Sandstorm Gold: I'm Pounding The Table

Summary

- 2022 was the year of aggressive transformation and confusion.

- While the share price has suffered, the price action and current valuation don't reflect the tremendously bullish fundamentals of the company.

- Everything is coming together for SAND.

- Sandstorm could be doing better on several fronts.

- The Gold Edge members get exclusive access to our real-world portfolio. See all our investments here »

VladK213/iStock via Getty Images

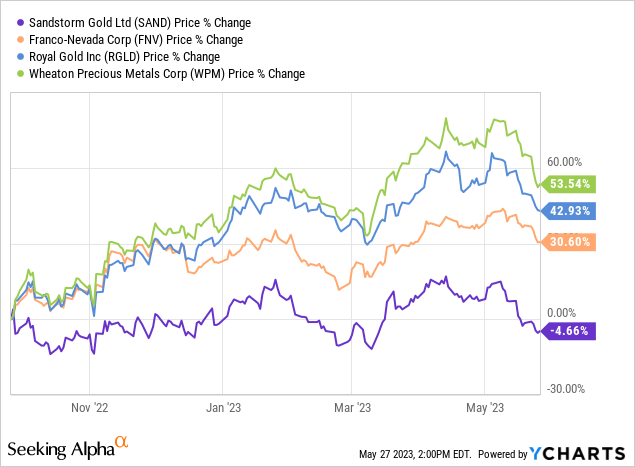

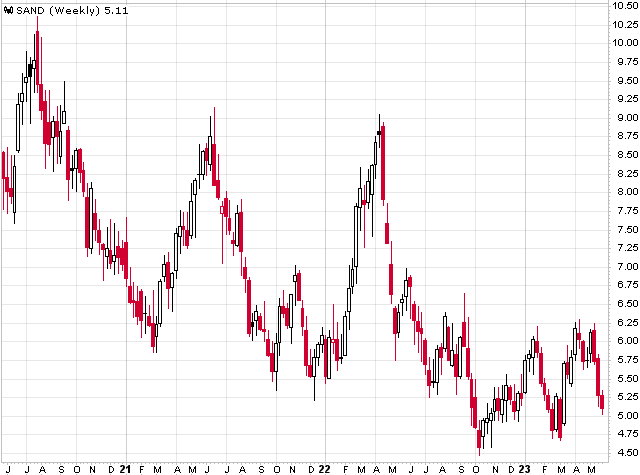

Sandstorm Gold's (NYSE:SAND) relative value has contracted dramatically since the lows in the gold sector last September. It's been one of the worst-performing gold stocks over the last 6-9 months, and its peers such as Franco-Nevada (FNV), Royal Gold (RGLD), and Wheaton Precious Metals (WPM) have left SAND stock in the dust.

Sandstorm's stock price is now only ~10% from retesting its lows from last October (as it bottomed later than the rest of the group), and SAND continues to trade near multi-year lows. Is this underperformance deserving? An emphatic "NO." It just proves that many gold stock investors don't have a strong understanding of what they are buying or selling or why they should be. Something we can exploit to gain that performance "edge."

StockCharts.com

So why have the shares gone in the wrong direction and acted so poorly? There are several reasons; let's review those.

2022 Was The Year Of Aggressive Transformation... And Confusion

Debt + Dilution

As the company said in its Q4 2022 conference call and 2022 annual report, 2022 was the year of "aggressive transformation," and that growth costs almost US$1.2 billion. To pay for all of this, Sandstorm shareholders got hit with dilution, a sizable pile of debt to cover the US$425 million cash component of the BaseCore transaction, and then SAND compounded matters as it issued more shares (US$92 million worth, or US$86 million of net proceeds) in October 2022, which was used to pay down some of the newly issued debt.

