2.05, beating estimates though by 14.7%, according to Seeking Alpha's data. Comparable sales remained flat in Q1, below the consensus estimate, with in-store sales rising 0.7% and digital sales declining 3.4%. Target highlighted its focus on convenience and customer response, but customers expressed concerns about inflation.

The company's Q2 outlook fell below expectations. Target expects a decline in Q2 comparable sales in the low single digits, with EPS projected to be between $1.30 and $1.70, lower than previous estimates. The company maintained its full-year EPS guidance of $7.75 to $8.75 [P/E of ~17x], centered around flat comparable sales. Target experienced an increase in gross margin due to lower freight costs, price increases, and lower clearance markdown rates. However, theft resulted in a projected $500 million profit drag from shrinkage.

Argus Research analyst, Christopher Graja, CFA [proprietary source], adjusted his estimates based on the Q1 results, lowering the FY2023 EPS estimate to $8.40 and reducing the Q2 estimate to $1.52. Target aims for a five-year EPS growth rate of 7%, with anticipated sales growth of around 3% and an operating margin of 5.7% by FY2025, according to his calculations. The company's ability to navigate inflation and drive sales growth will be crucial moving forward, he notes.

Among the positive moments of the first quarter, we can highlight the traffic growth, which according to the CEO has already continued for 12 quarters:

Even in the face of all these challenges we're continuing to see deeper engagement from our guests. That's most visible on our traffic, which grew just under 1% in Q1 and has now grown for 12 consecutive quarters. In fact, since 2019, prior to the pandemic, first-quarter total sales have increased more than 43%.

Source: Earnings Call Transcript [Q1 FY23], author's emphasis added

The increase in volume is completely offset by the fact that consumers pay less on average - that's why TGT's revenue didn't move.

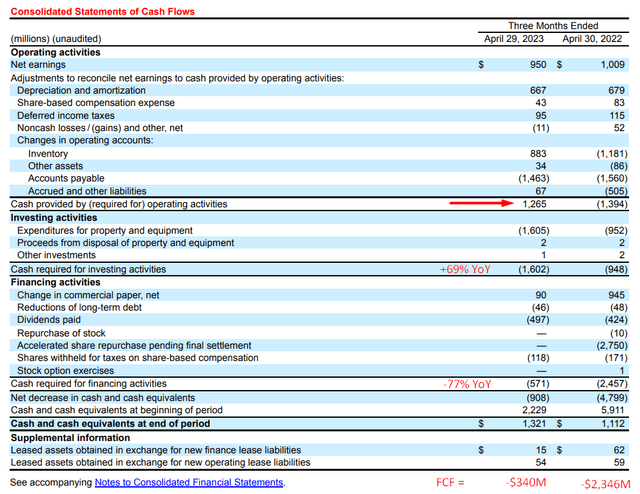

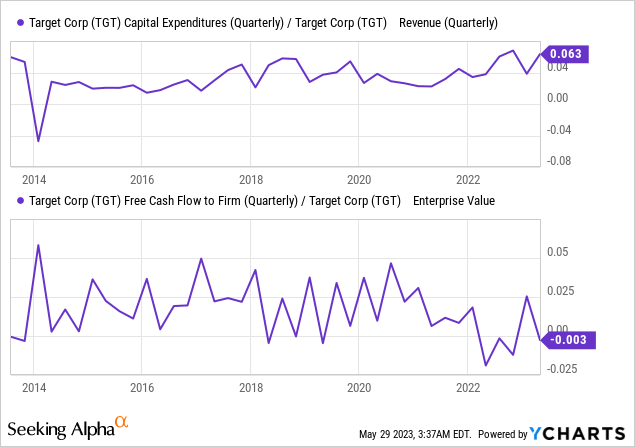

On the negative side, I don't like the fact that the company is increasing its capital spending amid an apparent stagnation in its top-line growth. In the first quarter of fiscal 2023, the ratio of capital expenditures to sales was over 6%, while FCFF [free cash flow to firm] fell from positive to negative.

During the earnings call, management talked mostly about good inventory management - but for some reason, executives said nothing about accounts payable, which has also fallen dramatically on the company's balance sheet, weighing on cash flow from operations. In terms of credit, the reduction in accounts payable seems appropriate because it reduces the company's current liabilities [meaning fewer obligations]. However, these payables are essentially free, which explains the negative impact of their reduction on working capital on the balance sheet.

Meanwhile, long-term debt has increased by almost 20% over the past year - and this is against a backdrop of rising interest rates.

