JEPI Holders Should Consider Adding DXD To Avoid Worst-Case Scenario

Summary

- Covered call writing ETFs, such as JEPI, can be vulnerable to sharp market declines, potentially losing years of premium and dividends in a short period.

- Investors can consider adding a "disaster hedge" to their covered call ETF positions, such as an inverse ETF like ProShares UltraShort Dow30 ETF, to limit downside risk.

- Hedging can help protect assets during market downturns, but may also limit upside potential during market recoveries.

Henrik Sorensen

This article relates to JPMorgan Equity Premium Income (NYSEARCA:JEPI), but it is more about a risk I see in covered call writing ETFs in general. I have invested in covered call ETFs for about 15 years, and have also written covered calls against stock and ETF positions for myself, and for clients back when I was an investment advisor. And that is why this article aims to provide an idea that any fan of covered call ETFs, JEPI or otherwise, can consider.

The point of this article: protect your backside

Here is what I offer as a research point for covered call ETF investors, so as to guard against the worst-case scenario: that years of covered call premium and dividends are lost in a short period of time, and it takes years to recover that.

Because covered call writing ETFs have quickly become all the rage. And the asset surge in JEPI in particular smells to me a bit like the attitude portrayed in the classic movie "When Harry Met Sally," where the iconic line was "I'll have what she's having."

Collecting a big income payment is what many of us pursue as investors. Heck, my "brand" is Modern Income Investor." So here I'm showing one of several "modern income" techniques that go beyond simply buying a covered call ETF and assuming that you have your backside covered, so to speak.

1. Consider a "disaster hedge" on your covered call ETF position. I offer one here as an example, ProShares UltraShort Dow30 ETF (NYSEARCA:DXD), primarily because it hedges the Dow Jones Industrial Average, and JEPI's portfolio more closely resembles the Dow than the S&P 500, Nasdaq or Russell 2000 Indexes, all of which have single and double-inverse ETFs that investors can consider.

2. Leveraged ETFs are to be approached carefully. The math can work against them if they are held for a long time. They are more tactical vehicles, not buy and hold ETFs. That said, there are single inverse ETFs that, although they are also tactical vehicles, are naturally less volatile.

3. As with any ETF or other investment, before using any inverse ETF, an investor must do the research and self-reflection to determine why they want it in the first place, what role it should play in the portfolio.

4. Once that part of the process is done, selection (which inverse ETF or ETFs to consider), allocation (how much as a % of the portfolio), time frame (how long do you expect to own it) and sell discipline (at what point do you re-consider whether it should still be in the portfolio, or if the position size should be adjusted).

JEPI: overvalued, overhyped, both or neither?

After I wrote this article on JEPI back on May 5, I came to truly understand just how passionate its holders are about what they own. JEPI is suddenly the dominant player in this category. And, while the 150 or so comments I received implied that I was bearish on that ETF, I did not rate it in that article, and can only say that I'd like it better than if it were a $2 billion ETF, not a $25 billion ETF. There are issues that come with size, especially when opaque, private investment contracts are involved. That is the case with JEPI.

So, after receiving many comments brushing off the fact that the firm does not disclose the specifics of the Equity Linked Notes (ELN) that it uses to create and adjust its covered call option position, I called JP Morgan Asset Management. It was a very thorough conversation, and the person I spoke to there was very helpful. But the transparency issue still exists, as the firm won't disclose specifics of its ELN position.

Frankly, I'm with everyone else in assuming that a firm like that would only work with iron-clad, rock-solid counterparties. But I'd hope they'd at least disclose the strike prices, expiration dates and sizes of the contracts. As I see it, if I am outsourcing the covered call aspect of portfolio management, I want to know what I own. Not generally, specifically. That's the whole point of owning ETFs instead of mutual funds. Daily transparency, not monthly or quarterly, as is the case with mutual funds.

OK, enough said on that. I have no interest in owning JEPI at this point, but since $25 billion of investor assets feel differently, I wanted to offer a slight enhancement to the experience of owning JEPI or any other covered call ETF. It is as simple as owning, tactically, an inverse (or 2X inverse) ETF that counters the cryptonite that impacts all covered call ETFs when markets correct hard or crash: the covered call income only halts part of the decline. Similar to buffered notes, the blow is softened, but you still feel the hurt.

