Freshworks: Strong Execution Seen In Q1, Continue To Stay Long

Summary

- FRSH delivered strong financial results, with 1Q23 revenue growth of 23% surpassing guidance. The company revised its FY23 revenue guidance upward based on this performance.

- Improved EBIT margin through cost optimization initiatives indicates management's focus on efficiency. FRSH also achieved an NRR of 108% in 1Q23, exceeding its own guidance.

- The use of AI in FRSH's solutions presents long-term benefits.

greenbutterfly

Overview

I still believe Freshworks (NASDAQ:FRSH) is undervalued today. My thesis remains that FRSH provides businesses with user-centric SaaS solutions, and they prioritize ease of use and customer needs in its product development. A key competitive advantage is that FRSH's solutions are designed to be easily implemented and scaled, allowing businesses to undergo digital transformation quickly and efficiently. The worry about FRSH stock was its SMB exposure and the impact it will get from the underlying layoffs at the customer level, both of which have caused the stock to be rangebound. The 1Q23 quarter proved that despite the challenging macro environment, FRSH is able to execute well and generate profits. FRSH's earnings and revenue for 1Q23 were both above expectations, and the company also surpassed its own guidance for EBIT margin by 880 basis points. Even though a difficult labor market will likely continue to slow FRSH's expansion, we shouldn't ignore the fact that NRR improved as the company gained ground in the upmarket. To be fair, it's not like FRSH's growth has slowed down, either; the company's new business momentum persists, especially as customers place greater emphasis on total cost of ownership and speed to value. Furthermore, this quarter's strong execution demonstrated the enhanced sales execution brought on by a 1Q23 restructuring that more closely synchronized FRSH land and expanded GTM motions. I continue to stay long on the stock.

Business overview

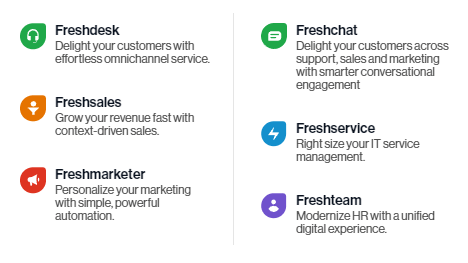

FRSH provides businesses of all sizes with cutting-edge, user-centric SaaS solutions. FRSH's primary offerings consist of Freshdesk, a customer experience product, as well as Freshservice and other customer relationship management solutions.

FRSH website

All types of businesses need to undergo a digital transformation of their marketing, sales, and customer service strategies in order to keep up with the demands of modern consumers. In spite of the heavy expenditures invested by legacy businesses on infrastructure, they are still struggling to keep up with the rising expectations of their customers and workers. In my opinion, all businesses need to undergo digital transformations if they want to meet and even exceed the expectations of their customers and employees.

Financials / Profits

FRSH delivered solid results, with 1Q23 constant currency revenue growth of 23% topping guidance for 21% constant currency growth. The strong 1Q23 performance has led to management revising their FY23 guidance for $580 million to $592.5 million revenue. Note that the increase is the size of the 1Q23 outperformance, which indicates that management expectations for the remaining FY23 has not changed. I believe the improvement in EBIT margin is the best takeaway for this quarter, which was driven by a series of excessive cost optimization initiatives. For instance (according to the 1Q23 earnings call), hiring process has been revamped, performance management culture has been improved to drive a lesser new hire, and marketing and back-office functions are consolidated (this is important as it reduces cost of retraining/rehiring, which implicitly increases profitability). Essentially, the margin improvement was due to cost cut, which is good as it shows that management is aware of the fats to cut. However, what should be noted is that this margin improvement is not due to scale or FRSH growth, as such I do not expect this magnitude of improvement to happen again. If this new lean structure is the optimal form, I believe we will see strong operating leverage ahead. Management remains committed to driving operating leverage and guided EBIT margins of 1% in FY23.

NRR

I think it's important to highlight NRR's excellent performance as it tells us how successful FRSH is at with up/cross-selling, customer churn rates, and also penetration into upmarket. NRR ended the quarter at 108%, exceeding FRSH's own guidance of 107%. In my opinion, the 108% is still lower than the 110% achieved in the previous quarter, so I think there is room for improvement here. Despite the fact that 1Q23 NRR was still under pressure due to fewer hire due to the tight labor market, it is important to note that churn improved due to stronger upmarket momentum offsetting weaker SMB trends. This is important as it tells us that FRSH is finding the in routes to the upmarket - which is a different market than SMB - and if traction continues, it could reduce the cyclicality of the SMB market and also extend FRSH growth runway. As a result of the still-present macro headwinds, management has projected a 2Q23 NRR of 105%, with the figure stabilizing in the second half of the year. With time and a better macro environment that encourages growth, I believe FRSH can definitely get back to the 110-115% NRR range.

Valuation/AI

I believe the successful incorporation of AI into FRSH business may help drive multiples structurally higher than where it has historically traded at. At the current 5x forward revenue multiple, this implies a forward PE multiple of 20x forward PE (assume FRSH can achieve 25% net margin, which is possible given gross margin is 81% and growing). For business that is still growing in the high-teens (much higher than the market), with potential to further accelerate growth and improve margins through the adoption of AI, I think it deserves a higher premium to the S&P (which is trading 18.4x forward earnings today).

The common bear case about AI is that may reduce the demand for new employees among FRSH's underlying customers, thereby reducing the number of seats that can be sold by the company. I think this is the wrong lens to use, though, because FRSH's management has already mentioned the existence of a pricing structure for bots that is based on the number of sessions or interactions. This means that growth is not dependent on the number of hires, but rather on the workload, and it can flex upwards if increased use of AI reduces the volume of seats. It's likely that with the help of AI, businesses will be able to take on more work, which is great news for FRSH. From the customer's point of view, if the total cost of ownership (AI + FRSH solution) is less than the cost of hiring an employee, then the combination will likely be adopted. Therefore, I think that progress in AI is good for FRSH in the long run.

Conclusion

I still think FRSH remains undervalued. The company's focus on user-centric SaaS solutions and its ability to prioritize customer needs and ease of use give it a competitive advantage. Despite concerns about the company's exposure to SMBs and potential impacts from customer layoffs, FRSH's performance in 1Q23 demonstrated its ability to execute well and generate profits. Earnings and revenue exceeded expectations, and the company surpassed its own guidance for EBIT margin. The improved NRR and the growing upmarket momentum are positive indicators of FRSH's expansion. The company's cost optimization initiatives have led to improved EBIT margins, although it is important to ensure that the cuts were not excessive and will not hinder future growth. NRR, though slightly lower than the previous quarter, shows potential for improvement, particularly as FRSH gains traction in the upmarket segment. The use of AI in FRSH's solutions has the potential to increase efficiency and workload capacity, offering long-term benefits. Overall, I maintain a positive outlook on FRSH and remain a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.