As Interest Rates Rise, The Era Of 'Deficits Don't Matter' Is Over

Summary

- For over thirty years, warnings about the federal debt and annual deficits have come from those who insisted that running up huge debts would become a problem. They were right, but the time frame has proven to be much longer than most anticipated.

- Many significant global political and economic changes intervened to ease the process of incurring an enormous national debt, even as the total debt exploded from $5.6 trillion to $22.5 trillion between 2000 and 2019.

- In the coming five years, we'll begin to see how a newly accelerating debt, declining demand for dollars, and rising price inflation will finally reveal how and why deficits do matter after all.

GamePH/iStock via Getty Images

Originally published on May 27, 2023

By Ryan McMaken

Back in 2002, then-Vice President Dick Cheney claimed, "Reagan proved deficits don't matter" and went on to push for tax cuts combined with more federal spending. After 2003, the economy seemed to be growing, and after the 2008 financial crisis hit, all that really mattered was bailing out Wall Street to "save" the global economy.

In fact, for more than thirty years, stern warnings about the federal debt and annual deficits have come from wet-blanket curmudgeons who insisted that running up huge debts would become a problem. They were right, but the time frame has proven to be quite a bit longer than most anticipated. Many significant global political and economic changes intervened to ease the process of incurring an enormous national debt, even as the total debt exploded from $5.6 trillion to $22.5 trillion between 2000 and 2019. These changes included rising global productivity, a new globalized workforce, and solid global demand for dollars - which fueled apparently limitless demand for for US government bonds. This ensured the debt remained easy enough to manage. For a time.

Things are changing, however, and in the coming five years we'll begin to see how a newly accelerating debt, declining demand for dollars, and rising price inflation will finally reveal how and why deficits do matter after all.

How Much Debt Are We Talking About?

The US's national debt is now projected to exceed $32 trillion in 2023. That's up by nearly ten trillion dollars since January 2020. Nearly eight trillion of that came in 2020 and 2021 alone. Since 2019, the rate at which the US government has taken on new debt has significantly accelerated beyond what was already a shocking rate of deficit spending. Back in 2019, I noted that the Trump administration had added nearly a trillion dollars to the deficit in a single year of what was considered an economic expansion. That was remarkable at the time. Of course, what happened under both Trump and Biden during the Covid panic made a trillion dollars look like spare change.

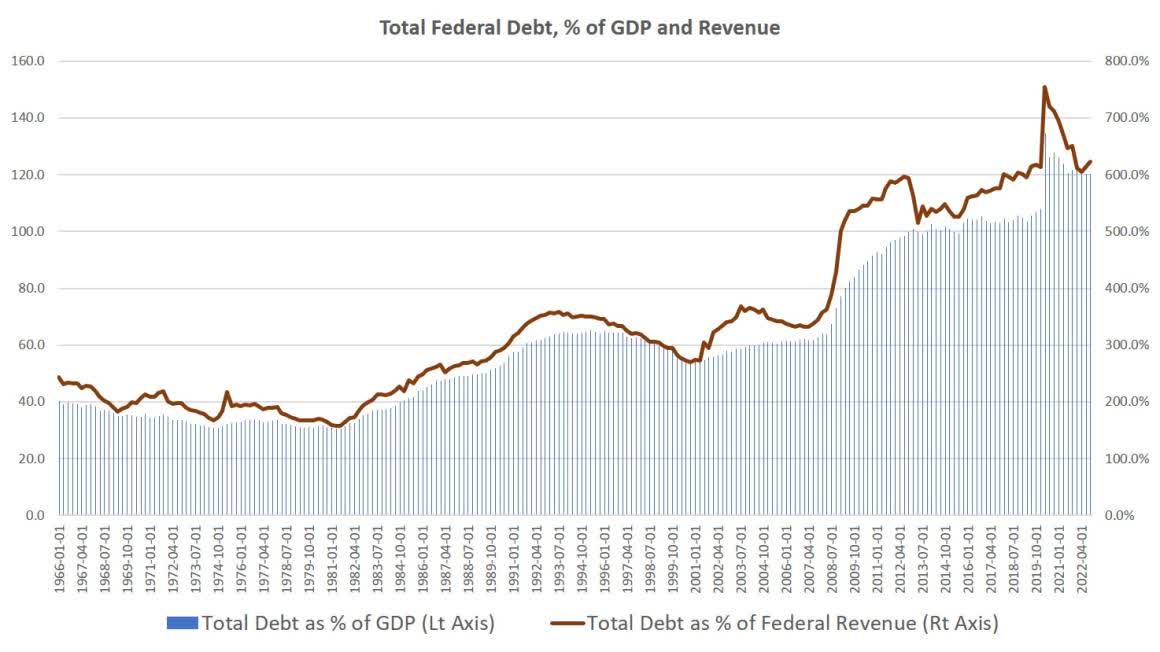

Moreover, the debt has reached new post-World War II highs in proportion to the overall size of the economy. In 2020, total federal debt as a percentage of national GDP shot up to 120%. This puts the US at previously unseen peacetime debt levels.