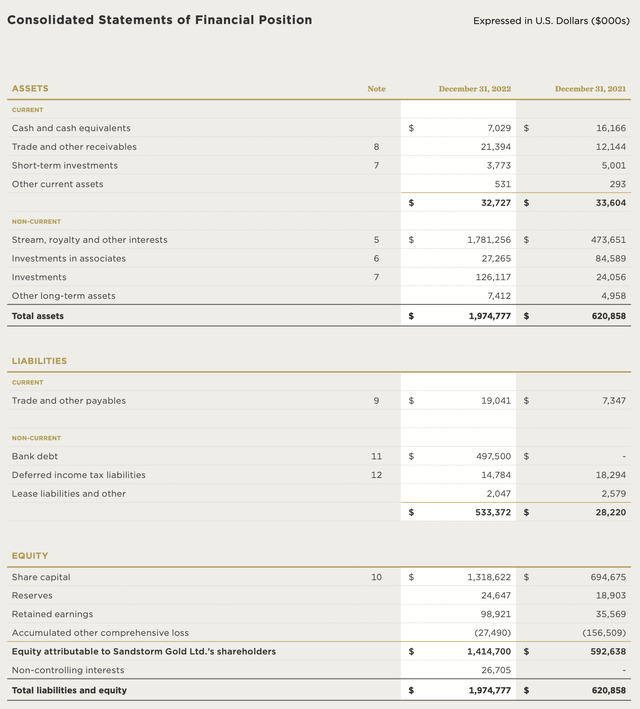

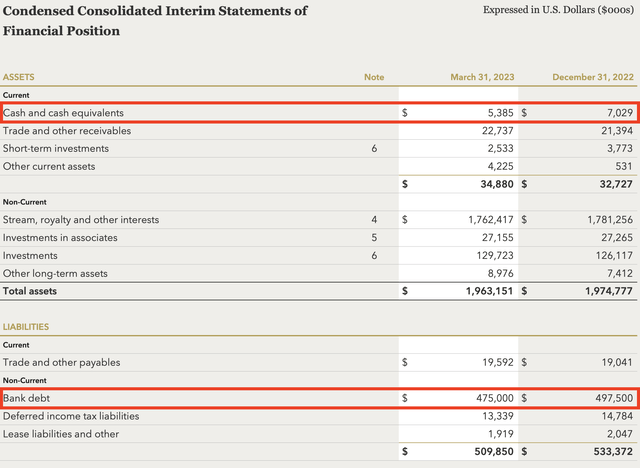

Sandstorm has typically carried a pristine balance sheet, which was one of the strengths of the company. But suddenly, it had over $500 million of debt and little in the way of cash. At the end of last year, SAND had just $7 million of cash and $497.5 million of debt, which was an improvement compared to Q3 2022, but still exceedingly high, and it didn't give Sandstorm any near-term financial flexibility to pursue other large deals.

One would think the market would've reacted positively to the growth and increased strength and diversification of the portfolio, but instead, the incredibly short-sighted focus was on how many shares SAND had to issue and the debt it accumulated in the process.

The Increased Complexity Of Sandstorm

I also believe that investors have become confused due to the numerous moving parts to this story, resulting in a lack of understanding regarding what assets Sandstorm actually owns and how much they will contribute to production. Below are several examples of the recent increased complexity.

1) The company turned its minority stake in Hod Maden into a stream last year and labeled itself a pure-play streaming and royalty company, thinking that would solve the issue that investors had with the asset. But SAND created a copper developer called Horizon Copper that would take over the Hod Maden equity interest, with SAND receiving a gold stream in exchange. This transaction didn't do anything to speed up the development of the project or do much to appease the concerns of investors. Sandstorm also plans to use Horizon Copper as a vehicle to gain access to more streams and royalties.

2) Then, SAND sold 2/3rds of the Antamina NPI that came with the BaseCore acquisition to Horizon Copper in exchange for a 1.66% silver stream on Antamina, US$50 million in cash, a US$105 million debenture, and US$26 million in Horizon shares.

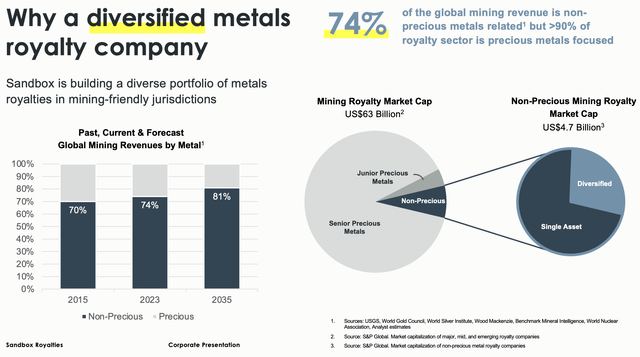

3) Then, Sandstorm and Equinox Gold (EQX) announced the creation of Sandbox Royalties, which was a new diversified metals royalty company that would have "exposure to a range of resource royalties including gold, silver, copper, zinc, graphite and uranium." The idea was to capture a potential market that was going unnoticed, as while 74% of global mining revenue is from non-precious metals, 90% of the royalty sector is precious metals focused.

The concept makes sense, but Sandbox was seeded with a couple of gold-producing royalties, including one on the Mercedes mine, which Sandstorm owns a gold and silver stream. Then this past March, Sandbox acquired a small gold stream on the Greenstone project in Canada that is under construction. A project that Sandstorm also holds a stream. So far, Sandbox is playing heavily in the gold royalty sandbox, which makes me question the purpose of this company and why all of these assets weren't just rolled into Sandstorm.

