Rambus: Rapidly Ramping Up

Summary

- Demand for faster, more efficient, and secure data transfer should ramp up in H2 2023.

- I believe that Rambus Inc. investors would do well to look beyond Q2. Starting Q3, there's likely to be sequential growth.

- I estimate that Rambus Inc. stock is priced at 30x this year's free cash flows. How to think about this multiple?

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

hh5800/iStock via Getty Images

Investment Thesis

Rambus Inc. (NASDAQ:RMBS) specializes in semiconductor innovations and intellectual property licensing. The majority of its revenues come from its interface designs which are reported within its product revenue segment.

Although a substantial proportion of its profitability comes from its licensing operations, Rambus' key strategy is to rapidly grow its product revenues.

My bullish thesis argues that Q2 2023 will mark the low point for Rambus' revenue growth rates. And that the outlook from there, when taken together with recent commentary from the rest of the industry, implies that investors would do well to look beyond Rambus' next quarter's results.

Why Rambus? Why Now?

Rambus Inc. is involved in the development and licensing of semiconductor memory. Rambus operates predominantly through licensing its intellectual property to leading semiconductor companies, such as Micron Technology, Inc. (MU), Marvell Technology, Inc. (MRVL), and others.

Rambus' value proposition is centered around intellectual property licensing and collaborative partnerships. At its core, through its interface designs, Rambus is focused on improving the performance and efficiency of data transfer within electronic devices.

In the near term, Rambus articulates its vision to increase its exposure to data center memory and increased demanding workloads. With this context in mind, we now turn to discuss Rambus' financials and what investors should think about.

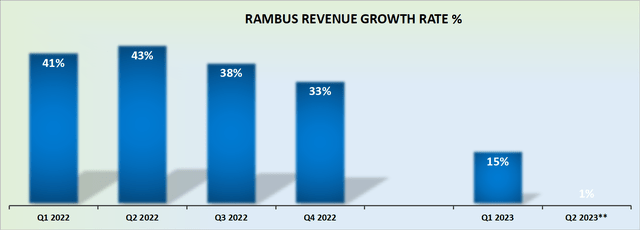

Revenue Growth Rates Will Improve in H2 2023

Above we can see that Q2 2023 (report at the end of July) is expected to post the slowest revenue growth rates of the past several quarters. However, before readers become too quick to dismiss Rambus, allow me to highlight a quote by Rambus' management,

[...] the server memory crossover to DDR5 is projected for the first half of 2024, and we expect our memory interface chip product mix to be lumpy during the transition period. Given our strong leadership position in DDR5 and improving market conditions in the second half, we believe we are well positioned for continued annual growth in 2023. (emphasis added)

What investors will be looking towards is this: Q2 marking the low point of this year, and Rambus revenues ramping up sequentially over the next several quarters, post-Q2.

Profitability Profile Should Improve in H2 2023

Q1 2023 saw Rambus' non-GAAP profit margins for its product segment report at 58.8%, a figure that was down approximately 300 basis points compared with the same period a year ago.

When asked on the Q1 conference call about Rambus' prospects at returning the products segment to around 60% to 65%, this is what management stated (emphasis added):

[...] We do expect to grow in the second half of the year.

And with that, we do expect to see a more favorable product mix from a margin perspective. And we do expect that, our gross margins will improve based upon that. As a company, we've been very disciplined in our ASP management, and will continue to drive our product cost reductions, Mehdi.

And for the full year of 2023, we do expect our product gross margins to be in line with our long-term target of 63% to 65% from there.

Essentially, once Rambus gets into H2 2023, its underlying profitability is set to improve. That being said, Rambus' free cash flow in Q1 2023 was not quite as strong as in the same period a year ago.

On yet the other hand, the business is clearly generating substantial free cash flows. In actuality, I believe it's possible that Rambus' free cash flow in 2023 will cross last year's record free cash flows of $230 million.

The Bottom Line

On the one hand, Rambus Inc. is priced at 30x forward free cash flows. This is not particularly cheap when we consider that its outlook for Q2 2023 points to around 1% y/y growth rates.

On the other hand, if one believes that the semiconductor sector is likely to be scrambling to buy memory interface chips in the second half of 2023, there's a serious likelihood that Q2 will mark the low point for Rambus Inc. revenue growth rates this year.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.