Installed Building Products: Good Long-Term Prospects

Summary

- The weakening single-family residential end market is a near-term headwind.

- However, there is light at the end of the tunnel with the Fed becoming less hawkish post the recent banking fiasco.

- Installed Building Products also has good, long-term growth prospects.

- Valuations are attractive.

Kameleon007

Investment Thesis

While Installed Building Products (NYSE:IBP) is expected to face some pressure in FY23 due to the weakening residential housing market, the company's long-term outlook is attractive. IBP's strong position in the insulation market and focus on growing commercial business and adjacent product lines should contribute to revenue growth in the coming years, once the economy starts to recover. The company should also benefit from favorable pricing and M&As.

In terms of margins, although FY23 may experience some pressure due to volume deleverage, there is potential for a residential recovery in FY24 and beyond which makes me positive about the medium-term prospects. Additionally, the company's emphasis on operational excellence and prioritizing pricing over volume should contribute to long-term margin expansion.

Currently, the company's stock is trading at a significant discount compared to its historical average. The company's positive long-term prospects make it an attractive investment at its current valuation. Therefore, I have a buy rating on this stock.

Revenue Analysis and Outlook

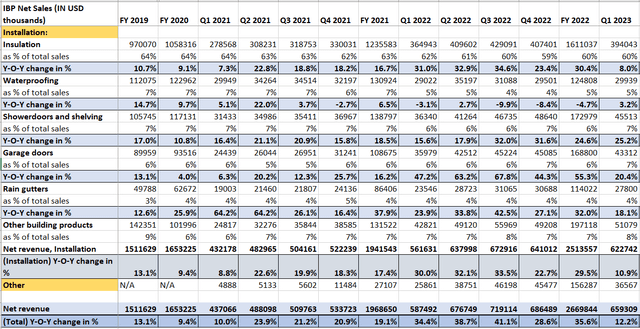

After experiencing robust growth of ~35% Y/Y in 2022, the company's revenue growth pace moderated due to a softening single-family housing market, accompanied by lower starts and completions. In Q1 2023, the company's installation business grew by 10.9% year-on-year to $622.7 million, marking the lowest growth rate in the past seven quarters, with a same-branch sales growth of 7% year-on-year. This slowdown was mainly attributed to a meager revenue growth rate of just 1.6% year-on-year in the single-family business, which offset the benefits derived from pricing, contributions from recent acquisitions, and robust growth in the company's multifamily and commercial business during the first quarter of 2023.

Conversely, the Other segment, which encompasses IBP's manufacturing and distribution operations, increased from $26 million to $37 million. This growth was primarily driven by organic manufacturing and distribution revenue expansion, as well as the acquisition of Central Aluminium in April 2022. Central Aluminium specializes in selling gutter supplies and accessories to high-volume gutter installers and independent contractors in residential, multifamily, and commercial markets. Overall, on a consolidated basis, the company's revenue grew by 12.2% year-on-year to reach $659.3 million in the first quarter of 2023.

IBP Historical Revenue Growth (Company data, GS Analytics Research)

Looking ahead, the company should benefit from a strong price mix, an extended backlog in its multifamily business, and overall strength in the multifamily and commercial end markets, which should continue to support revenue in the upcoming quarters. However, the weakening single-family end market, resulting from lower completions and declining housing starts, is expected to outweigh these positive factors, leading to flat to slightly negative revenue growth in 2023. The good news is we are likely near the bottom of the housing cycle. The Federal Reserve is expected to become less hawkish post the recent banking fiasco which should enable housing recovery in the next year and beyond.

