PPA: Aerospace And Defense Are Out Of Favor, Shares Are Expensive, And With Technical Downside Risk

Summary

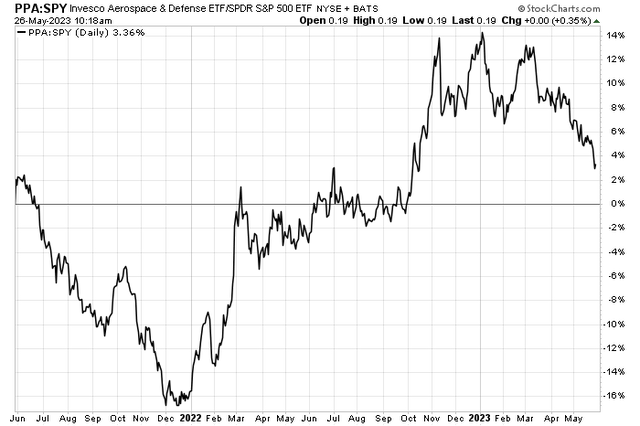

- National security was a major narrative during 2022, but as geopolitical tensions have taken a backseat to economic growth worries, PPA has underperformed.

- I have a sell rating on the fund based on valuation and a better aerospace & defense alternative.

- With the PPA ETF appearing risky technically, avoiding the fund for now looks to be the right play.

Дмитрий Ларичев

Aerospace & defense stocks were a hot theme coming into 2023. The Invesco Aerospace & Defense ETF (NYSEARCA:PPA) flew up to new relative highs against the S&P 500 very early in the year, but the Industrial group has faltered compared to the SPX in recent months. I have a sell recommendation on PPA – it's suboptimal compared to ITA and there are technical risks on this expensive fund.

Aerospace & Defense Stocks Struggle Against the SPX In 2023

Stockcharts.com

According to the issuer, PPA is based on the SPADE Defense Index. The fund will normally invest at least 90% of its total assets in the common stocks that comprise the index. The index is designed to identify a group of companies involved in the development, manufacturing, operations, and support of US defense, homeland security, and aerospace operations. The fund and the index are rebalanced and reconstituted quarterly.

PPA has a moderate 0.58% annual expense ratio and holds 54 total positions. With a trailing 12-month dividend yield of just 0.85%, it is not a big income generator. And with just $1.8 billion in assets under management, it is smaller than its big rival the iShares U.S. Aerospace & Defense ETF (ITA) which has an AUM of $5.8 billion and a lower annual expense ratio. PPA’s average daily volume is near 130,000 shares, much less than ITA, too. Lastly, PPA sports a decent 30-day median bid/ask spread of just six basis points.

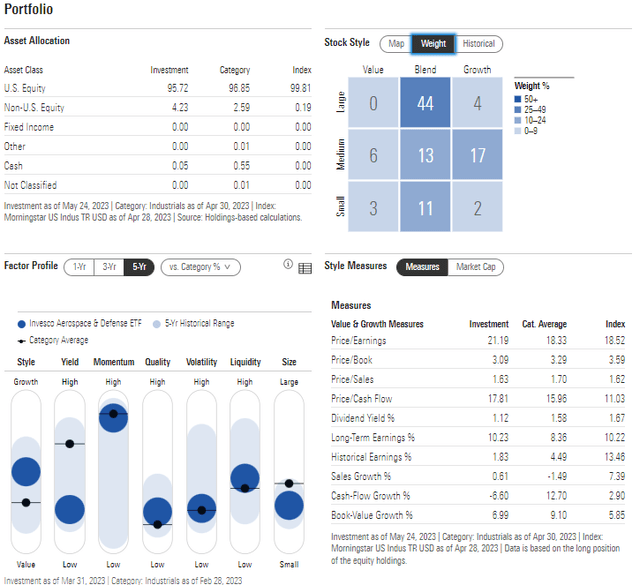

Digging into the portfolio, the fund is mixed across the market cap and value/growth spectrums. 48% of the fund is considered large cap while there’s significant mid and small-cap exposure. Most equities are considered in the “blend” category versus being strictly value or growth. On valuation, Morningstar notes that the portfolio’s average price-to-earnings ratio is slightly higher than the market average at more than 21 while its price-to-book ratio is also a bit lofty. Earnings quality and volatility are low when assessing the factor profile.

PPA: Portfolio & Factor Profiles

Morningstar

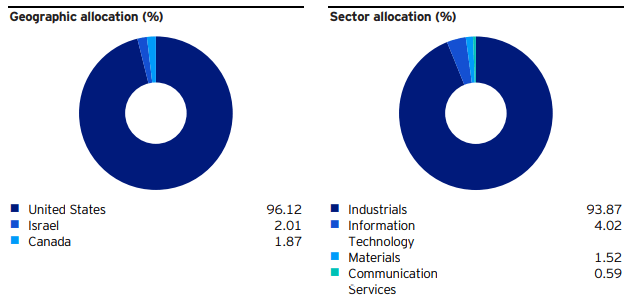

PPA is primarily a US fund while there is a modest amount of Information Technology exposure.

PPA: Geographic and Sector Allocations

Invesco

Seasonally, data from Equity Clock show that aerospace and defense equities tend to struggle in June before performing well in the back half of the year. So, it may be prudent to pick your entry on PPA with prudence in the coming weeks.

PPA Bullish Seasonality During the 2nd Half of the Year

Equity Clock

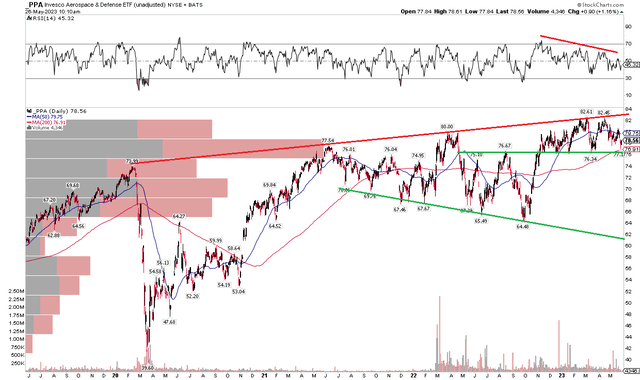

The Technical Take

I never like it when resistance is seen via an uptrend line (compared to horizontal resistance). It is just an ugly look to a chart that doesn’t indicate where supply truly is. Still, the line must be acknowledged, and it suggests long positions should be trimmed near $83. Near-term, I see support at the rising 200-day moving average near $77 which corresponds to the $76 to $78 range where buyers have stepped up to the plate since late last year. Below that, there is another ugly downtrend support line that enters the picture in the low $60s.

With high volume by price in the upper $70s, expect the ETF to continue churning near current levels. But what's bearish here is that the RSI momentum indicator at the top of the chart shows a series of lower highs as the ETF price rose – that bearish negative divergence is not encouraging. Overall, while the fund is near its highs, it is a messy technical situation with a potential small double top just under $83.

PPA: Bearish RSI Divergence As Shares Struggle To Maintain Highs

Stockcharts.com

The Bottom Line

My sell rating is based on a confluence of factors. The high valuation is coupled with a concerning technical situation. Also, PPA is inferior compared to ITA when it comes to tradeability and expenses.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.