USOI: Covered Call Oil Futures ETF, Unclear Investment Thesis

Summary

- A reader asked for my thoughts on USOI. The fund's strategy is equivalent to investing in oil futures and selling covered calls on its holdings.

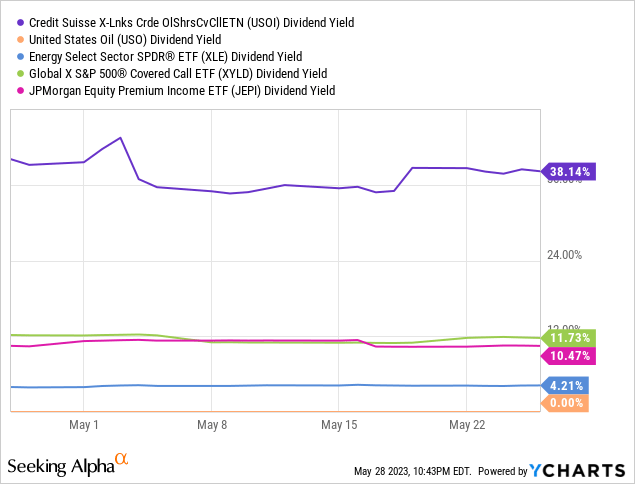

- USOI has a strong 38.1% distribution yield but reduced potential capital gains and unchanged potential capital losses.

- USOI's strategy of selling covered calls on oil futures may not be compelling or appropriate for all types of investors.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

LukaTDB

Author's note: This article was released to CEF/ETF Income Laboratory members on May 6th.

The X-Links Crude Oil Shares Covered Call ETN (NASDAQ:USOI) has exposure to oil futures, and sells covered calls on its holdings, distributing the proceeds to shareholders. The result is an incredibly strong 38.1% distribution yield, moderately reduced potential capital gains, no change to potential capital losses. As oil prices are incredibly volatility, the fund should see long-term declines in its share prices and distributions, as has been the case since inception.

In my opinion, although there is nothing inherently wrong with the fund's overall value proposition, I don't find it all that compelling, nor particularly appropriate for any type of investor. USOI seems like a solution in search of a problem: I can't really see why investors should want exposure to oil prices, but with reduced potential capital gains and a higher yield. Perhaps some oil bulls who wish to limit their risk find the trade-off compelling, but the fund's strategy only limits risks in a very indirect way, and there are simpler ways of achieving this (limiting exposure, for instance). As such, I would not invest in the fund, although some investors might find its overall value proposition compelling.

USOI - Strategy Analysis

USOI's investment managers have a surprisingly simple explanation of the fund's underlying index, its strategy and expected performance. This is as follows, lightly edited for length and clarity.

USOI seeks to implement a "covered call" strategy on oil futures, by investing in the United States Oil Fund (USO), while selling monthly call options on that position, which are 6% out-of-the-money. Net premiums received for selling the calls are paid out at the end of each monthly period as a distribution. The strategy is designed to generate monthly cash flow in exchange for giving up any gains above 6% per month. The strategy does not provide protection against capital losses / lower USO share prices.

The above is a quick, simple explanation of USOI's behavior, expected performance, and characteristics. These provide investors with several important benefits and drawbacks. Let's have a look at these, starting with the benefits.

USOI - Benefits

Strong Yield

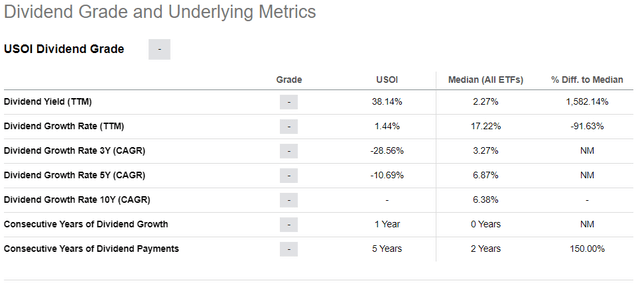

USOI's call options generate significant premiums which are distributed to shareholders. Due to this, the fund sports a massive 38.4% distribution yield. It is an incredibly strong yield on an absolute basis, almost 10x higher than that of energy equity indexes, and around 3x higher than average for a covered call fund. It is a massive yield, and a significant benefit for the fund and its shareholders.

