Is PAVE's Outperformance Set To Continue?

Summary

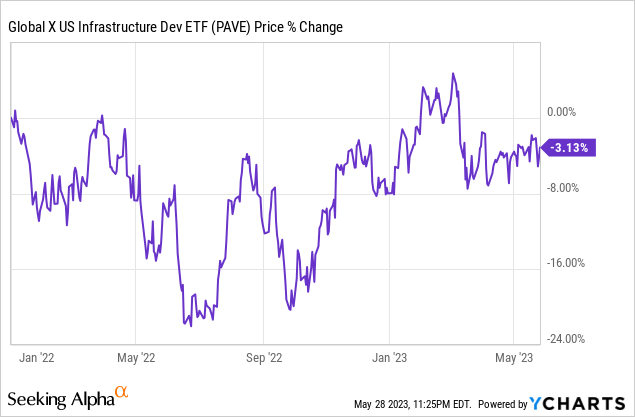

- PAVE has significantly outperformed the S&P 500 these past few years.

- Fundamentals have worsened, and fund performance might follow suit.

- A look at some recent negative developments for PAVE follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Gary Yeowell/DigitalVision via Getty Images

Author's note: This article was released to CEF/ETF Income Laboratory members on May 10th.

The Global X U.S. Infrastructure Development ETF (BATS:PAVE) has performed exceedingly well these past few years, with twice the returns of the S&P 500 since mid-2020. PAVE's outstanding performance was driven by its cheap valuation and strong growth prospects. Both of these have worsened in the recent past, although both remain at reasonable levels. In my opinion, PAVE remains a reasonable investment opportunity, but as fundamentals have worsened, I no longer expect the fund to outperform.

PAVE - Quick Overview

PAVE is an equity index ETF, investing in U.S. companies focusing on the development of U.S. infrastructure. The fund tracks the INDXX U.S. INFRASTRUCTURE DEVELOPMENT INDEX, an index of these same securities. The said index includes all U.S. equities from the following four industry segments / themes:

- Construction & Engineering Services.

- Raw Materials and Composites.

- Products and Equipment.

- Industrial Transportation.

Companies which derive the majority of their revenues from the above themes are eligible for inclusion in the index, although final security selection is somewhat discretionary.

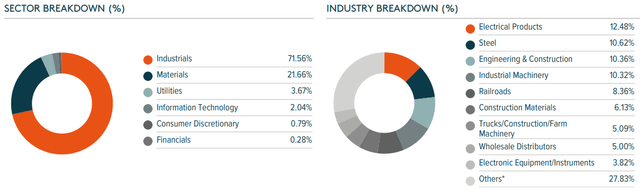

PAVE focuses on infrastructure development companies, which mostly means industrials and materials. Industry exposures are as follows:

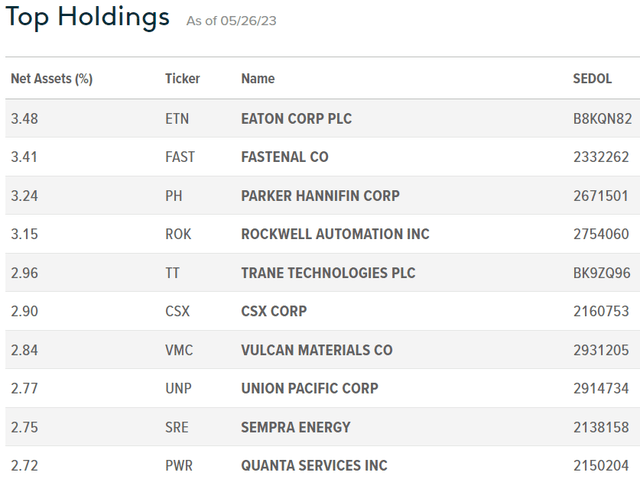

PAVE's holdings themselves are reasonably well-diversified, with investments in 98 securities. The largest of these are as follows.

In prior articles, I've argued that PAVE's investment thesis rests on the fund's cheap valuation and strong growth prospects. These have both worsened in the recent past, casting doubt on the fund's investment thesis. Let's have a closer look at these developments.

