Generali: Executing Well And Undervalued

Summary

- Italian composite insurer Generali has been prudently repositioning its Life business and growing non-motor P&C to reduce its reliance on investment income.

- Recent results have been solid and I expect growth to continue in FY 2023 and FY 2024.

- On both a ROE-driven P/BV basis and under a dividend discount model, these shares look around 15% undervalued.

Baloncici/iStock Editorial via Getty Images

Composite insurance giant Generali (OTCPK:ARZGF)(OTCPK:ARZGY) has been making the right moves in recent years, prudently repositioning its business so that it is less reliant on investment income. For current shareholders (and indeed prospective ones) that should mean more stable and predictable earnings, with overall lower earnings sensitivity to the vagaries of interest rates.

These shares have performed well since management kicked-off this strategic plan in late 2016, returning a little under 140% in that time as per the firm's shareholding calculator tool. Generali's recent results have been strong, too, and these shares look meaningfully undervalued at their current price. Buy.

What Does Generali Do?

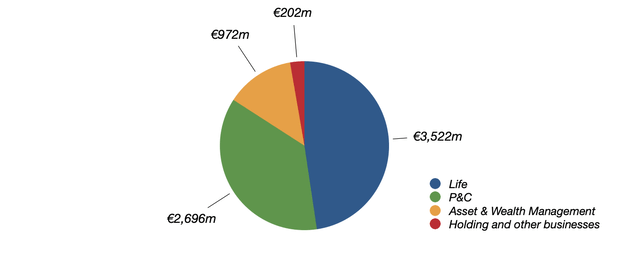

Generali is one of Europe's largest composite insurers, writing around €81B in gross premiums last year. It reports across four segments, though Life (its savings and protection business) and P&C (its non-life general insurance business) account for the lion's share of operating earnings:

Generali: FY 2022 Operating Result By Segment

Data Source: Generali FY 2022 Results

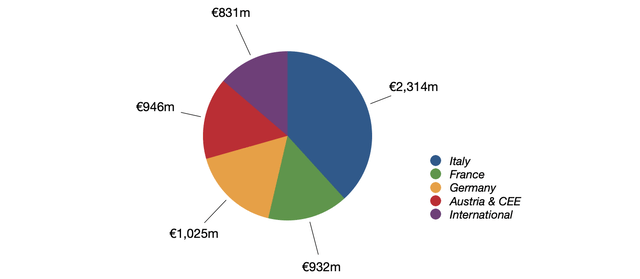

Generali is for the most part a European company. It does have some exposure to faster-growing areas like Asia (contained in the "International" segment in the below graphic), but mature Western European countries like Italy, France and Germany account for most of its earnings:

Generali: FY 2022 Operating Result By Country

Data Source: Generali FY 2022 Results

Repositioning The Business

As per above, the Life segment makes up a significant portion of Generali's earnings. This is essentially a savings and protection business. Protection is basically life insurance in the strictest sense of the phrase: customers pay premiums in return for a payout should they die before a certain age. Savings incorporates a broader range of products but, unlike protection, it includes an investment component.

To cut a potentially long story short, much of this savings business was in products that had a guaranteed return for customers. This became an issue in the low interest rate environment that followed the global financial crisis for a number of reasons. For one, these products were invested in fixed income and lower bond yields made these products less profitable for Generali. Furthermore, customer demand also fell because lower yields meant that the guarantee was also lower, while regulatory reforms meant that these products tied up more capital for insurance companies like Generali.

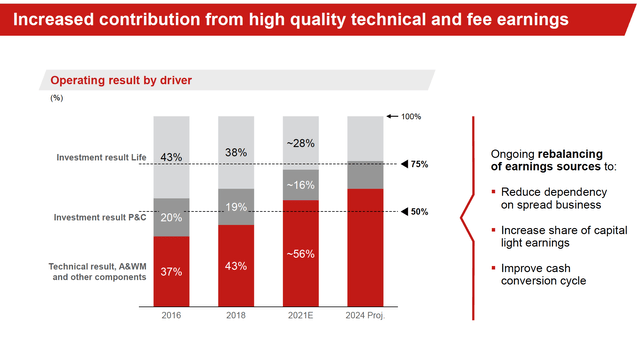

In 2016, 63% of Generali's operating result came from the combined investment result in Life and P&C. 43% came from Life alone. Said differently, most of Generali's earnings were tied to interest rates and bond yields:

Source: Generali Investor Day 2021

In response, the company set itself a number of goals in order to reduce its earnings sensitivity to interest rates. These goals include selling more protection and no-guarantee savings products (e.g. unit linked savings products) and expanding the non-motor P&C business.

Generali's non-motor P&C business has a solid history of good underwriting profitability, so expanding this would lower the company's overall dependency on investment income, as explained in the Q1 2023 conference call:

Our top line continues to grow in our key areas of focus, mainly non-motor P&C. The 11.4% non-motor gross written premium growth in 2022 continued this quarter with a 12.1% growth. This is important because this acceleration in non-motor GWP enables our P&C portfolio to gradually rebalance towards a segment that enjoys healthy underwriting margins with a combined ratio at around 90%.

