Recession Opportunities: Buying Weyerhaeuser Dividends At A Discount

Summary

- Weyerhaeuser is the largest timber REIT in the US, with strong ties to housing and lumber demand, making it a potential buying opportunity during economic downturns.

- The company offers dividend income, aiming to distribute 75-80% of its funds available for distribution through its base dividend and special dividends.

- With a fair valuation of 16x NTM EBITDA and more expected downside, WY presents an attractive option for investors seeking cyclical exposure and dividend income.

catalby

Introduction

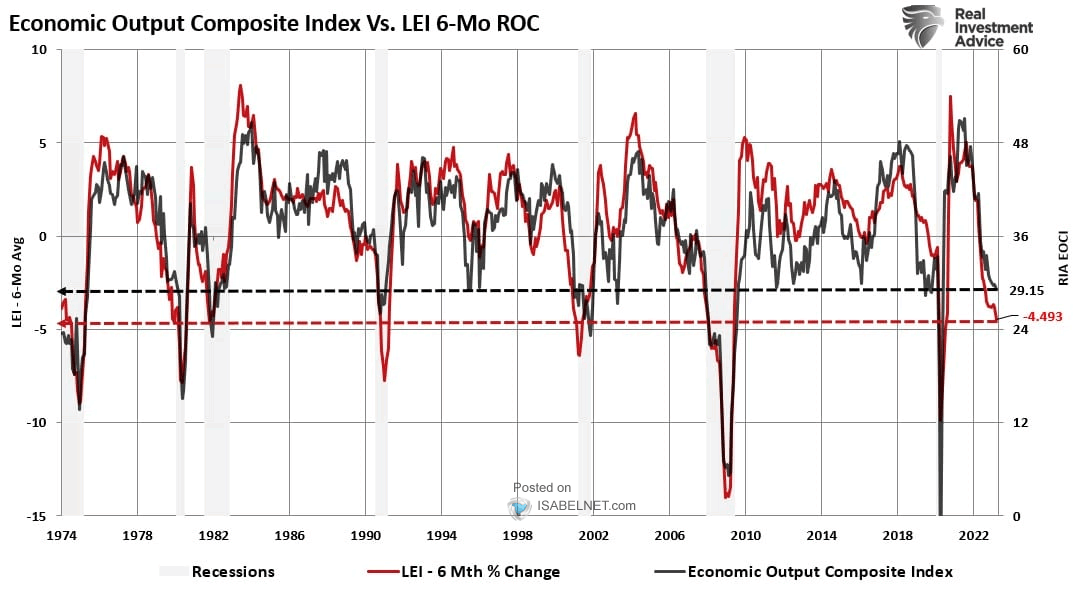

Recessions aren't fun. While the United States isn't officially in a recession yet, Germany already entered a recession, and economic indicators like consumer and manufacturing confidence hint that a recession is just around the corner.

Real Investment Advice

Recessions often come with high unemployment, financial distress, and everything related to that. The good news is that recessions often cause cyclical stocks to fall, which offers new buying opportunities for investors.

In light of high recession risks, I want to shed some light on timber REIT giant Weyerhaeuser (NYSE:WY), which isn't just one of America's largest landowners, but also a fantastic dividend stock for investors looking for cyclical exposure.

The company uses a mix of regular and special dividends to reward its investors while maintaining a strong balance sheet and a fantastic business model. Especially the special dividend part is often overlooked by investors, which is why it took me so long to write an article on this great company.

Thanks to a deteriorating stock price and elevated recession risks, the time is right to put WY on a watchlist.

What's Weyerhaeuser?

According to the company (emphasis added):

We were incorporated as Weyerhaeuser Timber Company in the state of Washington in January 1900, when Frederick Weyerhaeuser and 15 partners bought 900 thousand acres of timberland. Today, we are working to be the world's premier timber, land and forest products company for our shareholders, customers and employees.

Friedrich (Frederick) Weyerhaeuser was born in 1834 in Saulheim, Germany. His family initially fled the country during the Revolutions of 1848.

Once he had settled in the United States, he started to acquire lumber companies - after he tried a number of other jobs.

Fast-forward to 2023 (here's the full history of his fascinating life if you're interested), Weyerhaeuser is the largest timber REIT in the United States.

