AIEQ: Don't Be A Beta Tester, Avoid This Poor-Performing AI-Powered ETF

Summary

- The AI Powered Equity ETF has underperformed against all major market segments since its launch in 2017. To demonstrate, this article compares AIEQ's annual returns against nine passive alternatives.

- AIEQ's investment objective is to select stocks with a high probability of outperforming over the next twelve months. However, in the last year, its portfolio turnover rate skyrocketed to 1,700%.

- This feature is not a mark of confidence. Substantial changes are routine, and AIEQ does not consider ultra-concentration in any particular industry problematic. Semiconductors total 30% of today's portfolio.

- I rate AIEQ a "strong sell", and urge readers to avoid any AI-hype when it comes to building a well-diversified portfolio for the long run.

Shutthiphong Chandaeng

Investment Thesis

The AI Powered Equity ETF (NYSEARCA:AIEQ) is the first actively-managed ETF powered by artificial intelligence, using millions of data points to select between 30-200 U.S. stocks that have a high probability of success over the next twelve months. By harnessing the power of IBM Watson, this machine-learning-driven model claims to "equal a team of 1,000 research analysts, traders and quants working around the clock", according to its fund page. If true, AIEQ's 0.75% expense ratio is a small price for access to such expertise.

Unfortunately, AIEQ's performance since its October 2017 launch has been disappointing. It's well-known that AIEQ has lagged behind the SPDR S&P 500 ETF (SPY). Still, my performance analysis demonstrates that it consistently underperforms all other major market segments. Furthermore, my fundamental analysis illustrates how AIEQ is volatile and concentrated with an excessive portfolio turnover rate. AIEQ may use machine learning to select stocks, but it's still in beta testing, and no investor should sign up for it. Therefore, I rate AIEQ as a "strong sell," and I look forward to explaining why in further detail below.

AIEQ Overview

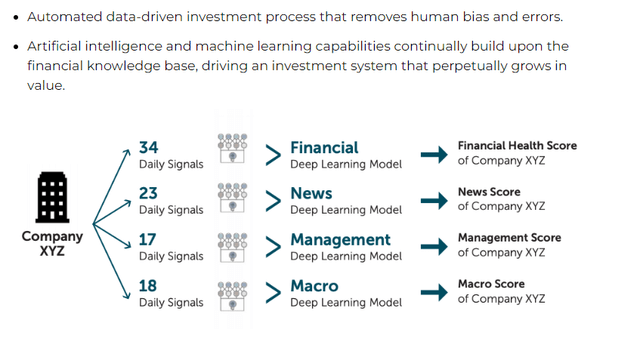

ETF Managers Group asks you to consider these reasons for investing in AIEQ:

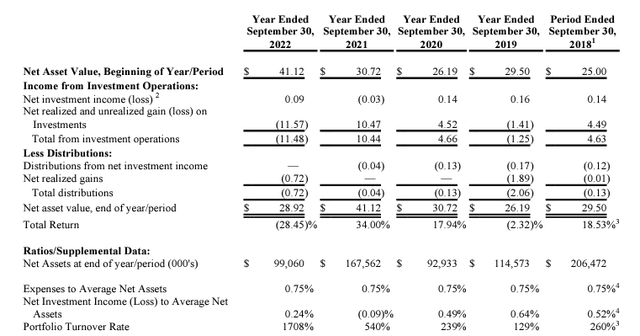

As shown, four separate learning models are based on financials, news, management, and macro signals. These models inform AIEQ's fund manager when to make changes, which are typically frequent. AIEQ's portfolio turnover rate for the year ended September 30, 2022, was 1,708% and 540% in 2021.

Although high, the portfolio turnover rates for 2019-2020 seem tame compared to 2021-2022. I usually look at an ETF's fundamentals, but with turnover rates this high, it's not very valuable because the portfolio constantly changes. Instead, it's all about performance, so let's dive into that next.

