FTI Consulting: Highly Regarded Firm With A Growth Trajectory

Summary

- FTI Consulting, Inc. is a global firm that offers business advisory services to help clients manage change, mitigate risks, and resolve disputes.

- Revenue has grown at a CAGR of 7%, driven by an expansion of its product suite, increased demand for consulting services, and recruitment of senior personnel.

- FTI's margins are relatively attractive, with its corporate finance and technology departments outperforming in both growth and margins.

- FTI is a highly regarded consulting firm that has the scope to grow and recruit talented personnel through its brand value.

- FTI is trading at a large premium to its historical average, which in our view does not allow for upside.

courtneyk

Investment thesis

Our current investment thesis is:

- FTI is a quality consulting firm with a respected reputation.

- Strong growth should continue as demand remains healthy and FTI continues to expand.

- We like the CF and Tech departments, and they should support margin evolution in the coming years.

- Despite the improvement in the business, we do not believe they justify the current valuation.

Company description

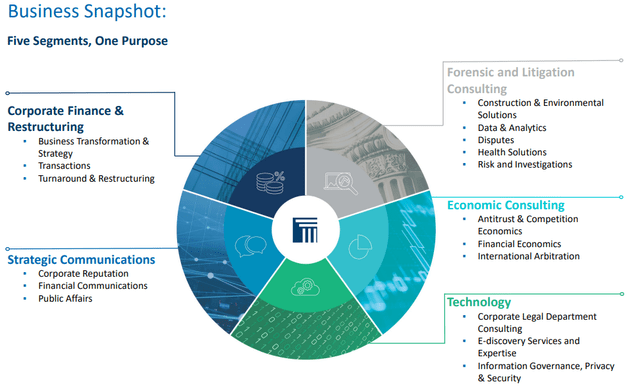

FTI Consulting, Inc. (NYSE:FCN) is a global firm that offers business advisory services to help clients manage change, mitigate risks, and resolve disputes. The company operates through five segments.

FTI Segments (FTI)

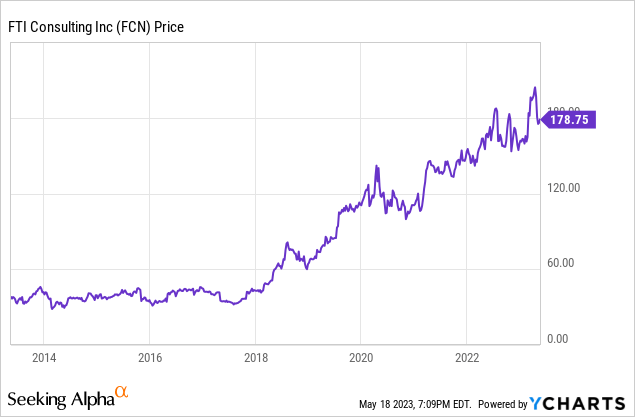

Share price

FTI's share price has performed incredibly well, driven by consistent and strong revenue growth and attractive margins.

Financial analysis

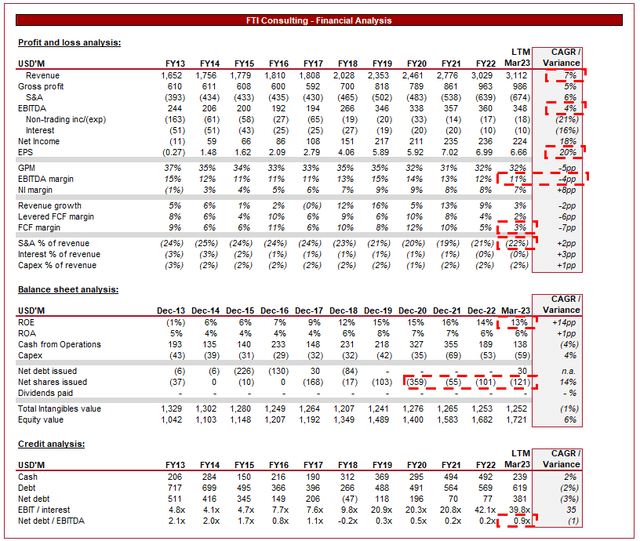

FTI Financials (Tikr Terminal)

Presented above is FTI's financial performance for the last decade.

