Market Celebrates Artificial Intelligence (Video)

Summary

- Basically, this is the very news that the tech industry had hoped for after seeing steep drops in valuations for some firms.

- 'US equities are being powered by the bet on AI because of high exposure to tech mega-caps,' says Bloomberg of Citibank analysts.

- This 2020s era of generative AI is upon us, and recognized by the market.

- The re-industrialization trend underway, and hence the U.S. economy, will benefit as well from these developments.

Bahadir Eroglu

After attending the Richmond Fed conference as noted in my last article, I'm seeking to cull some takeaways related to artificial intelligence (AI) as it had an amazing takeoff yesterday and continued its trend today. I continue to be floored by the sentiment of the Nvidia (NVDA) skyrocket valuation rise and NASDAQ. And, my disclaimer, I do not typically write in this area in a deep way, so forgive the omissions, but hear the connections.

Link To Video Backgrounder

Talking AI, LLMs (Concept Elemental)

In trying to wrap my head around the prospects of AI, a Bloomberg newsletter summary said it well:

Artificial intelligence led Citigroup strategists to raise tech shares to overweight. They upgraded overall US stocks to neutral on AI as well as the expected end of the Fed's rate hikes and resilient American economic growth compared with China and Europe.

US equities are being powered by the bet on AI because of high exposure to tech mega-caps.

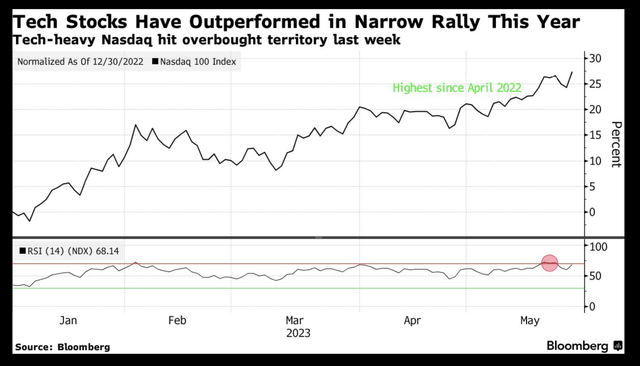

The Nasdaq 100 Index is up 27% in one of the world's top performances and set for its best start to a year since 1998.

The strategists also cut European equities to underweight and China stocks to neutral.

The implications of AI and large language models (LLMs) like ChatGPT are quite vast. One is that innovation and productivity could see 10, 20, or 50% gains for "cognitive workers." There are implications for monetary policy, inflation, the natural rates of interest, etc., according to the expert Anton Korinek, presenting at the conference. It is regarded as a positive supply shock. LLMs are the leading category in the space.

Basically, this is the very news that the tech industry had hoped for after seeing 30% drops in valuations for some firms. It is creative destruction par excellence, just the creative part, i.e., new beginnings, with some endings as well. At times, in the economic literature, one would hear that productivity gains are slowing. This is a potential reversal to that trend and a positive trend when so many forces are inflationary, which I discuss (here). The benefits of AI in the energy space are also top of mind. I can already imagine many applications.

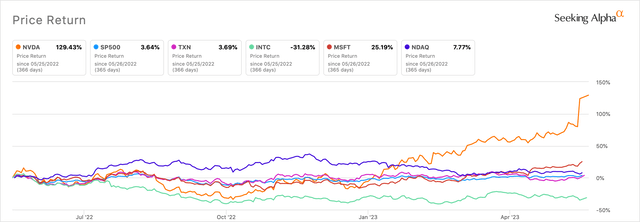

Many tech firms are benefiting from the spotlight. Few were left behind. As I discussed in the article "Innovation Economy: Tectonic Shifts And Use Cases?" yesterday, the trend of re-industrialization will also capture the tailwinds from the developments in AI. The supply chains being reworked globally are equally impacted in numerous ways.

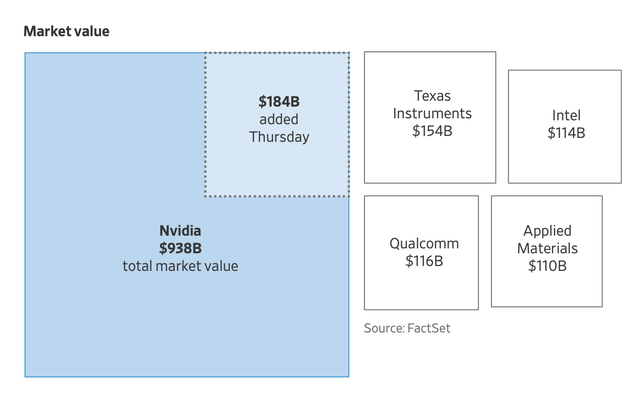

Higher value add? (WSJ) Nvidia dominates (Seeking Alpha)

See some of the thoughts surrounding the next gen AI era.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QQQA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.