3M: Sellers May Be Exhausted

Summary

- 3M's stock is down more than 50% over the last two years as a result of worsening margins and deteriorating macroeconomic conditions.

- 3M has significant outstanding legal liabilities that cannot be understated.

- The company is technically oversold, which presents an opportunity to shrewd traders.

- Selling puts to earn a solid cash-on-cash return while waiting for things to improve seems like the best course of action.

josefkubes

Over the last two years, 3M (NYSE:MMM) has seen its stock price fall by more than half, as tepid growth, weak margins and a deteriorating economic environment have weighed on investor sentiment. Additionally, speculation over potential PFAS/Earplug liabilities and concerns about the precariously positioned dividend have added fuel to the fire.

As the stock price dips under the $100 mark for the first time in more than a decade, we think it's time to take another look at the troubled industrial conglomerate to see if there's an opportunity here for shrewd investors, or whether it's time to leave 3M in the past for good.

Financial Results

In its most recent quarter, 3M reported mixed financial results. On the positive side, the balance sheet remains in decent shape, with current assets greater than current liabilities, and total assets roughly equal to total liabilities, once you remove ~18 billion in intangibles.

Trailing twelve months levered free cash flow also grew for the first time in a few quarters, signaling a possible turnaround in underlying businesses.

The company appears stable overall, but there are some potential issues here as well.

First, the company pays a robust 6%+ dividend; payouts total roughly $3.34 billion per year. For a company that retains $3.49 billion in levered free cash flow, the dividend safety remains a concern for investors.

Trailing twelve-month revenue (QoQ) also shrank by about $800 million, from $34.2 billion to $33.4 billion. This shouldn't alarm investors too much, as the company has been reporting fluctuating revenues between $30 and $35 billion for the last 10 years plus.

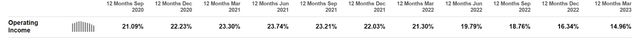

However, of concern are the deteriorating operating margins:

Since peaking about 2 years ago, operating margins have been dropping steadily; from a high of almost 24% in mid-2021, to ~15% in the most recent quarter. This drop lines up perfectly with the decline in the stock price, which begs the question as to whether or not these margin issues will continue.

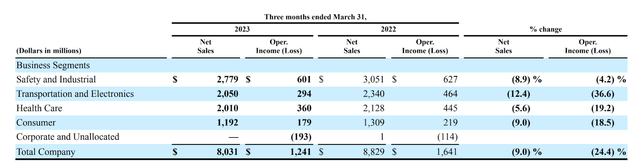

As we can see, the biggest operating income decline was actually driven by underperformance in the Transportation and Electronics segment:

The company had the following to say:

"Business segment operating income margins decreased year-on-year from lower sales volumes, manufacturing and supply chain headwinds, carryover raw material/logistics/energy cost inflation, investments in the business and China COVID-related challenges partially offset by benefits from pricing, aggressive spending discipline, and productivity actions."

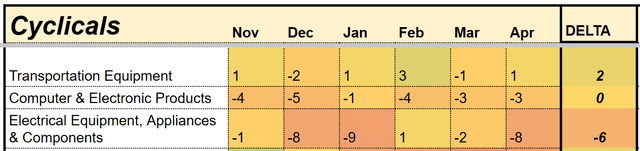

In short, the company was hit by a number of factors outside of its control. Some of the losses were likely due to company specific operational issues, but the story management is telling is backed up by trends reported within the industry. Cost pressures are high, and Electrical Equipment/Products manufacturers have been reporting contraction for the last few quarters:

Transportation has also been weak.

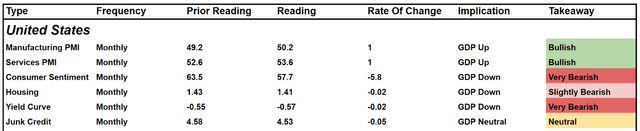

This should all begin to turn around as the economy improves, but it's currently unclear how quickly that will happen, given the mixed macroeconomic outlook:

Long story short, it's possible that company results could improve, but it would likely coincide with a broader macroeconomic rebound which may not materialize for some time.