Cristiano Borean, Generali CFO

Executing Well

Generali has been executing well against the targets it set itself. In Life, the mix of new business premiums ("NBP") continues to shift toward protection and savings products without a financial guarantee. These were 72% of the NBP mix in 2022, up from below 40% in 2016.

Note also that protection is a higher margin product (FY 2022: 8.46% margin on present value of NBP versus 4.92% and 3.70%, respectively, for unit-linked and savings). Protection has increased its share of the NBP mix in recent years, from 20% in 2018 to 25% last year.

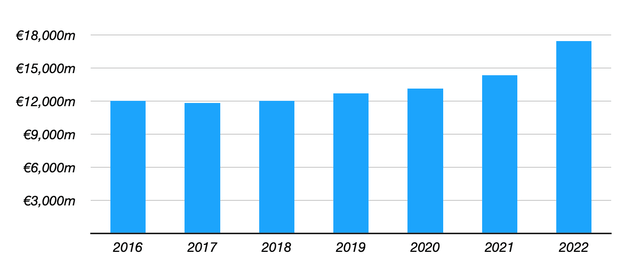

In P&C, the non-motor premium CAGR has been strong. Last year, Generali wrote €17.4B in non-motor P&C premiums. That is up from €12B in 2016, equal to a 6.4% CAGR.

Generali: Non-Motor GWP (2016-2022)

Data Source: Generali Annual Supplemental Financial Disclosures

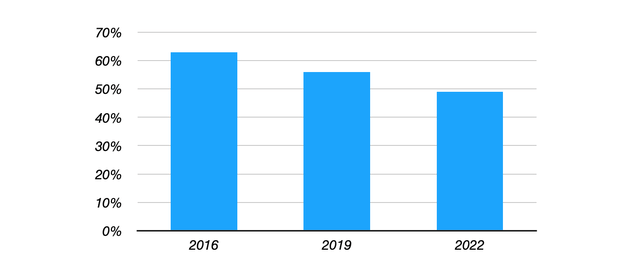

This puts the company on track to meet management's goal of drastically lowering earnings sensitivity to investment income. By my count, the Life and P&C investment result contributed 49% to Generali's consolidated operating result last year, down from 63% in 2016:

Generali: Share Of Life and P&C Investment Result As A Portion Of Total Operating Result

Data Source: Analyst Calculations From Generali's Annual Supplemental Financial Disclosures

The key point for investors is that this downward trend is producing a company with a more stable and predictable earnings profile.

The Outlook

Generali has been reporting strong results recently. Last year's operating result of €6.5B was a record, came in above consensus and mapped to a return on equity ("ROE") of 12.1% (2021 ROE: also 12.1%).

The company has followed that up with another set of very strong results in Q1 2023. Operating result of €1.82B was up 22.1% YoY, driven by strong growth in P&C, particularly non-motor P&C (P&C operating result: €847m, up 75% YoY).

Looking ahead, I expect the operating result for Life to be virtually flat this year (2022: €3.5B), in-line with management guidance on the Q1 earnings call, but for that to be offset by double-digit growth in P&C (2022 operating result: €2.65B). That leads me to FY 2023 and FY 2024 consolidated operating result estimates of around €6.8B and €7.1B, respectively. This maps to FY 2023 EPS and DPS estimates of €2.05 and €1.22, respectively, and FY 2024 EPS and DPS estimates of €2.18 and €1.30, respectively.

With regards to potential risks, my main concern is with the firm's exposure to Italian government debt. The value of these bonds amounted to around €44B at the end of that year, or around 1.5x shareholders' equity. This is actually an improvement on recent years (2021: €63B, or 2.7x shareholders' equity) but is something for prospective investors to consider.

Shares Attractively Valued

Generali shares trade for €17.95 each at time of writing, equal to 9.7x FY 2022 EPS and around 1x Q1 2023 book value per share.

I value Generali on a ROE-driven P/BV basis as well as using a simple dividend discount model. On the former, Generali has averaged a ROE of 11.1% since 2015, while my earnings estimates above would also imply a solid double-digit ROE for FY 2023 and FY 2024. That should be good for a 1.2x multiple on reported BV, which would map to a fair value of €21.40 ($11.48 per ADR).

Generali: Ex-OCI ROE (2015-2022)

Data Source: Generali Annual Supplemental Financial Disclosures

Similarly, plugging in my FY 2023 and FY 2024 DPS estimates into a DDM, fading gradually to a 1% terminal growth rate, gets me to a fair value of €20.40 per share ($10.95 per ADR). I use a 10% discount rate for Generali.

Taking the mid-point of those two methods leads to an overall fair value of €20.90 per share ($11.21 per ADR). Implied double-digit upside along with the aforementioned improvement in the firm's earnings profile marks these shares as attractive. Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.