Celestica: Undervalued With Solid Revenue Growth

Summary

- Celestica Inc. is growing revenue strongly YoY and 2023 is expected to be a solid year in terms of top-line growth.

- The balance sheet of the company highlights stability and no reliance on issuing debt to grow revenues.

- The valuation is incredibly low and I find there to be much more upside potential from these prices compared to risk.

Urupong

Introduction

Celestica Inc (NYSE:CLS) is an international company specializing in delivering cutting-edge supply chain solutions and manufacturing services across a diverse range of industries. With its headquarters in Toronto, Canada, Celestica boasts an extensive global presence, operating an extensive network of facilities to cater to customers worldwide.

Company Strategy (Investor Presentation)

At the core of Celestica's offerings lies a comprehensive suite of services that cover the entire product lifecycle. From initial design and engineering to advanced manufacturing, supply chain management, and post-production aftermarket services, Celestica provides end-to-end solutions to meet the unique needs of its clients.

Looking at the last earnings report by the company they managed to grow revenues at a strong 17% YoY rate, reaching $1.84 billion, more than their entire market cap and then some. If the revenue increase wasn't enough to showcase the momentum the company seems to be having, the cash flow made a massive improvement from the same quarter last year. Going from $0.1 million to $9.2 million, the company will be able to continue buying back shares at a similar rate providing steady value appreciation for investors seeking a long-term position. The balance sheet is the final point that tips me over and is able to rate the company a buy. Debt is very manageable as the cash position can wipe out more than half of it and you aren't overpaying for the company either, the forward p/b is just 0.83. All in all, I find Celestica to be a very intriguing investment based on the market share the company has and the solid market growth estimates there are for the industry. The company will be a Buy from me.

Company Breakdown

Looking at the company more closely they have two different segments making up the business, Advanced Technology Solutions and Connectivity & Cloud Solutions.

Celestica's ATS segment specializes in manufacturing and engineering advanced technology products, including innovative electronic components and systems for industries like aerospace and defense. Leveraging its expertise in high-reliability manufacturing, supply chain management, and product lifecycle management, Celestica delivers customized solutions that meet the stringent requirements of these industries.

Celestica's CCS segment provides connectivity and cloud solutions for customers across industries to connect, manage, and analyze their data. This includes services related to data centers, cloud computing, network infrastructure, and IoT connectivity. By offering scalable and secure solutions, Celestica supports customers' digital transformation efforts, improving efficiency and enabling informed decision-making.

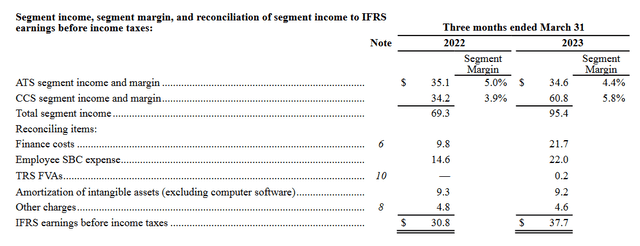

Company Segments (Earnings Report)

Looking at the picture above, we see clearly that the CCS segment makes up the source for most income and the one with the highest margin too. Where there might be some worry is that the company does rely quite heavily in the CCS segment on two customers, which make up together 26% of the revenues. Looking on a YoY basis, that wasn't the case in 2022, no customer made up more than 10%. This can be viewed as both good and bad. But I think it showcases the company's ability to grow their already established relationships further and build upon what they have. This in my opinion is an advantage that should help them continue growing efficiently like they have done already.

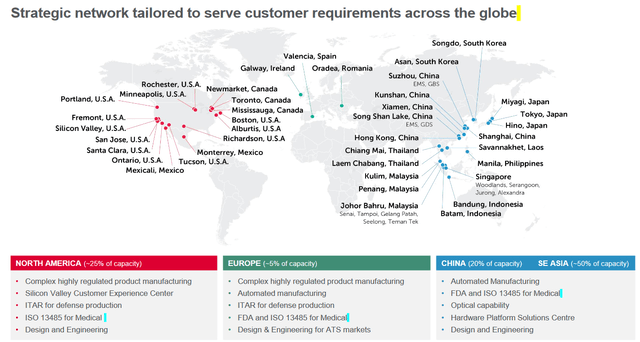

Celestica holds a competitive advantage with its global presence and robust manufacturing capabilities, setting it apart from competitors. Operating in various countries, Celestica offers localized support and adaptability to cater to customer requirements across the globe.

Growth Opportunity

The company serves a variety of markets and the revenues are quite diversified as a result of it. As the company is working as a service and solutions provider to companies they can easily integrate and scale their business to meet demand.