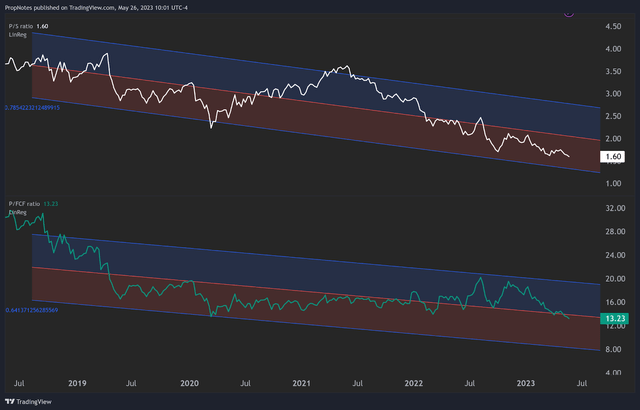

Should margins improve, then we think the stock is poised to rally, but it's not clear when that will happen. If margins stay where they are or deteriorate, then shares will likely remain where they are, at the current depressed valuation:

Technicals

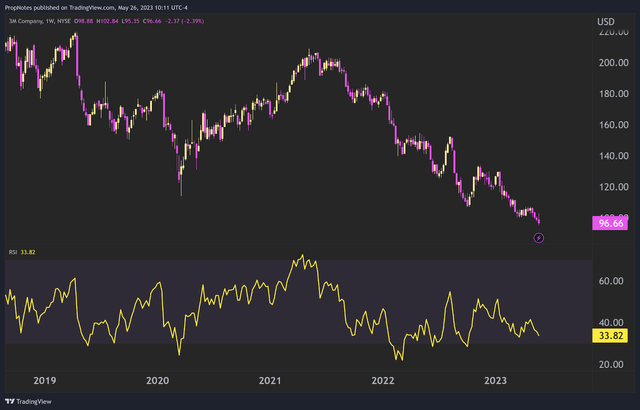

Operational results have been mixed, and the valuation, to us, seems largely justified. However, a closer look at 3M's stock chart reveals that a number of technical indicators suggest that the stock is currently oversold. The 14-week Relative Strength Index has dipped below, and is now hovering just above, 30, indicating that the stock is in oversold territory and could be due for a bounce:

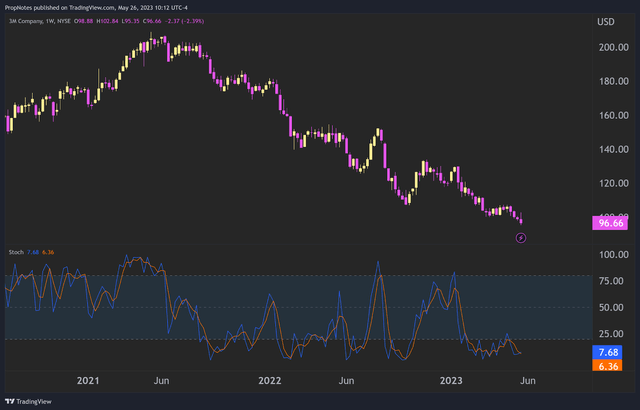

Additionally, the stock's stochastics are also hovering in the oversold range, further supporting the notion that selling pressure may soon be exhausted:

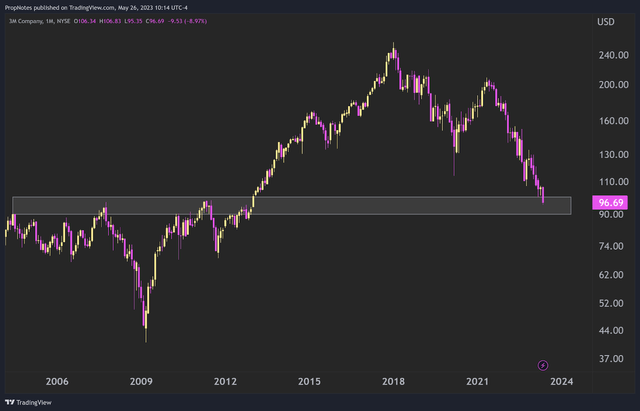

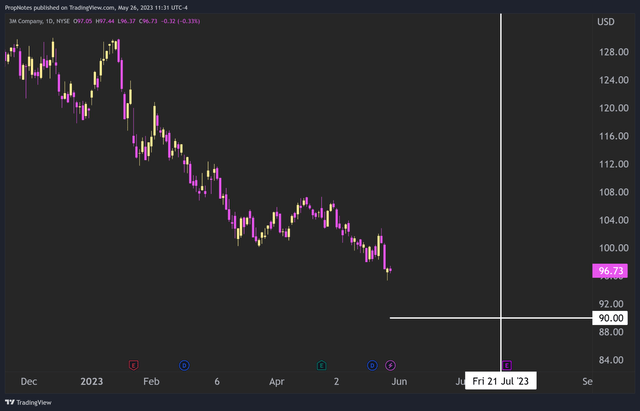

Last but not least, the stock is trading into a significant level of support between $90 and $100, which can be seen here:

Taken together, these technical readings and levels indicate that sellers are likely becoming exhausted, which could allow for buyers to step in and cause a rebound in 3M's stock price.

The Trade

Between the tepid fundamentals and depressed valuation, we don't think the company is poised for a quick, near-term bounce back. However, as shares are currently oversold on several metrics and the stock is trading into a support area, we do think there exists an opportunity to profit from this situation: by selling puts.

For those unfamiliar, selling a put option means you're essentially agreeing to purchase shares of a stock at a specific price, known as the strike price, up until a specified expiration date.

As we would only want to own 3M with a larger margin of error, we'll look at selling puts with strike prices below the current price.

We like the July 21st, $90 strike puts:

For sellers of these contracts, if the stock ends above $90 in the next 56 days, then you get to keep $180 per contract.

If the stock ends below $90, then option sellers need to purchase the stock at $90, but still get to keep the $180 per contract as a short-term return.

As this trade stands to return a healthy 2% over the next 56 days (13.2% annualized), it seems like the best risk/reward way to play the setup in 3M.

Risks

While the trade idea presents a relatively high probability of success (76%), it's crucial to be aware of the potential risks associated with the trade. Some of the key risks include:

Business Execution: 3M's ability to effectively manage its supply chain and control costs will be crucial in maintaining profitability. Any missteps in these areas could negatively impact the stock price.

Liabilities: As CashFlow Hunter laid out in their recent article, 3M has significant liability outstanding related to PFAS products and Earplugs. In short, while these liabilities are significant, we believe that the market has accurately priced their impact given the recent selloff. Analysts project ~$7 billion in total liabilities for the earplugs, which seems reasonable, and it's unclear whether the PFAS liabilities will require billions in cleanup by the company itself. Owning shares requires being sufficiently aware of these risks, which is another reason we only want to begin bidding for shares below the $90 price point.

Macro: As we illustrated earlier, 3M is basically a proxy for the broader macroeconomic environment as a result of its saturated TAM and product inputs. If things worsen, it will likely impact 3M's operating margins.

Technical Sentiment: Despite the oversold condition of 3M's stock, there's always a risk that negative sentiment or downward momentum could persist longer than anticipated, impacting the trade's success.

Summary

In conclusion, 3M is fairly priced given the issues we've discussed around Macro, Liabilities, tepid results, and the precarious-looking dividend. However, the company remains oversold and thus may be due for a respite from the selling.

We think that selling puts and earning a return while potentially acquiring shares with a larger margin of error is the best risk-reward way to play the stock. We rate 3M a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MMM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.