On paper, creating a company like Sandbox makes sense. The problem is, when it comes to the execution of the business model, the end result is different than the original concept, and Sandbox is looking more and more like a gold royalty/streaming play.

No Concrete Updates On Hod Maden

Hod Maden is a key asset for Sandstorm, and it has been for years. At one time, it accounted for 30-40% of the company's NAV.

Lidya Mines, which is a private company based in Türkiye and majority owner of Hod Maden, doesn't provide a consistent flow of updates on the project.

Horizon Copper hasn't either since taking over part ownership.

Sandstorm investors had to rely on Sandstorm itself for updates on Hod Maden's progress, but details were always lacking. Adding to the frustration for shareholders, and I assume the company as well, was Lidya had the permits at the end of 2021, but there wasn't any concrete news on development. All SAND disclosed was the project was in the financing stage and early-stage construction was advancing. Seemingly good news, but we had no pictures, no timeline, etc.

It was practically radio silence on Hod Maden over the last 1+ year, even though the EIA had been approved, and it seemed the project was a go. This undoubtedly did not help Sandstorm's stock price.

Sandstorm Still Hasn't Closed The Antamina NPI, And Terms Have Changed

The advancement of Horizon Copper is happening at a slow pace, as SAND still hasn't closed the Antamina NPI part of the deal and was waiting on Horizon to complete its financing (which it finally did last month).

Adding to the confusion, is the terms of the deal have been modified, as instead of $50 million in cash and a US$105 million debenture, SAND would receive US$20 million in cash and a $152 million debenture. However, the US$20 million cash component has now been further modified, with SAND only expected to receive $5 million in cash, with the remaining $15 million via secured convertible debt financing.

So, the actual outcome is far less upfront cash for Sandstorm compared to the original terms and much more debt received instead.

Horizon had US$33 million of cash on its balance sheet at the end of last quarter, so it's not clear why the company couldn't pay more cash to Sandstorm. The market for juniors seeking financing is tough right now, and I believe expectations were that Horizon would be able to raise much more than it did, so that could be one reason. Another reason is Horizon might want to keep a solid amount of cash on its balance sheet, and Sandstorm might want that for the company, too, as SAND has implied from the beginning that it's trying to build up Horizon to make it stronger and more valuable. You don't accomplish that feat with an inadequate balance sheet.

To summarize, 2022 might have been the year of aggressive transformation, but it was also the year of confusion, given the movement of key assets and what was going out (cash, stock, equity investments, existing royalties) and what was coming in (streams, new royalties, cash, debentures, equity stakes).

The complexity of the deals last year, combined with the lack of details on Hod Maden, also negatively impacted the stock.

5 Reasons Why I'm Pounding The Table

While the share price has suffered, the price action and current valuation don't reflect the tremendously bullish fundamentals of the company. Below are the reasons why I'm pounding the table:

1) Diversification And Strong Growth

The key to creating a powerful streaming/royalty company and leveraging the business model — making said company as close to bulletproof as you can get in this sector — is diversification across a plethora of quality assets.

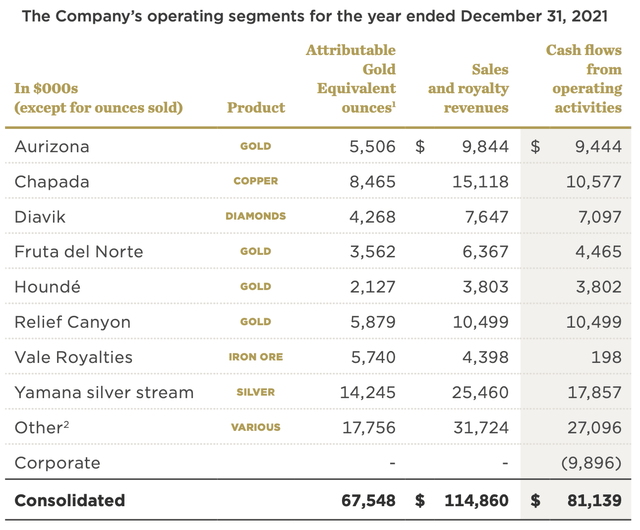

Below is Sandstorm's 2021 attributable gold equivalent ounce production and cash flow from key assets.