Revenue

Revenue has grown at a CAGR of 7%, with only 1 period of negative growth. This is a reflection of what has been a strong decade for the business, with revenue almost doubling since FY13.

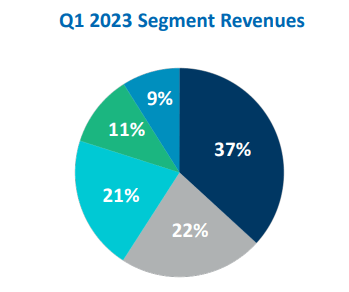

FTI's revenue is highly diversified, with Corporate Finance and Restructuring representing the largest share of revenue. What is impressive about FTI is that these business segments support a wide variety of clients yet there remains scope for cross-selling. This reduces external risk to any one segment. As an example, Restructuring is countercyclical and can support a weaker segment during an economic slowdown, such as tech.

FTI

FTI

One of the primary growth drivers for FTI has been the recruitment of high-quality personnel. The consulting industry, similar to Investment Banking, is highly dependent on talent. Humans are the "assets" and unlike a machine, we are all unique. For this reason, there is continued pressure to recruit talent who can deliver a superior service to clients, which will allow FTI to retain and expand its mandates. In conjunction with this, the recruitment of Senior personnel is arguably the most important. These individuals will have clients who are usually willing to move across with them due to a successful track record. For this reason, in many cases we see individuals poached by rival firms to inorganically win work. From an analysis of FTI's senior employees, the majority of them are from larger rival firms. For example, the head of EMEA CF & Restructuring is the former head of PwC global restructuring.

Clients increasingly seek integrated solutions that span multiple disciplines, as they consolidate their advisors. This is a logical decision as Consultants are increasingly connected to their clients' inner operations, as technological and economic development requires expertise to help businesses navigate. This is one of the areas FTI has performed extremely well in as it is a multiple-disciplinary firm that has developed a wide range of services. Many of its competitors remain within a narrow window, giving the perception of diversification.

The consulting industry is highly competitive, with firms usually choosing to specialize in particular segments, at least initially, as a means of gaining market share. FTI has developed a strong global brand in many segment verticals, allowing the business to pitch for larger projects over time.

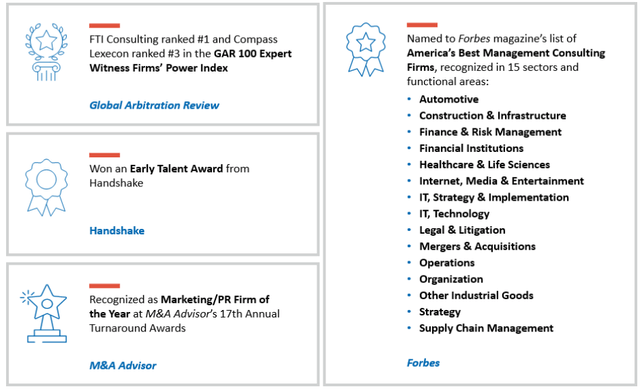

Ratings (FTI)

Although rankings are subjective, FTI is generally highly regarded. According to Vault / Firsthand, FTI is the 32nd most prestigious consulting firm in the world. Market perception alone should support growth in the coming years as it gets FTI "in the door", at which point its talented staff can pitch their expertise.

We are increasingly seeing a focus on sustainability and responsible business practices, which are pressures coming from shareholders, investors, and governments. This has rapidly increased the demand for ESG services, as current Management teams lack the expertise required to adequately transition their business. FTI has invested in building out its ESG offering, allowing the business to partake in this growth area.