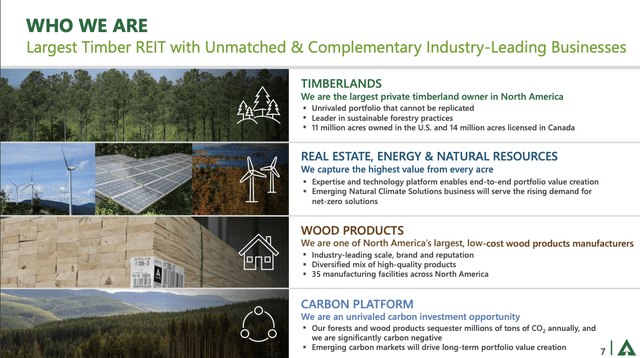

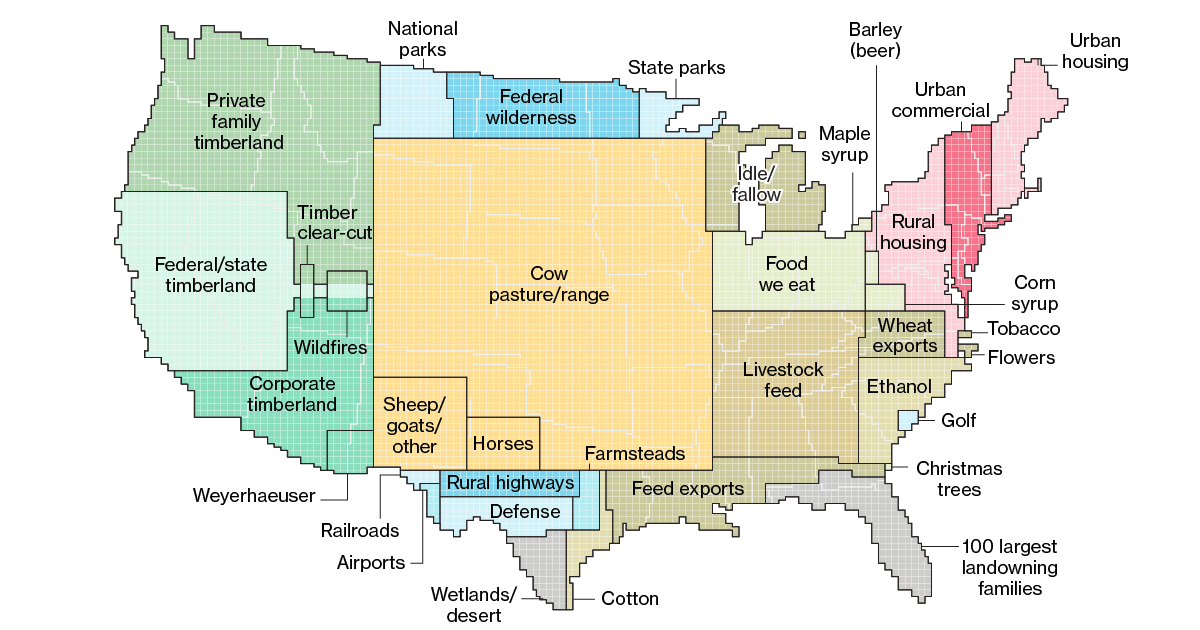

The company is the largest private timberland owner in North America.

Weyerhaeuser owns 11 million acres of land in the United States and has 14 million licensed acres in Canada.

According to Bloomberg, Weyerhaeuser is so large that it controls 2.3% of all commercially available timber. That's enough to cover an area nearly the size of the State of West Virginia.

The map below shows a distribution of land uses in the United States. In the border area between Arizona and New Mexico, we see how large WY's land ownership is.

Bloomberg

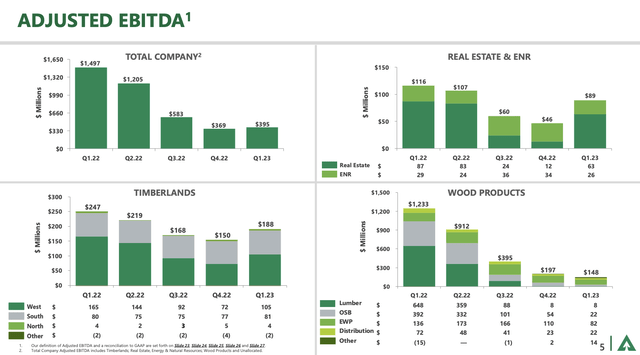

With that in mind, the company operates three business segments (% of 2022 total sales):

- Wood Products (78%): This segment focuses on the manufacturing of high-quality structural lumber, oriented strand board, and engineered wood products. They also offer a range of complementary building products for various applications, including residential, multi-family, industrial, and light commercial projects.

