VIG Vs. TDV: One Is The Ultimate Dividend Aristocrat ETF

Summary

- The right income growth ETF can help you become a dividend emperor and harness the entire world to pay for your financial dreams.

- VIG is the gold standard of aristocrat ETFs, with the best dividend dependability record of any ETF I've seen. It never cut its annual dividend, unlike the official aristocrat-ETF.

- VIG is an all-star team of 314 wide moat Ultra Sleep Well At Night world-beater blue-chips with fortress balance sheets.

- TDV is the technology aristocrat ETF, 5-star Morningstar rated, and since inception, it's doubled the annual returns of VIG.

- Find out whether this latest challenger to the aristocrat ETF throne has what it takes to dethrone the dividend king (and future dividend king) ETF or whether the current gold standard of dividend growth ETFs continues to reign supreme.

- Looking for more investing ideas like this one? Get them exclusively at The Dividend Kings. Learn More »

John M Lund Photography Inc

This article was published on Dividend Kings on Tuesday, May 22nd.

---------------------------------------------------------------------------------------

I bet you can't guess who the richest human to ever live was.

Adjusted for inflation, Augustus Caesar, who controlled the economy of 25% of the earth, was worth $5.4 trillion in today's money.

This isn't surprising since Caesar was an emperor, but you might be surprised to find out that anyone today can effectively do the same thing as Augustus.

In the 1st year AD, Caesar's empire contained about 45 million people at a time when the global population was about 250 million.

Imagine being able to command 1 in five people in the world. To harness their productivity and lives, to bend them to your will. To extract tribute from a vast empire, flowing steadily and ceaselessly to your bank account.

That's the power of emperors, and many considered themselves living gods.

Today, anyone can be an emperor through the world's best dividend blue-chips.

Through a single ETF such as Vanguard Dividend Appreciation ETF (NYSEARCA:VIG) you'll own 314 of the best blue-chips, the world's corporate titans. The world-beaters who bestride the earth like a colossus.

These 314 companies combined count nearly every human alive today as a customer. They don't just grant you the power of 45 million people or even 450 million. They collect money from 8 billion humans.

But unlike Caesar or dozens of emperors and warmongers, and dictators throughout history, they conquered without firing a shot, slaying millions, or committing genocide.

But just like Caesar and all the egotistical despots of history, these amazing companies will send tribute, in the form of dividends, from every corner of the globe.

A never-ending tide of quarterly payments that grows exponentially over time.

Do you know what money is? The 3rd greatest invention in human history behind language and writing.

Money is literally stored human power and ingenuity. With money, you can harness the power of millions, or even billions, to achieve goals across time and space.

You can bend the universe to your will by making everyone on Earth work towards whatever goal you have.

And you don't have to conquer, murder, or subjugate anyone.

That's the magic of modern global capitalism.

Elon Musk wants to colonize Mars. All he needs is enough money, time, and desire, and he can make it happen.

My dream? To end global poverty, which I can accomplish with my family hedge fund within 411 years through a perpetual charitable trust and save millions of children along the way.

My Plan To Save 200,000 Children Per Year

The greatest philanthropist in history is Andrew Carnegie, who donated $454 billion, adjusted for inflation, to causes he believed would enrich the world and better humanity.

The man who dies rich dies disgraced." - Andrew Carnegie

I deeply respect Carnegie's passion for philanthropy, and will devote my life to trying to donate even more to charity then he did.