Economic downturns and market uncertainties can impact consulting budgets as clients reduce spending on advisory services as a means of cutting costs. This is especially the case during the current inflationary conditions, as many businesses struggle to maintain margins through increasing prices. This represents a short-term risk for FTI.

Many consulting firms have been highly acquisitive, acquiring firms as a means of growing their expertise and winning clients. The biggest example of this is likely Accenture (ACN). This is not an avenue FTI has targeted but represents an opportunity to support growth in the coming years.

Q1 results

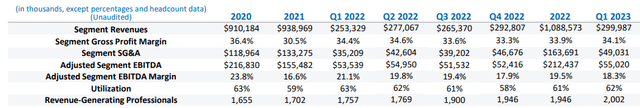

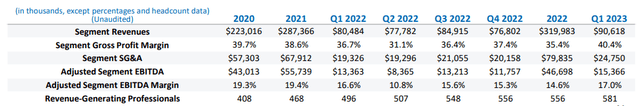

Corporate Finance & Restructuring

CF (FTI)

CF & Restructuring is the largest segment of the business. Unlike many in the CF industry, FTI continues to experience growth QoQ. The reason for this is FTI's weighting toward Restructuring, relative to traditional IB services. As a result of this, weaker economic conditions have benefited FTI with an uptick in Restructuring services. Further, this is the most profitable segment of the business, with a dip in EBITDA-M looking slightly concerning. This may be due to the impact of pay rises.

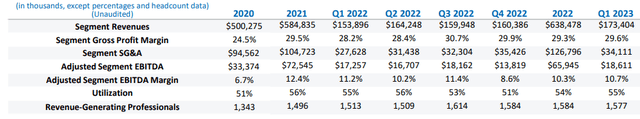

Forensic and Litigation Consulting

Forensic and litigation (FTI)

Similar to CF, F&L has also continued to grow despite the slower economic conditions. This segment has managed to maintain its margins, although its absolute level is disappointing.

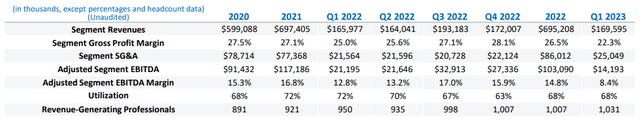

Economic Consulting

Economic consulting (FTI)

Economic consulting has seen growth slow, as well as margins decline, likely due to a slowdown in economic activity. The core offerings are antitrust & competition economics, financial economics, and international arbitration. These services are dependent upon business and government activity, during what is a period of consolidation as current economic conditions are weathered.

Technology

Technology (FTI)

Technology has remained surprisingly robust, with strong growth and margin expansion. This looks to be momentum-based, with continued recruitment and project work driving value. We recently covered Capgemini (OTCPK:CAPMF), which also showed similar resilience in the face of slowing corporate spending.

Strategic Communications

Strategic consulting (FTI)

Finally, SC has seen flat growth while margins have declined. This is a service that is likely most impacted by current economic conditions, with reduced activity and cost-cutting contributing to reduced demand.

Margin

FTI's margins are relatively good. The company has a GPM of 32%, EBITDA-M of 11%, and a NIM of 7%.

Due to this being a human services industry, employees are heavily remunerated otherwise FTI would risk losing talent to competitors. What we have observed over the last decade is some margin dilution, likely due to greater competition in the market. This said, there is volatility in margins, which are impacted by one-off large projects in any single period.

In the near term, we are slightly concerned with the dilution we are seeing from some of the business segments. CF and Tech look fantastic, while the other two segments are not generating attractive margins or growth. We could see margins drag further if Management cannot quickly improve margins.

Balance sheet

FTI is conservatively financed, with an ND/EBITDA ratio of 0.9x. This gives the business flexibility to raise further debt if required, in order to expand the business. Current FCF generation is low and so this should be a consideration.

Distributions to shareholders have come in the way of buybacks, which have been consistent in the last few years.

