Replace Some SPY With SHY: 2-Year Treasuries Look Better Than The S&P 500

Summary

- Big Nasdaq stocks are the big story lately, but not to me. The S&P 500 is limping along, and I think a much bigger situation is developing in 2023.

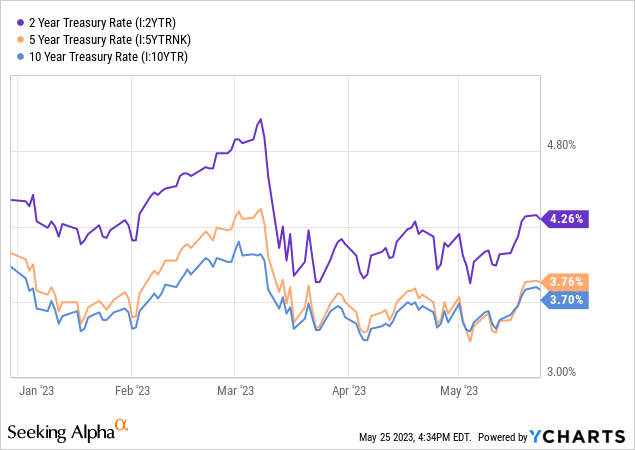

- That situation is the yield on the 2-year U.S. Treasury Note. As it carves out a path toward 5%, it has the potential to disrupt the stock market, big time.

- SHY is one ETF I favor to capitalize on this emerging 2023 story. Meanwhile, the S&P 500 will likely only go as far as the Nasdaq 100 can carry it.

Andrii Lysenko/iStock via Getty Images

The 2-year U.S. Treasury Note: sounds sexy, eh? Okay, not so much. But its appeal is growing by the day, and I encourage investors to take a good hard look at a pair of emerging trends:

1. The 2-year Treasury rate ascending toward a level that as a former long-time investment advisor, I believe will draw a ton of capital from the stock market.

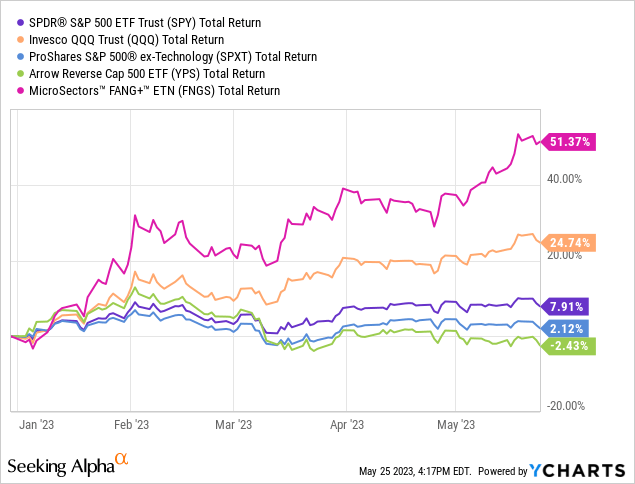

2. I think the S&P 500's "gain" in 2023 is a mirage and hides the fact that a small number of stocks are creating the appearance of a stock market healthier than it actually is. Remove the top-weighted holdings from Invesco QQQ Trust ETF (QQQ) that also populate the top of the S&P 500's holdings, and there's not much in terms of year-to-date performance.

I am far from the first one to write that. Michael Santoli from CNBC seems to talk about it every day, and I'm glad he does. But is the message getting through to retail investors and investment advisors? I guess we'll find out soon.

The sum total of this intertwined pair of trends is getting louder by the day. As 2023 continues, while the debt ceiling debate and the monster gains in a small number of mega-cap stocks continue to grab the headlines, I'm looking ahead… but not very far ahead… to the opportunity to lock in a near-5% rate. I'm not talking about an annualized rate on 1-month T-Bills, where the deal is about 0.45% for 30 days. Instead, this is getting a rate that is about 3 times the yield of S&P 500, and the only "risk" is runaway inflation (which is a loss of purchasing power, not a dollar loss) or if the debt ceiling issue closes the government, prompts a default, and drags on for 2 years. If that were to happen, we'd all have bigger issues than what ETF or stock or bond to buy!