PAVE - Worsening Fundamentals and Investment Thesis

Valuation Analysis

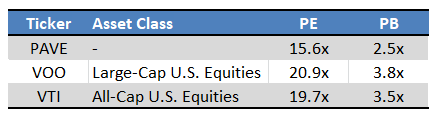

PAVE currently trades with a moderately cheaper valuation than the average U.S. equity or U.S. equity fund.

Fund Filings - Chart by author

Importantly, PAVE should trade with a cheaper valuation than average, as the fund focuses on older, stodgier industries and companies with weaker growth prospects. A sufficiently large discount might indicate a market inefficiency or profit opportunity, while a small discount would simply indicate a fair, rational market value. PAVE's current discount seems to be closer to the latter.

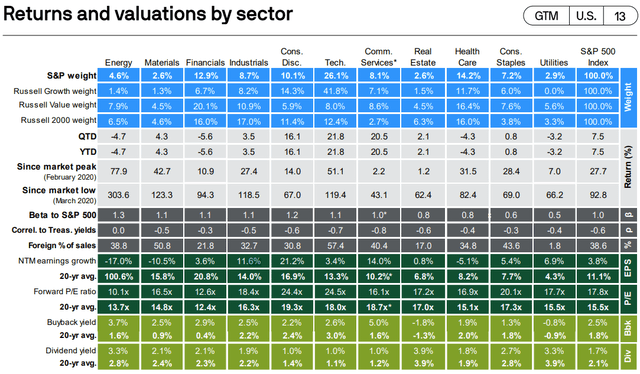

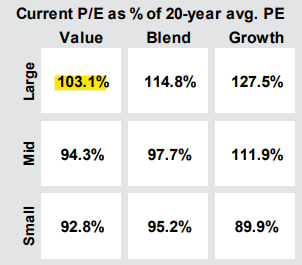

Specifically, as per J.P. Morgan, large-cap value stocks, the closest equity market segment to PAVE, are currently slightly overvalued relative to their historical averages. PAVE's valuation is quite cheap, but is within normal, historical parameters for the market.

JPMorgan Guide to the Markets

Industrials and materials, PAVE's largest industries, look moderately overvalued relative to their historical averages, adding more weight to the above.

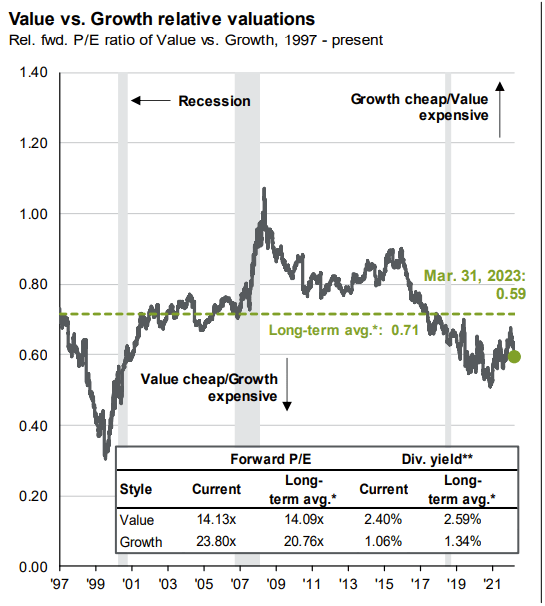

On a more positive note, value stocks look quite cheap relative to growth stocks right now, although less so than in prior months. Meaning, PAVE might not look all that cheap relative to its historical averages, but it does look cheap relative to tech, biotech, and other growth companies or industry niches.

JPMorgan Guide to the Markets

In my opinion, it would be fair to characterize PAVE's valuation as reasonable. It is a bit cheaper than the equity market average, much cheaper than growth stocks, but slightly more expensive than its own historical average. PAVE's price and valuation seem fine, even slightly good, but I'm not seeing the potential for significant capital gains here. PAVE does not seem cheap enough for that.

Growth Prospects Analysis

PAVE's underlying holdings have seen very strong growth these past few years. As per my calculations, these have averaged around 20.0% per year, with some volatility, and without accounting for changes in the fund's portfolio. Growth was due to increased infrastructure spending, tariffs on foreign manufacturers, rebounding durable goods spending following the pandemic, and higher profit margins from skyrocketing demand.