AIEQ Performance

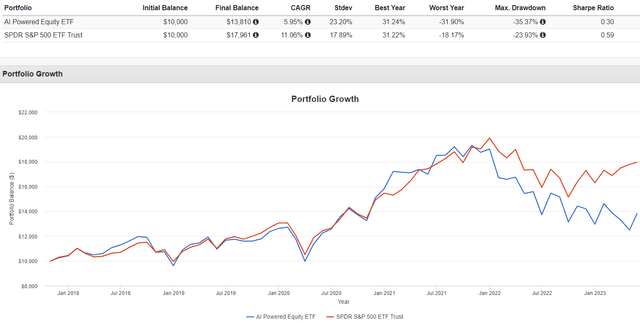

To date, analysts have focused on AIEQ's performance relative to SPY. Charts like the one below are why AIEQ has received poor reviews.

As shown, AIEQ held up reasonably well in its first few years, then sank, resulting in annualized returns that are more than 5% worse than SPY (5.95% vs. 11.06%). In addition, volatility was much higher, leading to substantially lower risk-adjusted returns (Sharpe Ratio). AIEQ may have doubled SPY's returns in January 2023, but the picture isn't pretty when you zoom out.

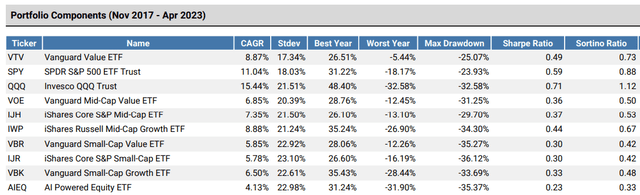

However, we must be fair and recognize that AIEQs selection universe is not the S&P 500 Index. Even today, AIEQ holds 69/125 stocks (35% of the total weight) in companies with market capitalizations below $13.6 billion, S&P's minimum for the large-cap segment. Therefore, we should do a more thorough performance analysis to determine how AIEQ performed against the other segments. To keep it simple, I selected the following nine largest ETFs by AUM in each of the following categories:

- Large Value: Vanguard Value ETF (VTV)

- Large Blend: SPDR S&P 500 ETF (SPY)

- Large Growth: Invesco QQQ ETF (QQQ)

- Mid Value: Vanguard Mid-Cap Value ETF (VOE)

- Mid Blend: iShares Core S&P MidCap ETF (IJH)

- Mid Growth: iShares Russell Mid-Cap Growth ETF (IWP)

- Small Value: Vanguard Small-Cap Value ETF (VBR)

- Small Blend: iShares Core S&P Small-Cap ETF (IJR)

- Small Growth: Vanguard Small Cap Growth ETF (VBK)

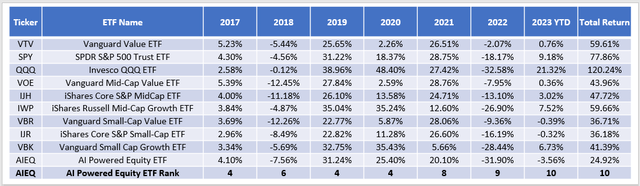

Now let's rank them by year. Please note that in the table below, 2017's returns include only November and December, and 2023's returns are through April. My data source is Portfolio Visualizer and assumes reinvested dividends.

This table highlights how AIEQ was an average-performing ETF until 2021, ranking either #4/10 or #6/10 and even slightly outperforming SPY on compounded returns (15.63% vs. 14.76%). However, AIEQ's ranking was #8/10, #9/10, and #10/10 from 2021-2013. Curiously, according to this archived article I found promoted on AIEQ's website, the ETF exited mega-cap stocks to begin 2022. While that was the right call, its replacements did not fare much better. AIEQ declined by 31.90% last year compared to 32.58% for QQQ. It's also missed out on QQQ's 21.32% recovery YTD through April, declining by 3.56%.

It's not a coincidence that AIEQ had a high portfolio turnover rate these years. Remember this statement, sourced from AIEQ's "Investment Process" section on its fund page (emphasis mine):

The models identify approximately 30 to 200 companies with the greatest potential over the next twelve months for appreciation.