- the power of a perpetual charitable trust

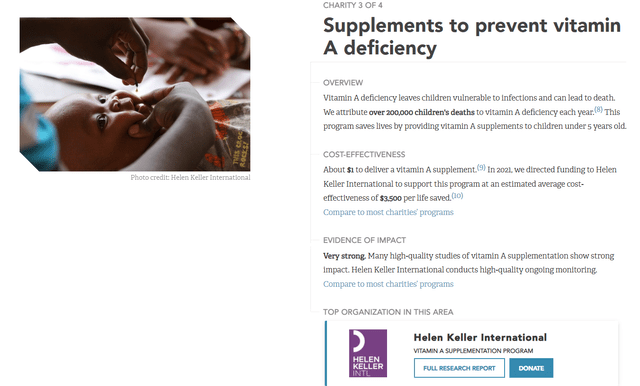

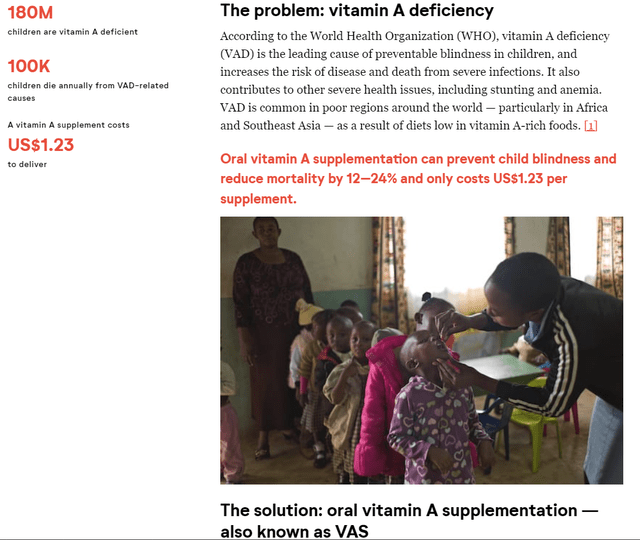

My favorite charity is Helen Keller International, the cheapest way for regular people to save a life.

- 2:1 match is now available through June 5th (up to $100,000); I'm donating $4,100 to save 2.34 children

Thelifeyoucansave Thelifeyoucansave

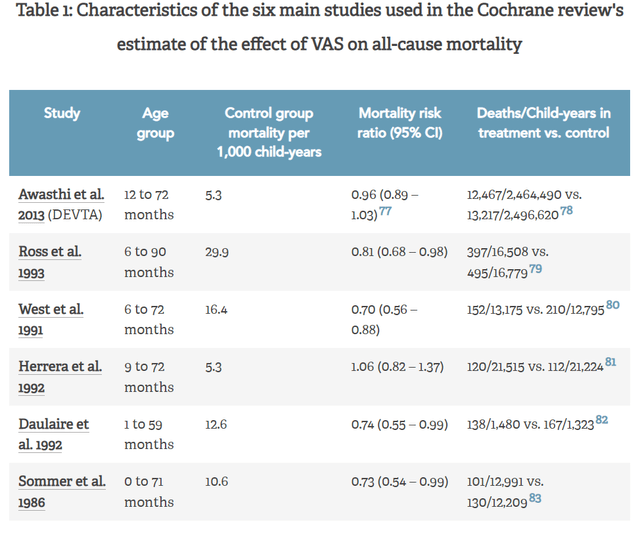

If you want extensive and rigorous statistical and scientific proof (including dozens of studies) that HKI is one of the most effective charities on earth, you can read GiveWell's extremely detailed report here.

Rest assured, this is scientific spreadsheet altruism at its finest.

GiveWell ranks Helen Keller International as one of the four most effective charities in the world as measured by the cost of life saved.

$3,500 to save one child's life by administering 2,846 Vitamin A supplemental doses for children between the ages of 6 months and six years.

For approximately $700 million per year, the 200,000 annual vitamin-A deficiency-related deaths could be eliminated from the earth.

200,000 children per year die, the equivalent of the population of Santa Barbara, California, or Oxford, England. This is 100% unnecessary, and I will help to put a stop to it.

Assuming this problem still exists in 2272, my charitable trust will eliminate this cause of childhood death from the earth.

How I Can Get Every Human On Earth To Help Me Save Millions Of Children

I'm not a politician, nor do I have any desire to run for office. I am not a king or dictator. I am just a retired Army Medical Service Officer turned financial analyst who wants to make a difference because it's the right thing to do.

