ZROZ: The Ultimate Play To Profit From Dovish Fed

Summary

- ZROZ is an ETF vehicle, which invests in long-duration zero coupon U.S. Treasuries.

- Since the FED changed its stance on the monetary policy, ZROZ has delivered nothing but inferior returns.

- High duration and notable convexity factors of ZROZ offer a great exposure for investors, who consider dovish monetary policy to be around the corner.

- While high duration and convexity play is the key feature of ZROZ, investors, who long the ETF are also being rewarded with ~4% YTM and protection from looming recession.

manassanant pamai

The 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA:ZROZ) tracks 25 U.S. Treasury securities with an effective duration of 27.54 years. All of the 25 securities are strips (zero coupon) to maximize the duration profile. The total assets under management is ~ $0.85 billion with a gross expense ratio at 0.15%.

Key characteristics of ZROZ and how to play them

ZROZ is extremely sensitive to the fluctuations in the interest rates. In fact, the whole ETF objective function is to carry this sensitivity to allow investors either short or long the interest rate risk at low cost and on an unleveraged basis.

The main drivers of the considerable sensitivity are the following:

- Long duration fixed income instruments (25+ year maturities).

- Zero coupon, which boosts the duration profile relative to a comparable but coupon-based fixed income instrument.

- Zero coupon, which increases the convexity, thus magnifying the sensitivity stemming from first-order effect (i.e., duration).

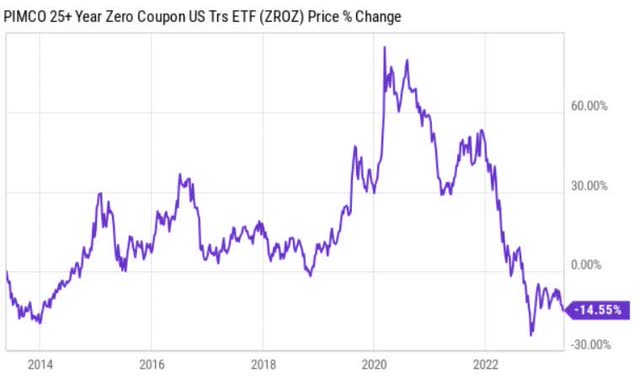

In this chart, we can see how ZROZ has responded to rate cuts from mid-2019 and hikes starting from April 2022. Obviously, ZROZ has responded (priced in) rate of change in the FED interest rates earlier than when the actual decisions were made. This is because bond and equity market are per definition forward-looking instruments, pricing in the probabilities of future cash flows.

When the FED slowly but surely started to decrease the FED Funds rate in August 2019, ZROZ skyrocketed and already by 2021 had appreciated by more than 80%. Conversely, when the FED switched gears in 2022 to combat surging inflation, ZROZ quickly lost all of the previous gains and entered a negative return territory on a trailing three-year basis.

These dynamics depict well the underlying strength of ZROZ's interest rate factor.

Now, here is my thinking on why ZROZ deserves a place in investor portfolios.

#1 To magnify portfolio returns from potentially falling interest rates

As the aforementioned dynamics indicate, ZROZ is structured to respond considerably to the rate of change in the interest rate policy.

In my opinion, it is close to impossible to predict with high precision and favourable success rate the trajectory of interest rates (and not only the trajectory, but also the magnitude and duration of it).

However, investors should appreciate the probability of rate cuts in the foreseeable future. It is clear that there are more and more elements occurring, which could potentially justify interest rate cuts - e.g., looming recession, tightness in the banking and capital markets space, tangible signs of disinflation etc.

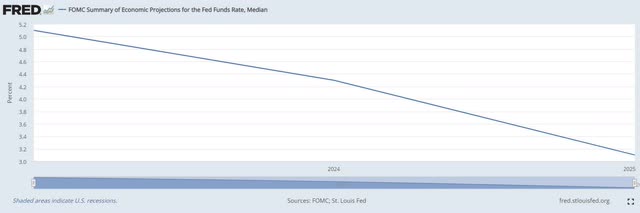

Federal Reserve Bank of St. Louis

In fact, the FOMC projections signal a gradual normalization of interest rates.

Again, while it is hard to predict and know with certainty the future path of interest rates, having an instrument in investor portfolios that inherently delivers superior returns from more accommodative monetary policy is, in my opinion, a sound idea.

#2 Exposure to duration and convexity at low cost and without leverage

Usually, one has to enter derivatives contracts to capture a sufficient duration/convexity factor exposure in order to enjoy an outsized return potential in the case of lowered interest rates.

Yet, derivatives tend to be complex and not easily understood by retail investors (and some institutional investors as well, given the recent history). Plus, buying, for example, options or futures comes along with premiums and margins, respectively, that have to be covered at the initiation.

ZROZ, however, provides a truly loaded interest rate factor exposure at very lost cost. Not only the gross expense ratio of 0.15% could be considered extremely low, but also the ETF's size and liquidity provide benefits on the bid-ask spreads (i.e., cheaper trading costs).

In some instances, investments vehicles embody a high degree of leverage to increase the underlying exposure to a certain return factor. Obviously, this comes with an extra (borrowing) costs.

The notion of zero coupon and ultra long duration Treasuries helps ZROZ maximize the factor exposure so that there is not that much of a need to introduce leverage.

#3 Acceptable yield and low beta exposure

The good thing about ZROZ is that it also provides predictable and somewhat acceptable yield for investors, who want to wait for interest rate factor to materialize. For derivatives contracts, usually the opposite is the case - i.e., investors incurring carry expense, while maintaining exposures to certain factors.

Currently, ZROZ yields ~4% and distributes 'coupons' on a quarterly basis.

Moreover, the fact that ZROZ's portfolio is comprised of U.S. Treasuries means that future returns will be less correlated with those of the market. In my opinion, this is crucial in the context of recessionary risks, where the odds are not in investors favour to enjoy further rallies in the equity markets.

In closing

ZROZ provides an exposure to high duration and high convexity factors, which could deliver abnormal returns in case the FED initiates a regime of interest rate cuts. At the same time, ZROZ awards investors with an acceptable yield of ~4% at very low cost, which is not that common for instruments that offer so strong duration/convexity factor exposures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.