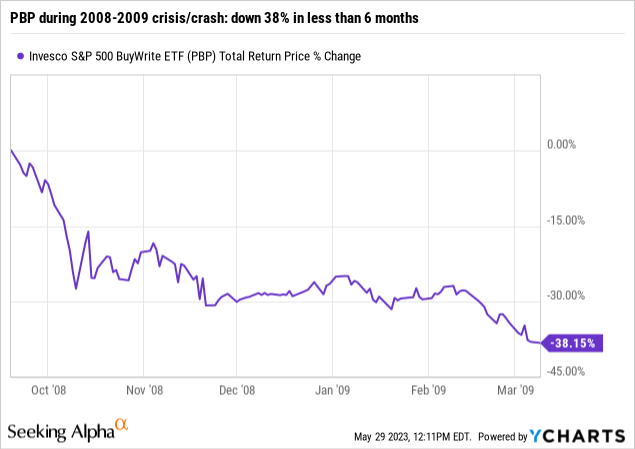

JEPI investors would not know this from owning that very popular ETF. That's because it debuted after the 2020 crash, when the S&P 500 fell by 33% in 5 weeks during the first quarter. JEPI debuted in late May of 2020, just over 3 years ago. However, there is, as they say in legal circles, precedent for seeing how covered call writing ETFs did in past crashes, even as far back as the 2008 debacle. I know because I managed money through it, and one of the many decisions I faced as a mutual fund manager back then was whether to incorporate covered call writing, directly by selling calls on my portfolio positions, via ownership of a few mutual funds that did that, or by owning Invesco S&P 500 BuyWrite ETF (PBP), which at the time was about the only game in town for ETF covered call writing. Its AUM peaked at over $400 million in 2014, and sits under $100 million today, as more progressive products, including JEPI, came along. But PBP does allow us to look back in time and see how covered call writing ETFs fared, and also how the concept of hedging such positions did to soften the downside risk.

Now, I'll build my case with a quick series of charts, then bring it back to the current market, and my suggestion that adding a bit of DXD or another inverse ETF to JEPI could be the type of "have my cake and eat it too" situation that I know I always appreciate as a career investor.

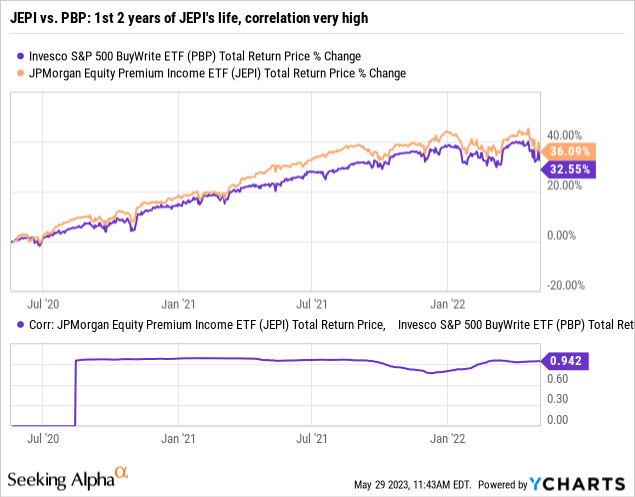

First, is PBP, that old relic of a covered call ETF versus the "cool kid" JEPI, even a reasonable comparison? The chart below tracks their progress from JEPI's 2020 inception through May 6 of 2022. I see a consistently high correlation, around 95% on average. So to me, that's enough evidence to conclude that I can use PBP's history in crashes to simulate what JEPI might have done if it had existed.

