Cheniere Energy Remains A 'Buy' After Strong Earnings

Summary

- Cheniere Energy stock fell despite a strong earnings report and outlook.

- Q1 will be the highest EBITDA quarter of the year, as LNG benefited from pre-selling some open volumes at higher prices last year.

- LNG stock remains a "Buy" as the long-term outlook remains attractive.

CreativeNature_nl

With Cheniere Energy (NYSE:LNG) down following my bullish write-up ahead of earnings, I wanted to take a closer look at its Q1 results.

Q1 Results

For the quarter, Cheniere saw revenue fall -2.4% to $7.3 billion. That easily topped analyst estimates calling for revenue of $5.5 billon.

Liquefied natural gas (LNG) cargoes rose 4% to 167, while exported volumes rose 3% to 603 TBtu. LNG volumes loaded were 3% higher to 602 TBtu. Total volumes recognized were 619 TBtu, as it recognized 56 TBtu of volumes loaded from Q4 and had 39 TBtu in volumes that were in transit.

Consolidated adjusted EBITDA for the quarter came in at $3.6 billion up 14.3% from nearly $3.2 billion a year ago. Distributable cash flow attributable to Cheniere was $2.94 billon, and increase of 17.6% from $2.5 billion a year earlier.

Net income attributable to common shareholders came in at $5.4 billion, or $22.10 a share, compared to a loss of -$865 million, or -$3.41 a share a year ago. The big difference was from the change in fair value of derivatives during the periods.

The company bought back 3.1 million shares in the quarter, spending $450 million.

Despite what was a relatively lackluster market for LNG imports in Europe and China during Q1, Cheniere put up strong results, helped by its long-term take-or-pay contracts. About 84% of its volumes were sold under long-term SPA or IPM agreements, while the company smartly pre-sold Q1 volumes last year when margins were higher.

Outlook

Looking forward, the company guided for full-year consolidated adjusted EBITDA of between $8.2-$8.7 billion. That was up from prior guidance of between $8.0-$8.5 billion.

Cheniere forecast distributable cash flow of between $5.7-$6.2 billion. It previously was looking for DCF of between $5.5-$6.0 billion. Management said the increase was largely due to capturing higher margins both upstream and downstream at its facilities.

Company Presentation

Discussing its increased guidance on its Q1 call, CFO Zach Davis said:

“While we don't provide guidance by quarter, obviously, given the full year guidance, we are forecasting lower EBITDA across the second, third and fourth quarters compared to our first quarter results. The guidance increase is enabled primarily due to selling some of our open CMI cargoes opportunistically at higher margins than previously forecast. The release of a couple of the origination placeholder cargoes to CMI to sell into the spot market, higher than originally forecast gas supply lifting margins and further contributions from optimizing our shipping portfolio. These increased guidance ranges continue to reflect current international gas price curves as well as our increasingly limited open position for the remainder of the year. Given the start of several long-term contracts this year and our planned maintenance at Sabine Pass this summer. Currently, we have approximately 35 TBtu of unsold LNG remaining this year, 15 of which are reserved for long-term origination and we currently forecast that a $1 change in market margin would impact EBITDA by approximately $20 million for the balance of 2023.

“Highlighting how proactive the team has been in securing margin this year to guide 2023 EBITDA into the mid-8 billions. As always, our results could be impacted by the timing of certain year-end cargoes heading into 2024. Our distributable cash flow for 2023 could also be affected by any changes in the tax code under the IRA. However, the guidance provided today is based on the current IRA tax law guidance in which we do not qualify for the minimum corporate tax of 15% this year. However, as noted previously, both of these dynamics would mainly affect timing and not materially impact our cumulative cash flow generation through the mid-2020s as we think about our overall capital allocation deployment. Despite our limited remaining open exposure this year and moderated international gas prices, our 2023 guidance ranges are well above the $5.7 billion high end of our 9-train run rate guidance, and we remain on track to achieve our 2020 vision of generating over $20 billion of available cash by 2026 and over $20 of DCF per share on a run rate basis.”

The company reported that its CCL Stage project is 28.7% complete, with the engineering work nearly 50% completed. The project is expected to be complete sometime between the second half of 2025 and the first half of 2027. The project will add production capacity of over 10 mtpa of LNG. Management said the project is currently ahead of schedule and that it could potentially have volumes flowing in 2025 and be completed by the end of 2026.

It has also filed an application with FERC for its CCL Midscale Trains 8 & 9, which will be adjacent to its CCL Stage 3 project. Meanwhile, its SPL Expansion Project, which is at its Sabine Pass LNG terminal, is in the pre-filing process.

Overall, Cheniere’s outlook was solid, with the company raising full-year guidance and its CCL Stage project currently ahead of schedule. While Q1 will be the largest EBITDA quarter of the year, this is a function of it being able to pre-sell some open volumes at attractive prices. This is just a bonus, and doesn’t reflect anything negative going forward.

Valuation

Cheniere trades at 7.2x the 2023 EBITDA consensus of $8.63 billion. For 2024, its trades at 8.7x the 2024 EBITDA consensus of $7.19 billion.

It trades at about 10.5x DCF of $5.95 billion and has a 2023 DCF yield of about 17.3%.

All estimates are up since I looked at LNG stock last month.

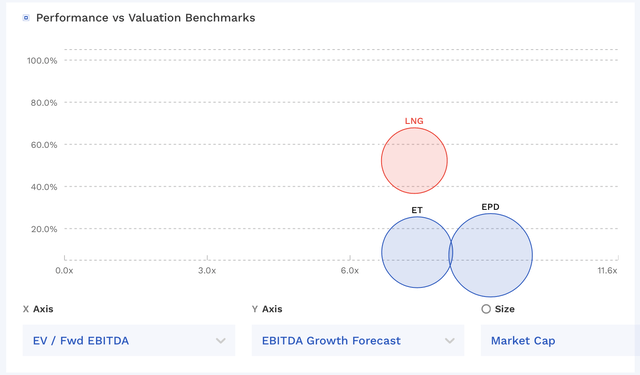

There aren't really any great comparisons for Cheniere, but it looks to trade at a comparable valuation to Energy Transfer (ET) and Enterprise Products Partners (EPD), both of which have export assets. Cheniere should have more long-term growth compared to these two larger, more diversified midstream companies, however.

LNG Valuation Vs Peers (FinBox)

Conclusion

While the LNG market had some volume weakness from Europe and China, the long-term outlook remains attractive. Europe was largely about weather, and China was still in lock-down mode. The longer-term picture from China and the rest of Asia is very strong, as demand is set to continue to nicely grow with China investing a lot in its natural gas infrastructure.

The combination of long-term take-or-pay contracts as well as expansion projects gives Cheniere a nice combination of safety and growth. In addition, the stock is attractively valued with a robust DCF yield and modest EBITDA multiple. With estimates up and the stock price down, Cheniere remains a “Buy.” My price target remains $225.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.