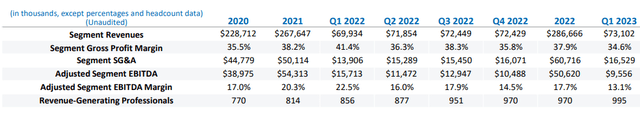

Outlook

Management forecast (FTI)

Management is forecasting a 9% growth in the bottom range, which looks to be possible given the strength of both CF and Tech.

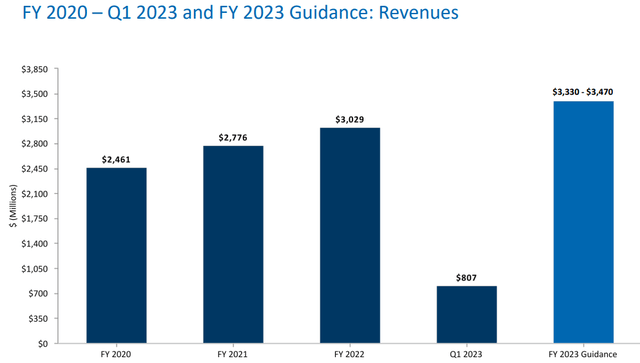

Outlook (Tikr Terminal)

Presented above is Wall Street's consensus view on the coming 5 years.

Looking more long term, we believe 5-10% looks achievable consistently. The company is highly regarded in the market and has a diversified revenue profile, which should allow expansion. We would like to see the business continue to expand its product offering and consider small-scale M&A.

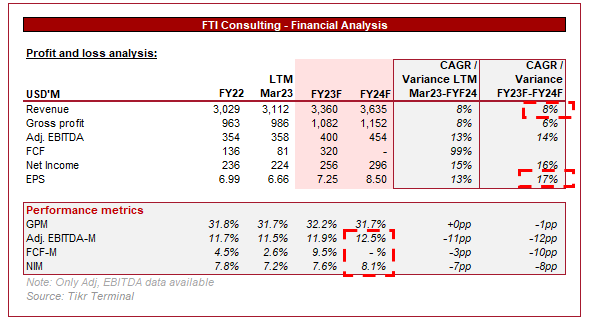

Valuation

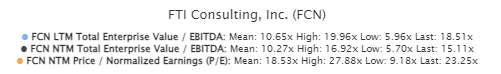

FTI Valuation (Tikr Terminal)

FTI is currently trading at 18.5x LTM EBITDA, 15x NTM EBITDA, and 23x NTM P/E.

The company's current valuation is a noticeable premium to its historical trading range, with investors far more bullish on the business.

The bull argument for a premium is:

- CF & Restructuring is continuing to grow well and has shown resilience to market conditions.

- Tech services are also growing well. Alongside CF, the segments have superior margins and should positively dilute the weaker performance of the other 3 segments.

- Despite some volatility in margins, NIM has been on a consistent upward trajectory.

The bear argument for a reversion toward the mean multiple is:

- FCF generation remains mild, making it difficult for investors to see value through distributions.

- 3 of FTI's segments are margin dilutive. They are net valuable to FTI due to the cross-selling opportunities and the improvement in brand image, however, are not ideal for profitability.

- Other consulting firms are arguably cheaper. Capgemini is growing at a similar rate with marginally higher margins, yet is trading at 11x EBITDA.

Overall, we do believe FTI has positively developed in the last 10 years, suggesting a premium is warranted. However, the current valuation looks slightly rich relative to other opportunities in the market.

Our view would be that a fair value for the business is closer to 15-17x EBITDA, which does not imply upside at the current price.

Final thoughts

FTI has done a good job of consistently growing. The company has recruited well, poaching staff and clients from key competitors while developing its suite of services. This has developed a strong brand image which should drive growth in the coming years as FTI is successful in winning work.

The financial profile of the business is equally attractive, with the outlook being positive. Our only real concern is that certain departments act as a drag on performance, but this is a cost to the business that is worth incurring in order to generate more lucrative work.

FTI's current valuation is rich at a time when we are seeing some margin slippage and difficult market conditions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.