Comparing debt to GDP doesn't tell us much about the government's ability to pay and service its debt, however. A more realistic measure is total debt compared to federal revenues. By this measure, we also find debt has accelerated to peacetime highs. Total federal debt is now more than 6 times the size of annual federal receipts.

This Translates Into a Lot of Interest Payments

The problem with a large national debt isn't that it's big or difficult to pay off. An enormous debt can be sustained indefinitely by a government so long as it can manage paying the interest on the debt. For most of the past three decades, the US government had it very easy in this respect. It could run up huge annual deficits, incur trillions of dollars in new debt, yet interest payments on that debt remained remarkably stable and did not rise to "out of control" levels.

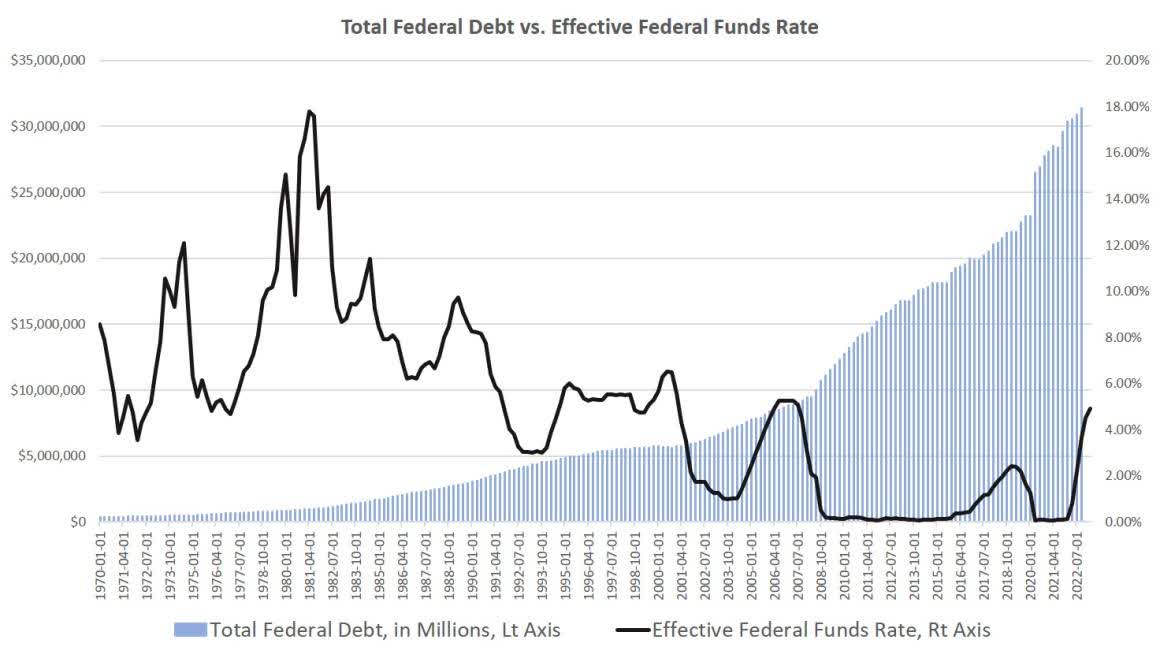

This was made possible by the fact that interest rates trended downward again and again for most of the past 35 years. If we look at the federal funds rate - which tends to trend with average interest levels paid on federal debt - we can see that debt levels surged at the same time that interest rates were falling. This fall in interest rates prevented interest payments from surging upward as well.

Why this rates fall? During much of the 1990s, the US grew to dominate the global economy in the wake of the end of the Cold War. This drove far greater need for dollars worldwide, and all those dollar holders put many of the dollars into buying US government debt. This pushed down the cost of issuing new federal debt considerably. Even after the rise of the euro after 1999, globalization helped sustain global demand for US debt, as did the eurodollar economy.

After 2008, interest rates on US debt were pushed down even further as the US central bank bought up nearly six trillion dollars' worth of US bonds. As this artificial demand for federal bonds rose, the interest rate sank further. So, even as the federal government was adding trillions to the national debt after 2009, interest payments remained manageable.

