Oatly: Asymmetric Opportunity

Summary

- The oat milk category continues to demonstrate strength, and Oatly's competitive position is resilient in the face of growing competition.

- Cost pressures are easing, which should be supportive of gross profit margins, along with price increases.

- Oatly's valuation remains depressed, which is likely more reflective of doubt about the company's ability to remain solvent than its long-term prospects.

YelenaYemchuk/iStock via Getty Images

Oatly's (NASDAQ:OTLY) stock price remains depressed due to the company's large cash burn and modest cash balance. While solvency is a serious risk, the oat milk category continues to demonstrate strength and Oatly is the market leader. Supply chain pressures that have undermined gross profit margins are abating, and a return to growth should provide operating leverage. As a result, cash burn could improve significantly over the next 12 months, provided consumer spending is resilient.

Top priorities for Oatly going forward include accelerating top line growth and lowering costs through supply chain improvements. This is driven by the fact that Oatly has a limited cash runway with which to demonstrate a viable path to profitability. While Oatly's future is cloudy, it is aided by the fact that the oat milk category continues to demonstrate strength, even in the face of inflation undermining consumers.

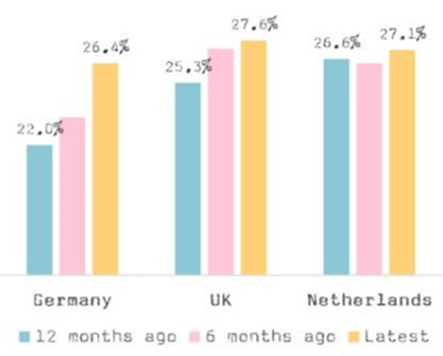

Figure 1: Value Share of Non-Dairy Milk (source: Oatly)

Non-dairy milk companies also appear to have an advantage over plant-based meat companies in that consumers appear to demonstrating more brand loyalty, leading to greater pricing power. This should not be overly surprising as dairy products have supported differentiated brands in the past, in categories like ice cream, flavored milk and yoghurt. Whether this advantage is sustainable over time is unclear, but it should help Oatly move towards profitability in the near-term.

Although strategy varies by geography, Oatly is generally aiming to expand distribution and launch new products. This includes the introduction of soft serve ice cream in the food service channel in EMEA and an expansion of its drink portfolio.

Asia is still immature relative to other geographies, with Oatly driving growth through gains in food service via the coffee and tea channels to establish its brand. Oatly is also seeing rapid growth in retail in Asia.

Figure 2: Oatly Revenue by Channel and Geography (source: Oatly)

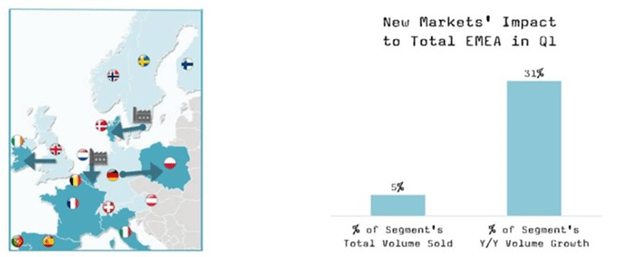

Oatly continues to expand geographically in Europe, with new markets performing well, although growing off a small base.

Figure 3: Oatly European Expansion (source: Oatly)

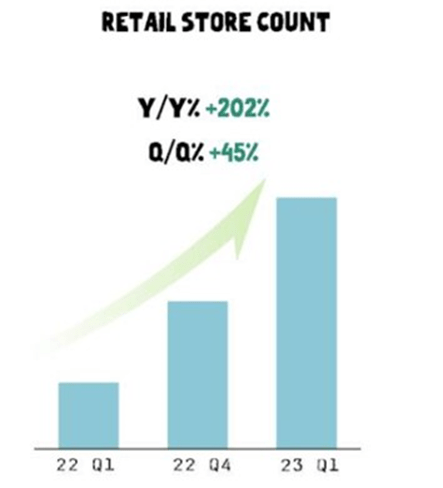

Oatly is rapidly increasing the number of distribution points in the Americas, which is supportive of growth. The company is also beginning to market more aggressively in the Americas, which is probably contributing to recent share gains.

