Yancoal Australia: Trading At Just 3 Times Earnings At Spot Prices

Summary

- Yancoal Australia Ltd is a large Australian coal producer, with an anticipated production of at least 31 million tonnes this year.

- The metallurgical coal price remains strong, but even the thermal coal price is hanging in there.

- 2022 won't be repeated, but even at current spot prices, I expect an EPS of around A$1.50 per share (and perhaps even more if Yancoal earns interest on its cash).

- I expect Yancoal Australia Ltd company to end this semester with at least A$1.5B in net cash, and likely north of A$2B by the end of this year (excluding interim dividends that might be payable).

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Roni Bintang/Getty Images News

Introduction

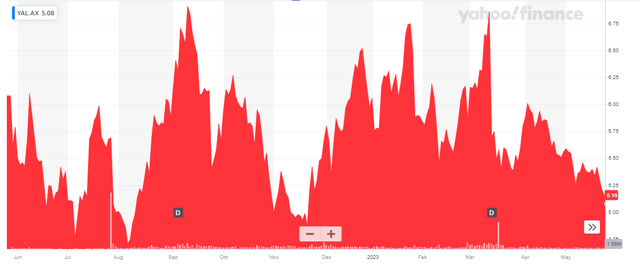

The coal sector has seen a massive revival in the past few years, and this sparked the interest in coal companies. And what a difference that makes: last time I discussed Yancoal Australia Ltd (OTCPK:YACAF) here on Seeking Alpha in 2019, the stock was trading at A$3/share, and it had an average trading volume of 15,000 shares per day in Australia (where the stock is listed with YAL as its ticker symbol). Fast-forward to today: the average daily volume in Australia is approximately 3.7 million shares per day, which is more than 200 times higher than in 2019 when nobody really cared about coal. While I cared about coal, I sold my small long position during the COVID crisis and thus completely missed out on the excellent Yancoal Australia Ltd stock performance in the past few years.

There are currently 1.32 billion shares outstanding, resulting in a market capitalization of just over A$6.6B at the current share price of just over A$5/share.

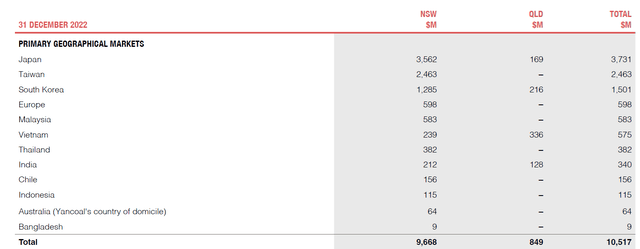

And while Yancoal’s majority owner is Yanzhou Coal, a Chinese company, the majority of the coal is going elsewhere. Japan and South Korea are Yancoal’s largest and third largest revenue-generating countries, and combined accounted for over half of the revenue in FY 2022 and just under half of the FY 2021 revenue.

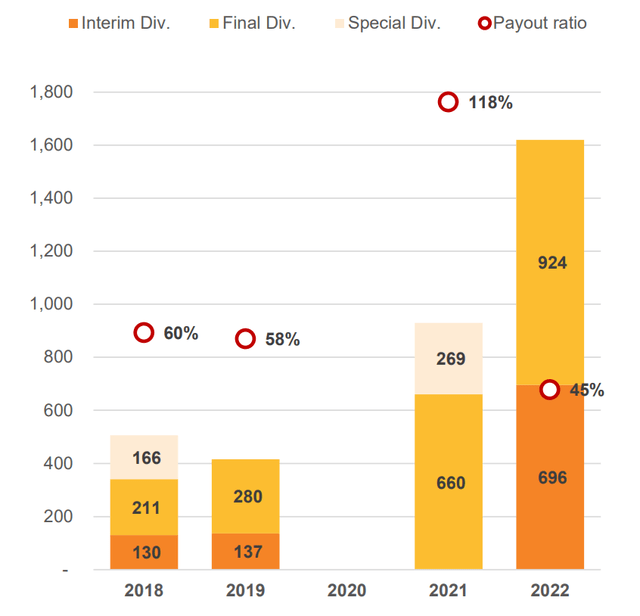

A booming coal market made the net debt evaporate

Yancoal Australia Ltd has paid a cumulative A$1.83 per share in dividends (representing about 60% of its share price when I last discussed the company), and the stock is trading at around A$5/share, so on a total return basis, the stock has performed well. That’s good to know, but it is pretty clear the "coal boom" is over and prices will gradually drift back to lower levels.

