ZIM Integrated: A Buy-High-Sell-Low Investment Strategy Isn't Viable

Summary

- ZIM is now near its IPO prices, overly sold off after its earning miss and dividend cut.

- With the macroeconomic outlook still uncertain over the next few quarters, we may see its intermediate prospects impacted indeed.

- Then again, anyone expecting anything different from ZIM may have been misguided, since the shipping industry remains highly cyclical and therefore volatile.

- Ultimately, losses are only recorded if stocks are sold here. Those with strong hands may continue holding on as the ZIM management iterates its 2023 guidance.

- Meanwhile, investors must brace for impact, since Q2 may be similarly underwhelming, suggesting that things may worsen before they get better.

Marcio Silva

An Investment Strategy That Rides The Volatile ZIM Roller-Coaster

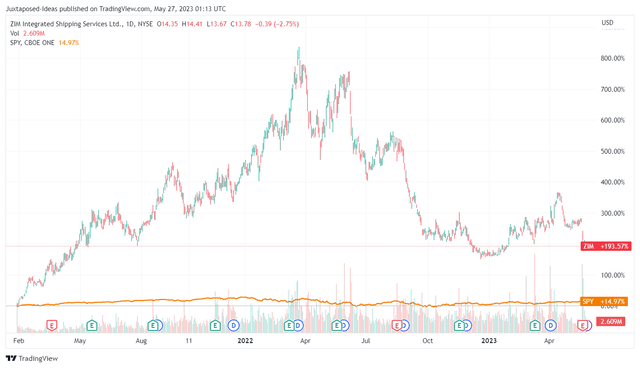

ZIM's 2Y Stock Prices

ZIM Integrated Shipping (NYSE:ZIM) has had a hyper-pandemic rollercoaster ride indeed, as evidenced by the tremendous rise and fall in its stock prices over the past two and a half years. Particularly, much of the pessimism is attributed to the temporary suspension of its previously stellar dividends for the current quarter, after paying out $16.95 over the past four quarters.

However, we suppose its long-term prospects remain decent, since six new vessels have been delivered thus far, improving its cost per TEU as highlighted by Xavier Destriau, the CFO of ZIM:

The cost of operating of 15,000 TEU ships on the Asia to the U.S. East Coast is clearly far much lower than the current cost with the 10,000 TEU ship that we currently operate. (Seeking Alpha)

In addition, ZIM is highly likely to surrender 54 of its older vessels through 2024, compared to the expected delivery of 40 new vessels, potentially improving its break-even rate. For now, it's largely spot-based contracts on the Transpacific (amongst others) remain decent, sustaining its "significant blank sailing" in the latest quarter.

However, with the overwhelming order book, the risk of oversupply in 2024 is a growing headwind, likely impacting freight rates and the container shipper's profitability compared to the hyper-pandemic levels.

Therefore, it remains to be seen if H2'23 may bring forth better numbers as projected by Alphaliner at +1.4% YoY, with the ZIM management also attempting to capture higher volumes at these times of impacted rates.

Meanwhile, the container shipper is still unable to commit clients to favorable long-term rates with negotiations still protracted, suggesting the increased exposure to the volatile spot rates in the near term.

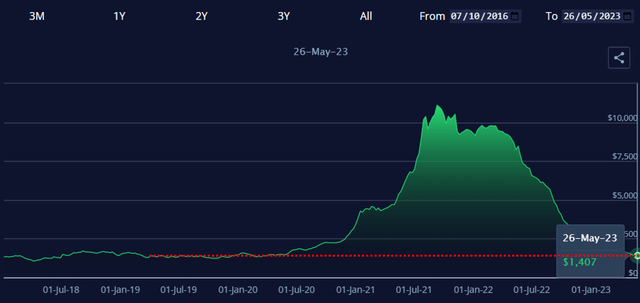

Freightos Baltic Index (FBX): Global Container Freight Index

Nonetheless, with the recent spot rates of $1.4K remaining consistent with pre-pandemic levels, based on the latest data from the Freightos Baltic Index [FBX], we are cautiously optimistic that the bottom may be near for the container shipping industry and ZIM alike. The worst may be here already.