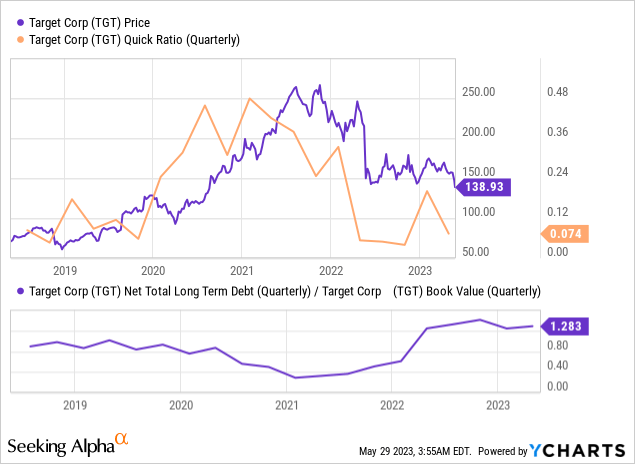

In Q1 FY23 the cash balance fell to $1.3 billion, which is 40.7% lower QoQ, but 19% higher YoY. Seeking Alpha's data shows that TGT has a total debt-to-equity ratio of ~165%, which is a lot, in my view. And despite the decline in accounts payable in current liabilities, the quick ratio continues to decline, miraculously leading the stock price, which may just be a coincidence [or not].

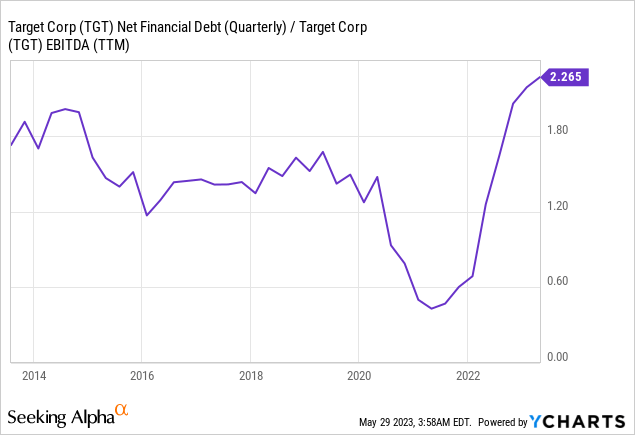

Net debt to EBITDA, another indicator of a company's creditworthiness, continues to reach 10-year highs in TGT's case, which in itself isn't a good sign if you ask me.

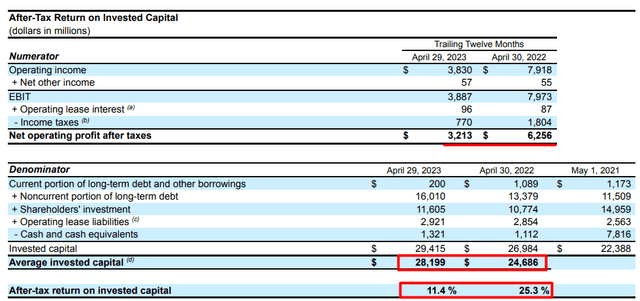

The simultaneous increase in debt on the balance sheet and the nearly 2-fold year-on-year decline in EBITDA caused the company's ROIC to fall from 25.3% to 11.4% - that's a lot.

In Q1 FY2023, Target Corporation did not engage in any share repurchases. As of that quarter, the remaining dollar value of shares that can still be purchased under the repurchase program amounted to $9.7 billion.

I suspect TGT won't be buying shares anytime soon despite the decline in share price - management is critical to maintaining stable credit ratings. So strong support for the stock through buybacks should not be expected - I think that's best in the long run, as TGT would be better off focusing on strengthening its balance sheet.

Boycott Calls Over LGBTQ+ Kids' Clothing

The relatively mixed financial results I described above have likely contributed only a small part to the continued decline in TGT shares we have seen since the report was published. There is also non-financial news that I believe has had a much larger impact on share price action.

Target faced controversy and backlash after launching its "PRIDE" collection, described as LGBTQ+-friendly clothing for kids. The backlash led to calls for a boycott on social media, causing the retailer to experience a significant decline in market value [~$10 billion in 10 trading sessions], based on NYP's report.

This situation reminds me of what happened to Anheuser-Busch (BUD) in early April when it teamed up with transgender influencer Dylan Mulvaney. At the time, Kid Rock's firing of cases of Bud Light didn't lead to a massive sale of BUD stock because the stock wasn't expensive - the viewpoint of SA's fellow JR Research.

In the case of Target, it's remarkable how quickly management reacted to the emerging backlash and threats - the retailer decided to make adjustments to its plans and remove certain items from its store.