In order to save millions of children, I need your help. In fact, I need every person on earth to give me money voluntarily. And here's how I do just that.

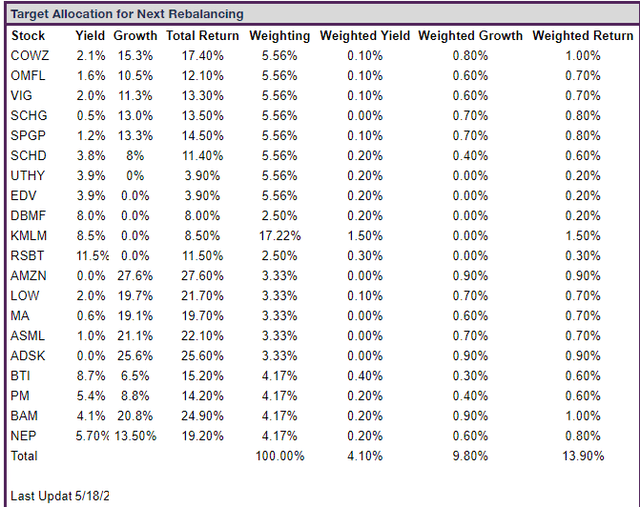

ZEUS Income Growth Portfolio: How My Family Will Thrive And Help All Families Thrive

Dividend Kings ZEUS Income Growth Portfolio Tracker

This is my family's long-term plans for our $2.5 million hedge fund.

1,024 of the world's best companies, with 8 billion customers, represent all of humanity.

By selling goods and services that every human wants, these 1,024 companies don't just make our lives better; they make the world better, steadily moving towards utopia.

Because those companies are paying dividends. And sending me a small cut of their profits, which derive from every human on earth.

I don't need to conquer nations or even run for political office.

I don't need to become a despotic dictator loathed by millions, who assassins are constantly trying to kill.

I only have to own these 19 stocks and ETFs, and everyone on earth will voluntarily give me enough money to end Vitamin A-related child deaths.

- After that, I'll unite humanity toward the goal of eliminating global poverty

- completed no later than 2434

Naturally, this is a very long-term project, my holy mission in life, which gives meaning to my existence and hopefully my future children's as well.

- Unless they want to do something else with their lives

- I'll try to raise them to be philanthropists

- Just like Buffett's kids are

So I'm always searching for the best world-beater blue-chip assets that will result in better long-term returns and income growth if added to the ZEUS Income Growth portfolio.

4.1% safe yield, 13.9% long-term return potential (14% historical), and the ultimate SWAN portfolio for my family's goals.

| Bear Market | ZEUS Income Growth Peak Decline | 60/40 Peak Decline | S&P Peak Decline | Nasdaq Peak Decline |

| 2022 Stagflation | -11% | -21% | -28% | -35% |

| Pandemic Crash | -10% | -13% | -34% | -13% |

| 2018 Recession Scare | -13% | -9% | -21% | -17% |

| 2011 Debt Ceiling Crisis | -1% | -16% | -22% | -11% |

| Great Recession | -24% | -44% | -58% | -59% |

| Average | -12% | -21% | -33% | -27% |

| Median | -11% | -16% | -28% | -17% |

(Source: Portfolio Visualizer Premium)

Recently a Dividend Kings member asked me to review the ProShares S&P Technology Dividend Aristocrats ETF (BATS:TDV) to see if it could dethrone VIG as the ultimate aristocrat ETF.

So let's take a look at how TDV stacks up to the king of dividend kings (and future dividend kings) and whether you and I should start investing our hard-earned savings into this ETF.

Let's systematically review five key fundamentals to help you decide if TDV is worthy of your own quest to become a dividend emperor.

