markets

How MF sectoral allocation changed in April

May 29, 05:05

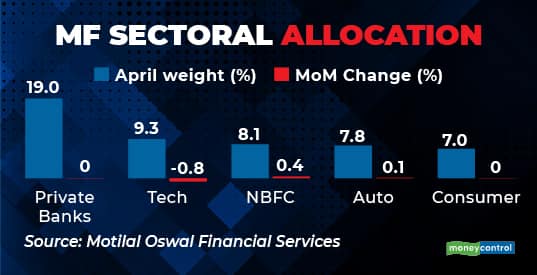

Mutual funds showed interest in Non-Banking Financial Companies (NBFCs), Autos, Capital Goods, PSU Banks, Telecom, and Infrastructure leading to a monthly rise in their weights, as per a report by Motilal Oswal Financial Services. On the other hand, technology, healthcare, cement, retail, and insurance sectors witnessed moderation during the month. Private banks (19 percent) was the top sector holding for MFs in April, followed by Technology (9.3 percent), NBFCs (8.1 percent), Autos (7.8 percent), and Consumer (7 percent). Technology witnessed a decrease of 0.8 percent in terms of allocation by MFs. Equity assets for MFs rose 4.1 percent to Rs 17.6 trillion in April, fuelled by a rise in market indices.