Pinterest's Make-Or-Break Moment: Innovating For Advertising Success

Summary

- Pinterest fundamentals do not provide much hope for investors, but the share price has stopped selling off, indicating a potential investment opportunity.

- The future potential for Pinterest lies in unlocking monetization opportunities, particularly in ecommerce, to diversify its revenue stream beyond advertising.

- Pinterest's monetization strategy focuses on driving advertiser value to create a comprehensive advertising platform.

- Pinterest's stock valuation does not price in much hope. This makes it an opportune time to consider Pinterest stock as an investment.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

SeanShot

Investment Thesis

An investment in Pinterest, Inc. (NYSE:PINS) is nuanced. What you'll see is that its fundamentals, which are backward-looking, provide investors with absolutely no hope. Indeed, there's very little reason for anyone looking through its fundamentals to be holding onto PINS stock.

And yet, as you'll see, investors have stopped selling the stock. Consequently, this is my core contention, that this is the time to become interested in Pinterest, Inc. stock: When the fundamentals are truly lackluster, but the share price isn't selling off.

Why Pinterest? Why Now?

Pinterest is a visual discovery platform. Users can gather inspiration for project planning.

The future potential for Pinterest is in unlocking its monetization opportunities, particularly in commerce. For a few years now, Pinterest has attempted to get shopping into the core of the product experience.

If, indeed, Pinterest succeeded in unlocking its lower funnel commerce conversion, this would diversify its revenue stream from being at the mercy of the advertising space.

Simply put, Pinterest's monetization strategy revolves around driving advertiser value, expanding shopping capabilities, and innovating ad formats to create a comprehensive advertising platform.

That being said, beyond this compelling narrative, there are ample reasons to be put off and not seek an investment in Pinterest. And I'm going to address several considerations here.

And yet, before we go further, I believe that it's important for us to get something in context.

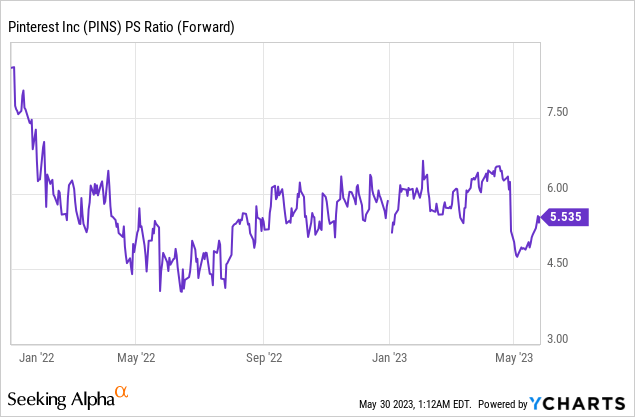

Even as you'll see there's very little in its fundamental performance to inspire any hope, Pinterest's multiple has stopped compressing.

I believe this is insightful. I believe this is the key to the investment thesis. It shows that virtually anyone that wanted to sell out of the stock has now sold out. There are very few shareholders looking to capitulate at this stage.

With that premise in mind, let's press ahead.

Revenue Growth Rates Have Troughed

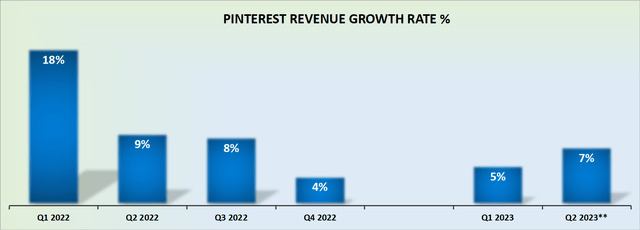

Pinterest's growth rates are now in sub 10% CAGR. There's a significant weakness in the advertising space. Everyone knows this.

But even with that consideration in mind, I believe that Pinterest is losing market share. Brands are particularly mindful of where they deploy their advertising spend.

From the brands' perspective, they are only deploying capital into platforms that they believe provide the highest and best-measured ROI. Anything that doesn't provide a very clear and measurable ROI is being avoided. And on the basis of that criteria, Pinterest is being avoided at present.

Pinterest Profitability Profile Doesn't Inspire Much Hope

Looking through Pinterest's profitability profile, there's very little one can say that's bullish about the company right now.

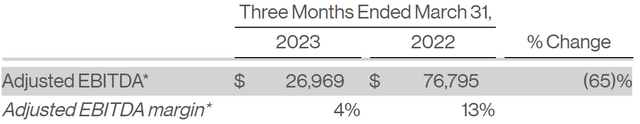

For example, Pinterest's gross profit margins in Q1 2023 were reported at approximately 72%, down approximately 300 basis points from the 75% gross margins reported in the same period in the prior year.

This lower level of profitability percolated all the way through its income statement, right to the bottom line.

As you can see above, Pinterest's EBITDA margin in Q1 2023 was substantially lower than in the same period a year ago, at 4% compared with 13% in the prior year.

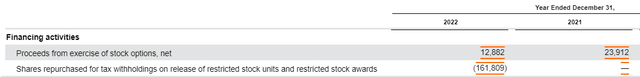

Meanwhile, the one area that did grow significantly was management's stock-based compensation ("SBC").

As you can see above, Pinterest's SBC expense increased by nearly double.

Furthermore, after repurchasing shares for tax purposes to the amount of $162 million in 2022, plus a further $160 million for combined tax withholding SBC plus common stock in Q1 2023, Pinterest's total number of shares outstanding has increased by nearly 4% y/y to approximately 681 million.

In summary, I don't believe there's any good news left when one is looking through Pinterest's trailing prospects. And yet, as I noted in the introduction, the share price does not appear to be continuing to sell off.

The Bottom Line

I make the case that enthusiasm for Pinterest, Inc. stock has washed out. While Pinterest still has a lot of heavy lifting to do, its valuation isn't pricing in much hope.

In essence, the time to get involved in a company is when its balance sheet isn't causing any problems and its valuation isn't pricing in any hope. Pinterest clearly meets the first requirement, given that more than 10% of Pinterest's market capitalization is equal to its debt-free cash position.

And secondly, when taking in the context of its uninspiring trailing fundamentals, I believe that this nicely fits into the second consideration, too.

In summary, I believe that as we look out twelve months from this point, investors will see a share price that's higher than the $24 per share that Pinterest, Inc. stock is currently priced at.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.