CBL & Associates Properties: Back In The Game But Far From Winning It

Summary

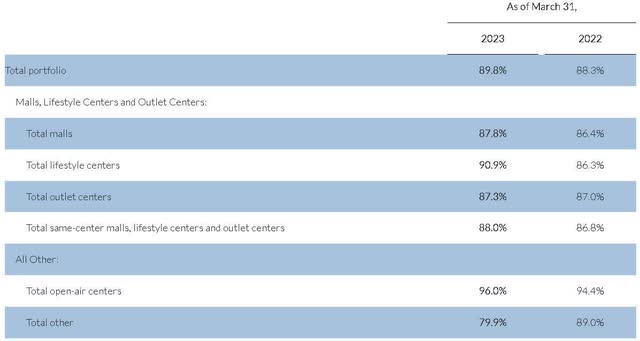

- CBL Properties experienced increased portfolio occupancy by 150 basis points to 89.8% in Q1 2023 as compared to 88.3% YoY.

- The decrease in same-center NOI and FFO per share, along with declining tenant sales per square foot, suggest that challenges persist.

- The company has been trading between 1.45x and 2.3x its book value since the pandemic shock. At the moment, it trades at 2.02x its book value.

onurdongel

CBL & Associates Properties, Inc. (NYSE:CBL) is back in the game but far from winning it. The Q1 earnings report showed mixed results with growth in occupancy rates and rents, but declining NOI, FFO per share, and tenant sales indicate ongoing challenges. Big brands such as Gap and Macy's are refining their strategies, prioritizing premium locations and in-store shop experiences while scaling back their general presence in malls. While the close to 5% dividend yield appears enticing, the potential risks supersede the prospective benefits in my opinion.

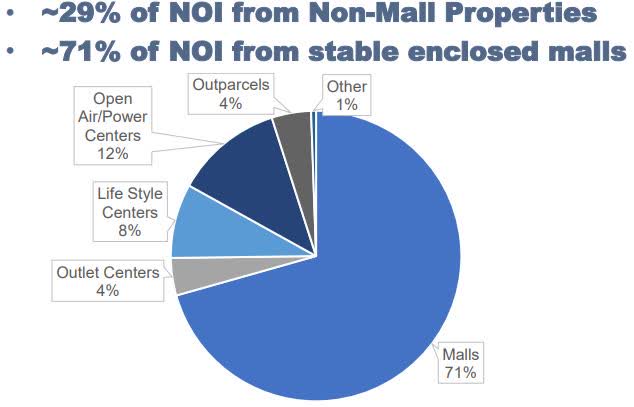

Property Portfolio

The company owns 94 properties across 22 states, primarily retail centers. It also holds a small number of hotels and office spaces. CBL has significantly reduced its operational scale from $6 billion in gross properties in 2020 to under $2 billion by 2023.

CBL Property portfolio (1st Quarter 2023 Earnings Presentation)

First Quarter Earnings

The first quarter earnings report indicated a mixed performance. The company showed signs of growth in occupancy rates and rents. However, the decrease in same-center NOI and FFO per share, along with declining tenant sales per square foot, suggests that challenges persist. We can easily say that the pandemic downturn is not over for CBL and I can hardly see that the company can fully recover even with some positive external momentum in 2023. It's also evident that the company has been working on managing its financing, engaging in significant activity, and demonstrating an ability to source capital despite a challenging market. The company's guidance indicates a cautious but steady outlook for the rest of 2023. I think this is partly due to the retail slowdown the sector has been experiencing for months despite consumers returning to face-to-face shopping.

CBL Properties, in the first quarter of 2023, experienced increased portfolio occupancy by 150 basis points to 89.8% as compared to 88.3% YoY. This growth in occupancy was also reflected across malls, lifestyle centers, and outlet centers. The company also successfully executed nearly 1.3 million square feet of leases, signing them at 2.5% higher average rents than before.

CBL Occupancy Rates (invest.cblproperties.com)

However, the same-center Net Operating Income witnessed a decline of 4.5% due to unfavorable variance in uncollectable revenues, a decrease in percentage rents, and increased operating expenses. Also, the Funds from Operations, as adjusted per share, declined from $2.05 for Q1 2022 to $1.56 for Q1 2023 which is a massive 24% decline on a YoY basis. The company also recorded a decline in same-center tenant sales per square foot. Nevertheless, the company maintained a healthy cash position with $282 million of unrestricted cash and marketable securities, and the Board declared a regular cash dividend for Q2 2023 of $0.375 per share. For the full year of 2023, the company reiterated its guidance, expecting FFO per share in the range of $5.85 - $6.47, and same-center NOI in the range of $418 - $440 million. Furthermore, the company undertook robust financing activity worth more than $312 million, including a significant mortgage for Friendly Center in Greensboro, North Carolina, and managed to generate $4.9 million in gross proceeds from the sale of four land parcels. Also, the company marked the opening of Nordstrom Rack at its open-air center in Chattanooga, TN.

