Buying Tractor Supply While Mr. Market Thinks It's A Discretionary Business

Summary

- Tractor Supply stock has dipped more than 11% in the past month, potentially offering a new opportunity for investors.

- Despite concerns about tightening consumer spending, Tractor Supply's Q1 report showed net sales increasing 9.1% to $3.3 billion and comparable store sales increasing 2.1%.

- I believe Tractor Supply's customer base and product offerings make it less susceptible to recessionary dynamics, as demonstrated by its growth during the Great Recession.

TrongNguyen

TrongNguyen

Introduction

Tractor Supply (NASDAQ:TSCO) is on a dip, losing more than 11% in the past month. Being this is a stock that has highly rewarded long-term investors, the current dip may offer a new opportunity to either initiate a position or increase one's stake in the company.

In this article, we will try to understand why the stock is dropping and if Mr. Market is getting it right or not. We will do this with the aid of past financial data and the most recent quarterly report.

Latest results

To answer our question, let's start from the latest report.

For those who are unfamiliar with the company, it is important to know that we are talking about the largest rural lifestyle retailer in the U.S. Its main focus is providing and selling goods to recreational farmers, ranchers and all those people who fit into the category of "Out Here" lifestyle, as the company likes to address them.

A very important fact about the company is that its stores are mainly located in rural communities. At the end of FY 2022, the company, whose history started 85 years ago, reported it was operating 2,333 stores in 49 states with a typical size between 15,000 to 20,000 square feet. Of course, the company also sells through its website.

Now, this is a piece of information which needs to be considered carefully. In fact, Tractor Supply's customers are usually ones that have a higher income compared to those who live in big cities; in addition, they usually have fewer expenses compared to the average consumer.

While we are seeing tech stocks rise, this year's market has not been kind to retailers, as fears of tightening consumer spending are making many analysts revise their EPS forecasts downwards.

However, when at the end of April the company reported its results for the first quarter, we found out that:

- Net sales increased of 9.1% to $3.30 billion.

- Comparable store sales increased 2.1%.

- Gross profit increased 10.7% to $1.17 billion.

- Gross margin increased 52 bps to 35.5%.

- SG&A increased 13.9%.

- As a result, operating income was flat YoY at $244.4 million.

- Net income, too, was hit by higher costs and came in 2.2% lower YoY at $183.1 million for the quarter.

At the same time, the company pointed out how bad weather in some areas of the country led to less sales than usual. This also makes the company believe that there was some pent-up demand that needs to be fulfilled in the second and third quarters. This is why the company didn't change its guidance for 2023, expecting to reach $15 billion in sales, with comparable store sales growth between 3.5% and 5.5% and an operating margin above 10%.

During the quarter, the company added another 31 stores to its count. In addition, it was able to return $197 million to its shareholder through share repurchases and another $113 million through cash dividends.

Overall, I don't think these results were that bad, even though, according to Wall Street expectations, this report missed both top-line and bottom-line results. However, is a $10 million miss on a quarterly revenue of $3.3 billion a real "miss"? When EPS comes in at $1.65 instead of the expected $1.72, are we talking about a huge miss? It is only about 3.5% less than expected.

The company is actually growing even though the economic environment sees consumers pulling back on their discretionary spending and becoming more value oriented and cost conscious.

Is Tractor Supply A Consumer Discretionary Retailer?

In any case, since the latest report, Tractor Supply is down double-digits. Investors appear to be fearing a recession, likely believing a company such as Tractor Supply may see its financials deteriorate, as many other companies considered discretionary probably will.

However, the more I research the company and its business, the more I am convinced Tractor Supply simply shouldn't be considered a discretionary retailer.

In fact, this company has many characteristics that make it almost defy any recessionary dynamic.

First of all, it addresses a market niche made up of home, land pet and livestock owners who generally have above average income and below average cost of living. Tractor Supply's customer base usually lives outside big metropolitan areas.

The assortment of products Tractor Supply's stores offer is classified through these major product categories, which I report with their respective percent of net sales at the end of 2022:

- Livestock and pets - 50%.

