U.S. Silica Holdings: Out Of The Doghouse (Rating Upgrade)

Summary

- U.S. Silica Holdings, Inc. has fixed the core debt problem that was a drag on its shares the last few years.

- The company has de-risked the ups and downs of the oilfield with a solid and highly profitable industrial segment.

- I think U.S. Silica Holdings stock is a strong bet at current prices.

- Looking for more investing ideas like this one? Get them exclusively at The Daily Drilling Report. Learn More »

mokee81/iStock via Getty Images

Introduction

U.S. Silica Holdings, Inc. (NYSE:SLCA) has been dead money, in the $12's mostly, since November of last year. Interestingly, SLCA stock fell much less than many others in the shale fracking service cadre, dropping from around $15 to just under $12. Not a bad performance given the train wreck that befell the drillers and frackers in the same time space.

I've written up the company a number of times in the last few years, with three buy ratings starting in May of 2020, at around $1.25 per share, followed by four hold ratings, starting in September of 2021 as the company struggled back into double digits and culminating in February of this year. Investors have been standoffish about SLCA for a couple of reasons in my estimation.

First is the general bad taste left by the string of sand company implosions in the 2018-2020 era. Badly managed and loaded with debt from over expansion and ill-timed acquisitions, sand companies became a very hard sell. It didn't help the case, that that sand prices fell into the single digits per ton as producers ground suppliers to the bone. Second, SLCA was one of those companies that made a series of ill-timed acquisitions, running up a few hundred million dollars with sand and logistics companies, and then in 2018 taking out competitor EP Minerals for $750 mm in cash. As they entered 2020, SLCA was $1.2 bn in debt, which became increasing oppressive as its due date in 2025 crept nearer.

In April of this year, the company's fortunes changed considerably, with the rescheduling of $950 mm of the ~$1.1 bn in debt due in 2025 to 2030, and further increasing their Revolver to $150 mm, zeroing out a $109 mm balance from proceeds of the Term Loan. When you add the success they have had with their Industrial segment, and regaining pricing power in the Oilfield segment, it can truly be said the company is back from the dead and worthy of an upgrade.

The thesis for SLCA

As a combination of poorer quality rock in lower tier intervals, a general consensus in the industry that more sand per foot of completion is better long term than less sand per foot of completion, and the need to replace aging wells to maintain output, companies providing frack sand have a long runway to generate revenue and increasing profits. There is no shale oil or gas without fracking, so as long as we are addicted to affordable energy, we will pump millions of tons of sand into the earth to liberate these resources. This is good for U.S. Silica Holdings, Inc. and SLCA stock.

The company has also developed a robust Industrial sales division, with a number of branded products that have gained traction over the last few years. Industrial sales account for smaller volumes, but come at considerably higher prices than oilfield sales.

U.S. Silica Holdings, Inc. is the top supplier to the oilfield in terms of tonnage per quarter. In Q1 2023, they knocked down 3.9 mm tons, a ten percent increase over the prior quarter. Some of their bulk sales are facilitated by their internal "Sandbox" last mile delivery service that containerizes bulk sand for handling at the rig site. Sandbox rentals also rose 9% QoQ. Segment margins are attaining levels not seen since 2018 - the last good year reference point - and the contribution margin for Q1 was $28.03 per ton, a 16% increase. CEO Bryan Shinn commented on the outlook for the rest of 2023:

In terms of kind of supply and demand, we think that demand, say, in the Permian kind of drives the bus around most of this. We think capacity may be up 6% to 7%, call it, 6.5% year-on-year, and we expect demand growth up 18%. So a significant tightening as we go through the year here.

The Industrial-ISP, segment has made real inroads to a number of areas, not the least of which are reflective coatings applied to roofing materials. They have also substantially grown existing high-value differentiated products such as ground silica, diatomaceous earth powders and fine fillers and high-purity filtration substrates; and third, expansion of our addressable markets with sales of new high-value advanced materials such as cristobalite, EverWhite Pigment and White Armor solar reflective roofing materials. Volumes for the ISP segment decreased 2% when compared to the prior quarter, due to seasonal slowdown. And totaled 1,013,000 tons. Segment contribution margin increased 7% on a sequential basis and totaled $42.9 million, which on a per-ton basis was $42.38. The sequential increase in the results for the ISP segment were mostly due to price increases and the benefit of lower production costs.

In summary, SLCA has survived a lot of the financial missteps it took in past years. The debt rescheduling was pivotal in this healing, and gives the company time to begin defraying the total amounts. CEO Bryan Shinn commented on their accomplishments to date, and plans to continue deleveraging-

We continue to forecast robust operating cash flow generation this year with free cash flow expected to fund growth capital needs and continue to opportunistically reduce net debt. Our current expectation is that we will end the year with net leverage around 1.5x.

