Ashland: Strong Performance Despite Macroeconomic Headwinds

Summary

- Sales are stabilizing after a long restructuring process, but demand remains weak as customers hold high inventories.

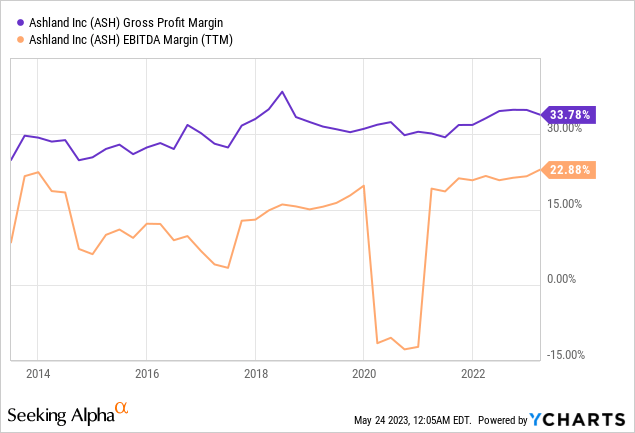

- Profit margins have increased significantly in recent years thanks to the divestment of less profitable businesses.

- Ashland's debt is widely manageable thanks to strong cash from operations and very high inventories.

- Aggressive share buybacks passively expand shareholder positions year after year.

- This represents a good opportunity to add shares to any dividend growth conservative portfolio.

Khanchit Khirisutchalual

Investment thesis

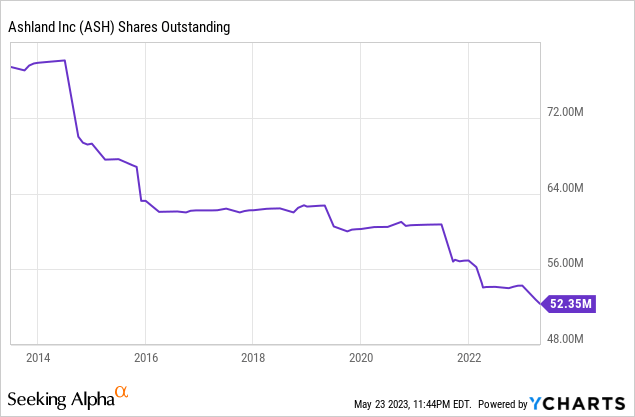

Ashland (NYSE:ASH) is a company whose shares can be held for decades as it operates in key industries by providing critical components to other manufacturers. After a few years of restructuring its operations by divesting the least profitable businesses, the company has become a highly specialized materials company with high profit margins, which allows for reliable cash from operations year after year. This makes it possible to pay a dividend with a relatively low cash payout ratio, as well as perform aggressive share buybacks in order to continuously reduce the total number of outstanding shares.

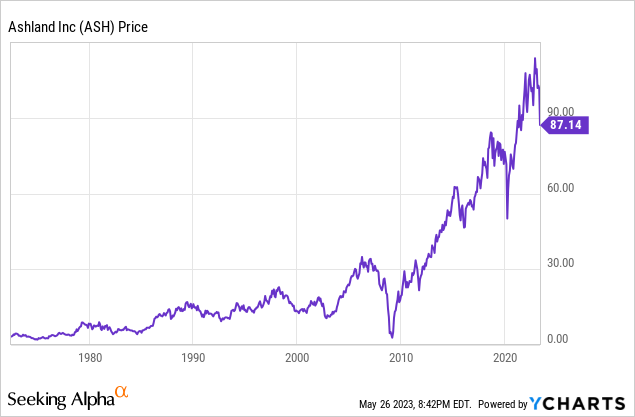

The company is currently facing a series of headwinds related to inflationary pressures, and while recent price increases for its products have offset the increased costs, demand remains weak as a result of customer destocking and a slower-than-expected reopening of the Chinese economy after self-imposed restrictions derived from the coronavirus pandemic. Furthermore, there are growing concerns about a potential recession as a consequence of recent interest rate hikes, which could have a significant impact on the company's sales and profit margins. For these reasons, the share price declined by ~24% from all-time highs, which represents, in my opinion, a good opportunity for long-term conservative dividend growth investors as the company is highly profitable.

