DHT Holdings: A Promising Future With Strong Financial Structures And Positive Market Outlook

Summary

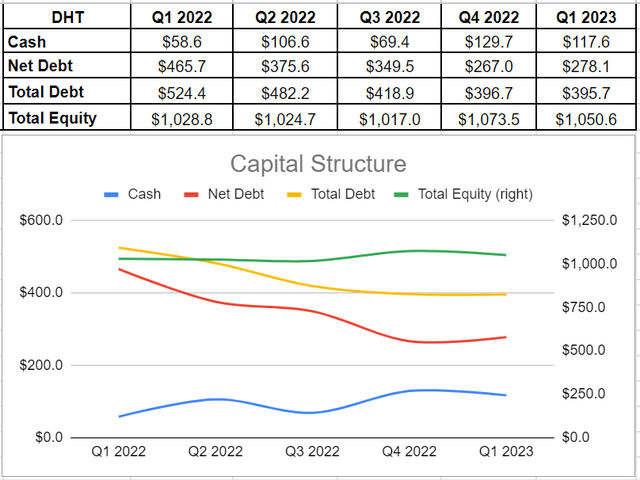

- DHT Holdings' cash balance for the first quarter of 2023 has significantly increased to $117.6 million from $58.6 million in the same period of 2022.

- Moreover, they have successfully reduced their debt levels to $395.7 million in 1Q, which is a 24% decrease compared to the first quarter of 2022.

- According to the company's existing contracts, DHT’s VLCC spot and charter rates in the second quarter of 2023 are higher than in 1Q 2023.

- Due to higher seasonal crude demand and also higher crude oil demand from China and India in the second half of the year, VLCC rates in 2H 2023 may be higher than in 1H 2023.

HeliRy

Introduction

DHT Holdings (NYSE:DHT) possesses a fleet of 23 VLCC crude oil tankers, making it a significant player in the industry. Seven of its vessels are currently on time charters, while the remaining sixteen operate in the spot market. This allows DHT to have a presence in both markets, while operating on international routes. After conducting a thorough analysis of the company's financial structures and market outlook, I have concluded that a buy rating is appropriate for its stock.

DHT financial outlook

During these uncertain economic times, brought on by the COVID-19 pandemic and rising interest rates to combat inflation, it is crucial to consider companies with strong financial standings. DHT Holdings is one such company, as evidenced by recent developments indicating that management has taken steps to improve their liquidity. In early 2023, DHT Holdings secured a new $405 million credit facility with ING Credit Facility, which will mature in early 2029. They also increased their credit by refinancing $37.5 million with Credit Agricole, which will mature at the end of 2028. Additionally, the sale of three vessels in 2022 generated a gain of $19.5 million for DHT Holdings.

During the first quarter of 2023, lower TCE rates and a weaker crude oil market resulted in decreased revenue and Adjusted EBITDA compared to the end of 2022. The company's Adjusted EBITDA and revenue for 1Q 2023 were $71.9 million and $131.5 million, respectively, compared to $95.4 million and $166.5 million at the end of 2022. However, these amounts were significantly higher than the same period in the previous year, which saw figures of $14.4 million and $76.4 million in 1Q 2022. DHT's decision to sell vessels during the second half of 2022 partially improved their cash balance and reduced net debt amounts. Furthermore, DHT Holding's cash balance for the first quarter of 2023 has significantly increased to $117.6 million from $58.6 million in the same period of 2022. Moreover, they have successfully reduced their debt levels to $395.7 million in 1Q, which is a 24% decrease compared to the first quarter of 2022. This has resulted in a remarkable 40% decline in net debt, from $465 million in 1Q 2022 to $278 million in the current year's first quarter. With an equity level exceeding $1 billion, DHT Holding's capital structure remains robust and healthy, making it a winning choice amidst economic pressures (see Figure 1)

Figure 1 – DHT’s capital structures (in million)

Author

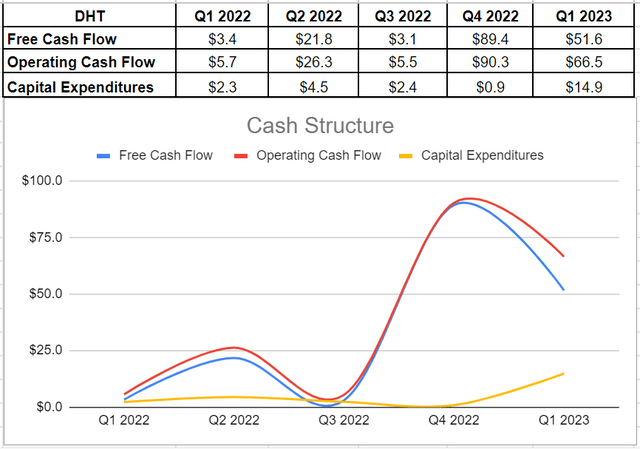

Analyzing DHT's cash structure reveals the company's strong performance in recent quarters. In 1Q 2023, DHT generated $66.5 million in operating cash flow, and their capital expenditures were primarily driven by the acquisition of two VLCCs, 10 exhaust cleaning systems, and water treatment systems over the past few years. In 1Q 2023, their capital expenditures totaled approximately $15 million. As a result, DHT was able to generate $51.6 million in free cash flow during the recent quarter, which is significantly higher than the $3.4 million generated in 1Q 2022. These figures suggest that DHT is well-positioned to provide returns to shareholders without facing significant concerns related to their cash structure (see Figure 2).