Portfolio Strategy: Winner VIG

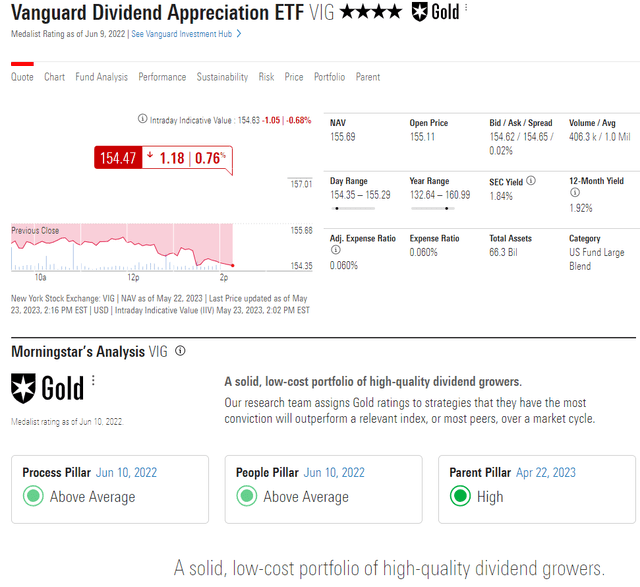

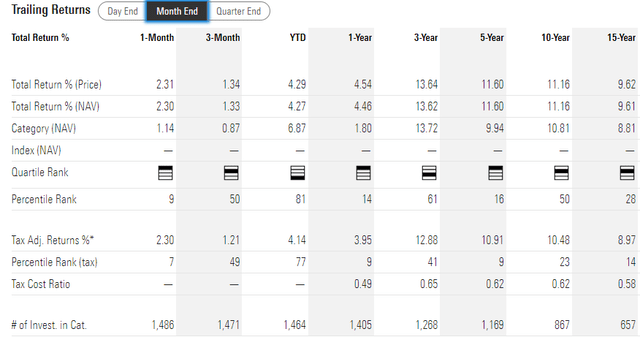

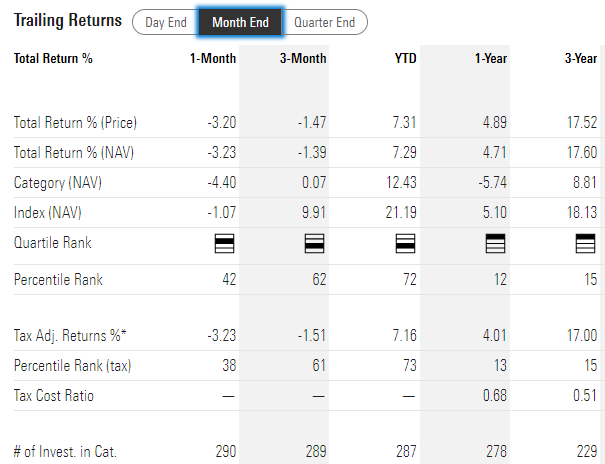

TDV comes out swinging, a 5-star Morningstar-rated ETF which is slightly better than VIG's 4-stars.

So it's obviously the better ETF, right? Not necessarily.

Morningstar's star ratings are based on historical returns compared to a fund's peers. VIG is competing with 1,267 other ETFs.

Morningstar Quartile Rankings are based on Morningstar Percentile Ranking in Morningstar Category, where 1% - 25% = first quartile (1); 26% - 50% = second quartile (2); 51% - 75% = third quartile (3); and 76% - 100% = fourth quartile (4). The Morningstar Percentile Ranking compares a Fund's Morningstar risk and return scores with all the Funds in the same Category, where 1% = Best and 100% = Worst...

The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10 year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. " - William Blair Funds

Not only does TDV compete with 5X fewer peers, it's only been around for four years, and tech was red hot except for 2022.

So let's consider Morningstar's medal ratings.