If the AI identifies high-potential companies set to outperform over the next twelve months, it doesn't make sense to change up its holdings so frequently. Instead, the AI appears focused on the short-term, and its 4.13% annualized return through April 2023 ranked the worst. Finally, as the table below notes, AIEQ's risk-adjusted returns (Sharpe and Sortino Ratios) were the worst, failing its stated investment objective to deliver a "maximum risk-adjusted return versus the broader U.S. equity market."

Current Portfolio Analysis

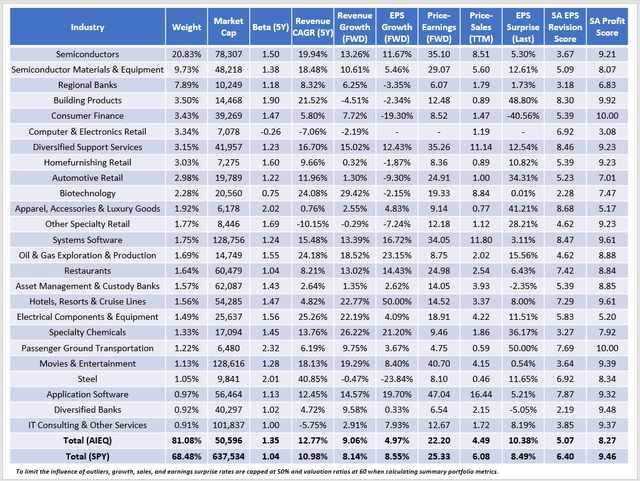

As mentioned, evaluating an ETF's current composition is crucial to my investment research process. However, it's less valuable here because of the high portfolio turnover rate, so take this section with only a grain of salt. The table below highlights selected fundamental metrics for its top 25 industries comprising 81% of the portfolio.

One feature is AIEQ's 1.35 five-year beta. Based on historical standard deviation figures, this is standard. Second, over 30% of the portfolio is devoted to Semiconductor and Semiconductor Materials & Equipment stocks. Evidently, the model does not consider Modern Portfolio Theory and the benefits of diversifying to reduce risk. This is a significant drawback if the intent is to use AIEQ to replace SPY.

AIEQ ranks well on historical and estimated sales growth, leading SPY by 1-2%. However, its estimated earnings growth rate is just 4.97%, about 3.5% less than SPY. A high allocation to Regional Banks and Building Products contributes to the relatively poor growth rate. These securities trade at low valuations, so I assume that's why they were selected. Overall, AIEQ trades at 22.20x forward earnings, or three points cheaper than SPY, but its profitability score is notably lower (8.27/10 vs. 9.46/10). Therefore, the discount is warranted to some extent.

Finally, AIEQ's selections delivered a weighted average 10.38% earnings surprise this quarter compared to 8.49% for SPY. However, analysts are less optimistic over the next twelve months. After adjusting Seeking Alpha's EPS Revision Grades on a ten-point scale, AIEQ scored just 5.07/10 compared to 6.40/10 for SPY. This result is at odds with AIEQ's investment objective, so I'm not confident it places much emphasis on what professional analysts consider good value. The claim that its AI can replace 1,000 analysts is questionable since it appears few professional analysts would create a portfolio like this one.

Investment Recommendation

AIEQ is the AI version of a high-conviction portfolio manager with a terrible track record. Occasionally, I joke about how I'd love to invest in these managers' latest ideas, but unfortunately, I don't have any money left because I lost it all following their past picks. That's how I feel about AIEQ. After evaluating its past performance against nine low-cost passive alternatives representing the entire U.S. equity market, it delivered average gains from 2017-2020 and then awfully after that, leading to the worst long-term results. Furthermore, higher turnover coincided with these poor results, so AIEQ isn't operating as designed. Its investment process is to select stocks that should outperform over the next twelve months, not one. Portfolio turnover shouldn't be this high.

Given AIEQ's poor historical returns, excessive allocation to just a few industries, and strategy that seemingly ignores consensus opinion, I strongly urge readers to avoid this high-fee ETF. AIEQ may be driven my machine learning, but current shareholders are the beta testers, and unfortunately, they're paying the price for this experiment gone wrong.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.