Figure 4: Oatly US Distribution (source: Oatly)

Oatly is also rapidly expanding distribution in Asia, which is driving growth there.

Figure 5: Oatly Asia Distribution (source: Oatly)

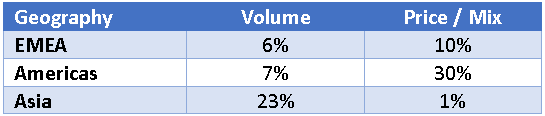

Volume growth in EMEA has remained strong, despite price increases, indicating that Oatly continues to have pricing power.

Growth in the Americas in the first quarter was driven by price / mix benefits as a result of:

- Price increases in the food service channel

- Beneficial customer mix due to strong retail volume growth

- Beneficial customer mix in food service

Volume growth in Asia has been strong with relatively stable prices as promotional intensity has moderated.

Table 1: Oatly Growth Drivers (source: Created by author using data from Oatly)

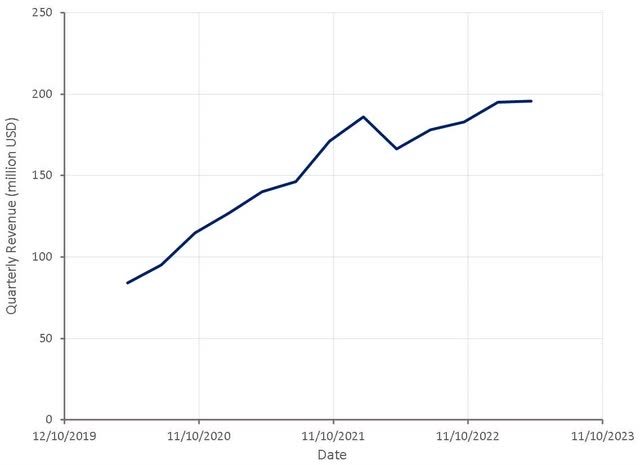

Constant currency revenue growth was 24% in the first quarter, representing a significant sequential acceleration. Oatly's management continue to expect constant currency revenue growth in the 23-28% range in 2023, suggesting that growth will remain relatively flat through the rest of the year.

Figure 6: Oatly Revenue (source: Created by author using data from Oatly)

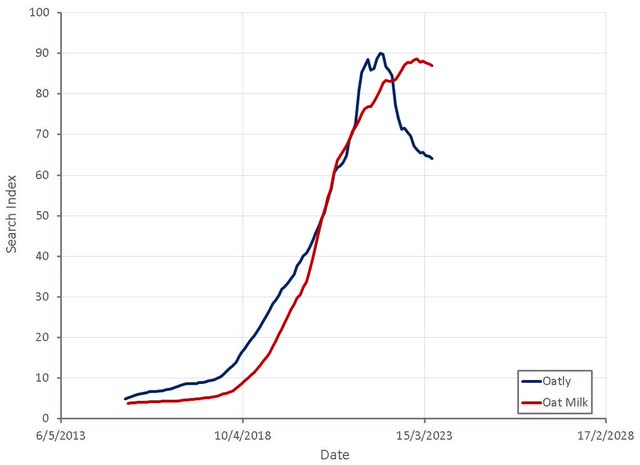

Search data indicates that interest in the oat milk category is still strong, although interest in Oatly has fallen off somewhat. While this is likely to be a noisy indicator, demand for oat milk appears to be far more sustainable than plant-based meat, which is currently looking like a fad.