The chart below tells us all we need to know about 2023 and the stock market. The short story goes like this: 10 market darlings are up more than 50% this year (pink line), which has lifted the otherwise neutral Nasdaq (winners and losers offsetting each other) by about 25%. The S&P 500 is up 8% because it is partially allocated to those 10 darlings. But if you take out those stocks, or if you simply reverse the weighting order of the S&P 500's components, you get a flat to down year. So yes, I'd argue it's a market of 10 stocks more than it is a stock market rally. At least, that's the case through the first 5 months of 2023.

That makes for a moribund stock market environment, and an environment for clients of financial advisors asking en masse why they aren't keeping up with the "market." As someone who lived through and invested for advisory clients during the late 1990s through a few years ago, this appears, in my opinion, like a redux of 1999, 2019, and a few other periods in recent memory. It almost always ends badly, but who knows when?

But for those in the phase of their financial life where establishing a base return of 4-5% for a couple of years while all of this inflation, debt ceiling, recession assessment, as well as the possibility that AI will replace a lot of us humans, it sounds pretty good. At least, it does to me. That's why my own portfolio has a higher weighting to T-Bills (not credit bonds, as those still appear treacherous to me) than ever before. That, and I'm about to turn 1 year short of 60. But that is very different from the knee-jerk reaction some retirees and pre-retirees may have, which is to "go all in on T-Bills." I can't remember a time when going all in on anything was a good idea. And even if it did work out, it wasn't worth the risk and involved the process of convincing yourself that you are smarter than you are. I've been there!

Furthermore, predicting how the market will react to how the debt ceiling debate ends is like trying to forecast the exact spot where a hurricane will make landfall. Until it happens, we don't know. And history may be a decent guide, but prone to huge error risk.

For example, in mid-December of 2021, the Federal Reserve expected to raise rates three times during 2022. Then they did… by June 15, 2022. Then, they raised rates four more times in 2022, and another three times this year. And no, they were not talking about 2023 when they said three rate hikes would do it.

So, since rate forecasting is difficult enough even if you have all of the information at your disposal that the Fed does, and even if you are the body that determines when rates are adjusted, how is a mainstream investor supposed to have a beat on where rates are going? The debt ceiling is far from the only issue on investors' minds these days. As actor Kevin Costner said to an umpire during a visit to the pitcher's mound in the movie classic "Bull Durham," we're dealing with a lot of stuff here.

And that brings me back to those much-maligned 2-year Treasuries. Of course, they can be purchased in bond form, but my "beat" is more about finding ETFs for income and steady returns.

Above, here's a chart of the path of the 2-year as well as the 5 and 10-year Treasury yields. I'm a fairly simple fellow, and to me, the 2-year is in the sweet spot of the yield curve right now. It is comfortably above the yield you get for lending your money to Uncle Sam for much longer than 24 months. Yet it has more visibility as to what you will actually earn over the next 2 years than T-Bills can ever deliver. Suffice it to say, I like T-Bills, but I'm starting to love the 2-year US Treasury.

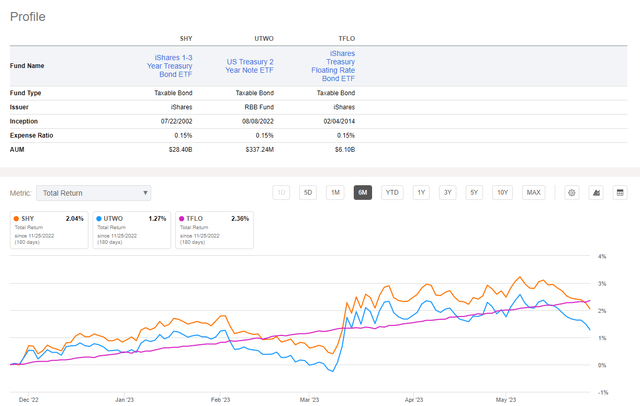

As for how to take advantage of this, UTWO is a straightforward way to always own the current 2-year Treasury Note. SHY and TFLO are other options. The former allocates across 1-3 year Treasuries, and the latter allocates only to Treasury securities whose rates float with market rates. There are merits to all 3 of these ETFs, but it depends on specific circumstances of an investor, which is beyond the scope of what I write in this space.