Morningstar also provides Analyst Ratings and Quantitative Ratings. Both of these systems rate funds on a scale of Gold, Silver, Bronze, Neutral, and Negative. In both cases, the medal system is a forward-looking assessment of how Morningstar believes a fund will perform in the future. The better the ranking, the more likely Morningstar feels it is that the fund will outperform the market." - Smart Asset

Morningstar medal ratings are based on analysts' or quantitative algos estimates of how an ETFs strategy is likely to perform in the future, where all actual profits and dividends come from.

Morningstar loves VIG's strategy, earning it a gold rating. That means Morningstar's analysts have the "most conviction" that VIG will outperform its peers over the long-term.

VIG's 15-year tax-adjusted returns of 9% annually are in the top 14% of its peers.

- top 92 out of 657 funds

What is the secret to VIG's money-minting magic?

Vanguard Dividend Appreciation takes a quality approach to equity income instead of chasing riskier high yields." - Morningstar

Quality over sucker yield? I like the sound of that.

The fund tracks the S&P U.S. Dividend Growers Index, which provides a market-cap-weighted portfolio of stocks with at least 10 consecutive years of increasing their regular dividend payments." - Morningstar

100% dividend contenders, the aristocrats of the future. Another solid choice.

Securities must have more than $100 million in market cap and $1 million in three-month median daily trading value to be eligible for additions...

Existing constituents face lower thresholds to reduce turnover." - Morningstar

No tiny companies are likely to blow up in a severe recession or die because they couldn't compete-and tax efficiency is great. Taxes are the form of charity I'm least enthusiastic about;)

On top of the long lookback period, the index excludes stocks with unsustainable yields that are likely to have trouble growing their dividends. The index removes existing constituents ranking in the top 15% by indicating annual yield and new eligible securities in the top 25%. Selected constituents are weighted by their float-adjusted market cap, subject to a 4% cap on any individual holdings' weight." - Morningstar

It's a shame to miss out on ultra-swan ultra-yielders like BTI and EPD, but overall this is a very sound and prudent way to screen for world-beater blue-chips.

TDV: Tech Aristocrats That Aren't Really Aristocrats

That expense ratio of 0.45% is rather high, 0.1% higher than NOBL, the official aristocrat ETF and 0.39% higher than VIG. But then again, look at that star rating; maybe it's worth the extra 39 bips.

- in finance, basis points are called bips

- because it makes us feel cool to say such things;)

Morningstar

For the last three years TDV has delivered tax-adjusted annual returns of 17%, twice that of VIG.

But compared to its peers, it's in the top 15%, while VIG is in the top 14%.

So you see, that extra star isn't as impressive as it seems.

Morningstar's quant medal rating of neutral indicates Morningstar's algo doesn't think TDV is going to outperform its tech fund peers in the future.

- so maybe not worth the extra bips after all

Why does Morningstar not sing the praises of a tech aristocrat ETF? How can combining fast growth and aristocrats not be the best strategy in the world?

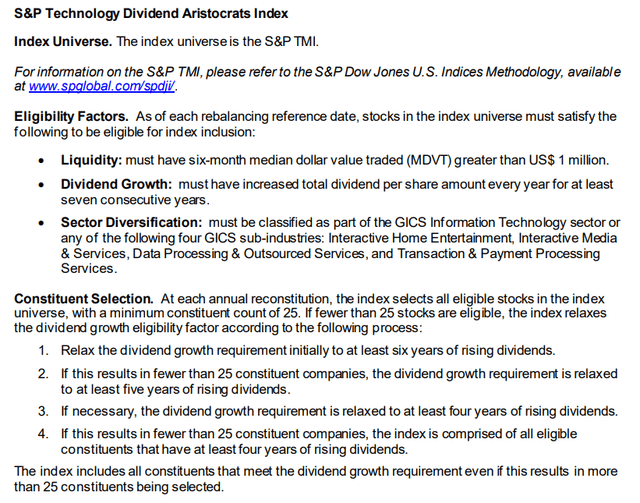

TDV is the only ETF focusing exclusively on the S&P Technology Dividend Aristocrats, which are quality, well-established, technology-related companies that have paid dividends and grown them for at least seven consecutive years.