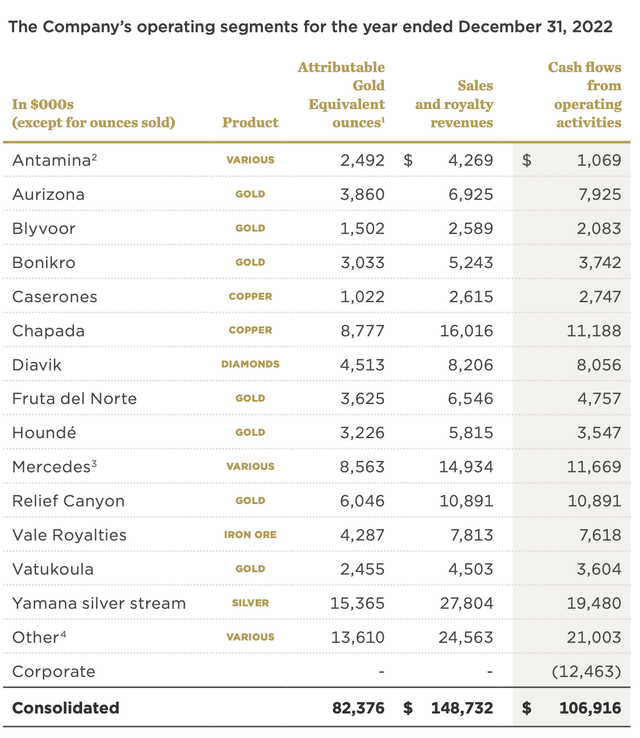

And here are 2022 results — we are going in the right direction. Thanks to the acquisition of Nomad Royalty, BaseCore, and the Mercedes stream, SAND dramatically increased the number of key producing assets last year. Also, look at the fairly even distribution of production in the portfolio, which reduces risk considerably. The Yamana silver stream is still by far the largest, but SAND keeps stacking more streams and royalties. Yes, we are going in the right direction.

While SAND hasn't reached critical mass like Franco-Nevada, Sandstorm has made tremendous strides over the last few years.

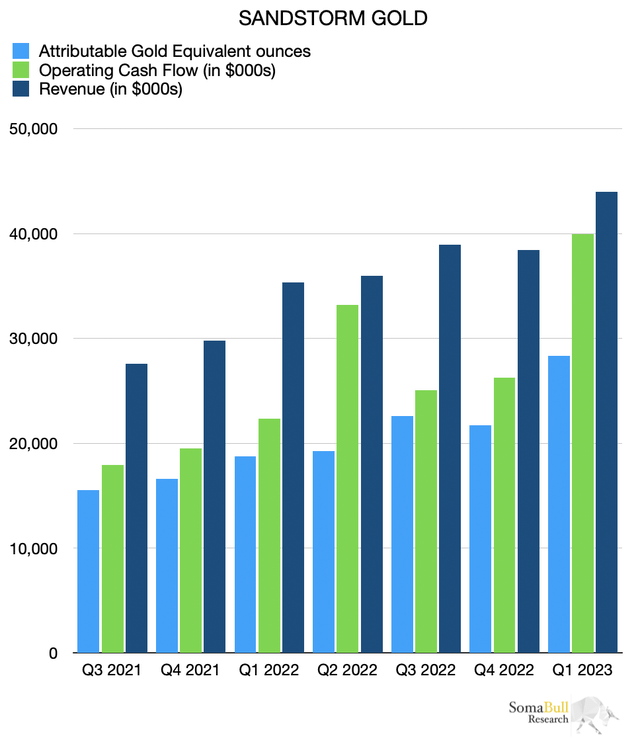

The tables below show the quarterly revenue, production, and cash flow since the September 2021 quarter. All three of these key operational and financial metrics continue to increase. Quarterly operating cash flow has more than doubled over the last two years (from just under $18 million to ~$40 million), revenue has surged from $27.6 million to $44.0 million, and GEO production has increased by more than 80%. The US$1+ billion in deals last year has contributed to this surge in production and cash flow and greatly diversified the company's asset base.

2) Big New For Hod Maden

Three weeks ago, SSR Mining (SSRM) announced that it had purchased 10% of the Hod Maden project in Türkiye from Lidya Mines for a US$120 million upfront cash payment (paid May 8, 2023), followed by $150 million in earn-in structured milestone payments to acquire an additional 30% interest (payable between the start of construction and the first anniversary of commercial production).

SSRM has taken over as operator of Hod Maden, and the project will be managed "under a tri-party ownership structure" between SSR Mining (up to 40% of the project), Lidya Mines (30%) and Horizon Copper (no change to its current 30% position).

SSRM has been operating in Türkiye for many years, and there are significant synergies with the company's Çöpler mine in the region. Lidya also owns 20% of Çöpler and has a long-standing partnership with SSRM.

This is exceptional news for Sandstorm Gold.

SSRM is far better capitalized and has been a great partner for Lidya.

Having SSRM as the operator and significant equity owner will also result in Hod Maden finally being on track for a construction decision, as SSRM will not drag its feet like Lidya did over the last few years. While the timeline for production has now been pushed back to 2027 (vs. 2025), this is a date that I feel can be trusted.