- Timberlands (18%): Maximizing land value and managed acres through effective timber harvesting.

- Real Estate & ENR (Energy and Natural Resources) (4%): Increase the value of timberland by identifying and capitalizing on lands with higher and better uses and realizing the full potential of surface and subsurface assets.

In other words, the company has a wide moat and a very important place in various supply chains like housing and construction. This also makes WY very cyclical.

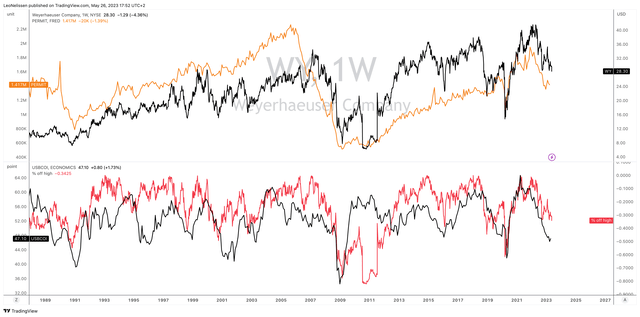

- The upper part of the chart below compares the WY stock price to building permits, which emphasizes the connection between housing and lumber.

- The lower part of the chart compares the distance (in %) WY shares are trading below their all-time high to the leading ISM Manufacturing Index. There aren't a lot of stocks that follow business cycles more closely than Weyerhaeuser.

TradingView (WY, Building Permits, ISM Index)

Currently, WY shares are down 28% from their 52-week high, which brings me to the next part.

Buying WY Shares For Income

More often than not, people buy REITs for income and safety. While WY comes with a wide moat, a net debt ratio of just 1.7x EBITDA, and a BBB credit rating, it's not necessarily safe when it comes to protecting capital, as we just briefly discussed.

While WY isn't a must-own REIT, there are benefits that come with regular sell-offs. For example, investors get to buy a stock that is capable of high shareholder distributions during strong economic years.

Thanks to its business model, the company is able to prioritize shareholder returns over capital expenditures and its capital structure. After all, its balance sheet is already healthy.

The company has one of the most generous capital allocation plans on the market. It aims to distribute between 75% and 80% of its FAD (funds available for distribution) to shareholders. This includes its base dividend and supplemental (special) dividends.

If needed, excess cash is used for growth CapEx or debt reduction.

In 2022, the company had $2.3 billion in adjusted FAD. It spent more than $1.1 billion on dividends. More than half of this consisted of special dividends. $550 million went towards share repurchases.

Using the current stock price, the total 2022 dividend yield was 5.7%.

The special dividend is often underestimated, as it doesn't show up when people look up WY's dividend yield. The company's current quarterly dividend is $0.19. This translates to a 2.7% yield.

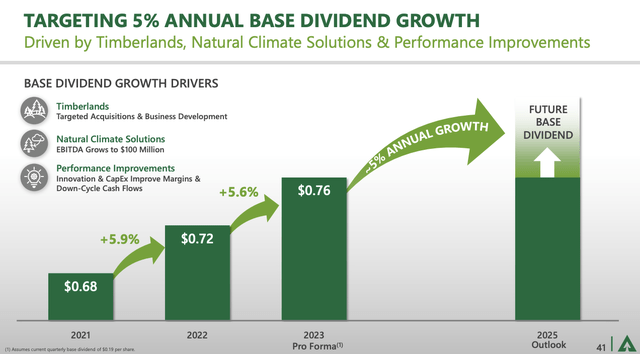

While the special dividend is what makes WY attractive, the base dividend has been hiked consistently in prior years. The company aims to hike the base dividend by 5% per year until 2025.

Unfortunately, current estimates show a steep decline in cash flow per share:

- 2020 (pandemic): $2.04

- 2021 (recovery, lumber shortages): $4.21

- 2022 (housing & economic peak): $3.81

- 2023E: $1.69

- 2024E: $1.90

While this won't interfere with the base dividend, it will make it likely that the current total yield (including the special dividend) comes in below 5%.

However, when economic growth improves, investors quickly benefit from a highly satisfying yield on cost, which is what makes WY a good income tool.