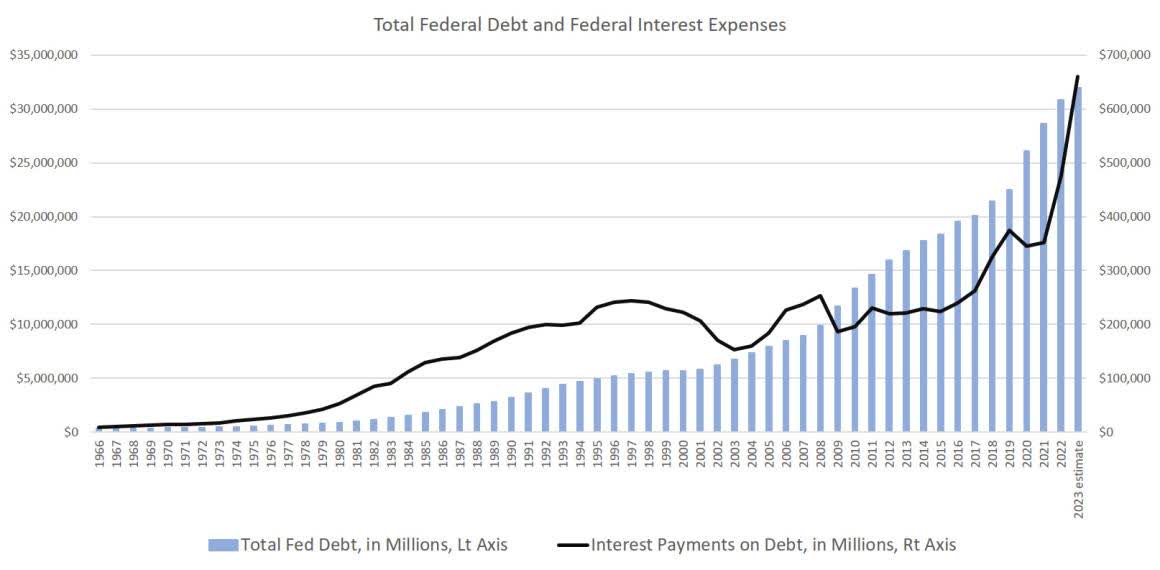

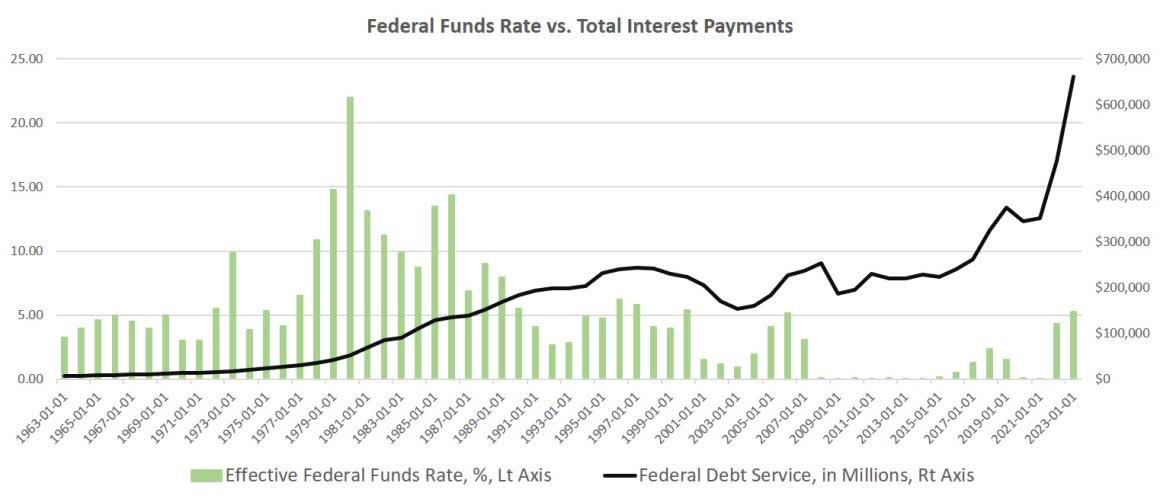

We can see how from 1998 to 2015, total debt service costs barely budged in spite of an ever-growing national debt. This finally began to grow after 2017 with the growing mega-deficits and efforts at the Federal Reserve to finally allow interest rates to increase over fears of price inflation. After 2020, of course, interest payments on the debt then surged above half a trillion dollars, and are projected to increase further:

Interest Payments Will Gradually Consume the Federal Budget

It is here where we begin to see the problem with such huge debt levels. An enormous debt makes total debt payments far more sensitive to movements in interest rates. In 2007, when the national debt was at a "mere" nine trillion dollars, the federal funds rate could rise above five percent without a resulting surge in interest payments. More than a decade later, with debt levels at $30 trillion, a similar increase in the federal funds rates leads to a much larger increased in debt service payments.