Also, Sandstorm and its shareholders can now expect more disclosures and information on Hod Maden. I anticipate regular updates on the project during every quarterly report and presentation from SSRM.

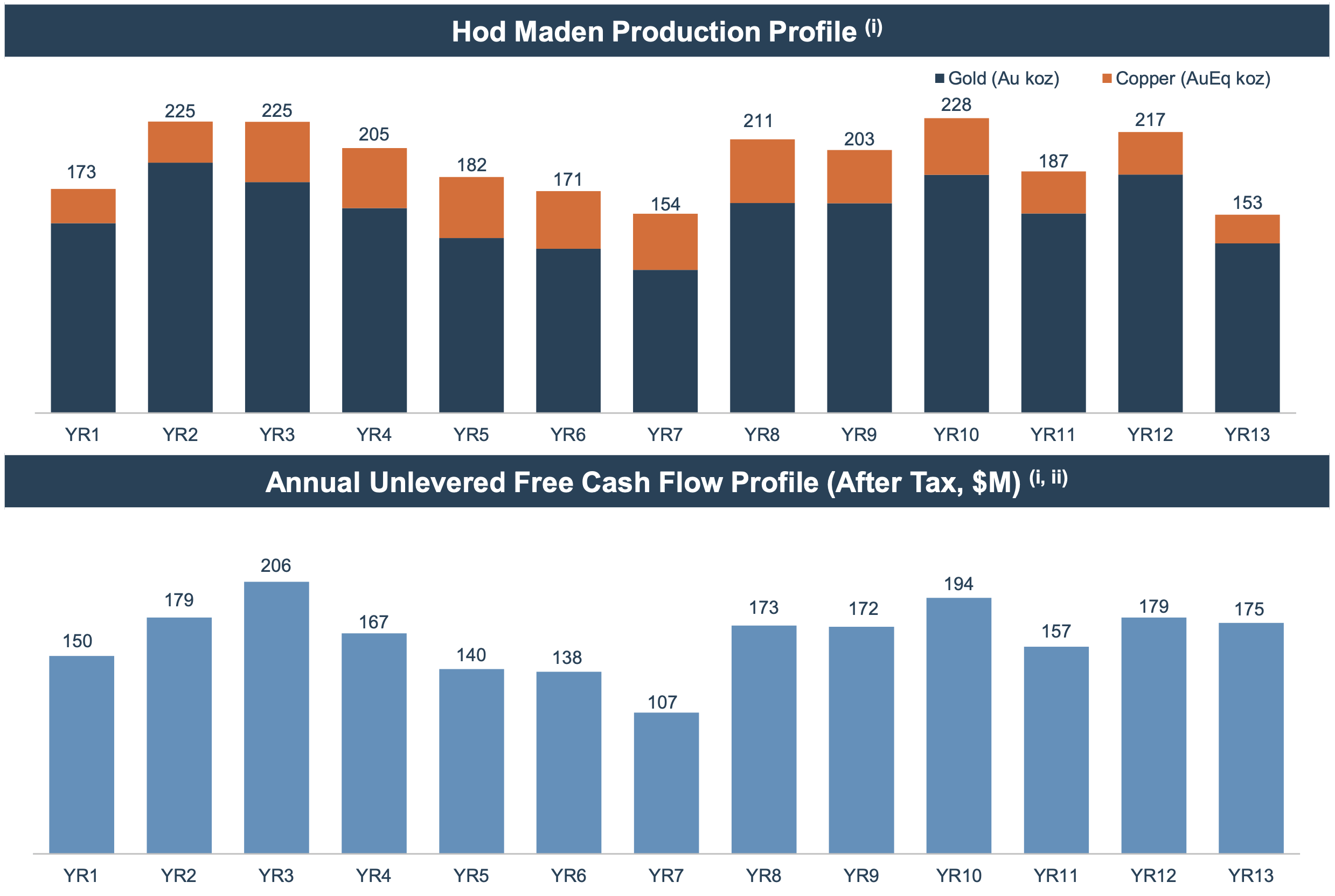

SAND owns a 2% NSR and 20% gold stream on Hod Maden, which should result in about ~30,000 GEO of production per year on average over a 13-year LOM when the mine is online.

SSR Mining

As a side note, while I'm speculating as to the reason for the delay in construction of Hod Maden last year, it very well could've been because Lidya didn't want to develop the project themselves and prefers the minority stake strategy (which has worked well for them) and was waiting on SSR Mining to complete its due diligence.