There were some management changes as well. A couple of weeks ago, CBL Properties promoted Katie Reinsmidt to Chief Operating Officer, Jennifer Cope to a key operations role, and Joseph Khalili to a financial planning position. As the new COO, Reinsmidt will lead the company's operations and will be responsible for overseeing the operations of the company's portfolio, driving strategic growth initiatives, enhancing analytics, and improving financial performance and operational efficiency.

Shopping mall trends to be aware of

The year 2023 is anticipated to be a critical juncture for shopping malls, determining which ones prosper or flounder. Despite the global pandemic and the substantial growth of e-commerce, mall traffic is rebounding, exhibiting resilience. More and more people shop offline just like more and more people get on the road, travel by plane and go to hotels. Looking at TSA checkpoint travel numbers we can clearly say that the pandemic is over. However, there are some shifts in the mall and retail landscape. The largest U.S. mall owner, Simon Property Group, Inc. (SPG), reported sustained momentum with an upward trend in occupancy rates. Yet, a study from Placer.ai warns that inflation may drive consumers to curtail non-essential shopping, especially in states with above-average inflation. Although inflation numbers are coming down YoY basis MoM figures are not that great yet. There's been a noticeable shift in consumer preferences, with rising demand for holistic, entertainment-driven experiences leading to longer, more comprehensive mall visits. This trend has propelled mall owners to diversify their tenants to meet these changing demands, incorporating non-traditional outlets such as medical offices and gyms. Major brands like Gap and Macy's are adjusting their strategies, focusing on top-tier locations and shop-in-shop experiences while reducing their overall mall presence. As part of its strategic plan to focus on its digital operations, Gap announced that it will be closing 50-55 stores across North America by the end of 2023. This includes both Gap and Banana Republic stores.

The impact of these shifts varies across different types of malls. Grocery-anchored shopping centers, for instance, saw growth in 2022 compared to both 2019 and 2021, driven by a surge in necessity shopping, and suburban expansion. Outlet malls, on the other hand, are facing increased competition and a decrease in visits. As consumers focus on essential purchases, these malls are struggling to retain traffic. On the other hand, I believe that despite these challenges, shopping centers remain a pivotal part of the American retail landscape. The transformation will likely continue into 2023 as struggling malls, particularly lower-tier ones, repurpose their real estate. This could result in a significant reduction in their numbers, and the conversion of more retail space into workspaces, residential units, or e-commerce fulfillment centers. Consequently, 2023 could witness an increased divergence between higher-tier (Class A) malls and the struggling lower-tier (Class B and C) malls.

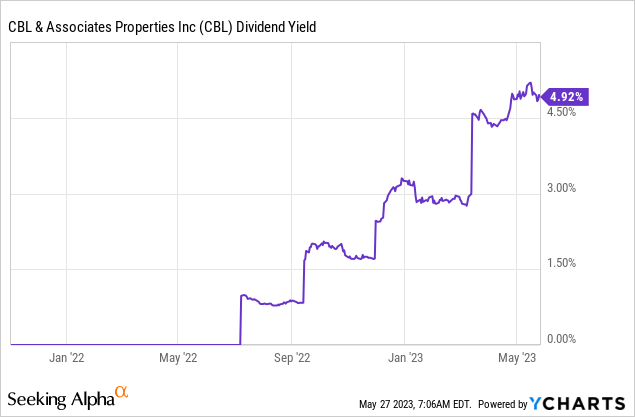

Valuation and Dividend

The company has been trading between 1.45x and 2.3x its book value since the pandemic shock. At the moment it trades at 2.02x its book value so based on this data I am confident that the company is fairly valued and far from undervaluation, especially with only a stable outlook and no major growth for 2023. As the company reinstated its regular dividend it is now trading at almost 5%, which might be attractive for income-seeking investors. However, I believe that the risks out-weight the potential reward at the moment.

CBL announced a regular quarterly cash dividend of $0.375 per share. This dividend corresponds to an annual dividend payment of $1.5 per share. However, there is a big chance that the company will need to announce a special dividend at the end of 2023 just as they did in 2022 to retain its REIT status. According to my calculations, this year’s special dividend will not be that massive but it is realistic to expect a special dividend between $0.8- $1 although it is risky to count on because we only saw the Q1 results for 2023.

Final thoughts

CBL is coming back from its ashes but they are far from a great stable and secure REIT company in my opinion. The almost 5% dividend yield might be tempting but the external retail trends projected no growth in 2023 and a fair valuation does not make the company a primary REIT investment target for me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.