USOI's distributions are particularly strong relative to other covered call funds, as some of these retain a portion of their distributions, and because options on oil are quite expensive, due to heightened oil volatility.

In my opinion, as USOI's comparatively strong distribution is partly due to differences in distribution policies, investors should not consider the distribution to be indicative of higher income or potential returns relative to other covered call funds. It is still a massive yield though, and a massive benefit for shareholders.

Potential Outperformance

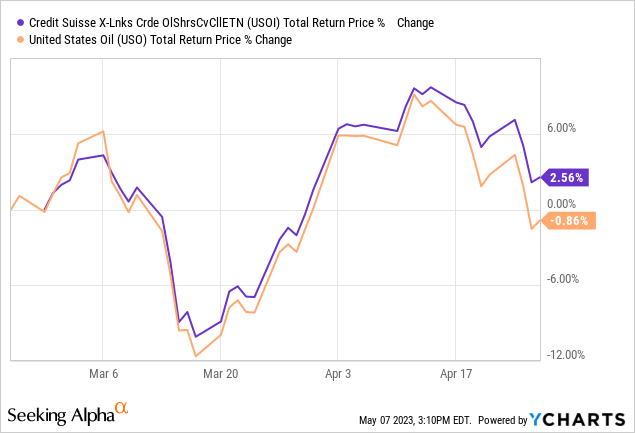

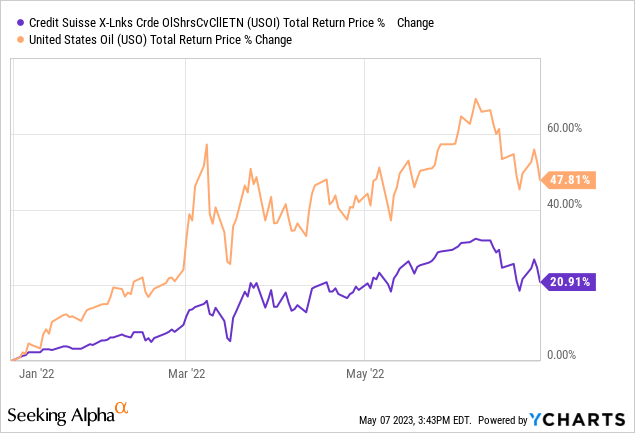

USOI's strong distributions directly increase the fund's total returns, and are generally particularly impactful when oil prices are muted or declining. Expect the fund to outperform USO when oil prices are flat, as was the case from early January to late April.

Data by YCharts

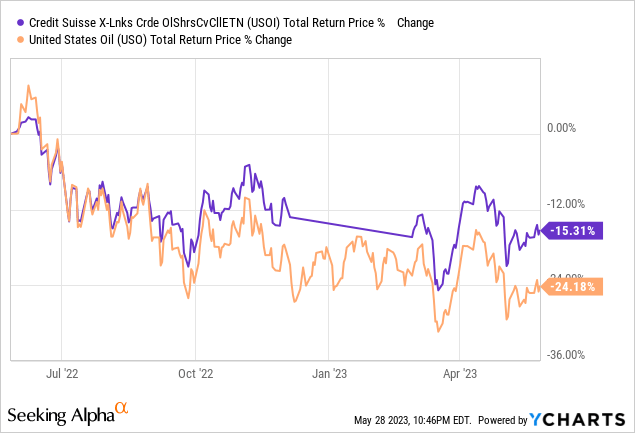

Expect the fund to outperform USO when oil prices are declining, as has been the case these past twelve months.

USOI's outperformance relative to USO during periods of declining or flat oil prices is a significant benefit for the fund and its investors. Said benefit seems to be particularly beneficial for more bearish, conservative investors, looking to limit any potential losses from declining oil prices.

Good Potential Capital Gains

USOI's covered call strategy limits capital gains to around 6.0% per month, a significant reduction in potential gains, considering heightened oil price volatility. Nevertheless, gains remain quite strong on an absolute basis. Fact of the matter is, 6.0% in potential capital gains per month are a lot, and could result in sizable gains for investors if oil prices increase.