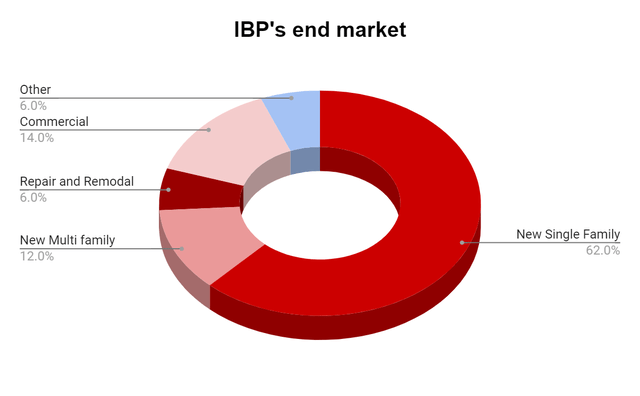

Further, the company is actively focused on increasing its presence in the commercial sector. This move is driven by the longer-term nature of commercial projects, which offer greater revenue visibility. Additionally, the company is seeking to expand its offerings beyond insulation by venturing into segments such as waterproofing, shower doors and shelving, rain gutters, garage doors, fire-stopping/fireproofing, and window blinds. The company plans to achieve this expansion through cross-selling to its existing insulation customers. There is a significant growth potential in these categories and I believe this expansion in adjacent offering as well as commercial market should aid the company's organic revenue growth in the near future.

IBP's end-market (Company data, GS Analytics Research)

Furthermore, the company remains focused on its goal of achieving $100 million in acquired revenue annually, and it has already completed three deals in 2023, which should contribute $46 million in annual revenue. Additionally, the company maintains a strong liquidity position, with a net debt-to-EBITDA ratio of 1.4x as of the first quarter of 2023 end. This ratio is well below the company's target of 2x, providing ample room for strategic investments and further driving revenue growth through acquisitions.

So, while FY23 is expected to be a slightly down year, the company's medium to long-term growth prospects look good and the company should see cyclical recovery in FY24 and beyond. This coupled with the company's growth initiatives like M&As, expansion in commercial end-market, and other product adjacencies, bodes well for its revenue growth outlook.

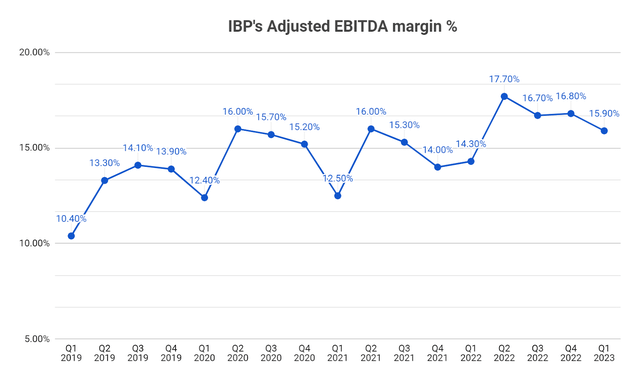

Margin Analysis and Outlook

In the first quarter of 2023, the company's adjusted EBITDA showed a year-on-year improvement of 160 basis points, reaching 15.9%. This growth was mainly driven by a 16.5% increase in pricing within the installation business, as the company made necessary adjustments to align pricing with the value offered. This positive pricing effect more than offset the negative impact of volume decline during the quarter. Furthermore, the adjusted gross margin expanded by 250 basis points year-on-year, reaching 31.9% during the quarter.

IBP's Adjusted EBITDA margin (Company data, GS Analytics Research)

Looking ahead, the margin trajectory should be similar to the revenue growth trajectory with a decline in the current year due to volume deleverage but growth in FY24 and beyond as revenue growth recovers. Further, the company is prioritizing pricing over volume which should help its margins in the long term. Additionally, the company's national scale that enables low-cost purchasing, and its emphasis on enhancing operational efficiency should contribute to margin expansion in the medium to long term.

Valuation and Conclusion

The company's stock is currently trading at a forward price-to-earnings (P/E) ratio of 12.70x, based on FY23 consensus EPS estimates of $8.43. This valuation represents a discount compared to its five-year average forward P/E ratio of 17.78x. Although the company is expected to face some challenges in terms of revenue and margin in FY23, the medium to long-term story looks attractive and IBP is positioned to benefit from the strength of its multifamily and commercial businesses, strategic acquisitions, and expansion of adjacent product lines in the longer term, once the economy begins to recover. Furthermore, the company's margin is expected to benefit from its focus on price over volume and its emphasis on operational efficiency in the long run. The company's P/E multiple should re-rate towards historical levels once the revenue and EPS growth resume in FY24 and beyond. Given the company's current undervaluation relative to its historical valuation and positive medium to longer-term prospects, I recommend a buy rating on this stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Vedang S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.