Current Conditions & Valuation

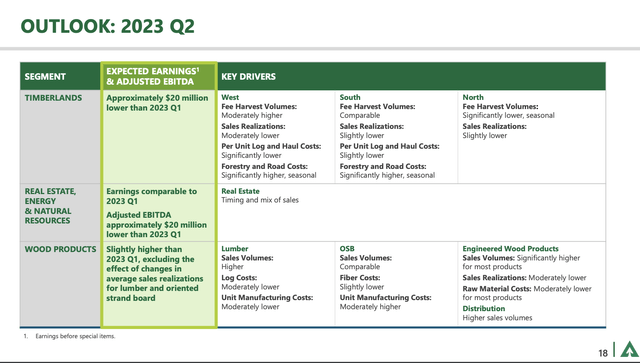

As the company's stock price already suggested, the fun times are over - at least for the time being. While the company expects domestic sales to remain stable throughout the second quarter, the quarterly average is expected to be lower than the first quarter due to falling log prices since the beginning of the year.

The fee harvest volumes are expected to be moderately higher, and per unit log and hauling costs are expected to be significantly lower, partly due to lower fuel prices.

When it comes to export markets, the company sees some weakness as well.

In Japan, the elevated inventories of European lumber imports and reduced consumption continue to weigh on log demand and pricing. The company expects these conditions to persist through the second quarter, resulting in lower Japanese sales volumes and realizations compared to the first quarter.

However, the company anticipates European lumber inventories to normalize as the year progresses, leading to increased demand for their logs in the Japanese market.

Hence, the company is shifting a certain amount of logs to its internal mills to take advantage of domestic market conditions.

In China, construction activity and log consumption are improving, but log imports from New Zealand have increased significantly following the disruption in the first quarter due to cyclone activity. This is expected to put downward pressure on log pricing until excess inventories are cleared.

Consequently, the sales realizations in China are expected to be slightly lower, and sales volumes will be significantly lower as logs are directed to domestic customers for higher-margin opportunities.

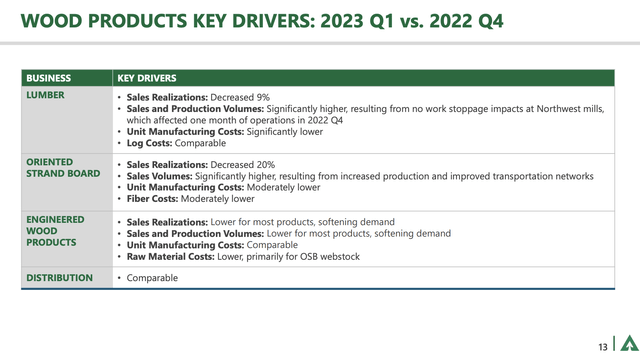

When it comes to lumber products, Weyerhaeuser expects higher production and sales volumes for lumber in the second quarter, along with moderately lower unit manufacturing costs.

Log costs are expected to be slightly lower, primarily for Western and Southern logs.

Sales volumes for OSB are expected to be comparable to the first quarter, with slightly lower production volumes and moderately higher unit manufacturing costs due to planned downtime for maintenance.

For engineered wood products, WY expects significantly higher sales volumes for most products compared to the first quarter, but sales realizations are expected to be moderately lower due to supply and demand rebalancing.

Raw material costs for most products, including OSB Webstock, are expected to be moderately lower. The distribution business is expected to see improved sales volumes, leading to slightly higher adjusted EBITDA compared to the first quarter.

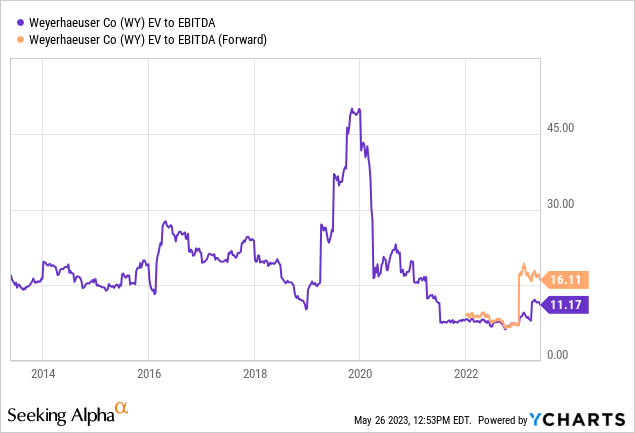

Thanks to these developments, the valuation looks good. WY is trading at 16x NTM EBITDA, which is a very fair valuation.