3) Debt Reduction Underway And A Path To Quick Repayment

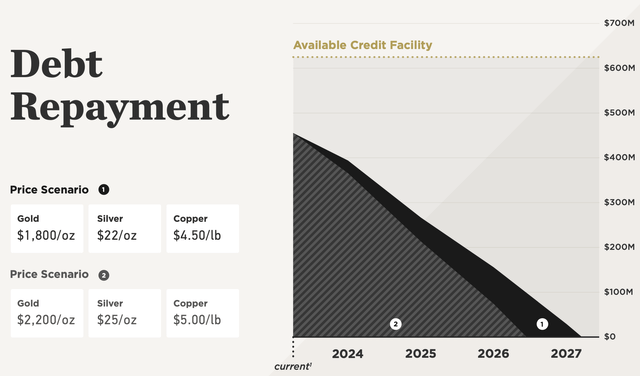

Nolan Watson, CEO of Sandstorm, stated earlier this year in the Q4 2022 conference call that the company "plans to aggressively pay down debt this year to save on interest and recharge the balance sheet" and that while "2022 was the year of aggressive transformation, 2023 and perhaps 2024, will be the years of calm consolidation where we take time to pay down debt, consider the odd small stream, and start looking at long-lead deals" with Horizon for the future.

Watson also stated, "Debt repayment is likely the most intelligent allocation of capital" this year, given rising interest rates, and that the company does not plan on issuing shares in 2023. He also disclosed that Sandstorm is only looking at one small gold stream deal, which it could do without raising any equity.

So far, Sandstorm is executing on this plan, and its portfolio of assets will allow that to continue.

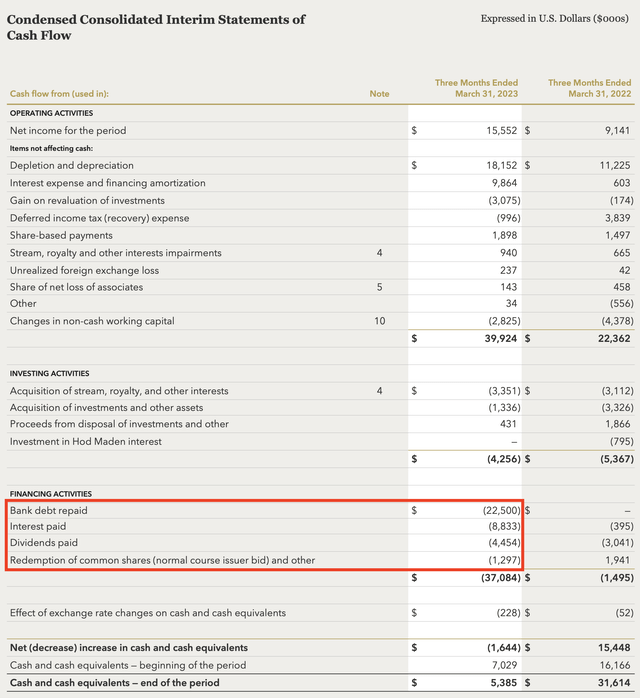

While investors were concerned about the debt that SAND took on when it made these acquisitions last year, the royalty/streaming model generates dependable free cash flow (as evidenced by the $40 million of operating cash flow that Sandstorm generated in Q1), and the company is starting to chip away at this debt. Last quarter, it repaid ~$22 million of debt and kept the cash balance relatively stable.

There was also almost $15 million in interest and dividends paid and common share repurchases last quarter. So SAND was able to reduce debt by a healthy amount, still pay a small dividend, buy back a bit of stock, and cover its interest payment. As debt drops, so will the interest due, so more cash flow will go towards repaying the debt outstanding, quickening the pace of debt reduction each quarter.

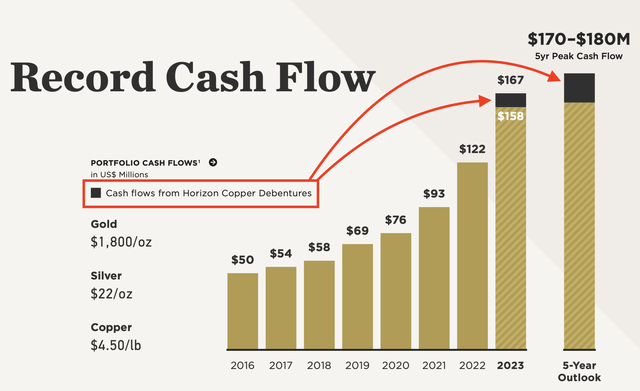

The beauty of this model and having a diversified portfolio of quality assets is substantial positive free cash flow is guaranteed, no matter what the price of gold, silver, or copper. At $1,800 gold, $22 silver, and $4.50 per pound copper, SAND will have repaid its debt by 2027, as the company expects to generate an average of $150+ million of operating cash flow per year over the next five years at those metal prices. At higher metal price assumptions, debt repayment will be even quicker.

