CCD: Highest Premium In The Past Decade, Time To Sell

Summary

- Calamos Dynamic Convertible and Income Fund is a closed-end fund focused on convertible securities.

- The fund is up 14% this year, mostly driven by an expansion of its premium to NAV.

- Its premium to net asset value clocks in at 19%, the highest level for this name in the past decade.

- CCD has a high leverage ratio of 40% and a high beta to market moves.

Maica

Thesis

Calamos Dynamic Convertible and Income Fund (NASDAQ:CCD) is a closed-end fund focused on convertible securities. We have covered this name before here, where we analyzed the fund's structure. The vehicle has an extremely high leverage ratio of 40% which gives it a high beta factor. Beta is a measure of the volatility of a security compared to the market as a whole. In an up market high beta stocks will perform better, while in a down market they will lose more money.

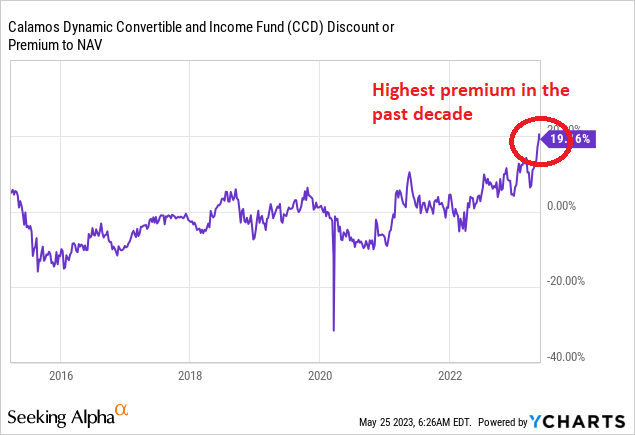

What is uncanny about this fund is the fact that it is currently trading at its highest premium to net asset value in the past decade:

CCD Premium to NAV (Ycharts)

So right now CCD is trading with a 19% premium to NAV, when historically it has averaged a flat premium to NAV. The vehicle has a high beta on the premium side as well, meaning that it tends to balloon when markets are rising, and contract when markets fall. We can see that behavior during the Covid crisis, as well as during some of the market sell-offs in 2022.

Make no mistake, Calamos is a great fund family in this space, and CCD has delivered via its composition and leverage when rates moved to zero in 2020 (it was up 45% that year), but it is not the case now where we would be going to see an accelerated lower Fed Funds rate, despite what some market participants are thinking.

The CEF's NAV this year has been fairly flat (the net asset value is the valuation of the actual assets in the fund), while its positive performance has been mainly driven by market participants bidding up the shares in the secondary market. There is an embedded convexity in converts via their ability to gain exponentially as the underlying securities gain in value (they basically have embedded long call options), and we interpret the recent run-up as market participants betting on lower rates via this high beta vehicle.

We think this is an erroneous vie on the market and on the Fed. We think rates will stay higher for longer, and the Fed will only cut starting in 2024. We are also of the belief that we will see another significant market sell-off this year (i.e. we have not started yet a structural bull market), which in turn will put tremendous pressure on CCD's NAV and market values. Judging by its past performance, there is a 10% to 15% to be shaved-off its premium and another 5% to 10% from its NAV in such a sell-off scenario. That translates into a drawdown from today's levels of roughly -20%. We are therefore at Sell for this CEF at the moment.

Performance

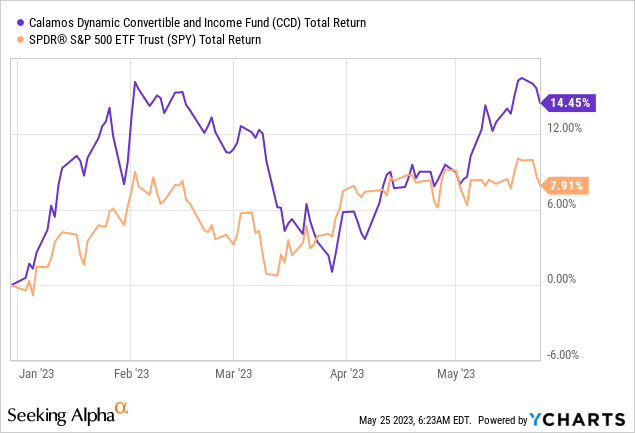

The converts CEF has outperformed the S&P 500 this year, but has been extremely volatile:

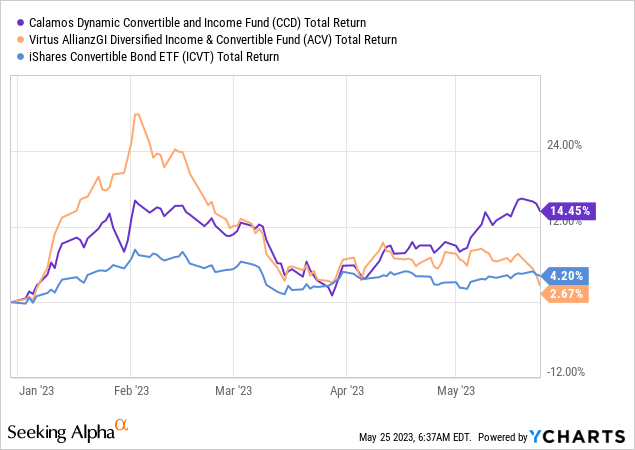

When compared to its peers in the converts space the fund is the outperformer as well, but we have identified that a significant portion of that move comes from a premium widening rather than NAV:

In fact the fund NAV is fairly flat this year:

Distribution Coverage

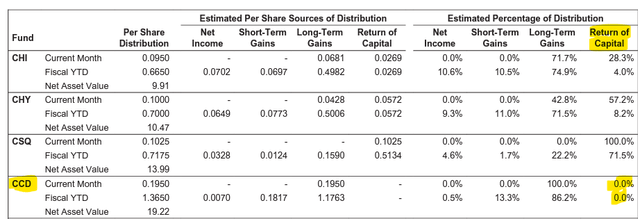

This CEF does a good job in terms of covering its distribution:

Distribution Coverage (Section 19a)

We can see from the above distribution table as of April 2023, that the CEF is not utilizing ROC for its figures. That is an amazing feat in today's tough market.

Conclusion

CCD is a convertibles CEF from the Calamos family. This is a premier fund manager in the space, and it has achieved great results, especially in decreasing rates environments. The fund is up 14% this year, beating its peers in the convertibles space, but the vast majority of the gain comes from an expansion of the premium to NAV rather than fundamental NAV accretion. In fact, the CEF is now trading at its highest premium to NAV recorded in the past decade, premium which clocks in at +19%. The fund has a high leverage ratio of 40% and a high beta, making it susceptible to market sell-offs. We can see that historically the fund trades on average flat to NAV. Not this year. We believe we are not in a new structural bull market, and we are going to have another leg down in equities this year. Such an event will result in the premium to NAV contracting, as well as the value of the underlying assets decreasing. We see a -20% downside for CCD from today's levels, hence we are a Sell here for this CEF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.