The problem is that the market expects demand to weaken. While WY currently benefits from strong homebuilding demand because people aren't selling existing homes, this could change if economic growth deterioration hits unemployment - I discussed that in this article.

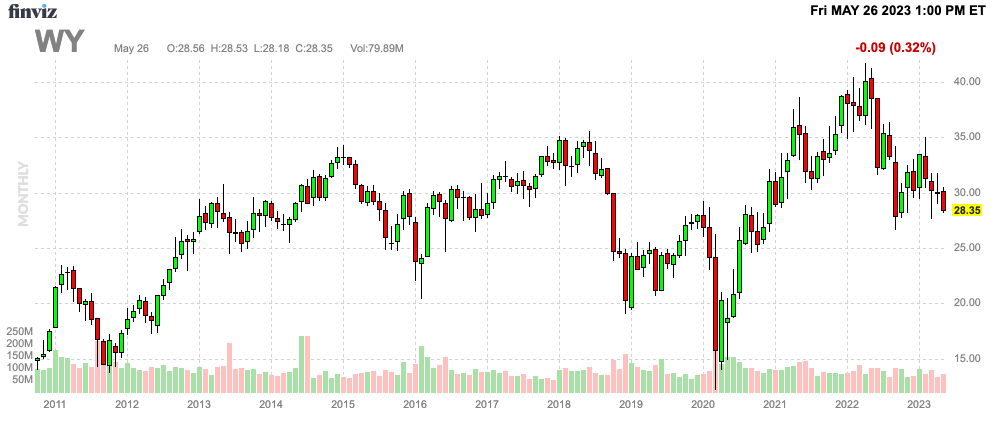

While I'm currently not in the market for more high-yield exposure, I would be a buyer of WY shares below $25. While a recession could provide more downside than that, I believe below $25 is where the risk/reward gets good.

FINVIZ

At that point, I would be a buyer and average down if the stock keeps dropping.

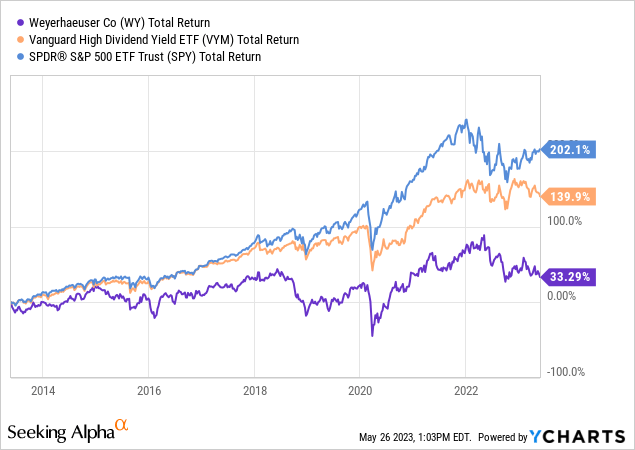

Also, please bear in mind that WY is a stock that needs to be bought on weakness. The risk of missing out on a rally is worth it, as WY shares have a very poor long-term total return. Over the past ten years, WY shares have returned just 33%. Buying WY for income makes sense as long as it's done during downturns. In that regard, WY reminds me of regional banks. While WY comes with different risks, they are both cyclical assets for income-oriented investors that need to be bought on weakness.

With that said, here's my takeaway.

Takeaway

Weyerhaeuser presents an interesting opportunity for investors seeking cyclical exposure and attractive dividends. As one of America's largest landowners and the largest private timberland owner in North America, WY holds a significant position in the timber industry.

However, the company's stock price has declined due to the current economic climate and recession risks.

Despite the risks, WY offers compelling rewards to investors. The company maintains a healthy balance sheet with a net debt ratio of 1.7x EBITDA and a BBB credit rating. WY's capital allocation plan prioritizes shareholder returns, distributing between 75% and 80% of its funds available for distribution to shareholders through regular and special dividends.

The base dividend has been consistently increased, and the company aims to raise it by 5% annually until 2025. Additionally, WY's special dividend, often overlooked, adds further value to its attractive dividend yield.

The current valuation, trading at 16x NTM EBITDA, presents a fair opportunity for investors.

Ideally, buying WY shares below $25, despite potential recession-related risks, offers a favorable risk/reward balance.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.