And about that debenture for the Antamina NPI....

Many reading the section above where I discussed the change in terms to the Antamina NPI might assume this is bearish news for Sandstorm, but according to the company's Q1 2023 MD&A, principal repayments of the debenture are "subject to a 100% cash sweep of the excess cash flow Horizon receives from the 1.66% Antamina NPI after the Antamina silver stream and Antamina residual royalty obligations are paid." The way I interpret these terms is once this deal closes, SAND will receive the 1.66% silver stream and 055% NPI, and then all of the excess cash that Horizon receives from the rest of the NPI as part of the repayment of the debenture (until it's repaid in full). Plus, SAND gets 3% interest on top of that. Another way to put it, while SAND won't own the full 1.66% NPI on Antamina, it will receive all of the cash flow from this NPI — plus interest — until the debt that Horizon owes is extinguished. We can see this in action in the estimated cash flow forecast, as SAND also includes projected annual cash flows from the Horizon Copper debt it holds.

4) Valuation Matters

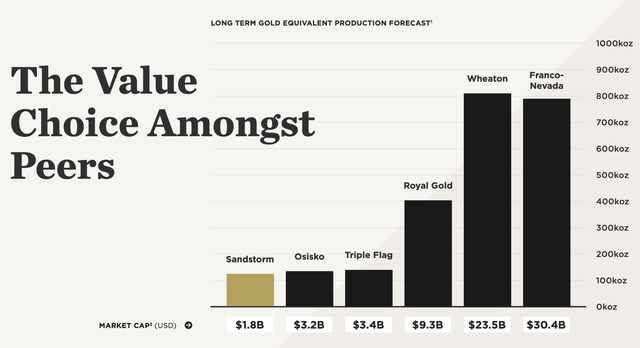

SAND is producing as much gold as Osisko Gold Royalties (OR) over the long term, yet it trades at a significantly lower relative valuation (which is now $1.5 billion after the recent drop). While this comparison graph doesn't account for enterprise value, that doesn't matter. Whether you compare SAND to Osisko, Triple Flag, Royal Gold, Wheaton, or Franco-Nevada, SAND is a stunning bargain when analyzing the current and potential GEO production, and there is no reasonable explanation for this valuation gap between it and its peers.

5) Stable 15-Year Production Outlook And Additional Optionality

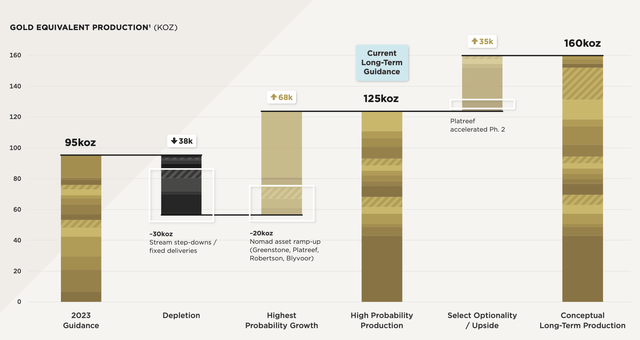

The graph below reflects the consistent growth in GEO production over the last 7 years and the positive long-term impact from these new acquisitions and the Hod Maden news. To show how much SAND has upgraded its portfolio, a few years ago, this would have been only a 5-7 year average production profile, but now it's a 15-year annual average with estimated production of 110,000 ounces and a peak output of 125,000+ ounces.

I do want to clarify this updated long-term production outlook, which I believe has introduced confusion as well.

Last year, the company expected production of ~150,000 GEOs in 2025, and historically, the company would show a breakdown of production by year. However, it has changed the way it presents long-term guidance. Instead of year-by-year, SAND is posting an average long-term production estimate.

The problem with SAND over the last few years is it put out these aggressive forecasts — because it thought Hod Maden would be online by now — and then it kept having to reduce estimates as Hod Maden was continually pushed back. That's also the main reason the peak in production is 125,000 ounces, as Hod Maden is now expected to enter production in 2027 instead of 2025.

Some might assume ounces were lost because the peak output was reduced from the prior estimate, but it's primarily because of the deferral of ~30,000 ounces of production from Hod Maden.

Roberston was also pushed back from 2025 to 2027, so that's another 2,500-4,500 ounces (at 10-year+ mine life) deferred.

Only about 10,000 ounces of the reduction is from reassessments of assets, such as Relief Canyon.

The bottom line, it's mostly the change in timing that explains the reduced peak production estimate, as some assets will see a step-down in 2025-2026 (e.g., Cerro Moro and Mercedes), and Hod Maden and Roberston are now coming online later.