In my opinion, the fund's potential capital gains are good, and should be construed as a benefit. These do remain limited, and lower than those of USO, but are, in general terms, quite good.

With the above in mind, let's have a look at the fund's drawbacks.

USOI - Drawbacks

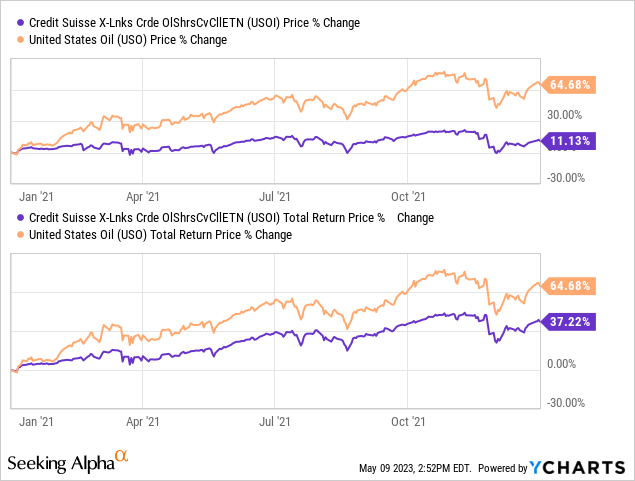

Below-Average Potential Capital Gains

As mentioned previously, USOI's capital gains are lower than those of USO, an important disadvantage of the fund relative to its benchmark. Expect the fund to see significantly reduced capital gains, and to underperform, when oil prices skyrocket, as was the case in 2021.

Data by YCharts

Although including the fund's potential capital gains as both a benefit and a drawback seems, well, inconsistent, I do think there is an important distinction here. USOI could see good capital gains and these are generally lower than those of USO. Both of those statements are true, and investors should consider and understand both.

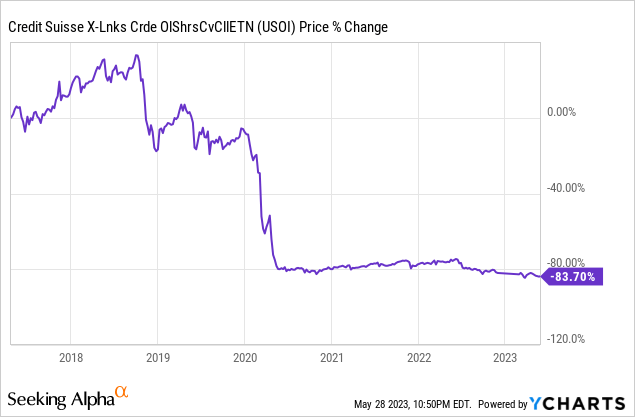

Long-Term Capital Depletion and Distribution Cuts

USOI's capital gains are somewhat limited, while downside potential remains unchanged. Due to this, and considering elevated oil price volatility, the fund will very likely see long-term capital losses / lower share prices, as has been the case since inception.

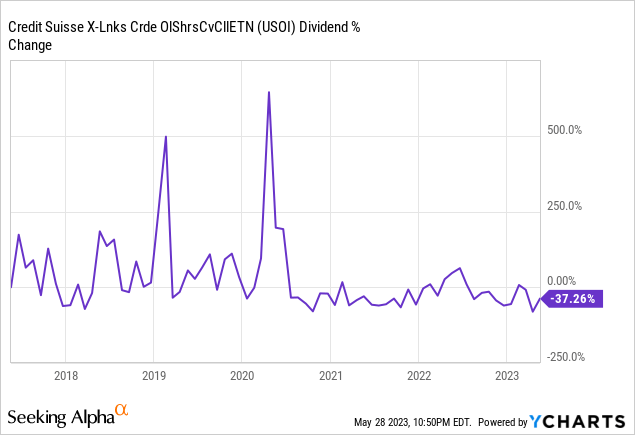

As USOI's assets and share price decreases, so does the amount of calls it sells, leading to lower option premiums and distributions. Due to this, USOI's distributions should decline long-term. Although this has been the case since inception, as distribution volatility is sky-high, these figures are not necessarily all that material.

Looking at annual distributions also shows a decline, with some volatility.

Seeking Alpha

USOI's declining share price and distributions are two significant negatives for the fund and its shareholders.