Holdings generally have had stable earnings, solid fundamentals, and strong histories of profit and growth." - ProShares

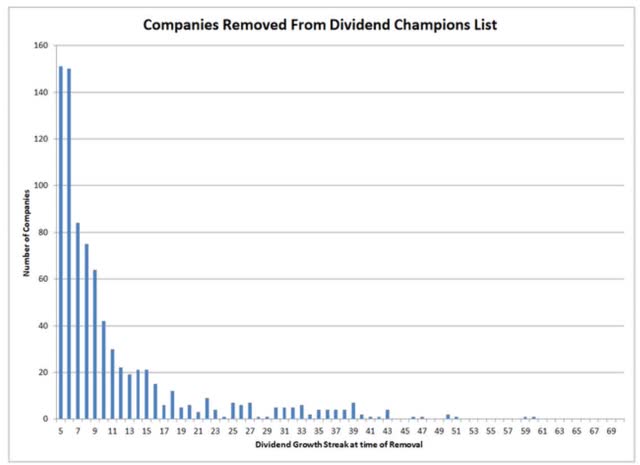

7 years is better than six-year, to be sure, but statistically speaking, it's not an indication of quality.

10 years is a lot more significant than seven year, though Ben Graham's standard of excellence is 20-year streaks, and in the Pandemic, 12+ years was the major cutoff for far lower risk of a dividend cut.

- 12+ years: Justin Law standard of quality

- 20+ years: Ben Graham standard of excellence

- 25+ years: dividend aristocrat/champion

- 50+ years: dividend king

What other quality screens does TDV use?

There is no other quality screen; it's 7+ year streaks for tech stocks.

- equality weighted though

Mind you, TDV did buy Apple 3 years before VIG did, and there are tech stocks that I am 80% absolutely certain will eventually become aristocrats.

- 80% is the Marks/Templeton certainty limit for individual companies

- "I'll die on this hill," confidence

Diversification And Companies: Winner VIG

TDV is 80% tech, as you'd imagine a tech aristocrat ETF to be.

- Actually, I'm a bit surprised its only 80% tech

VIG has exposure to every sector of the economy, which isn't surprising since it now owns 314 companies.

- more every quarter achieve a 10+ year streak

VIG has 314 companies and TDV 39.

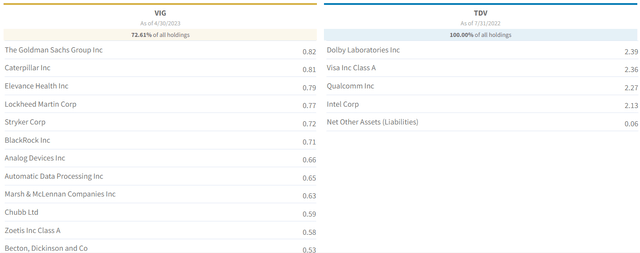

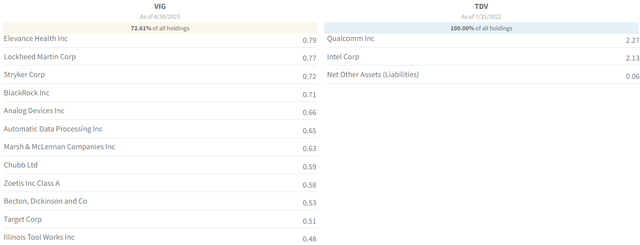

What Both ETFs Own

fund visualizer fund visualizer fund visualizer fund visualizer fund visualizer

The number of companies in VIG that I personally wouldn't want to own fits on one hand.

TDV? Equally, weighting Intel? And Western Union? And HP? And IBM? And Motorola? That doesn't exactly sound like a great growth portfolio.