JPMorgan Guide to the Markets

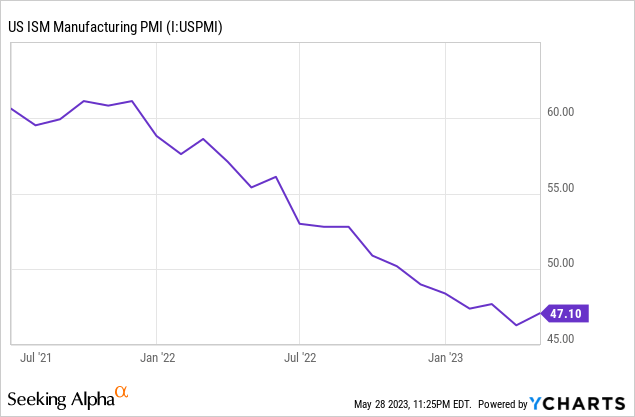

Growth prospects seem to be weakening, however. ISM PMI, a U.S. economic barometer based on purchasing manager surveys, has steadily declined since mid-2021. It breached 50, indicating a generalized economic / manufacturing slowdown, in November 2022, and has remained there ever since.

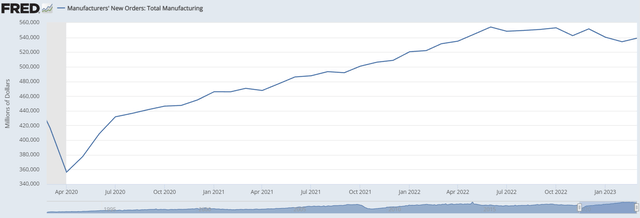

Durables goods spending is stagnating, due to inflation, and as conditions normalize following the pandemic plus pandemic recovery.

Federal Reserve Bank of St. Louis

Similar situation for manufacturing.

Federal Reserve Bank of St. Louis

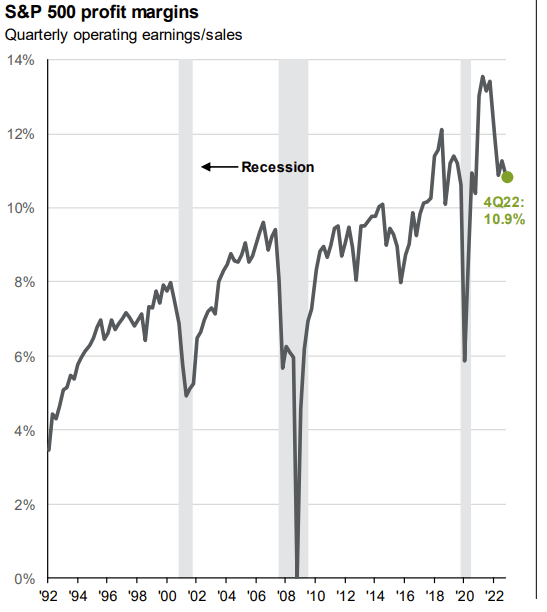

Profit margins are softening, due to weakening consumer demand, and as past supply chain issues are resolved.

JPMorgan Guide to the Markets

PAVE's declining earnings are also noticeable in the fund's PE ratio. The said ratio has increased during the past year:

Even as the fund's share price declines:

Depending on when, exactly, those PE ratios were calculated changes implied earnings growth rates, but these remain exceedingly weak regardless.

On a more positive note, analysts seem to be expecting reasonably strong 11.6% earnings growth for industrials, PAVE's largest industry. Expected growth is quite high, albeit a bit lower than in the recent past. Analysts expect materials, the fund's second-largest industry, to see earnings decline 10.5% next year.

From the above, it seems that PAVE's growth prospects have weakened, although analyst expectations of these remain strong. Perhaps analysts have a more complete, accurate view of the situation than I do, or perhaps they have yet to update their figures.

In my opinion, PAVE's growth prospects have significantly weakened these past few months. Growth expectations do remain strong, so perhaps the situation will improve in the coming months, but I'm seeing weakened fundamentals right now.

As with the fund's valuation, growth prospects are such that the fund remains a reasonable investment opportunity, but I'm not seeing the potential for significant gains or outperformance here.

Conclusion

PAVE's investment thesis rests on the fund's cheap valuation and strong growth prospects. Both have weakened as of late, but remain at reasonable levels. As such, the fund is currently a reasonable investment, but not one which I believe has the potential for significant outperformance.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.