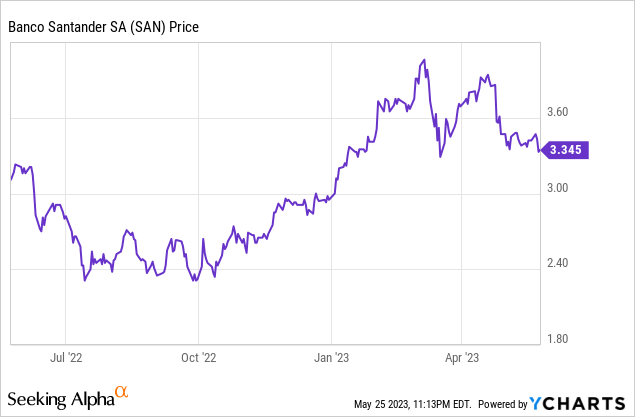

Banco Santander: Strong Liquidity Position, Trading At Just 5.5x Earnings

Summary

- Banco Santander reported a 12% net income increase in the first quarter of the year.

- The net interest income increased and the operating expenses (excluding loan loss provisions) decreased.

- The bank will likely post full-year earnings in excess of 0.55 EUR per share.

- About 50% of the earnings will be used to fund shareholder rewards.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

valilung/iStock Editorial via Getty Images

Introduction

Banco Santander (NYSE:SAN) is still being seen by the markets as a weak conglomerate. While the bank was one of the main victims of the Global Financial Crisis as well as the sovereign debt crisis which hit Europe about a decade ago, the bank's balance sheet is now much more robust. As of the end of Q1, almost 40% of the customer deposits were backed by cash and securities on the balance sheet which means Santander's liquidity buffers should be fine. Additionally, the strong earnings performance in the first quarter actually bodes well for the future. I will use the Euro as base currency throughout this article.

The net earnings remain robust

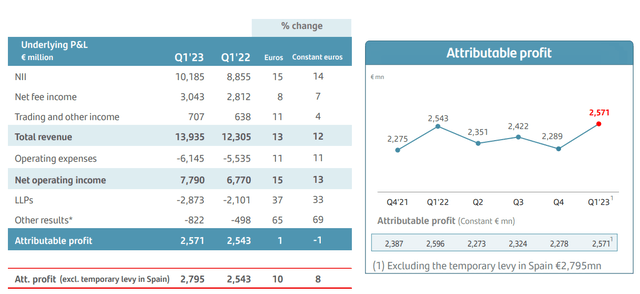

The bank has repurchased almost one billion shares in the past year (the share count decreased from 17.34B shares as of the end of Q1 2022 to just 16.45B shares at the end of the first quarter of the current financial year), and this has helped the per-share performance in the first quarter of this year.

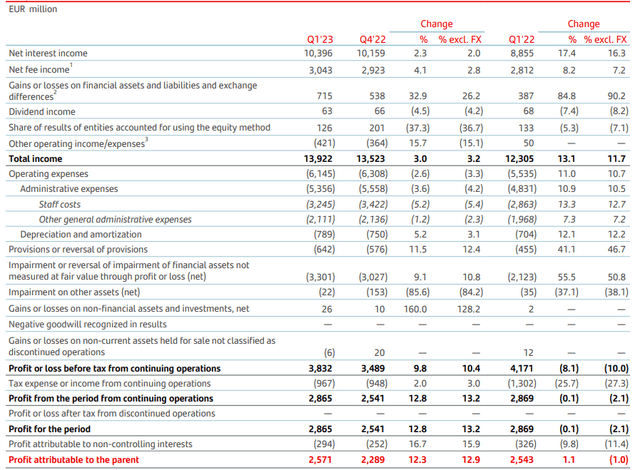

That being said, the earnings increase wasn't just caused by a lower share count as the reported net income increased by in excess of 10% as well. Mainly under the impulse of a higher net interest income (up 2.3% QoQ) and higher net fee income up 4.1% QoQ), but also because the operating expenses decreased by 2.6% QoQ thanks to a 5.2% reduction in staff costs.

Banco Santander Investor Relations

And despite an increase in the loan loss provisions (which increased by 9% from 3.03B EUR in Q4 2022 to just over 3.3B EUR in the first quarter of this year), the pre-tax income increased by almost 10% to 3.83B EUR resulting in a net profit of 2.87B EUR, of which about 2.57B EUR was attributable to the shareholders of Banco Santander. This resulted in an EPS of 0.15 EUR and applying the current share count rather than the average weighted share count during Q1, the EPS would actually have been one cent higher at 0.16 EUR per share. Needless to say Banco Santander started 2023 on a pretty strong note.