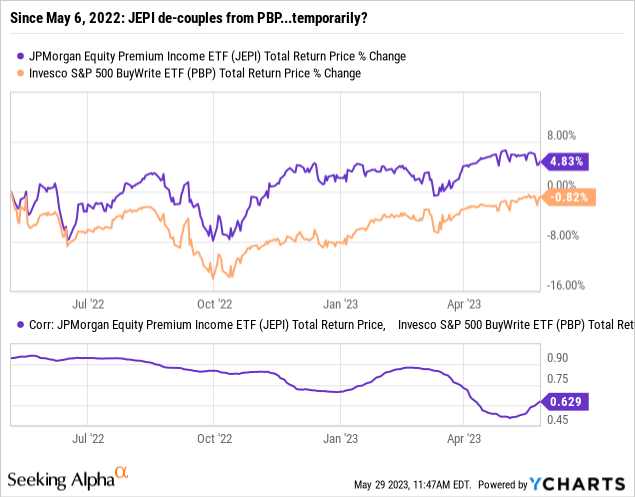

But of course it is not perfect. JEPI will outperform an S&P 500-related covered call ETF when its actively-managed stock portfolio does particularly well. Since May 6 of last year, it has de-coupled, at least a bit, and at least for those 12 months, from PBP's more regimented portfolio.

The converse is also true, in that JEPI's equity portfolio style will sometimes lag the broader market, perhaps by a lot. And we are seeing that in 2023, when JEPI's portfolio is lagging the S&P 500, primarily because JEPI's style doesn't allow it to own those high-flying, no yield stocks in high weightings, as the Nasdaq does. However, it gets some of that "juice" from writing covered calls versus the S&P 500 instead of its individual holdings.

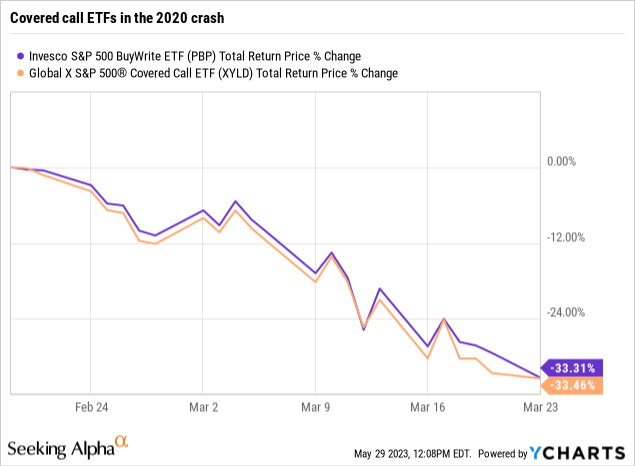

JEPI did not exist during the 2020 pandemic-induced crash I described earlier. But these 2 peers did, and they both fell every bit as much as the S&P 500 did. That is shown in the first of the 2 charts immediately below.

The second in that chart pair shows that back in 2008, when the S&P 500 fell hard, and didn't bottom until March of 2009, guess what? PBP, representing the covered call ETF peer group (as it was a group of one back then), fell with the market. So, when it comes to showing that unhedged covered call ETFs are not at all immune to sharp market selloffs, history is 2 for 2.

Conclusion: don't rely on that covered call income to protect your assets in a sharp market decline. There is not enough time to gather more option premium to offset the price declines. I think that sometimes, covered call investors forget that while the call premiums are nice to take in, the underlying stock portfolio is still unhedged. And that's my key point here.

Investors can certainly just look at this and say, "OK, then I'll just own a bit less JEPI or sell a little of it when the market tips over." I prefer to have the disaster protection at my side much of the time, abandoning only during the most rosy of market conditions, if at all. And currently, I continue to believe that this a high risk stock market, but one that offers potential for large short-term profits, at least until the current Nasdaq-craze-phase ends.

JEPI plus DXD = a smoother ride?

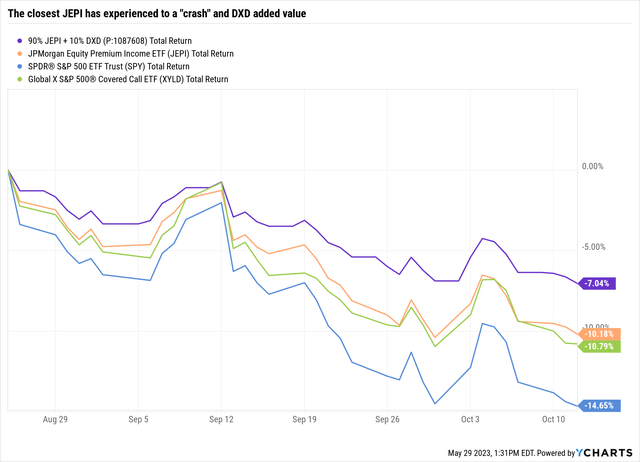

As I noted at the top of this article, adding just a pinch of hedge to a position like JEPI could make a difference. My weapon of choice for this example, as noted earlier, is DXD. A mix of 90% JEPI and 10% DXD (the 2X levered inverse ETF) cut the downside by 30% in the closest thing JEPI has seen to a rough market, a correction of under 15% in the S&P 500 from August to October, 2022. JEPI fell by 10%, but the JEPI-DXD combination kept that loss to 7%.