NYP [May 28, 2023], author's notes![NYP [May 28, 2023], author's notes](https://static.seekingalpha.com/uploads/2023/5/29/49513514-16853481547258487.png)

While no specific details were provided, some of the items that sparked controversy included "tuck-friendly" trans women's swimsuits for kids.

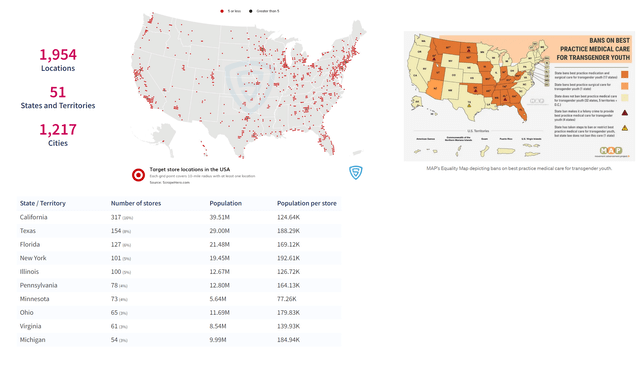

At the moment, it's quite difficult to assess how Target's store traffic will change as a result of growing dissatisfaction. One way to gauge the extent is to look at a map of states where Target has a strong presence and compare it to states that have enacted bans on medical care for transgender youth [a pretty reliable sign of LGBTQ+ intolerance, in my opinion].

Author's compilation, different data sources

Among the company's largest regions where traffic can really suffer are Texas and Florida, which together account for about 16% of the company's total revenue. That's quite a lot, so I think there's a reason the market reacted so negatively to the scandal.

But to what extent does the fair value of the stock match this negative sentiment?

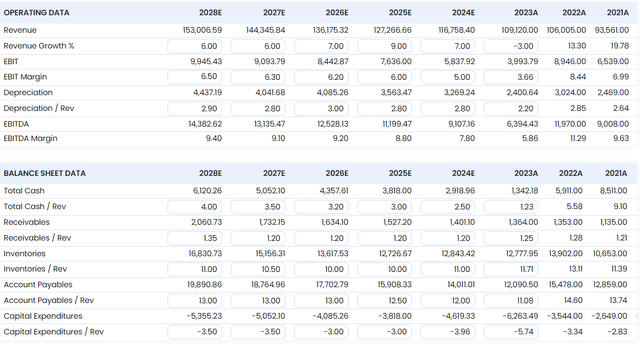

I'll use the DCF model developed by Stratosphere - it's based on a standardized set of parameters that I can adjust to my own inputs. For fiscal 2023, I'll take the TTM values from Q1 results and assume that full-year revenue will decline by 3%. This forecast includes both a further decline in average check per customer and the risk of lower traffic due to the recent scandal. Next year [E2024], revenue will grow 9% YoY according to my calculations, and then TGT's top-line growth will slow by 100 basis points by the end of the forecast period [FY2028 = 6%].