A brief overview of the company

Ashland is a global specialty additives and materials company that operates for a wide range of markets, including architectural coatings, construction, energy, food and beverage, nutraceuticals, personal care, and pharmaceuticals. The company was founded in 1924 and its market cap currently stands at $4.55 billion, employing around 3,900 workers worldwide. Its products are sold in over 100 countries as the company enjoys wide geographical diversification, and it is continuously launching new products in order to maintain its leading position.

Ashland logo (Ashland.com)

The company operates under four main business segments: Life Sciences, Personal Care, Specialty Additives, and Intermediates. Under the Life Sciences segment, which provided 34% of the company's sales in fiscal 2022, the company manufactures products related to pharmaceuticals, nutrition, nutraceuticals, agricultural chemicals, diagnostic films, and fine chemicals. Under the Personal Care segment, which provided 28% of the company's sales in fiscal 2022, the company manufactures biofunctionals, microbial protectants (preservatives), and skin care, sun care, oral care, hair care, and household solutions. Under the Specialty Additives segment, which provided 30% of the company's sales in fiscal 2022, the company manufactures additives serving architectural coatings, construction, energy, automotive, and various industrial markets. And under the Intermediates segment, which provided 11% of the company's sales in fiscal 2022, the company produces 1,4-butanediol (BDO) and related derivatives, including n-methylpyrrolidone, which are used as chemical intermediates in the production of engineering polymers and polyurethanes, and as specialty process solvents in a wide array of applications including electronics, pharmaceuticals, water filtration membranes and more.

Currently, shares are trading at $87.14, which represents a 23.80% decline from all-time highs of $114.36 on December 2, 2022. This recent share price decline is beginning to reflect investors' concerns as demand for the company's products is currently weak due to high customer inventory levels. Also, growing concerns about a potential recession are generating more moderate expectations in the medium term. But despite these two factors, recent restructuring efforts have significantly improved the company's profit margins, and in addition, both high customer inventories and a potential recession are headwinds of a temporary nature, so I consider that this represents a good opportunity for the longer-term focused dividend investors.

Latest acquisitions and divestitures

The company has divested the least profitable business segments in the past few years, which has enabled higher profit margins and lower long-term debt, as well as aggressive share buybacks. In September 2019, the company sold its Composites business and butanediol manufacturing facility in Marl, Germany, for $1.02 billion, and a year later, in October 2020, the company also sold its maleic anhydride business and manufacturing facility in Neal, West Virginia to AOC Materials LLC, for $100 million.

In April 2021, the company acquired the personal care business from Schülke & Mayr GmbH for €262.5 million, and in February 2022, it completed the sale of its Performance Adhesive business to Arkema (OTCPK:ARKAF) for $1.65 billion. Later, in June 2022, the company sold around 77.8 acres of land located in Sayreville, New Jersey, for $40 million, and in August 2022, the company sold approximately six acres of land located in Ajax, Canada, for $CAD 12.25 million.

During the second quarter earnings call conference of fiscal 2023, the management expressed its intentions to seek potential acquisitions going forward, so it appears that the restructuring process has reached its final stage. From now on, investors could expect moderate growth rates as profit margins have improved significantly in recent years while debt is at very sustainable levels, which should allow for free cash available for potential acquisitions year after year.