Here are the 3 ETFs that, to me, create a nice triumvirate to attack the emerging attractiveness of 2-year Treasuries. I'll focus primarily on iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY) here. It is the "granddaddy" of short-term bond ETFs that invest exclusively in US Treasuries, dating back to 2002. That allows us to use its long-term record as a proxy for the 2-year government note. For most of its history, SHY was, shall we say, shy about exhibiting much volatility. But then 2022 came along, and bonds started to act more like stocks when it comes to price fluctuation. It had never had a calendar year loss through 2020. Then it had 2 in a row, 2021 and 2022. And, if short-term rates were to pop higher by more than another 1% or so, a third straight losing year is possible, but I don't consider that likely. I am more interested in looking at SHY as a place to strategically capture that 2-year Treasury rate as it nears a peak.

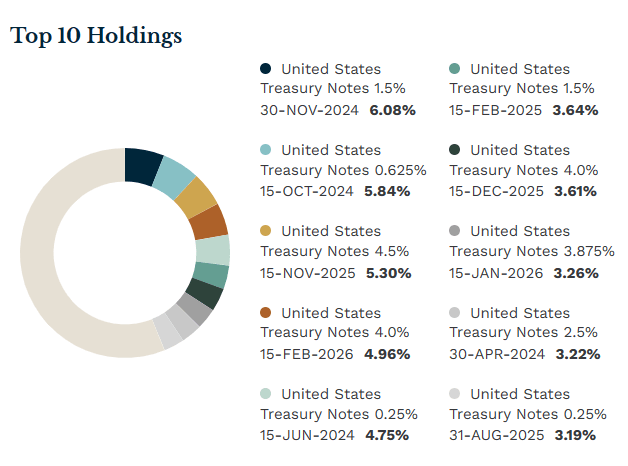

SHY ETF Top 10 Holdings (ETF.com)

The other thing to note about SHY is that many of its holdings still have miniscule yields, left over from bonds issued prior to the rate hike cycle that began last year. Those will soon roll off and out of the SHY portfolio, replaced by higher-coupon bonds. SHY is also quite liquid and matches the other 2 in my mini-peer group (as a reminder, I like them all) when it comes to its 0.15% expense ratio.

The chart above requires some explanation, since it goes a long way toward explaining why I like SHY, but see it as part of a "tactical trio" around the 2-year Treasury's path, now and for the foreseeable future. SHY and US Treasury 2 Year Note ETF (UTWO), which I wrote about last month, own bonds with fixed coupon rates. That approach works best when the 2-year rate is not rising. But currently, it is rising. So I view SHY and UTWO as useful now, but with some temporarily annoying price drag while the yield hits my account every month. You can see that both of those ETFs have been inconsistent in their price returns, thanks to the awkward path short-term rates have taken lately. However, that current headwind will be a nice tailwind once the market starts to level out on the 2-year rate, and eventually, we see that rate drop. That will be an excellent, and dare I say historic, total return opportunity that stock investors may flock to as much they are flocking to T-bills now.

On iShares Treasury Floating Rate Bond ETF (TFLO), which I've also written about this year, note how steady its total return has moved higher. That reflects the fact that its portfolio is built to keep pace with rising rates much more adeptly than the other 2 ETFs can. Translation: the best one of the group while rates are going up. And once they stabilize, perhaps around 5%, and either hang there for a while or start to decline (if a recession takes hold and/or the Fed finds another reason to reverse course on short-term rates), TFLO will see its yield drop while the other will enjoy having their rates more locked in for a bit.

The bottom line is that this trio, led by the "old man" SHY, is the type of thing that used to be a garnish in my income portfolio. Nowadays, it is more like the core! And the 2-year US Treasury yield is my personal benchmark for both the broader attractiveness of this ETF set, and for how I think equity investors will behave. And the closer the 2-year gets to 5%, the more risky the equity market looks by comparison.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TFLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I also own put options on XSP, the S&P mini.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.