- INTC will be dropped in the next rebalance

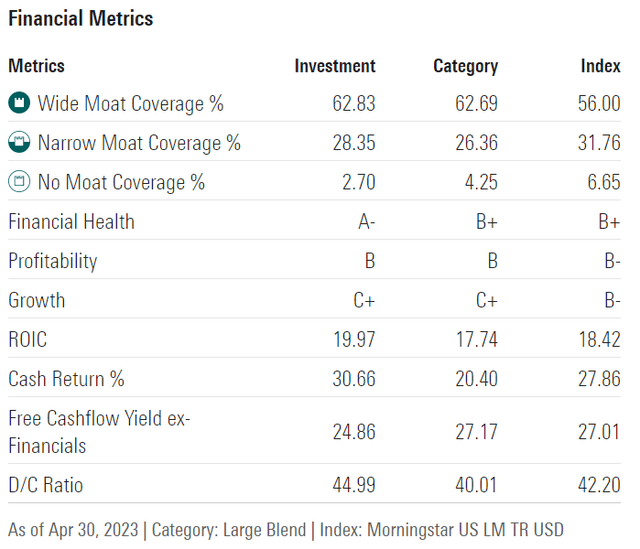

Company Quality: Winner VIG

Wall Street's favorite quality metric is profitability. So let's see how VIG and TDV compare on profitability.

VIG

90% narrow and wide moat with A- financial strength and 20% returns on capital, and 25% free cash flow margins (like Apple).

And 45% payout ratios vs. 60% safe.

This is basically an Ultra SWAN portfolio.

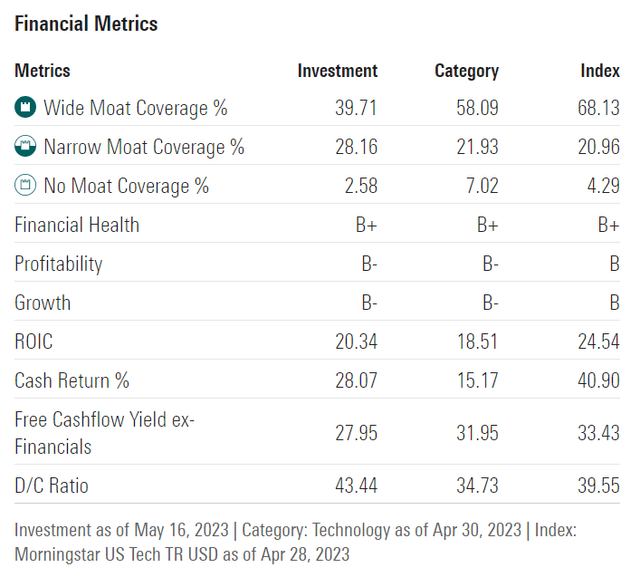

TDV

You'd imagine that a tech ETF would be a wider moat and higher profitability than a 314-stock ETF, but you'd be wrong.

TDV, due to having to select lower quality companies (like Western Union and IBM) and equally weight them, ends up with a less wide moat portfolio, with slightly worse financial health, though it does have slightly higher free cash flow margins.

- identical returns on invested capital

Consensus Future Return Potential: Winner VIG

I was surprised that an ETF that delivered 17% annual returns in the last three years didn't win this category.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential |

| ZEUS Income Growth (My family hedge fund) | 4.1% | 9.8% | 13.9% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.7% | 12.6% |

| Nasdaq | 0.8% | 11.2% | 12.0% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% |

| REITs | 3.9% | 7.0% | 10.9% |

| Dividend Champions | 2.6% | 8.1% | 10.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% |

| ProShares Tech Aristocrats ETF | 1.5% | 8.6% | 10.1% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% |

(Source: DK Research Terminal, FactSet, Morningstar)

TDV isn't expected to beat the actual aristocrats in the future or even the S&P.

That's what you get when you equal-weight companies like HP, Western Union, and IBM, while VIG is market cap weighted, and its top names are MSFT, AAPL, UNH, V, and MA.