Figure 2 – DHT’s cash structure (in millions)

Author

The market outlook

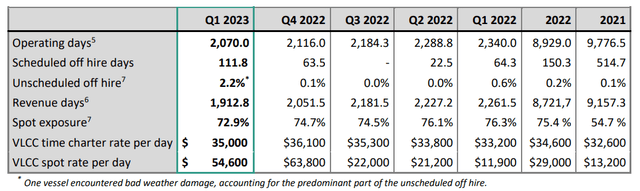

According to Figure 3, in the first quarter of 2023, DHT’s VLCC time charter rate per day was $35000, lower than in 4Q 2022 and higher than in 1Q 2022. Also, the company’s VLCC spot rate per day in 1Q 2023 was $54600, lower than in 4Q 2022, and significantly higher than in 1Q 2022. DHT has a spot exposure of more than 70%, implying that the company can benefit from higher spot rates as the market condition improves. On the other hand, as the demand for crude oil decreases and spot rates fall subsequently, DHT’s relatively high spot exposure can negatively impact its financial results. It is worth noting that in February 2023, DHT entered into a three-year time charter contract, that decreased its spot exposure slightly. As of 3 May 2023, 65% of the company’s available VLCC spot days had been booked at an average rate of $70300 per day, meaning that the company’s 2Q 2023 VLCC spot revenues can be significantly higher than in 1Q 2023. In the first quarter of 2023, as of 8 February 2023, 75% of DHT’s available VLCC days (combined spot and time charter days), had been booked at an average rate of $48400 per day. In the first quarter of 2023, as of 3 May 2023, this rate was $55800. Furthermore, it is important to know that the company’s estimated spot P&L break-even decreased from $26200 per day for 1Q 2023 to $24900 per day for 2Q 2023. Thus, in the second quarter of 2023, DHT can benefit from both higher rates and lower expenses.

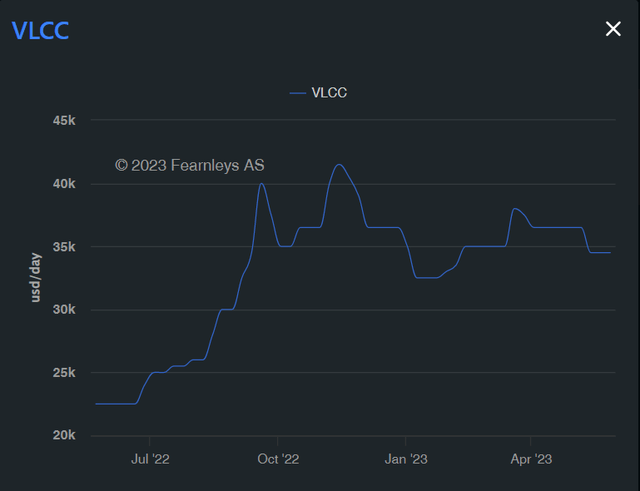

Figure 4 shows that the VLCC 1-year average time charter rate decreased from November 2022 to January 2023, then increased from the end of January 2023 to mid-March 2023. In April and May 2023, the average 1-year time charter rate was lower than its levels in mid-March 2023, however, still higher than in January and February. According to EIA’s short-term energy outlook, the world’s liquid fuel consumption in the second half of the year is expected to be higher than in the first half, reflecting higher seasonal demand and increasing crude oil demand from China and India. Thus, in the second half of 2023, VLCC rates can increase, especially VLCC spot rates, bringing a good opportunity to DHT to benefit from its high spot exposure.

Figure 3 – DHT’s operational highlights

DHT's First Quarter Results

Figure 4 - VLCC 1-year average time charter rate

Fearnleys Weakly Report

Risks

Overall, the global economic growth is improving. However, as a result of high-interest rates especially in the United States, the global financial markets can experience some instabilities by the end of the year. A contraction or tightening of the global credit markets can result in serious volatility in the financial markets, hurting global economic growth and limiting the demand for crude oil. Lower demand for crude oil means lower demand for VLCCs and lower spot and charter rates. DHT has a high spot exposure, which makes the company able to benefit highly from strong market conditions. However, if despite the expectations, the demand for crude oil decreases, DHT’s cash generation ability may get hurt seriously. Furthermore, a limited number of customers comprise the main part of DHT’s revenue. Five customers represented 50% of DHT’s revenue in 2022. Thus, even if the demand for crude oil continues to increase according to the current expectations, the loss of one of its main customers can adversely affect DHT’s cash generation ability in a significant way. Thus, besides the importance of keeping an eye on the global crude oil market, you should continuously follow the company’s news about its customers.

Conclusion

According to the company's existing contracts, DHT's VLCC spot and charter rates are projected to increase in the second quarter of 2023 compared to 1Q 2023. Additionally, due to increased seasonal crude demand and higher crude oil demand from China and India in the latter half of the year, VLCC rates in 2H 2023 may surpass those of 1H 2023. Given this positive market outlook, coupled with the company's robust financial structures, I recommend buying DHT stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.