- Seasonal, gift and toy products - 21%.

- Hardware, tools and truck - 19%.

- Clothing and footwear - 7%.

- Agriculture - 3%.

Now, we have enough data to get to my point. Tractor Supply deals with a customer base whose rural lifestyle is not a discretionary habit, but, as the word itself suggests, a choice of how to live one's own life. This means that before giving this up, such a consumer must be really forced to do so.

Secondly, if we see the net sales breakdown, we discover how half of the company's sales come from livestock and pet. This spending is not discretionary, either. In fact, someone who owns livestock and pets, can't just stop nurturing them because of a recession. More and more, livestock and pet are perceived as part of a household. An owner of a pet, for example, won't be able to cut on food and medicine spending because a pet will always need to be fed and be taken care of.

A backtest

To backtest my understanding of the company, I looked at the results the company published during the Great Recession.

In its 2008 annual report, the company reported it was indeed taken aback by a sudden change in consumer purchasing patterns. This is what we read in the shareholder letter of that year:

Our initial planning for 2008 assumed the year would look much like the second half of 2007. However, only six weeks into the year, our analysis of customer purchase patterns indicated a marked departure from their historic behavior. As a result, we recognized we were facing a challenging year and took action. We quickly met with all of our store managers and above, asking them to help us cut costs, reduce waste, improve efficiency, and maximize sales at every point of customer contact. As the year progressed, the retail environment continued to weaken as consumers further modified their spending behavior and commodity prices increased significantly. In this dynamic year, our team expertly managed our margins and market share while concurrently reducing inventory. Importantly, we executed a number of key merchandising initiatives that resulted in sharper store presentation, greater inventory efficiency, and enhanced strategic sourcing and private label brand programs. While we continued to find ways to do more with less, we once again reduced store manager and team member turnover and improved our customer loyalty scores.

These are for sure interesting words to read, but do some data support that the company weathered the Great Recession well?

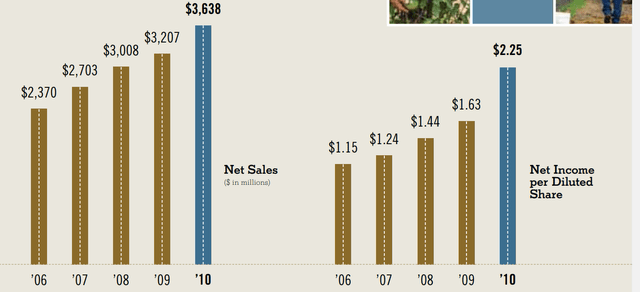

If we look at the 2010 Annual Report, we see how from 2006 to 2010 the company simply kept on growing both its net sales and its net income.

In the same years, the company grew its store count from 676 in 2006 to 1,001 at the end of 2010. So, we see that stores increased by 48%. In the meantime, revenues grew 53.5% and net income per share grew by 95.7%. What does this mean? Simply put, Tractor Supply knows how to leverage scale and the more stores it opens, the higher its overall profitability becomes. It is also truly impressive seeing how not long ago the company's annual revenue was more or less equal to what the company does now in just one quarter.

Now we understand why Tractor Supply has been able to fund its growth and pay a dividend for many years, keeping its payout ratio between 20 and 40% and reducing its outstanding share count by 27% in the past ten years.

Conclusion

In my previous article, I suggest the stock had run a little bit ahead of itself and that investors could either take profit or hold for the long-term, without adding new shares near ATHs. I personally took my gains. However, as we said above, the stock has dipped, and it has experienced multiple contractions that have deflated its fwd PE from 22 to 20, close to its historical range lows. The company's profitability remains high, with a gross profit margin above 35% and a return on total capital at 15%. As I said elsewhere, this company is able to execute so well that I think its business deserves to trade at a premium. Therefore, I think the recent drop in price has put the company back in line with its current financials. Starting from around $210, it is reasonable to build a position step-by-step, taking advantage of any further drop in price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.