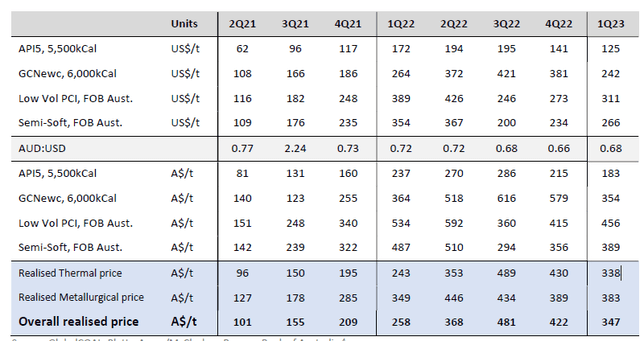

Yancoal’s Q1 results were actually still pretty good, mainly because there is a lag between the market prices and the realized coal prices. This means Yancoal was still able to benefit from "older," higher prices in the first quarter of this year while market prices have been trending down, and the first quarter may actually be the best quarter of the current financial year.

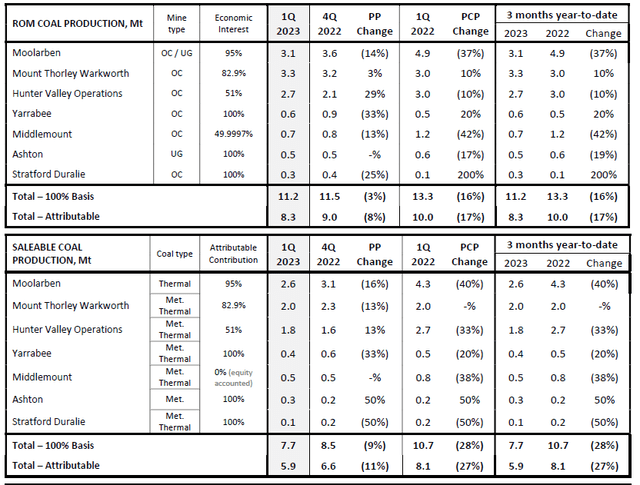

During the first quarter of the current financial year, the company’s assets produced about 11.2 million tonnes of coal (on a 100% basis), of which 7.7 million tonnes were saleable. The attributable saleable production was 5.9 million tonnes. That’s pretty low, but the production is anticipated to increase throughout the year.

That might be the saving grace for Yancoal this year, as there’s very little chance the company will continue to be able to sell its coal at an average weighted price of A$347 per tonne. As you can see below, the average realized price for thermal coal was A$338/t, while the metallurgical coal was sold at an average price of A$383/t, which resulted in the aforementioned average of A$347/t.

The main question will be to see how the thermal coal prices will behave in the next few quarters. I’m not too worried about the metallurgical coal right now, as the prices seem to be hanging in there. I will obviously keep a finger on the pulse and an eye on the coking coal prices, but the benchmark prices seem to indicate a price north of A$350/t and even closer to A$400/t for the remainder of the year, while the futures market doesn’t seem to indicate any problems well into 2024.

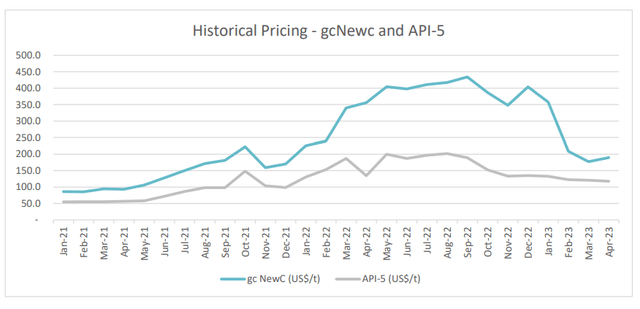

The main unknown element right now is obviously the price of the thermal coal. Additionally, the NSW coal reservation requirements will have an impact as well: Yancoal will have to provide 310,000 tonnes of thermal coal per quarter at a maximum price of A$125/t. While that’s only 4% of the total quarterly saleable production rate (on an attributable basis), it will have a negative impact. Competitor New Hope published a nice chart of the coal prices. The API-5 coal price was trading at around A$150/t last month, while the gc NewC was trading closer to US$200/t, which is approximately A$300/t.

