CrowdStrike Earnings Coming Up: What Will It Take To Bolster Recent Gains?

Summary

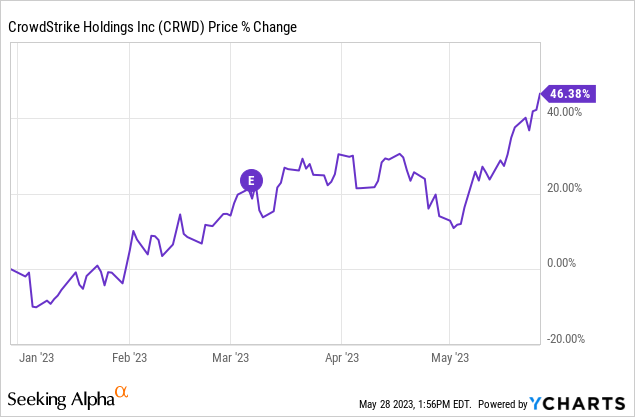

- CrowdStrike stock has enjoyed a 46% run YTD, with a recent push from AI enthusiasm.

- The company has a bold, quantifiable initiative for growth over the next three years.

- Let's examine key performance indicators to look for and whether the stock's recent run is sustainable.

arthon meekodong

When are CrowdStrike's earnings?

CrowdStrike (NASDAQ:CRWD) will release Q1 fiscal 2024 earnings after the bell on Wednesday, May 31. The earnings call is viewable here for everyone interested.

I last covered CrowdStrike when I asked if I was right to double down before it released fiscal 2023 results. Earnings didn't disappoint, and the market only shrugged.

Then, NVIDIA (NVDA) happened.

You may have noticed a few NVIDIA articles if you have spent time on Seeking Alpha lately. It's been very thoroughly covered (and rightfully so - it's a big story!). NVIDIA's earnings smasher on May 24 buoyed the entire technology sector, including most companies remotely connected with Artificial Intelligence (AI). CrowdStrike stock surged and is up 46% YTD, as shown below.

The big question: Are the gains sustainable?

CrowdStrike has a $5 billion Plan

CrowdStrike lays out a bold objective: $5 billion in annual recurring revenue (ARR) by fiscal 2026 - three fiscal years from now. And it has a roadmap to get there.

As an investor, this vision is excellent because it is (1) specific, (2) aggressive, and (3) attainable.

The importance of a specific target:

Having a specific objective is refreshing. We can measure management's performance based on quantitative expectations. It also helps performance by defining targets. Just like an athlete visualizes certain plays and outcomes before a game, explicit goals improve performance more than ambiguous ones.

It's time to be dynamic:

The aggressiveness of the target is also crucial. CrowdStike has formidable competition, the market is fragmented, and the next several years could determine whether it is a dominant player over the long haul (and we investors profit handily) or becomes an also-ran. The time to push is now.

The goal is attainable:

CrowdStrike's Falcon platform provides solutions from Cloud Security to Identity Protection, but its bread and butter is Endpoint Security.

Endpoint protection is vital to comprehensive and effective cybersecurity. Most cyberattacks and breaches originate here, and hybrid and work-from-anywhere trends amplify the need. CrowdStrike's Falcon platform is the market share leader with 17.7% of the total market, just outpacing Microsoft (MSFT), which holds 16.4%.

According to industry studies, the total endpoint market is expected to rise from $8.6 billion to $20 billion over the next three years. From here, the math is pretty simple; the Modern Endpoint market alone should provide CrowdStrike ~ $3.5 billion ARR by 2026 by maintaining its current share. CrowdStrike believes its total addressable market will exceed $100 billion, so market constraints aren't an issue. Gobbling up as much of the market as possible is.

Let's do the math:

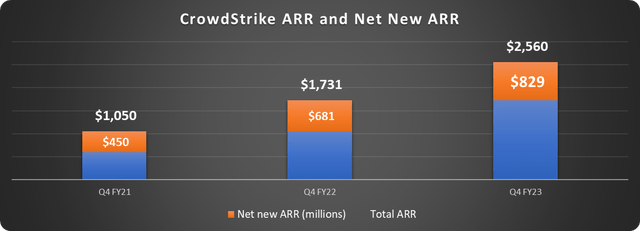

CrowdStrike's ARR grew 48% last year, with a record $829 million. The company adds more net new ARR each period, so absolute growth is accelerating even as percentage growth will slow due to the laws of large numbers, as shown below.

Data source: CrowdStrike. Chart by author.

CrowdStrike will easily eclipse its $5 billion goal by maintaining its $829 net new ARR pace from fiscal 2023. The fact that net new ARR will probably continue to increase means we should expect CrowdStrike to blow this number out of the water.

Looking at it another way, if ARR grows by 25% compounded annually, we will see $5 billion by fiscal 2026.

Metrics to watch

The obvious metrics by which CrowdStrike's quarter will be judged are ARR and the growth rate; however, the dollar-based net retention rate (DBNR) and customer growth are better indicators of future success.

Retention rates

DBNR measures the expansion of revenue within the existing customer base. A 100% DBNR means customers are spending the same as the prior year. CrowdStrike has maintained a DBNR of over 120% since Q1 2019 and above 125% last quarter despite tightening budgets economy-wide.

Why is this important? Maintaining the DBNR above 120% will push CrowdStrike towards its $5 billion goal just from its current customer base.

Customer counts

New customers are also crucial to long-term success. Switching costs are high for cybersecurity providers; CrowdStrike's gross customer retention is over 98%, so customers have incredible lifetime revenue values.

The customer count more than doubled over the past two fiscal years from 9,900 to over 23,000. And the average ARR per customer rose from $106,000 to $111,000.

CrowdStrike added over 1,800 customers last quarter. Given the current economic situation, adding customers near this clip would be a huge win.

Cash flow

CrowdStrike produced $941 million in cash from operations last year and $677 million in free cash flow, both records. This comes with a massive dose of stock-based compensation, over $500 million last year, which is expected to dilute shareholders ~3% annually over several years. The company has an aggressive employee stock purchase program (ESPP) and rewards executives.

The company also has $2.7 billion in cash and investment on hand. A stock buyback program to offset dilution would be a wonderful gesture to shareholders; however, by reading between the lines, I no longer expect it. CrowdStrike's latest investor briefing guided for $129 million in interest income by the middle of this fiscal year. I'll spare you the math, but this wouldn't be possible if the company spends a material chunk of its liquid assets on buybacks.

There is good and bad here. As a shareholder, dilution is frustrating. On the other hand, I'm willing to bet that CrowdStrike wants to keep its cash hoard to be opportunistic if an acquisition makes sense. The ESPP also aligns employee and executive interests with shareholders. Who wants to purchase stock (even at a discount) if it's falling? Finally, $129 million interest income is a 5% cherry on top of last year's ARR.

Is CrowdStrike stock a buy?

I have been bullish on CrowdStrike for a while and still am. It was one of my rule-breaking top long-term picks for 2023, and the stock has done very well YTD. By reaching its attainable ARR goal, the market cap can double while maintaining the same sales valuation ratio.

However, a word of caution. The NVIDIA and AI hype train has definitely left the station, and the rising tide has lifted many boats - including CrowdStrike. Dollar-cost averaging and patience are really important. There should be opportunities to purchase CrowdStrike at a better price soon, barring a shockingly great quarter and guidance raise. For this reason, I am bullish on CrowdStrike for the long haul but rate it a hold for now.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.