Historical Returns: Winner TDV

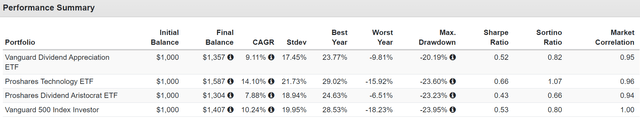

Historical Return Since December 2019

Yes, TDV has benefited from the tech bubble, but at the price of much higher volatility, and it's not expected to outperform VIG going forward.

Meanwhile, VIG, which historically outperforms the aristocrats, did that in the last four years and is expected to continue doing it in the future.

- the power of higher quality companies

- and faster-growing ones

- future aristocrats like Nike

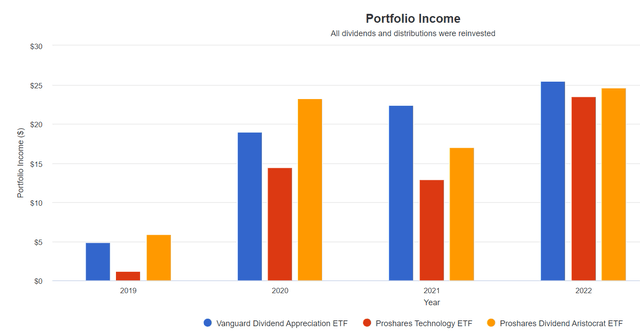

Historical Income Growth: Winner VIG

How is it possible that the official aristocrat ETF had a dividend cut in 2021? When none of its holdings cut their dividends?

Equal weighting vs. market cap weighting.

- VIG: 15% annual dividend growth since 2020

- TDV: 31% annual dividend growth

- NOBL 4.3% annual dividend growth

What about future income growth? Here's the FactSet consensus through 2025:

- VIG: 6.3% CAGR

- TDV: 1.8% CAGR

- NOBL: 4.5% CAGR

Even with the recession, VIG, which has never had a negative dividend growth year, is expected to grow its dividends much faster than TDV.

- in the Great Recession VIG's annual dividends were flat

- not a single down year since 2006 inception

- I don't know of any ETF that has such dependability

Bottom Line: VIG Is Still The King Of Aristocrat ETFs Because Of TDV's Fundamental Flaw, Which Is The Same As NOBL's

TDV is a great idea with poor execution and two major flaws.

It starts and ends with the dividend streak, just like NOBL.

VIG starts with a dividend streak and then adds quality screens just like SCHD does.

What's more, TDV compounds its error with equal weighting, which historically leads to overweighting lower-quality companies and less dependable annual dividend income.

I don't know about you, but when I'm looking for an aristocrat ETF, I kind of want the dividends to go up every year, or at least not decline.

- NOBL's dividend fell 23% in 2021

- TDV's fell 7%

- VIG's went up 16%

What's more, VIG has superior future total return and income growth potential, according to Morningstar's analysts and FactSet's consensus.

- This means almost 4,000 analysts covering all 314 companies

Morningstar is correct; VIG's portfolio construction, risk management, and portfolio management strategy are the gold standard for aristocrat ETFs.

Is TDV a dangerous ETF? If you own it, should you rush to sell it? No.

It's likely to deliver market-like returns in the future, and its quality of companies are above-average.

But VIG remains the ETF by which all other aristocrat ETFs and dividend growth ETFs should be judged.

It's a super low-cost, Ultra SWAN wide-moat dividend growth titan with the best dividend dependability I've ever seen in an ETF.

Vanguard has done an exceptional job with VIG, and so yet another challenger to the aristocrat ETF crown falls before VIG's superior skill, quality, and execution.

VIG still reigns supreme among dividend aristocrat ETFs, its grip on the aristocrat iron throne absolute.

Long may VIG reign, and long live the dividend king (and future dividend king) ETF!

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's $2.5 million family hedge fund.

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.