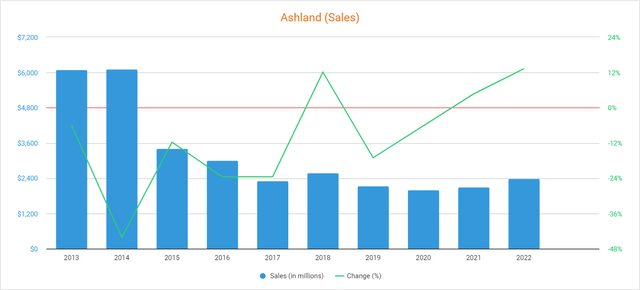

Sales are stabilizing after a restructuring process

The company's sales have decreased over the last few years as a result of the divestitures carried out to restructure it and focus on the operations of those businesses with higher profit margins. Nevertheless, sales started to show improvements in fiscal 2022 as the company increased the price of its products in order to offset cost impacts coming from inflationary pressures. In this regard, sales increased by 13.26% in fiscal 2022, and during the year, the company announced the expansion of its Viatel bioresorbable polymer manufacturing and research and development site in Ireland after announcing its plans to increase the production capacity of Natrosol hydroxyethylcellulose (HEC) at Hopewell, Virginia. Using fiscal 2022 as a reference, 32% of the company's sales are generated in North America, whereas 35% are provided by operations in Europe, 24% in Asia Pacific, and 9% in Latin America and the rest of the world, which reflects the geographical diversification of the company's operations.

Ashland sales (Seeking Alpha)

As for fiscal 2023, sales increased by 2.54% year over year during the first quarter but declined by 0.17% year over year during the second quarter. Currently, customer demand is weak due to inventory destocking despite high consumer demand, and the reopening of the Chinese economy after coronavirus-related restrictions is happening at a slower-than-expected pace. Still, high demand in the company's pharmaceutical ingredients business, as well as increased product prices, is offsetting these impacts. With recent divestitures having been very successful given recent profit margin improvements, the company is ready to expand current operations both by investing in growth initiatives or performing acquisitions of high-margin businesses, both strategies mentioned by the management during the last earnings call conference.

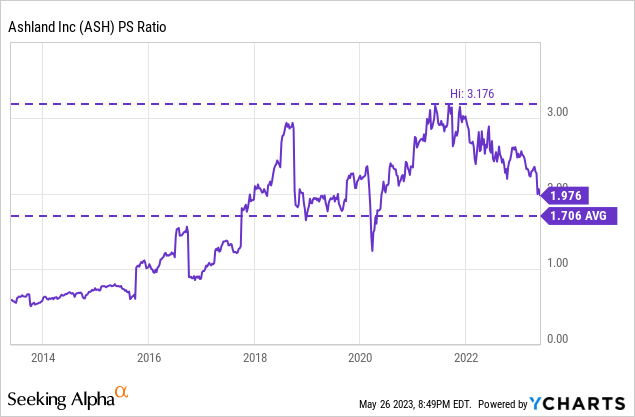

The recent fall in the share price and the slight recovery in sales have caused a significant drop in the P/S ratio to 1.976, which means the company currently generates sales of $0.51 for each dollar held in shares by investors annually.

This ratio represents a 37.78% decline from the peak of 3.176 reached in 2021, but is 15.83% higher than the average of 1.706 during the past decade, which shouldn't be cause for concern since profit margins are now significantly higher than in recent years. In fact, I consider that a P/S ratio of 1.976 is very acceptable considering that profit margins are high.

The company is highly profitable

The company has remained highly profitable in recent years and said profitability has improved over the years thanks to the restructuring efforts carried out. In fact, the company maintained very healthy profit margins despite increasing raw material prices, energy costs, freight rates, negative foreign exchange rates, and increased labor costs. In this regard, the trailing twelve months' gross profit margin and EBITDA margin currently stand at 33.78% and 22.88%, respectively, which means the company is highly profitable.

In fact, the EBITDA margin improved to 27.53% during the past quarter, whereas the gross profit margin was slightly weaker at 32.67%. These high margins despite current headwinds are the result of restructuring efforts and continuous product price hikes as the company raised the price of its products by up to 15% in 2022 in order to offset increased costs caused by inflationary pressures.