Market Growth (Investor Presentation)

One of the more noticeable and high-growth markets they have exposure to is Industrials. Here they help companies with supply-chain solutions, planning out full-scale productions and after-market services. The company notes that this market is expected to grow around 13.6%, which would provide ample revenue growth for the company. Some of the areas the company specializes in here are EV Charging, Mobility Power, and Energy Storage. All markets are expected to see strong growth over the coming years, providing good opportunities for CLS to continue supplying their customers with solutions.

Market Exposure (Investor Presentation)

It was mentioned before that the company has a global presence and it continues to improve upon this, with around 50% of the company's capacity focused on the SE Asia region, 25% in North America, and 20% in China. The growth in Chinese manufacturing is creating a strong market that CLS can tap into to continue growing both the top and bottom lines. The company continues to make investments and announcements to help bolster its status in the market and prove why its services are valuable. Celestica has stabilized its margins over the last few quarters and the net margin sits around 2%. But I think this leaves more room for the upside and the company seems to be on the right track as the last report showed, with operating margins growing 80 bps YTY.

Financials

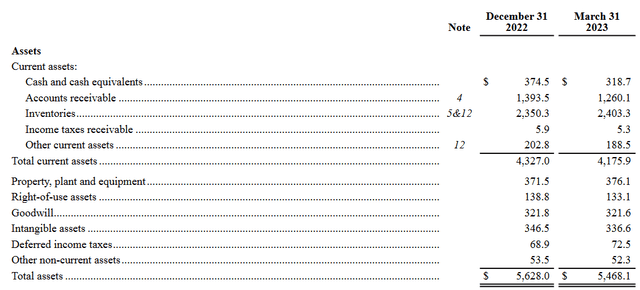

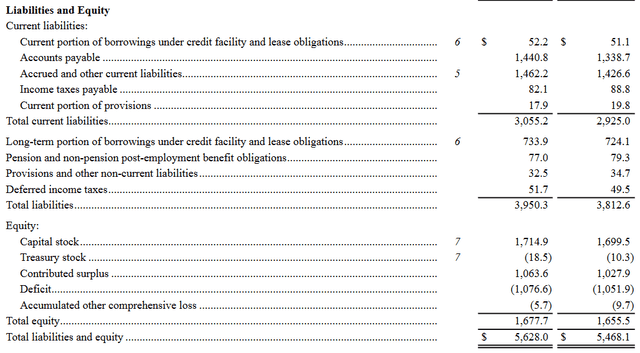

Looking at the balance sheet of the company, it's not often you find a company with over 4x as many total assets compared to the market cap of the company. But that is the case with CLS as they have $5.6 billion in total assets and it's been growing 3.7% YoY. The company has made some good valuable improvements on the balance sheet in my opinion. The cash position has been increased by close to $60 million, which I think just puts the company in a better position financially as they have more freedom to spend cash flows for investments.

Assets (Q1 Report) Liabilities (Q1 Report)

Looking at the debts the company holds them stable at around $730 million, only increasing slightly YoY. With the solid cash position, the debts aren't an issue in my opinion, and the net debt/EBITDA ratio sits at under 1, which highlights the low likelihood of debts becoming a hurdle for the company. Moving into the remaining quarters of the year I think it will be key to watch the rate the cash position is increasing and if the company is taking any more debt. Right now they seem fine as they are able to grow revenues YoY without a large increase in debt.

The levered cash flows being over $200 million further puts the company in a strong position, and I think the share buybacks will continue as a result of it. Over the long-term, I think investors should feel safe that the financial state of Celestica is strong enough to support these buybacks and in time a dividend might even be able to be established if the margins increase further.

Risks

Some of the risks I think are presented with Celestica is a slowdown could really hurt their earnings. A slowdown in spending and investments by companies will hurt the revenues greatly of CLS as that is what they rely on.

But it seems companies have shown these risks to be true and are continuing to spend despite the fears of a recession looming and interest rates remaining high.

Looking at the last earnings report though, there was a downturn in the revenues across all segments on a QoQ basis, with "communications" taking the first place with a decrease of 18% sequentially. But this is likely seasonal as the YoY rates tell a different story, where the "enterprise" segment for example shows a 38% increase. Looking ahead the company is expecting the "communications" part to take a hit decrease in the mid-teens. Surprise downwards could in my opinion be another reason for the company to trade at the valuation it does. I think there needs to be a major catalyst or surprise for the share price to steadily climb up to something more in-line with the sector. Until then the company might remain quite speculative.

