Carpenter Technology Is A Good Buy At The Current Levels

Summary

- Carpenter Technology's revenue should benefit from favorable demand and robust backlog levels in the coming quarters.

- Strong pricing and improving productivity should help in margin expansion in the coming quarters.

- Valuation looks attractive considering the growth prospects.

phive2015

Investment Thesis

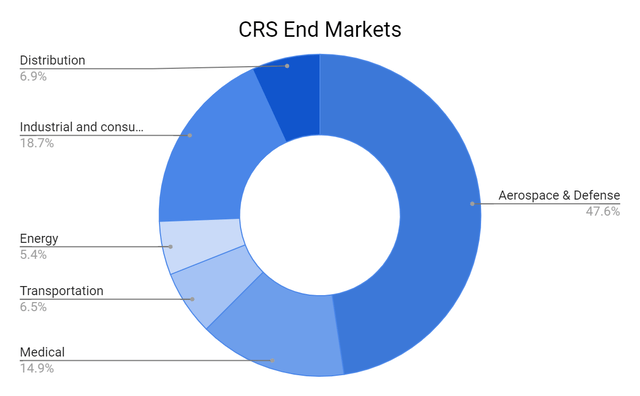

Carpenter Technology Corporation (NYSE:CRS) is expected to continue benefiting from strength across all end markets and a robust backlog, primarily in the Aerospace and defense sector. This is driven by robust demand and higher lead times. The company's margin is also expected to improve due to volume leverage, investments in productivity, and the focus on high-margin business. The company is expected to post a strong growth in EPS over the next few years, and its valuation looks attractive considering these growth prospects. Hence, I have a buy rating on the stock.

Revenue Analysis and Outlook

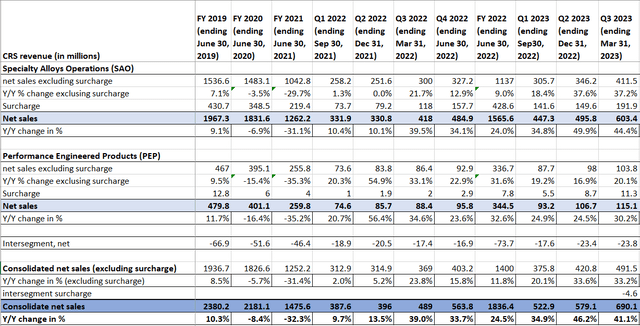

Carpenter Technology is a manufacturer of specialty alloy-based material and process solutions for use in aerospace, defense, medical, transportation, energy, industrial, and consumer end-market. Aerospace is the biggest end-market for the company, amounting to almost half of its sales. With the recovery in the Aerospace end market thanks to travel resuming along with good demand in other end markets, the company is witnessing good growth. This good demand helped the company post strong growth during the third quarter of FY23. The Specialty Alloy Operation (SAO) segment witnessed an impressive growth of 37.2% year-over-year, reaching $411.5 million (excluding surcharge). This growth can be attributed to a 13.3% increase in volumes (due to higher shipments), strong pricing, and an improved product mix across key end markets. On the other hand, the Performance Engineered Products (PEP) segment achieved a 20.1% year-over-year growth, reaching $103.8 million (excluding surcharge), thanks to increased demand in its Dynamet titanium and additive business.

The remarkable growth in both segments led to a substantial 41.1% year-over-year increase in revenue, reaching $690.1 million. Excluding the surcharge, revenue grew by an impressive 33.2% year-over-year, amounting to $491.5 million in the third quarter of FY2023.

CRS Revenue Growth (Company data, GS Analytics Research)

Looking ahead, I anticipate that the company will experience revenue growth in the coming quarters, driven by the strength across all end markets, strong pricing, and robust backlog levels, particularly in the Aerospace & Defense sector. The Aerospace & Defense end market, which witnessed a significant 59% year-over-year growth in Q3 FY23, is expected to maintain its strong momentum. This is primarily due to the urgent material requests and higher delivery requirements from customers in the Aerospace submarket. Additionally, the ongoing improvements in global travel demand, coupled with the industry's need for new planes and increased production targets by OEMs, will contribute to the demand for the company's products in the coming years.

Furthermore, the continuous growth in electric surgery, driven by hospitals addressing staffing challenges and increasing manufacturing activity by OEMs to meet the demand for electric surgery, is expected to drive revenue in the Medical end market.

CRS End-Markets (Company data, GS Analytics Research)

The Industrial & Consumer end market business, encompassing semiconductor fabrication, chemical and energy infrastructure build-out, is poised to benefit from ongoing demand in the semiconductor sub-market. Additionally, there is strong demand from the consumer electric submarket for materials produced by the new hot strip mill at the Reading, PA facility.

Furthermore, the transportation business is expected to capitalize on the high demand for high-duty vehicles, as well as the recovering demand in China and the anticipated global increase in build rates in the coming years. The Energy end market should experience revenue growth due to the escalating need for advanced solutions in the oil and gas sector, as well as the growing demand for industrial gas turbines for both new installations and overhauls.