In practical terms, this means that a government with enormous debt levels likely cannot sustain any sizable increases in interest. Under these conditions, debt payments will gradually grow larger and larger until they consume much of the nation's federal spending.

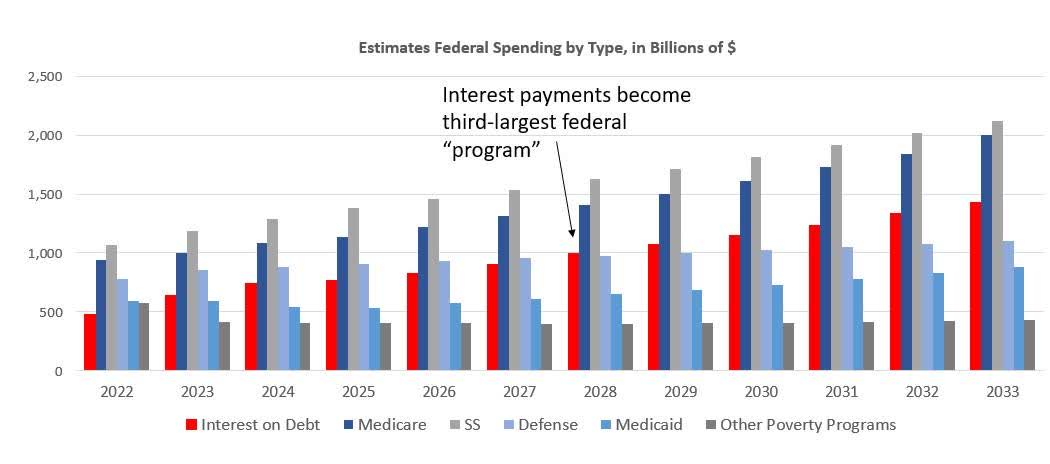

We can see this in even the official federal projects for debt payments moving forward. For example, according to the Office of Management and Budget (OMB), the federal government will owe $660 billion in debt service in 2023. But this will increase to $960 billion by 2028, in five years. For comparison, we can note that the OMB also projects the entire defense budget in 2028 will be $966 billion.

The OMB's projections are rather conservative compared to forecasts in a February report from the Congressional Budget Office. According to the CBO report, interest payments will reach nearly a trillion dollars in 2028 and will continue to climb after that. In a decade, total interest payments will exceed $1.4 trillion and will be the third-largest federal "program" behind Social Security and Medicaid. At that time, interest payments will exceed defense spending by $300 billion.

On a per capita basis, this is not exactly trivial. In 2030, for example, the $1.4 trillion owned in interest payments will work out to approximately $4,000 per American adult of working age (adults between ages 18 and 65).

In other words, within six years, American taxpayers will be forced to pony up more than a trillion dollars every year to just to cover long-past federal spending on various lost wars and failed social programs.

Keep in mind, however, that this is all a "best-case scenario." CBO and OMB estimates assume there will be no recessions in coming years, and they also assume relatively stable interest rates. The CBO estimates forecast interest on US federal debt will average about 2.7 percent in 2023, but will not increase significantly after that, rising only to 3.2 percent by 2031.

That's possible, of course, but current trends suggests the CBO is too optimistic. Geopolitical realities point to a relative decline in demand for the dollar - which will also lead to a decline in demand for US bonds. The US insists on isolating itself both politically and economically as it wages sanction wars - or threatens to do so - on many of the world's key economies. This will all drive up interest rates. As we've shown here on Mises.org, the dollar is unlikely to disappear as an important global currency, but it is likely to face more competition. That will mean higher interest rates for federal debt as dollar demand wanes.

Another key development here is that the central bank no longer has the freedom to force down interest rates as it did a decade ago. Back then, the Fed could simply buy up new government debt to prop up demand and keep down interest rates. This has required the central bank to engage in large amounts of monetary inflation. For a time, that seemed to work, but then price inflation rose to 40-year highs and has remained stubbornly high. The Fed can no longer simply print up an additional trillion dollars to buy up US government debt - and then just hope no price inflation appears. Rather, because price inflation is so politically unpopular, the Fed has to treat lightly on new monetary expansion. This ties the hands of Fed in how much it can intervene to keep interest rates low.

Thus, the very mild increases in interest rates predicted by the CBO may greatly understate the true risks.

Moreover, this all assumes that endless increases to debt service will be politically tenable ten years from now. Will voters really be convinced that they have to endure increasingly large cuts to popular government programs in order to keep paying money to bondholders forever and ever?

At some point, the voters are likely to say "enough" when it comes to escalating debt payments. And that's when a country gets either hyperinflation or a sovereign debt crisis. In the meantime, that interest bill is just going to keep getting bigger.

Disclosure: No positions.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by