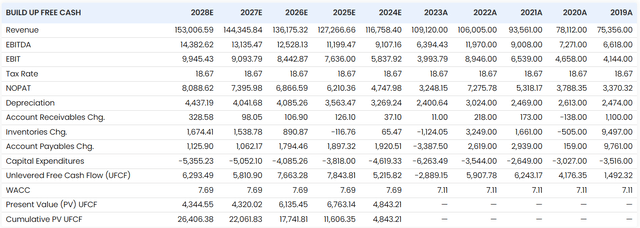

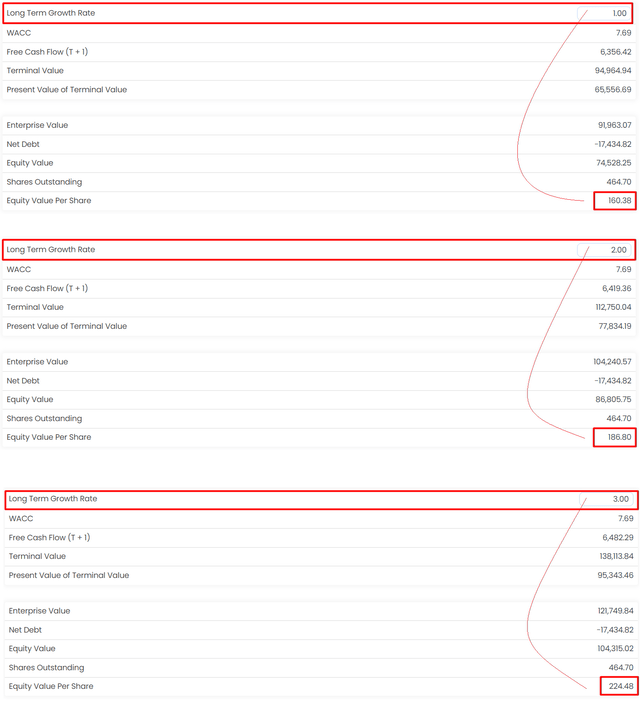

In general, I expect a soft return to normalcy - that applies to both CAPEX-to-sales and working capital ratios, which will drive FCFFs. The same is true for the margin forecast - I expect the EBIT margin to return to 6.5% by E2028, the same as it was in the pre-Covid years [the average EBIT margin in 2014-2019 = 6.52%]. Here are the outputs my calculations come up with:

One way to find a company's cost of debt is to look at the yield to maturity on its bonds. TGT has bonds maturing in 7 years [ISIN: US87612EBH80] that, using the market price at the midpoint of the bid-ask spread, yield 4.32% to maturity - this is Target's cost of debt. Using a risk-free rate of 3.8% derived from 10-year treasuries, and assuming the market's risk premium of about 5%, the resulting WACC for Target should be 7.69%, which I believe is relatively optimistic.

In this case, the build-up free cash flow will be calculated as follows:

Using different Gordon's g rates, the model shows TGT's underestimation assuming growth of 1% to 3% in perpetuity:

Stratosphere, the author's compilation

TGT's mid-range growth rate of 2% in perpetuity gives $186.8 per share, 34.5% above the current share price. From this, we can conclude that TGT was sold off for absolutely nothing - the current intrinsic undervaluation cries out for a strong buy signal. But there are some risks that I must mention.

Risks To My Buy Rating

First, my DCF model says that revenues will only decline 3% this year and then grow through E2028. If we assume that revenues fall 10% in FY2023 and another -5% in FY2024 [and grow 5% per year thereafter], then the fair value of TGT falls to $148.61 per share, all else equal:

Note: surprisingly, this is still almost $10 higher [7%] than the stock price at the last close of trading.

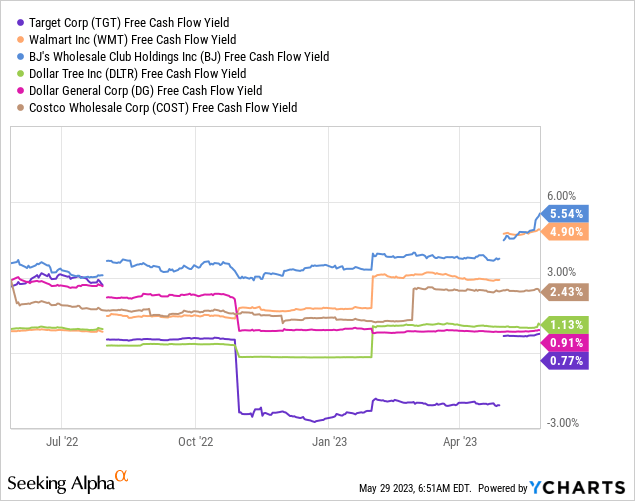

Second, my model is based on the assumption that TGT will eventually return to the pre-COVID margin levels, which may not be the case. However, the current reality is that the FCF yield - another valuation analysis metric - indicates that TGT appears to be a grossly overvalued company, contrary to all my DCF assumptions.

The third risk is extremely poor technical signals. The price action triggered by the boycott fears puts TGT stock in a vulnerable position, in my opinion, as the stock is forced to fight for its local weekly support at $135-140.

TrendSpider Software, author's notes

On the other hand, I highlight the oversold zones on the weekly chart, consistent with what is happening now. Perhaps the fall of the price onto the current local support will activate buyers - if the optimism in the market continues.

This is the 5th but not the last risk for TGT - the macro environment. I've written more than once that the market is currently in a greedy zone, and with a liquidity crunch looming, I expect tough times for equities as an asset class. TGT's shareholders beware.

The Verdict

Despite wild swings in TGT stock in the recent past and new risks for the foreseeable future, I think TGT is a fundamentally undervalued stock when we talk about the long-term holding period. Yes, recently management has made moves that aren't entirely "socially responsible" in my opinion, raising doubts about the resilience of the company's traffic dynamics. However, if we predict relatively modest growth rates and a return to normalcy, then TGT 's stock starts to look attractive. Of course, the question is whether it's advisable to increase capital spending in light of all the macro problems in the U.S. I'd also like to see share buybacks resume in the future - perhaps sometime in 2024 or late 2023. In any case, I don't think there is any reason for long-term investors to worry too much about current events.

Thanks for reading!

Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TGT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.