Thanks to these strong profit margins, the company generates strong cash from operations year after year, which makes its current debt position very sustainable as the deleveraging process continues.

The company's debt position is widely manageable

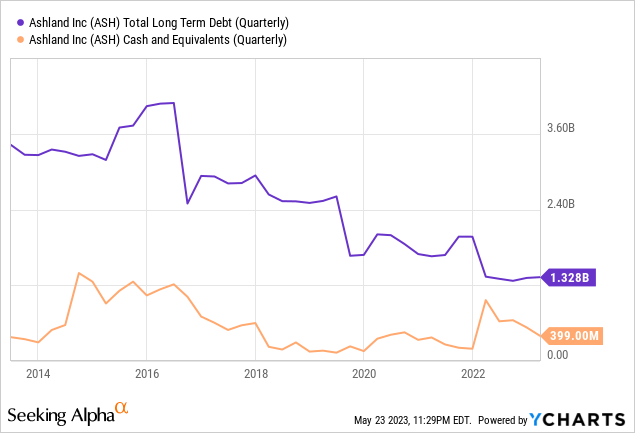

The company has been reducing its long-term debt over the years thanks to the divestitures carried out as long-term debt currently stands at $1.33 billion. Although it may seem like a very heavy debt load, its cash position is strong as it holds $399 million in cash and equivalents.

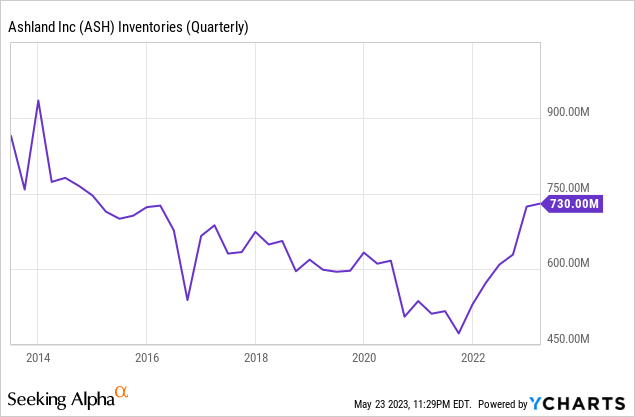

Furthermore, the company's debt position is widely sustainable as there are no long-term debt maturities for the next four years, and inventories are unusually high at $730 million. In this regard, the management plans to reduce inventory levels in certain product lines in the coming quarters.

These high inventory levels should allow the company to generate strong cash from operations in the coming years, which will be very useful to continue paying down debt and making key acquisitions, as well as covering the dividend and performing further share buybacks.

The dividend is safe as cash generation is very high

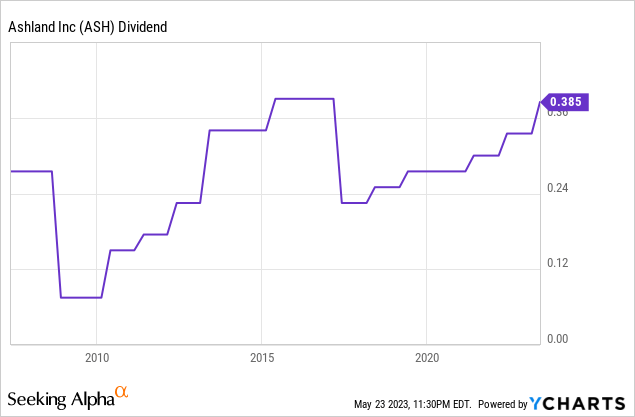

Shareholders have enjoyed growing dividends over the years, but the management is quite conservative with the use of cash as it aims to maintain a relatively low cash payout ratio that allows it to gradually pay down the company's debt pile and carry out share buybacks, a fact by which the dividend can be temporarily cut when headwinds hit the company's operations during a bad year. Nevertheless, the company raised the quarterly dividend by 15% to $0.385 per share in May 2023 and announced a share repurchase program of $100 million.

