DXJ: Hawkish Fed Feeds The Hedge

Summary

- The markets are beginning to think that the Fed may actually stay hawkish, despite regional banking woes and signs of slowdown globally.

- This is good for the USD, and since DXJ is hedged against Yen declines, it's good for DXJ.

- This is because while DXJ will be unaffected by a Yen decline, its portfolio companies will see real economic benefit from a Yen decline as it supports automotive markets.

- DXJ is well positioned in the near and medium term, but we maintain a bullish stance on the Yen over the next two years as it remains depressed and rate regimes could reset.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

StockByM

The WisdomTree Japan Hedged Equity Fund ETF (NYSEARCA:DXJ) is a way to get Japan exposure while avoiding Yen exposure. We are actually bullish on the Yen, but we acknowledge that the market may actually favour the USD in the near and medium term. While DXJ will be unaffected on a direct basis by the Yen decline relative to the dollar, they will benefit on a business basis, because holdings do better when the Yen is cheaper. There are still risks for its holdings as it pertains to the credit environment, but the USD strength is a plus. We probably wouldn't actually go long DXJ, also because we believe the rate regimes are not permanent, but ETF investors should take into account the puts and takes around the Yen decline for DXJ.

Quick DXJ Breakdown

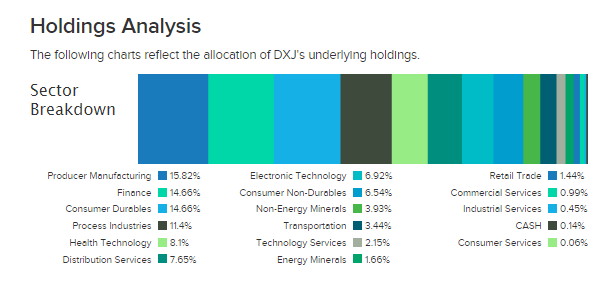

DXJ is a value-weighted exposure to the Japanese markets, so lots of financials, lots of consumer discretionary mainly being driven by automotive, and a lot of industrial exposures.

Sectors (ETFDB.com)

While having these exposures, the ETF is hedged so that declines in the Yen do not affect the stock price value of the stock holdings in USD terms, independent of the effects of Yen declines on the fundamental outlook of the holdings.

This is why the expense ratio is a little high at 0.48%, even though Japan is a liquid market and the DXJ theme is broad.

Yen Declines

The Yen declines are being driven by a couple of factors as of now, and weakness may persist into the medium term for a couple of reasons.

As of now, the Fed is appearing to be maintaining some hawkishness despite easing inflation, especially wholesale inflation which indicates less scary pricing spiral dynamics, that may lend strength to the USD. Higher rates plus decent inflation conditions could lead to USD strength, as it has from speculation so far.

We think these gains could continue as the debt ceiling issue develops. The USA's hegemony depends probably in greatest part on the reserve currency status of the USD. A default would fully jeopardise that, and would without hyperbole be the end of the current world order. There is very little chance that those governing the US would allow that to happen. Some resolution will be found, and Biden cancelled his Asia trip to come home and try make sure that happens ASAP, since there isn't much time left at all before the government needs to start cutting programmes to keep paying out lenders. An eventual resolution of the debt ceiling issue will restore some of the lost confidence in the USD.

Bottom Line

As the USD gains, Yen-denominated shares would decline in USD value, however DXJ hedges this. Meanwhile, Yen declines actually mean more Yen income for the holding companies, which are focused on consumer discretionary and industrial, with those markets being substantially export oriented for Japan. A weaker Yen means better competitive standing on international export markets - these products are cheaper for customers to import. The net effect as far as the Yen declines go will be positive for DXJ.

However, besides the fact that once inflation cools divergence between monetary policies should revert, DXJ does have an issue insofar the sources of demand for USD. Higher rates in the US will also mean weaker demand for credit-financed spending, including automotive and industrial. In Germany, we are already seeing recession due to falling industrial demand and production. The spending cycles by corporates are definitely coming down on the industrial side, which will pressure those export markets for Japan. On the other hand, China is at least recovering, so there is ambiguity here. However, automotive is still skating on the pent-up demand from the pandemic. Weaker credit conditions could mean this demand goes off a small cliff suddenly once pent-up demand is exhausted. Automotive still needs to take a hit and DXJ would not benefit from that.

Overall, DXJ is by no means a clear buy, although they have some favour in being positioned against what should be a strong USD over the next 6 months.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.