Banco Santander Investor Relations

Liquidity shouldn't be a huge issue

One of the main issues that has plagued the small-cap and mid-cap banking sector is the access to liquidity. That's usually not a big problem for larger banks as they have more and cheaper sources of capital available to them, including tapping the capital markets.

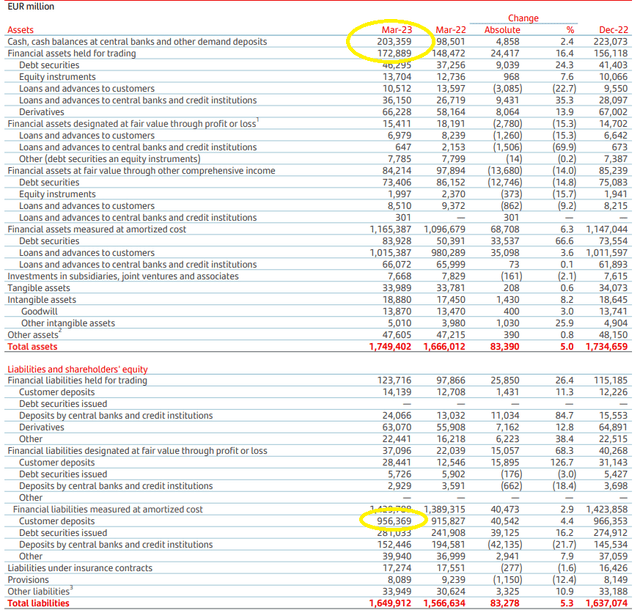

Banco Santander is no exception. Let's have a look at the balance sheet of the bank. On the asset side, you see there's about 203B EUR in cash with an additional 173B EUR in assets held for trading. That's a combined 376B EUR in cash or in securities that should be fairly easy to liquidate. While it likely would take some time to liquidate the 173B EUR in financial assets, and while there would likely be a small haircut, I think it's fair to assume that within a two-week timeframe Banco Santander can generate a triple digit Euro amount by selling off those securities.

Banco Santander Investor Relations

If we subsequently look at the liabilities side of the balance sheet we see there are only about 956B EUR in customer deposits (excluding the deposits related to the positions held for trading). This means that in excess of 20% of the total amount of customer deposits is held in hard cash. That's a very healthy percentage. And while you could argue this indicates the balance sheet is sub-optimally arranged, keep in mind the current crisis in the financial sector is mainly a liquidity crisis. So I am fine with Santander keeping 200B EUR in cash on the balance sheet to show the financial markets and its customers liquidity should not be an issue.

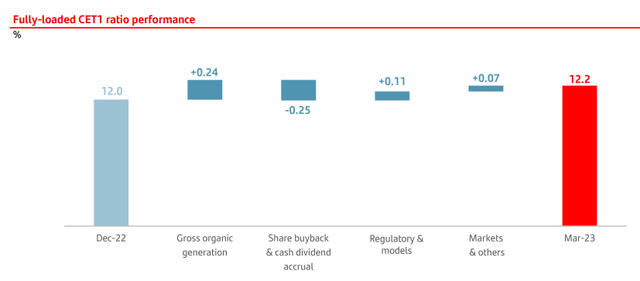

In fact, the capital ratio even increased in the first quarter of this year. Whereas Santander ended FY 2022 with a CET1 ratio of 12.0%, this increased to 12.2% as of the end of Q1.

Banco Santander Investor Relations

Investment thesis

While the financial sector is once again facing some tough times, Santander seems to be navigating through the choppy waters pretty well. The bank added liquidity to the balance sheet and in excess of the customer deposits are backed by cash and securities held for trading (this excludes the about 99B EUR in other securities). This means liquidity shouldn't be an issue. And as the bank's capital ratios actually increased in the first quarter of this year one could argue the balance sheet has gotten safer as well.

Of course this does not mean Santander can't be hit by additional problems going forward but it for sure looks like Santander is in no way the bank that was hit hard during the Global Financial Crisis and subsequently had to deal with the Spanish Sovereign Debt crisis. Unfortunately the financial markets are still not fully convinced and Santander has always been trading at a discount versus its peers. Barring any unforeseen circumstances, I expect this year's EPS to come in around the mid-50 cent range which would be close to $0.60 per share. This should increase to in excess of 0.60 EUR ($0.65) from next year on. Applying the new 50% payout ratio for shareholder rewards (including share buybacks), I continue to expect a healthy dividend and a sizeable share buyback program while the bank will retain half of its net profit (4.5-5B EUR) on the balance sheet.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a small position in Banco Santander and will be looking to increase this position in the next few weeks around the 3 EUR level.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.