Overall, the company's continued strength across all end markets, combined with its diverse product portfolio and increasing backlog, are expected to drive revenue growth in the coming years.

Margin Analysis and Outlook

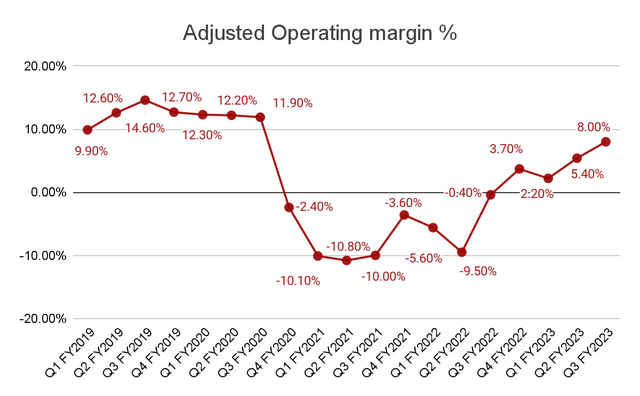

The company posted an adjusted operating margin of 8% in the third quarter of FY23, which was a meaningful improvement compared to a negative margin of 0.4% in the previous year. It was primarily driven by the benefits derived from volume leverage in both the Specialty Alloy Operation (SAO) segment and the Performance Engineered Products (PEP) segments. Additionally, the company successfully realized pricing gains, which further helped to offset the negative impact of inflationary pressure.

Adjusted Operating Margin (Company data, GS Analytics Research)

Looking ahead, the company should continue to experience volume leverage in the coming quarter, driven by the strength across all end markets. This, in combination with the company's raw material surcharge mechanism and its ability to increase prices to counter inflationary pressure, is expected to continue supporting margins in the upcoming quarters.

The company is also actively focusing on enhancing the productivity of its labor force across its facilities. This includes initiatives likes making investments in training to accelerate the learning process of new employees across all production centers, which should help margins in the long run.

Furthermore, the company maintains a strategic focus on high-margin, high-growth businesses such as material solutions used in semiconductor fabrication and others. The optimization of this product mix is expected to further contribute to the company's margin improvement in the long term.

Overall, I believe that these ongoing efforts to improve productivity and the company's strong performance across all end markets will aid in continuing margin progress and eventually lead to a return to pre-COVID margin levels.

Valuation and Conclusion

The company's revenues and margins experienced a significant downturn post-Covid but are now showing a quick rebound, largely due to robust demand in end-markets, easing supply chain restrictions, and the company's concentrated efforts to enhance productivity.

When evaluating the figures for the current year, margins have seen a considerable improvement, moving from 2.20% in Q1 FY23 to 8.00% in Q3 FY23. This recovery trend is anticipated to persist, and I predict the company will regain pre-Covid margin levels sometime within the next fiscal year.

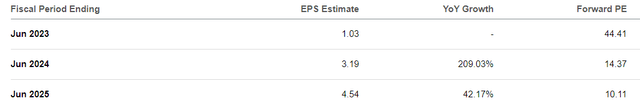

Thanks to robust revenue growth and the improvement in margins, the company's EPS is forecasted to exhibit a notable increase in the coming years. While the company's P/E multiple based on FY23 (ending June) EPS of $1.03 may seem high at 44.41x, its P/E multiples based on FY24 and FY25 EPS are 14.37x and 10.11x respectively, which seems quite attractive.

CRS Consensus EPS estimates (Seeking Alpha)

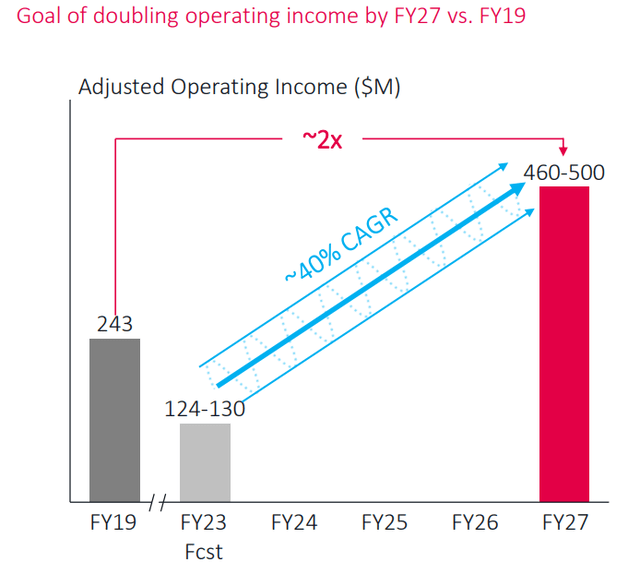

Additionally, the company has recently communicated its goal to double its operating income from FY19 levels within the next four years. A portion of this objective involves restoring margins to pre-Covid levels. However, the company is also placing a strong emphasis on high-margin, value-added products and market share growth to reach this target.

Company's Long Term Operating Margin Target (Investor Presentation)

I recommend buying the stock, given its appealing P/E multiple based on FY24 and FY25 consensus EPS estimates. Further potential upside may also emerge as the company advances toward its FY27 objectives.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Vedang S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.