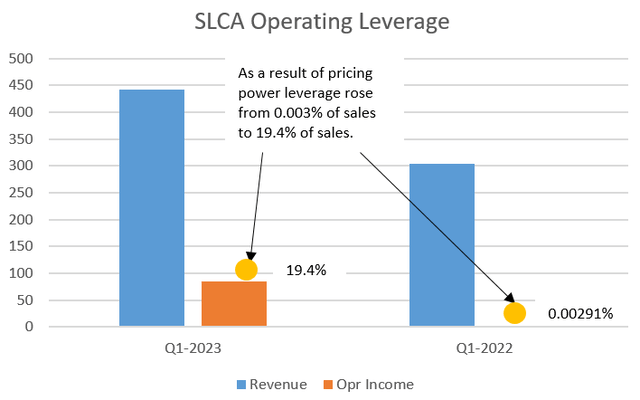

Q1 2023 and guidance

The company generated $442 mm in sales for Q1 and landed out with $85.1 mm in operating income. Year-over-year, this is a dramatic increase in both areas that illustrates the return on demand and pricing power to the industry.

Operating Leverage for SLCA (Seeking Apha/Chart by author)

CEO Bryan Shinn commented on a couple of points that naturally come to mind with the slowdown we have seen in drilling, since the first of the year. The first is the integration of sand as part of fracking service that we have seen with companies like ProFrac Holding Corp. (ACDC), Liberty Energy Inc. (LBRT), and Halliburton Company (HAL):

We’re still serving all of those customers, even though they are doing some integration, but I think the sand is still needed from folks like us and SandBox is a key part of what some of those companies are doing as well in terms of transportation.

The point about Sandbox is compelling. Logistics is critical, and only Liberty has significant resources in this area. The tendency to pair complementary services to minimize supply chain complexity is a natural reflex, along with operator desire to secure long-term supplies.

Next, and probably most important, on any decision regarding SLCA is price stability and potential continued growth.

The reality is the amount of sand that's being used in the industry is going up. We see customers signing new contracts for sand, signing new long-term contracts for sand. We signed even a couple of new Northern White contracts here in Q1 we're also seeing an increase in some of the smaller private energy companies looking at what they're planning to do for the remainder of the year seems to be much more significant than perhaps what's being reported out there.

During the first quarter, SLCA delivered $121 mm of EBITDA, and $40.9 million of cash flow from operations. Capex for Q1 ran to $18.9 million, primarily for facility maintenance cost improvement and growth projects. Full year capex is forecast between $50-$60 mm. The company's cash and cash equivalents on March 31, 2023, totaled $139.5 million, which includes the impact of the $109 million loan extinguishment mentioned earlier and associated fees. At quarter end, our $150 million revolver had $0 drawn, with $128.7 million available under the credit facility after allocating for letters of credit.

Risks

It's clear U.S. Silica Holdings, Inc. is benefiting from completion intensity-amount of sand per foot and the new desire of the industry to drill longer wells. Talk of 15,000' wells is becoming commonplace in industry calls. With 3,000# per foot being injected, that's another 15 mm pounds per well. Were that to change - not likely in my view - the new price regimes could be under threat.

A big slowdown in homebuilding could put their primary ISP business - roofing tile coating - under threat. Low inventories in housing make this a fairly remote concern, and this could easily be offset by repairs post catastrophic storms.

Your takeaway

I think U.S. Silica Holdings, Inc. has again become investible at current levels. Having the debt wall relief for another five years gives the company ample time to chip away at it with cash flow, as they have indicated they will do.

SCLA is trading at a ridiculous EV/EBITDA multiple of 4X for a company exhibiting their operating leverage. Analysts are bullish, suggesting investors overweight the stock. Price targets range from $15-$24 per share, with a median of $20. SCLA beat EPS estimates handily in Q1, coming in at $0.64 per share vs. estimates of $0.49. Q2 estimates are currently $0.60 per share. If they beat again by the same margin, EPS could land out at ~$0.75. That would lead to EBITDA of over $650 mm on a full year basis, and earnings of $225 mm. To keep the multiple at 4, the U.S. Silica Holdings, Inc. stock price would have to rerate toward the $24 per share that's the upper range of current estimates.

I think investors looking for growth should take a hard look at U.S. Silica Holdings, Inc. No commentary was made about U.S. Silica Holdings, Inc. shareholder returns, but they would become a natural consequence of the goal of 1.5X debt to capital.

This article was written by

I am an oilfield veteran of 38+ years. Retired from Schlumberger since 2015. My background is drilling and completion fluids. I have authored a number of technical papers on completion topics. I have worked around the world- Brazil, Russia, Scotland, and the Far East. I still maintain a training and consulting practice and am always willing to help people who want to learn.

New- The Daily Drilling Report is Live!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SLCA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.