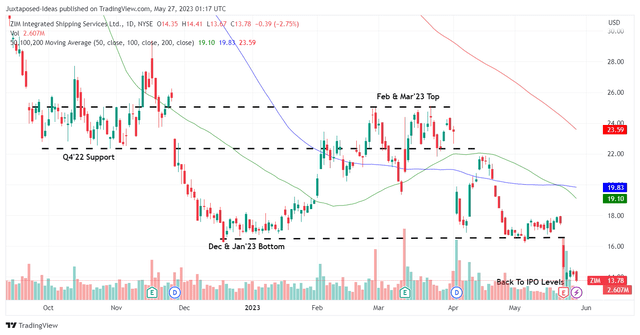

ZIM 6M Stock Price

As a result of the pessimism, it is unsurprising that ZIM has been sold off post-FQ1'23-earnings call and plunged near its IPO levels. However, we applaud the management's prudent decision, since capital preservation proves to be more important than shareholder returns for now.

By the latest quarter, its lease liabilities have further risen to $2.99B (+7.9% QoQ/ +7.5% YoY), with its interest expenses similarly expanding to $95.2M (+26.2% QoQ/ +110.1% YoY). The latter is likely attributed to its increasing interest rates with a weighted average of 7.7% by December 2022 (+2.7 points YoY), thanks to the Fed's sustained hike thus far.

Therefore, we concur with the management's strategic choice of keeping its cash/ short-term investments stable at $2.95B (-9.2% QoQ/ -38.6% YoY) by the latest quarter, or speculatively at $2.19B after accounting for the recent dividends payout of $760M.

This is on top of ZIM consistently deleveraging its loans and other liabilities to $87.6M (-4.6% QoQ/ -48.8% YoY) by the latest quarter, since it remains to be seen if the Fed may pause the hikes by June 2023, and pivot by the end of 2023.

Then again, investors must also temper their expectations since the container shipper expects its net leverage ratio to rise to the industry standard of approximately 2.5x moving forward, compared to the current 0.1x by the latest quarter, largely attributed to its new build vessels.

As a result of the potential volatility ahead, does it make sense to add ZIM here? It really depends on individual investors' risk tolerance and investing style. The shipping market is highly cyclical, with TEU rates and dividend payouts naturally variable, as witnessed through the container shipper's historical data thus far.

Furthermore, anyone looking for hyper-pandemic payouts may be sorely disappointed, since it is a one-off event, with the peak recessionary fears further suppressing demand and rates in the near term.

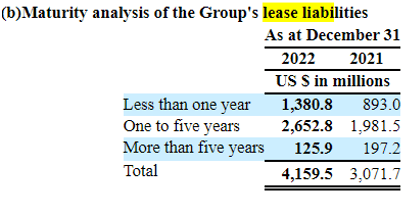

ZIM's Maturity Of Lease Liabilities

Seeking Alpha

Then again, while ZIM expects a consistent expansion of its lease liabilities over the next two years as more new vessels are delivered, we are cautiously optimistic for now, since the $4.03B maturing over the next five years (as of December 2022) may be well-staggered.

In addition, the management maintains its FY2023 guidance of adj EBITDA of $2B (-73.4% YoY) and adj EBIT of $300M (-95.1% YoY) at the midpoint. The recovery in demand and TEU rates by H2'23 may potentially negate its growing quarterly debt service of over $500M then, temporarily stabilized by the balance sheet.

Hence, we continue to rate the ZIM stock as a speculative buy at its previous IPO levels of $11.50 (-19.3% from current levels), for an improved margin of safety, since its Q2 may remain underwhelming, with profitability only returning by H2'23 along with its dividends.

With the macroeconomic outlook remaining uncertain, the portfolio must also be sized appropriately in the event of volatility, though we do not recommend selling at this near bottom since doing so may realize losses.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.