Figure 7: Oatly Search Interest (source: Created by author using data from Google Trends)

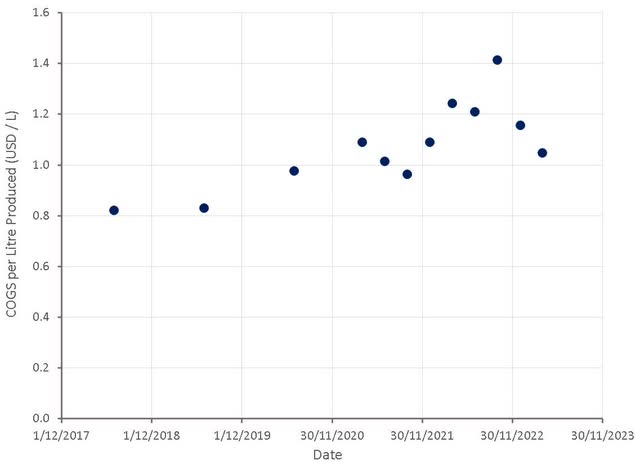

The transition to Ya Ya Foods is reportedly going well, which Oatly has attributed to Ya Ya's operational experience and the hiring of Oatly frontline employees. This transition is enabling Oatly to consolidate its co-packer network, which is expected to have a material impact on Oatly's cost structure. The consolidation of operations should be complete by the end of the third quarter.

Demand in Asia is also increasingly being met with local production rather than purchases from EMEA, which should be supportive of margins. Oatly's Asia team also recently launched several efficiency programs that are expected to reduce costs.

A substantial portion of recent cost improvements are also likely to have come from an easing of supply chain pressures. Freight costs are down significantly and the price of oats is now only modestly higher than pre-pandemic levels. Cost improvements are also likely still flowing through Oatly's inventory, leading to better margins in coming quarters.

Figure 8: Oatly Production Costs (source: Created by author using data from Oatly)

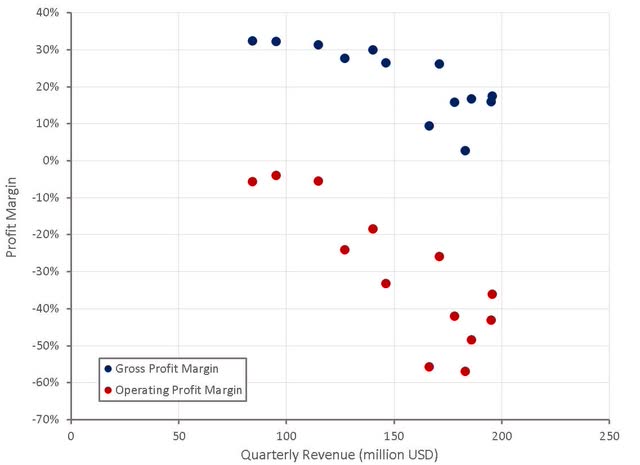

Oatly's gross margins increased to 17% in the first quarter and are expected to continue improving throughout the year to the high 20s in the fourth quarter. Operating profit margins have also begun to improve on the back of cost improvements and operating leverage. Oatly is implementing an aggressive marketing plan in the second and third quarters, which could weigh on margins, depending on how much growth the company achieves.

The company expects to reach adjusted EBITDA breakeven in 2024, which is possible, although an aggressive target. Oatly will likely need strong growth, gross margins above 30% and an outright decline in operating expenses to achieve this.

Figure 9: Oatly Profit Margins (source: Create by author using data from Oatly)

CapEx is expected to be 180-200 million USD in 2023, which will significantly drain Oatly's cash balance, even if margins improve. Oatly recently raised 430 million USD, which came in the form of 300 million USD of 9.25% Convertible Senior PIK Notes due 2028 and a 130 million USD million term loan B credit facility commitment. The company also plans on raising another 35 million USD through a convertible note. This potentially puts Oatly in a position to reach cash flow breakeven without requiring further cash infusions, but this will depend on consumer demand and supply chain pressures. Even without an improvement in cash flows, Oatly still has sufficient cash to continue operating for around another 12 months.

If Oatly can demonstrate a viable path to profitability, investor focus will begin to shift to the company's valuation and future prospects. The oat milk category offers a significant growth opportunity, and company specific metrics look positive for Oatly. A shift in sentiment would likely cause a significant rerating of the stock, but it comes at the risk of substantial losses.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.