Currently, the dividend yield stands at $1.77%, which may be too low for most dividend investors. Still, it is very important to understand that the company is using cash from operations to reduce its debt levels and make aggressive share buybacks, which will give more space for further dividend raises in the future. To calculate the cash payout ratio, in the following table, I have calculated what percentage of the cash from operations the company has used each year to cover its dividend and interest expenses. In this way, we can assess the sustainability of the dividend through actual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $643 | $333 | $678 | $383 | $297 | $241 | $203 | $560 | -$213 |

| Dividends paid (in millions) | $103 | $98 | $97 | $77 | $60 | $64 | $66 | $70 | $70 |

| Interest expense (in millions) | $163 | $166 | $180 | $227 | $116 | $114 | $88 | $69 | $62 |

| Cash payout ratio | 41.37% | 79.28% | 40.86% | 79.37% | 59.26% | 73.86% | 75.86% | 24.82% | - |

As one can see, the cash payout ratio has been quite low over the years, except for fiscal 2022. During 2022, the company raised inventories and made strong capital investments to increase capacity for key product lines in the pharmaceutical, personal care, and architectural coatings businesses, which should allow for high cash from operations in the coming quarters. As for the second quarter of fiscal 2023, cash from operations was $43 million, inventories increased by $6 million, and accounts receivable by $45 million while accounts payable remained flat, which means the company is highly profitable and both the dividend and interest expenses are easily covered, which should allow for further debt reduction and more share buybacks in the foreseeable future.

Aggressive buybacks as a way to reward shareholders

The company has made continuous share repurchases in recent years in order to reduce the total number of outstanding shares. This means that each share represents an increasingly bigger size of the company, which improves per-share metrics as they are calculated among fewer shares.

In May 2023, the company announced a new share repurchase program of $100 million after completing a previous $200 million buyback plan, which means share buybacks are still in force today.

In this regard, the total number of shares outstanding declined by 32% during the past 10 years, and therefore, the position of shareholders has been significantly expanded by simply holding the company's shares.

Risks worth mentioning

Although I consider Ashland's risk profile to be low thanks to high profit margins and a very strong cash position, there are certain risks for the short and medium term that I would like to highlight.

- The company may find it difficult to keep raising the price of its products if inflationary pressures continue to impact the current macroeconomic landscape, which could have material impacts on the company's profit margins.

- Recent interest rate hikes to alleviate high inflation rates around the world could cause a global recession, which could have a direct impact on demand for the company's products. This would not only negatively affect the company's sales, but also profit margins as a result of unabsorbed labor.

- Because the management has historically been conservative in the use of cash, it could decide to temporarily cut the dividend if profit margins decline as a result of either of the above factors (persistent inflation or the materialization of a recession).

- The company may find it difficult to empty its inventories since customer inventories are also high. In this regard, cutting production without it resulting in unabsorbed labor is a task that the management will have to face in the coming years.

Conclusion

Despite weak sales in the short and medium term as a result of high customer inventories, the company's operations continue in good shape as the company enjoys high profit margins thanks to recent restructuring efforts. Current debt levels are highly sustainable as the company can easily cover both dividend and interest expenses with cash from operations, and the balance sheet is very strong thanks to high cash and equivalents and inventories, which greatly reduces the company's short and medium term risks stemming from the current complex macroeconomic environment.

Now that the restructuring stage appears to have reached its final stage, long-term investors can expect a gradual increase in sales as the company finds potential acquisitions, along with continued share buybacks and dividend hikes as the cash payout ratio is relatively low. In this regard, I consider that the recent share price decline represents a good opportunity for long-term dividend investors, but I would also like to remind you that it comes with increased risks as recent interest rate hikes could trigger a global recession, which would certainly have a significant impact in the company's balance sheet.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.