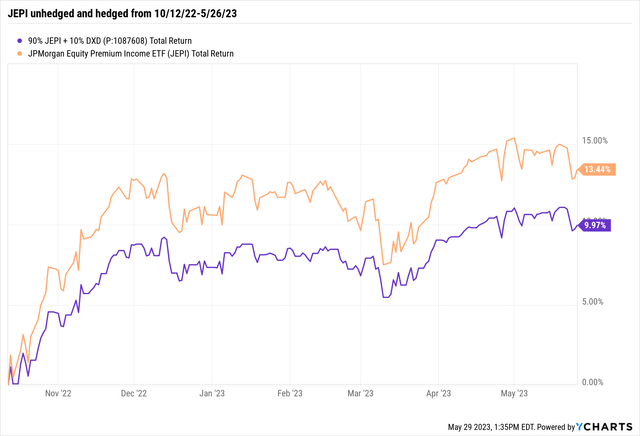

The natural next question is what happened when that quick correction reversed? Exactly what you'd think would happen. JEPI on its own outperformed a hedged JEPI as I created. Here's the chart below.

2008-2009: the ideal "crash test" for covered call writing ETFs

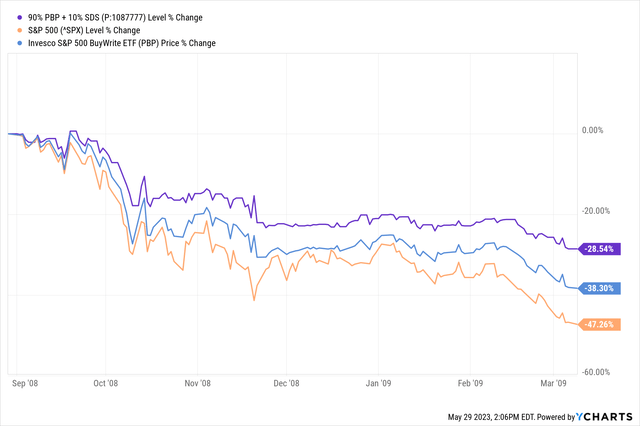

Finally, the chart above shows a portfolio mix I created, which is similar to the 90% JEPI + 10% DXD mix above. The difference is that I used peer ETFs to those 2 that existed back in 2008, allowing us to crash test the utility of adding a hedge as I have indicated throughout this article.

Would it have helped? The chart shows that when the S&P 500 fell by 47% from September 1, 2008 through March 9, 2009, the covered call ETF (PBP) captured 38% of that 47% decline. However, adding just a bit of hedge via ProShares UltraShort S&P500 ETF (SDS), limited the damage to "only" 28.5%. That's about a 60% "down capture" versus the S&P 500, so not bad for just a 10% double-inverse ETF allocation.

Conclusion: hedging can save some assets, for those who wish to consider and implement it.

The simple truth is that hedging works...both ways. It helps you on the downside, and hurts you on the upside. But here is the key thing to me as an investor in 2023, and looking forward another 1-2 years. Other than a Nasdaq-infused sprint for a little while longer, are we looking at a new bull market, where covered call writing ETFs will have the wind at their back? I apply a low likelihood to that scenario. I think it is far more likely that we'll see a period of stagnating equity returns, with occasional crashes thrown in. That makes the case for hedging in some form.

I write a lot about different ways to both hedge and exploit the type of markets we are in, and modern markets in general. In this article, using JEPI, DXD and others to exhibit some possibilities and provide some "hedge-ucation," so to speak, I hopefully added a useful dimension to the research process for some of my fellow covered call writing fans.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.