So instead of a spike in production in 2025 and then a drop, it's more of a gradual increase as Hod Maden and Roberston are now offsetting the declines in production from other assets. Also, MARA, the Platreef expansion, the Chapada expansion, etc., aren't included in these estimates, and there is a realistic path to increase production to a peak of ~160,000 ounces and boost the long-term annual average. MARA alone would be an additional 20,000 GEOs per year if Sandstorm exercises that option.

Everything Is Coming Together For SAND, But Improvements Are Still Needed

Sandstorm continues to increase production and cash flow, is paying down debt, has dramatically upgraded its portfolio, has a stable 15-year production profile and compelling growth prospects, and we now have good news on Hod Maden.

Yet the reaction in the stock price suggests something is wrong. I believe it's the market that is wrong, and there've been countless instances in this sector where stocks become mispriced as investors don't understand the story or see the catalysts.

I'm not calling a bottom in SAND, but at this valuation and all of the positives discussed, it's a stunning bargain, and I expect that continued progress on reducing the debt this year will result in a change in sentiment and outperformance, finally. As long as gold doesn't implode, I believe the shares will be much higher in 12 months than they are today.

However, that doesn't mean Sandstorm is executing perfectly. It could be doing better on several fronts:

1) It should never have bought a stream on Relief Canyon. I'm not surprised that it didn't work out, as I had concerns from the beginning as it reminded me of the low-quality, heavily burdensome deals with extreme counter-party risks that SAND used to make with developers/producers when the company was still in its infancy. I thought Sandstorm learned from those mistakes, so I was surprised by this decision.

As I told subscribers of The Gold Edge in 2019 after the acquisition of the Relief Canyon stream was announced:

I'm not sold on the Relief Canyon transaction. Even though SAND is getting extremely favorable terms and it will be a highly profitable stream, I'm concerned about Americas Silver ability to deliver.

The Relief Canyon stream cost US$25 million, and it's generated almost that amount of cash flow since 2021. It will probably be a wash in the worst-case scenario, so certainly not anything disastrous, but the company temporarily reverted to its old ways, and this is a mistake that shouldn't have happened. These are not the kind of assets that Sandstorm should be acquiring.

2) The Hod Maden 30% equity stake was perplexing and obviously had a negative impact on the stock price because of the project delays and considering it accounted for a hefty amount of the company's NAV. The logic behind this ownership structure was that the average AISC for Hod Maden was so low that it was like a stream anyway. But trying to repackage an equity stake as a stream was a miscalculation/misjudgment from the start and didn't have the desired results.

3) Sandstorm needs to reduce (better yet, rid itself completely of) the complexity of the ownership structure of its assets and investments and the inter-company deals between itself and Horizon Copper, Sandbox, etc.

This is something that SAND needs to address in 2023.

My message to the management of Sandstorm is: Don't overcomplicate the model, remain laser-focused on building up Sandstorm Gold, AND ONLY SANDSTORM GOLD, look for high-quality, 1-2% royalties and streams of various sizes, and just keep stacking. That's how you will generate optimal shareholder value and eventually reach your goals for the company.

Despite the missteps, I have tremendous confidence in Sandstorm's management, believe they are going in the right direction, and have SAND on a solid path.

Interested in becoming a member of The Gold Edge?

Join now and save 20% on an annual subscription.

This article was written by

I’m a private investor with a strong track record of outperformance, and also currently work as a research consultant for high-net-worth clients who invest in the precious metals sector.

My focus was mostly on Tech/Internet when I started investing, but almost 20 years ago I became extremely interested in the gold and silver sector as I anticipated a major bull run.

I’ve been doing in-depth research on gold and silver miners since then. I'm familiar with their stories, their stock patterns, their highs and lows, their operations/projects, their successes and failures, their management teams and turnover at the top, and all other facets of these precious metal companies.

This sector is my singular focus as I expect a massive bull market will unfold. These mining stocks are the cheapest they have been in over a decade, some in fact, are near multi-decade lows as they are oversold and significantly undervalued. I expect strong appreciation in these mining stocks as the bull market in gold and silver recommences.

I believe in buying value, and not chasing the next hot stock. I use several basic investing principles, the main one being buying the balance sheet. I wait for opportunities to present themselves and then establish positions. I believe in doing your homework, and I have a very research intensive focus.

*Disclaimer* I am not a Certified Financial Advisor. My research and articles should not be interpreted as a recommendation to purchase, sell, or hold any security at any time. The accuracy, completeness, or timeliness of the information posted in my articles is not guaranteed. Do not rely on any statement that I make in my articles. All readers and subscribers should always conduct their own research and should consult a professional financial advisor when it comes to making investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SAND either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.