That’s actually still pretty encouraging, and Yancoal may be able to keep the damage limited, especially as the average production rate will increase in the next few quarters. The company sold less than 6 million tonnes of saleable coal but has guided for a full-year production of 31-36 million tonnes. Even if I would use the lower end of that guidance, Yancoal will have to produce 25 million tonnes in the next three quarters, which is in excess of 8 million tonnes per quarter.

Assuming 25 million tonnes of thermal coal are sold at an average price of A$225/t, 1 million tonnes of thermal coal gets sold at A$125/t as part of the NSW coal reserve direction and 5 million tonnes of coking coal are sold at an average of A$325/t (I’m pretty conservative here given the market prices), the weighted average received price per tonne of coal would be A$241/t. Rounding that down to A$240/t and applying a production cost of A$100/t (the official guidance calls for a cash operating cost of A$92-102/t), the 31 million tonnes of saleable coal would generate a gross margin (before taking royalty payments into account) of approximately A$4.2B.

If I would now assume average royalty payments of around A$0.5B per year and A$900M in depreciation and amortization expenses, the pre-tax income would likely come in at around A$2.8B. Applying a 30% corporate tax rate would result in a net income of A$1.9B, or almost A$1.5 per share.

Of course, that’s just a back of the envelope calculation using the current spot prices as base case scenario. We know the average realized price in Q1 will be higher and unless coal prices completely collapse in the second half of the year, the net income of Yancoal will be higher. But using current prices in a base case scenario, the EPS would likely come in around A$1.5/share. And applying a 70% payout ratio (pro forma, Yancoal’s only dividend policy I’m aware of is paying at least 40% of the earnings) would then result in a dividend of in excess of A$1/share.

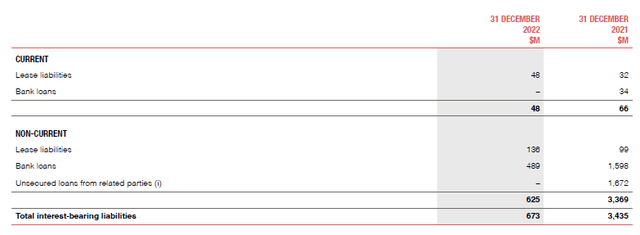

Yancoal also took advantage of the past two years by completely erasing its net debt (and gross debt, for that matter). As of the end of December, Yancoal had A$2.7B in cash and just A$675M in financial liabilities left on the balance sheet. A substantial portion of the financial liabilities consisted of lease liabilities, and the A$489M in financial debt was paid off earlier this calendar year by making an US$333M cash payment from the available cash on hand. As of the end of March, Yancoal still had about A$2.8B in cash on the balance sheet (although it did not provide any details on working capital changes, and the A$1.5B tax payment hasn’t been made yet).

Investment thesis

While we can probably agree the crazy times on the (thermal) coal markets are over, that doesn’t mean Yancoal won’t be making any money. Using the current spot prices, the EPS will likely still come in close to A$1.50 and perhaps even exceed that amount if Yancoal makes some money on its massive cash pile.

Yancoal had a net cash position of approximately A$2.2B, or about one third of its current market cap in net cash as of the end of last year. Thanks to the very strong operating and financial performance so far this year, the cash pile will likely remain robust. Robust, but lower, as subsequent to the end of last year, Yancoal made an A$900M+ cash dividend payment while it will have to pay about A$1.5B in taxes this year (based on last year’s pre-tax income those taxes were owed based on FY 2022 but are only payable this year).

I expect Yancoal to end the current semester with a net cash position of approximately A$1.4-1.7B (depending on the realized pricing in the current quarter). And with a very healthy net cash position on the balance sheet, we can expect the dividend payout ratio to come in pretty high as well. Yancoal historically used a minimum payout ratio of 40% of the earnings, but with a few billion in cash on the balance sheet, there really isn’t anything preventing Yancoal from doubling that payout ratio. Unless it wants to hoard cash to make a go-private offer.

Yancoal Australia Ltd is in an excellent shape and has spent the incoming cash flows in the past few years very well. While the coal prices will remain volatile, the stock will likely still generate about A$3.5/share in FY 2023 and 2024 combined, even if the coal prices get weaker. While I wouldn’t allocate a large portion of my portfolio to coal, Yancoal Australia Ltd stock is now back at the top of my list and I may re-initiate a position on weakness.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.