CEF Weekly Review: Term CEFs Continue To Be Misunderstood

Summary

- We review CEF market valuation and performance through the third week of May and highlight recent market action.

- CEFs were mostly down on the week as rising Treasury yields were the key headwind.

- Several aspects of term CEFs continue to be misunderstood.

- We discuss distribution changes for Allspring CEFs.

- And highlight recent portfolio updates.

- We're currently running a sale for our private investing group, Systematic Income, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on May 20.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund ("CEF") market activity from both the bottom-up - highlighting individual fund news and events - as well as the top-down - providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of May. Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

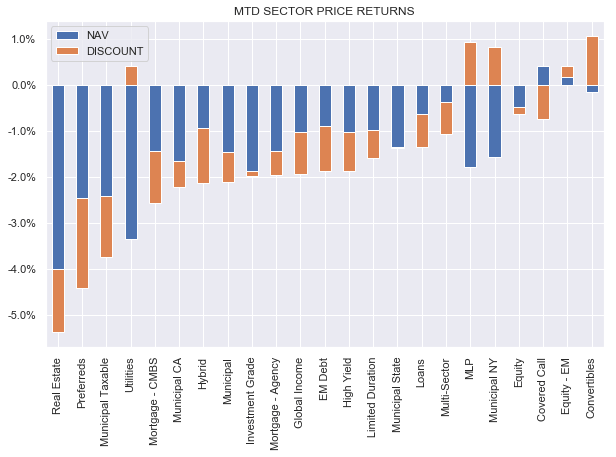

CEFs were roughly flat this week as NAV losses were roughly matched with discount gains. Month-to-date, all but two sectors are in the red. Primary headwinds have been the back up in credit spreads and Treasury yields.

Treasury yields have likely moved higher both due to the unwinding of the worst-case debt ceiling scenario as well as the fact that the Fed is selling $100bn of bonds on the market from the failed banks.

Systematic Income

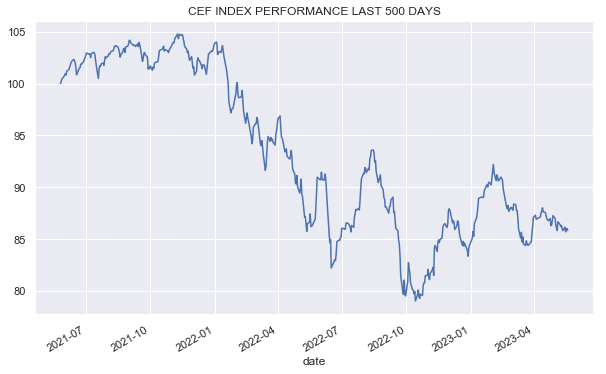

After the initial move lower in 2022, the CEF market has been range trading in a "fat-and-flat" pattern seen below. It's roughly in the middle of this range now.

Systematic Income

Sector discounts remain on the wide side of the recent range and not far off their 2020 wides. CEF valuations are fairly-valued in our view.

Systematic Income

Market Themes

Term CEFs remain a core part of our allocation approach. However, many investors continue to harbor misconceptions about how these funds work.

A common view is that term CEFs have a "maturity". This is wrong on a number of counts. Unlike securities, term CEFs don’t have "maturities". Rather, they have expected termination dates.

As this designation implies these terminations don’t have to take place. We can point to any number of term CEFs that did not, in fact, terminate. All it takes is for the fund manager to ask for a shareholder vote to either extend the term of the fund (as was the case for BSL) or to cancel the termination date and turn the fund into a perpetual one (as was the case with DMO). Bizarrely, fund shareholders are happy to vote against their interests and turn a discounted term CEF into a perpetual one, foregoing alpha. Perhaps loss aversion bias is the key driver here as investors don't like the prospect of losing a fund they have grown familiar with. From a risk/return perspective the termination itself is not the key bit - what matters more for investors is whether they are given an exit at the NAV. This can be achieved with a termination but also can be achieved with a tender offer at NAV. This is what happened with JPT (cousin of Nuveen preferred CEF (JPI) which is also a term CEF). A tender offer at NAV is preferable to a termination because there is no slippage in selling assets (i.e. no drag on the NAV) and the fund continues to exist (i.e. the more funds the better). The other misconception with term CEFs is that they expose investors to some sort of cliff risk. The naive view is that if asset prices are down, a CEF termination is very undesirable because it locks in losses. This is not correct since investors can simply buy another fund holding similar assets.

In fact, investors get a better deal by rotating from a term CEF into a perpetual one in the same asset class because they would very likely be buying the new fund at a wider discount. And so rather than locking in losses they have an opportunity to hold pretty much the same type of assets but at an even better price.

We currently like two Nuveen term CEFs: JHAA and JPI, both of which have near termination dates and offer an attractive level of discount compression. Nuveen has been exemplary in giving investors an exit at the NAV, allowing them to monetize discount compression. JHAA is more appropriate for defensive investors.

We also like the Invesco High Income 2023 Target Term Fund (IHIT) for more tactical investors. IHIT trades close to a 7% discount and offers an asymmetrically attractive proposition of a 7% discount compression or a discount widening closer to 10% in case of a conversion to a perpetual fund.

Target term funds like IHIT are less likely to convert to perpetual funds as they would have to not only fully turn over their portfolio but also change their investment mandate (two things that term CEFs don't have to do). IHIT holds short-dated, primarily investment-grade CMBS assets, with an allocation to office properties of around 20%.

Market Commentary

Allspring CEFs (EOD, ERH, EAD) made another distribution cut. These funds have a managed distribution policy so their distribution changes are very easy to forecast.

For example, EAD has a policy of distributing 8% on its 12-month NAV average and because this average has been slowly falling (primarily due to the drop in early 2022) the distribution has been declining steadily. The rate of change has fallen as the NAV has been range-trading over the past year.

If we get a move higher in bonds, we could see a sustainable reversal in distributions like we did in 2021. This will also likely allow the fund to outperform the sector. EAD has outperformed the HY bond CEF sectors in total NAV terms over the longer term and remains in our High Income Portfolio.

Stance And Takeaways

This week we made a couple of rotations in our Income Portfolios.

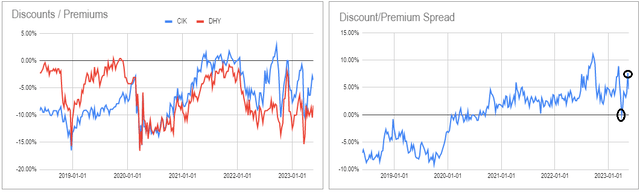

In the Core Income Portfolio, we reduced the primarily investment-grade CEF GDO position. This was due to the recent rally in Treasuries (prior to the back-up in yields over the last few days) as well as the relatively tight discount of the fund. In the High Income Portfolio we are moving back to the High Yield CEF DHY from CIK. We made the switch from DHY to CIK in early April when CIK traded at a 1.5% tighter discount than DHY and has now moved to trade at a 6.3% tighter discount (see annotation in the right-hand chart below).

This is a good pair of sister funds to track as they are broadly similar (except for the management fee differential) but whose valuations can move relative to each other. Investors can significantly increase their effective yields by moving between the two funds when these opportunities present themselves.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPI, JHAA, DHY, IHIT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.