The Debt Ceiling Deal May Drain A Massive Amount Of Liquidity From The Market

Summary

- The debt ceiling uncertainty has led to excess liquidity being piled into stocks.

- However, that process is likely to unwind now that the limit has been increased.

- It will start with the issuance of new debt.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

Viorika/iStock via Getty Images

The debt ceiling headlines have been a significant tailwind for stocks, primarily due to the draining of the Treasury General Account (TGA) and the flight to safety into mega-cap stocks. However, with an agreement reached to increase the debt ceiling, the dynamics should reverse, creating a sell-the-news event.

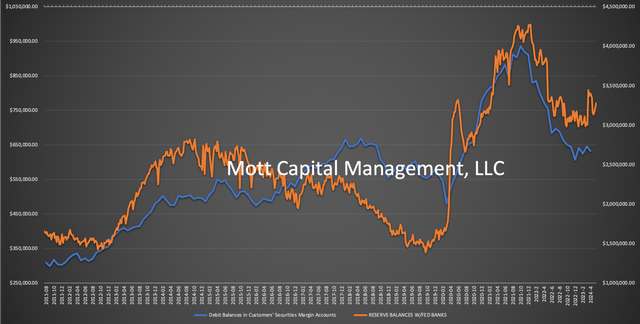

The TGA's depletion, resulting from reduced debt issuance, has benefited the market by freeing-up reserve balances. However, as the debt ceiling is raised and new debt issuance occurs, the TGA will likely see a substantial increase.

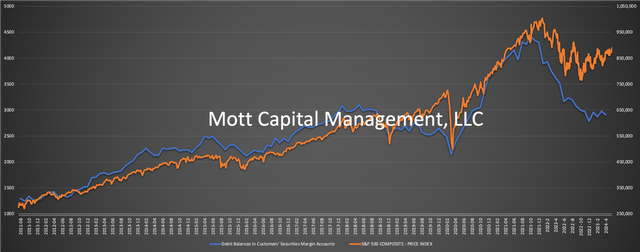

As the TGA rises and reserve balances decrease, there is a potential for liquidity to be drained from the market. The relationship between the TGA and the S&P 500 has been evident over time, suggesting that once the TGA rises again and reserve balances start to fall, the S&P 500 could reverse its trend and move lower.

The amount of money flowing back into the TGA and the source of funds used to buy the newly issued debt will play a crucial role in determining the magnitude of the reserve balance decline. This, in turn, could trigger a de-leveraging process. Historical data from FINRA indicates a lasting relationship between reserve balance and margin levels, further supporting this notion.

As the Treasury General Account (TGA) increases, it represents a liability on the Federal Reserve's balance sheet. Consequently, an increase in the TGA will likely result in a decline in reserve balances. This decrease in reserve balances can lead to a reduction in margin levels within the market.

When margin levels fall, liquidity is effectively withdrawn from the market, initiating a de-leveraging process. This can impact market participants who rely on margin borrowing to finance their investments. As margin levels decrease, it can create selling pressure and contribute to market downturns.

Flight-To-Safety

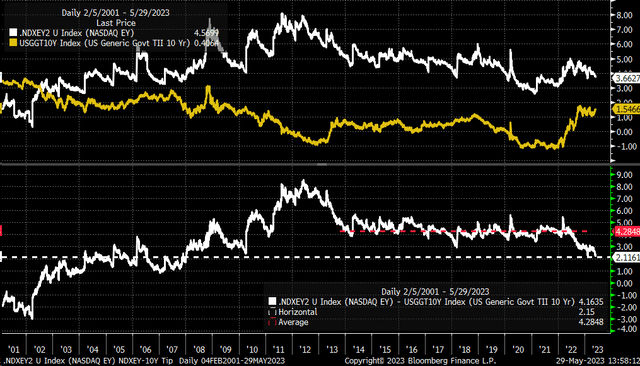

There has been a notable rotation in recent weeks towards mega-cap stocks, which has led to distortions in the movement of indexes, particularly the NASDAQ 100. This is primarily due to the top-heavy nature of the NASDAQ 100, where a few stocks have driven the overall returns. Strong balance sheets, large market capitalizations, significant free cash flows, and robust earnings potential characterize these stocks. Additionally, they are highly liquid and, in some cases, have market caps bigger than some G-7 economies, which may have made them attractive to investors seeking safety amid concerns over interest rate risk.

This trend is particularly evident when examining the spread between the earnings yield of the NASDAQ 100 and the 10-year real yield. This spread has reached its lowest level since 2007. The uncertainty surrounding the debt ceiling may have prompted investors to gravitate towards the most liquid and safest assets, which, in this case, appear to be the mega-cap names based on this relationship.

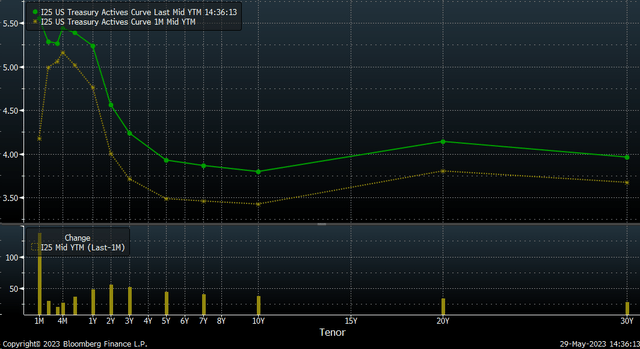

The uncertainty in the market has indeed been reflected in the yield curve, particularly with the significant increase in bond yields at the front end of the curve over the past month. This rise in yields indicates a shift in market sentiment and expectations regarding interest rates.

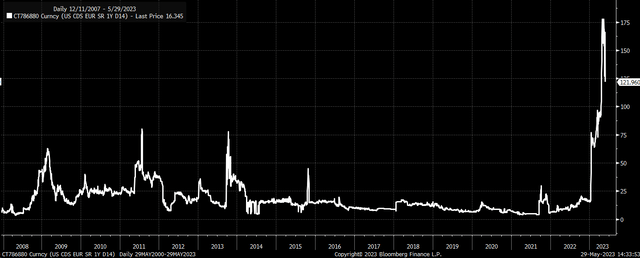

The surge in the 1-year US Credit Default Swap (CDS) to its highest levels clearly indicates heightened market concerns and perceived risk associated with the US defaulting on its debt. The CDS serves as a form of insurance that firms can use to hedge against the possibility of a default.

However, investors may shift their focus back to the front end of the yield curve, which could lead to a rotation out of the highly liquid and safer mega-cap names. This rotation could result in unwinding the big rally seen in the NASDAQ 100.

Regarding market liquidity, if the unwind of the Treasury General Account leads to a significant increase in the issuance of new debt and the subsequent increase in the TGA, it could potentially drain liquidity from the market.

In this case, the market would be confronted with a deleveraging process and the unwind of a flight to safety simultaneously, which could make the debt ceiling agreement a "sell-the-news" event.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.