Underperformance When Oil Prices Skyrocket

USOI sees lower capital gains when oil prices significantly increase, which could lead to underperformance during the same. As an example, USOI significantly underperformed relative to USO during 1H2022, during which oil prices skyrocketed 47.8%.

Data by YCharts

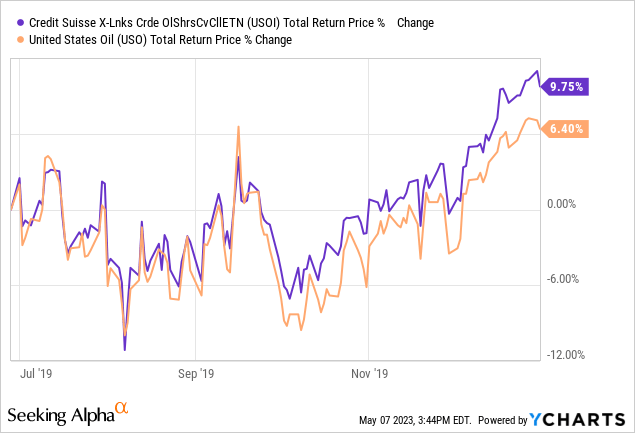

On a more positive note, as USOI still sees some capital gains and boasts a strong distribution, the fund might not necessarily underperform during less aggressive oil price upswing. As an example, USOI outperformed in 2H2019, during which oil prices increased by 6.4%.

Data by YCharts

In my opinion, and considering the above, USOI will only necessarily underperform when oil prices skyrocket. This remains a negative for investors, but a somewhat muted one.

Futures Risks and Costs

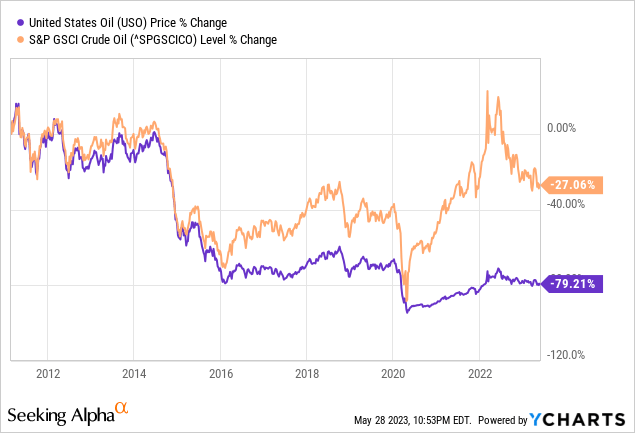

USOI is notionally exposed to USO, a futures ETF. These ETFs tend to suffer from several issues. The specifics are complex, but the overall situation is quite simple. Strategies which heavily rely on futures tend to be quite costly to implement, reducing returns. In the short-term, favorable price movements can easily swamp these costs. In the long-term, these costs steadily erode a fund's asset base and returns. Costs vary, which introduces an extra element of risk to futures ETFs.

These issues and costs have led USO to lag behind oil price indexes since inception in the past, and will likely have a similar impact moving forward.

USOI tracks USO, so it suffers from the same issues as above - a negative for the fund and its investors.

Conclusion - Unclear Investment Thesis

USOI is a covered call oil futures ETF, providing investors with several important benefits and drawbacks. As a whole, I think these make for a reasonable fund, but I don't find the overall value proposition compelling, nor do I think there is a clear target market for what the fund is offering.

In my opinion, oil bulls would almost certainly be better off investing in a simple oil futures or oil equity fund, like USO or the Energy Select Sector SPDR Fund ETF (XLE). Oil bears would almost certainly be better off avoiding the industry entirely. Income investors would be better off focusing on funds with more sustainable distributions, including the JPMorgan Equity Premium Income ETF (JEPI) and the Global X S&P 500 Covered Call ETF (XYLD).

The fund does look somewhat enticing for more conservative oil bulls, as the fund's distributions could lead to outperformance when oil prices decline, but even this is arguable. USOI experiences the exact same price declines as USO, and the distributions might not make up for the fact that USOI sees weaker recoveries (due to fewer capital gains). As such, I would not invest in the fund, although some investors might find it a compelling investment.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.