Looking Ahead

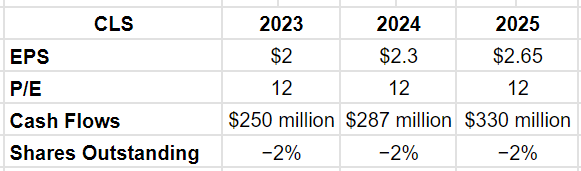

Company Estimates (Author's Calculations based on data from the Company)

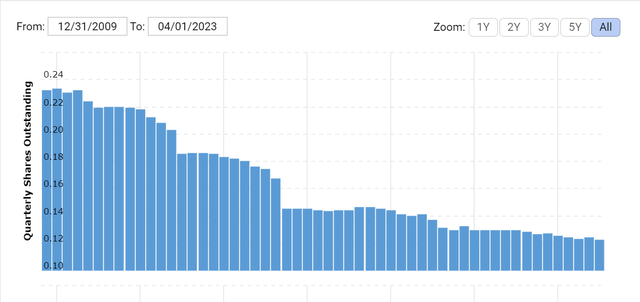

Looking at the chart above I think the EPS is quite possible given the strong position the company has worked itself into. Margins remain stable at the 2% rate, and whilst I don't see a major improvement in them in the short-term, I think revenue growth will over the years help EPS grow around 15% CAGR. Especially when the company is buying back around 2% of the shares outstanding, this will in my view further help increase the EPS at the rate I estimated. With the EPS growing I believe the same to happen with the cash flows. With $250 million cash flows in 2023, the company could buy back close to 20% of the shares outstanding, which isn't necessary but it does make the current buyback program safe to continue with in my opinion.

My estimates for 2023 go in line with the management too which estimates the yearly EPS to land between $2 and $2.05. Much of the reason I think the company will achieve these numbers is their already proven resilience in a challenging market and with demand remaining strong it will be a question of scaling the business. In terms of cash flows, the company has kept a positive one for the last 17 quarters, all through the pandemic and supply chain issues. The company is strong and my outlook I believe is positive. If the valuation goes up to my estimates the share price in 2023 would be $24, an upside of 118% from current levels. I think it might be unlikely the company sees such a drastic upswing, but it also highlights the low-risk investing in CLS offers right now. A P/E of 12 would be far under the rest of the sector, which I think might be fair given the still small size of the company, and the lack of a dividend.

Looking At Peers

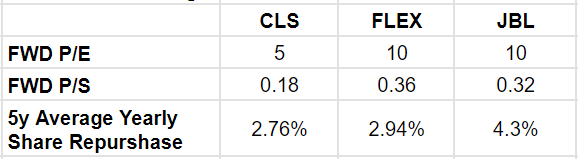

Peer Comparison (Author's Calculations based on data from the Company)

Looking at the chart above I think what draws me the most to CLS is the lower valuation they have compared to the other companies, Flex Ltd (FLEX) and Jabil Inc (JBL). These other companies also offer companies supply chain solutions and have the same tendency as CLS to buy back shares at a strong yearly rate. CLS might have the lowest net margins out of the 3, but I think the upside potential is stronger with CLS. Trading at half the forward P/E leaves more room for a correction upwards. The moves that CLS has made so far with investing more heavily into their CCS segment makes me optimistic about their chance to catch up to these other two giants in the industry generating nearly 4x as much in revenues. What CLS offers that the other ones don't is the potential for more appreciation of an investment. If you go by my chart shown previously, the current price would have a nearly 100% upside if CLS had the same multiple as these other two. Perhaps a showcase of even stronger margin improvement could be that catalyst.

Final Thoughts

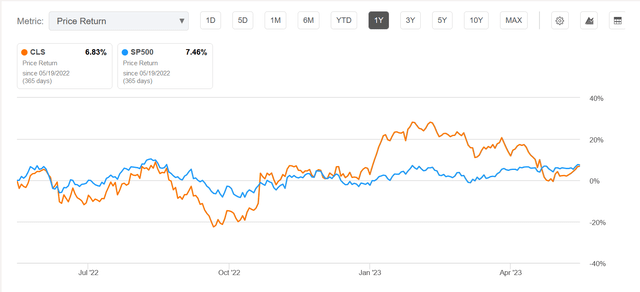

Celestica Inc has broad exposure to many different end markets but hasn't despite this been able to grow revenues at a strong 17% YoY rate in a challenging market environment. Looking ahead the company continues to estimate strong revenues generated for the year, with Q2 in 2023 expected to come in around $1.75 - $1.9 billion, more than the entire market cap of the company. In the last 12 months, the shares have grown close to 13% as a result of the solid reports the company has had. With that, investors have also been able to enjoy their stake in the company increasing in value as a result of the company buying back shares at a decent rate YoY, about 2.76% from 2018-2022.

CLS vs S&P 500 (Seeking Alpha)

One of the worries investors might have is that supply issues are diminishing and that will provide CLS with a smaller addressable market, but I think this is false, as CLS does more than just help with supply-chain issues. They help companies from the very start of production to the end which leaves CLS with still a very strong market to tap into. The company has a very low valuation, and I think there is plenty more upside from here than downside. Margins seem to have been stabilizing, and the company is even buying back shares at a decent rate. The company is a Buy in my opinion, especially with the shareholder-friendly approach the management seems to have and the stable balance sheet the company has maintained so far.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.