Triple Flag: A Solid Q1 Despite Slow Start From Core-4 Assets

Summary

- Triple Flag released its Q1 results earlier this month, reporting record revenue, cash flow, and gold-equivalent ounce sales.

- This record performance was despite a slow start to 2023 from its core four assets, with the acquisition of MMX picking up the slack, plus higher deliveries from ATO.

- And while 2022 was a slower year due to lower silver prices and lower production at Fosterville, Triple Flag should see meaningful growth in GEO sales in 2023/2024.

- So, with a diversified portfolio of high-quality royalty/streaming assets, considerable exposure to silver relative to peers, and a team that consistently delivers on promises, I would expect further weakness in TFPM to provide a buying opportunity.

tracielouise

The Q1 Earnings Season for the Gold Miners Index (GDX) is finally over and one of the first companies to report its results was Triple Flag Precious Metals (NYSE:TFPM). While we saw mediocre results on balance from the producers because of a combination of higher fuel and consumables prices offset by flat to lower production which affected unit costs, Triple Flag had a solid start to the year. Record revenue, cash flow, and gold-equivalent ounce sales evidenced this, with Triple Flag on track to generate ~$150 million in operating cash flow this year if metals prices can continue to hang out near 52-week highs. Let's dig into the Q1 results and any recent developments below.

Camino Rojo Operations (Orla Mining Website, Triple Flag Royalty)

Q1 Production & Sales

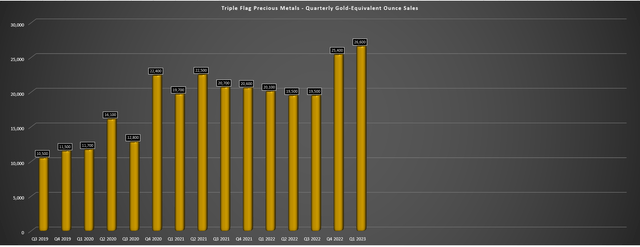

Triple Flag released its Q1 results earlier this month, reporting quarterly sales of ~26,600 gold-equivalent ounces [GEOs], a 32% increase from the year-ago period. The material increase was despite a slow start to the year from three of its primary assets (Northparkes, Fosterville, RBPlat), with the former affected by a delayed shipment that will be recognized in Q2. Fortunately, this was offset by much higher deliveries from ATO (~3,200 GEOs), a better quarter from Cerro Lindo, and new contributions from Beta Hunt (~1,000 GEOs), Moss (~1,600 GEOs), and several other smaller assets that helped to pick up the slack. Notably, this did not represent a full quarter of contributions from assets added in the Maverix deal, with the transaction closing on January 19th, resulting in the results reflecting only ~78% of a regular quarter.

Triple Flag - Quarterly GEO Sales (Company Filings, Author's Chart)

Despite the delayed shipment from Northparkes and considerably lower grades at the Fosterville Mine in Victoria, Triple Flag's production hit a new all-time high of ~26,600 GEOs, beating out its previous record achieved in Q4 2022 by nearly 5%. As noted above, contributions from newer assets helped to deliver this result, with the ATO Mine having a strong Q4 and Q1, with an average of ~7,000 ounces of gold produced, benefiting from higher tonnes stacked (trailing two-quarter average of ~228,300 tonnes stacked). Meanwhile, Beta Hunt also put together a phenomenal quarter, with ~26,600 ounces produced on the back of higher grades and higher tonnes milled. And with its second decline and its first of three vent raises completed on schedule (a key deliverable for its growth plan), this is an asset that should continue setting new records in the coming year.

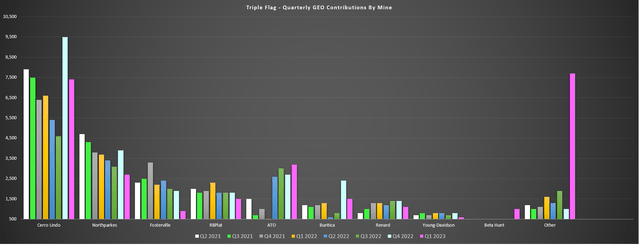

Triple Flag - Quarterly GEO Contributions by Mine (Company Filings, Author's Chart)

Looking at the portfolio in more detail, it's quite clear that Fosterville was one asset that took a toll on the Q1 results, with the combination of lower throughput and lower grades. During the quarter, Fosterville produced just ~86,600 ounces, comparing unfavorably to the ~127,000 ounces produced in Q1 2022. And while the operator has maintained its guidance of 305,000 ounces at the mid-point, this trend of declining quarterly contributions should continue as we see some normalization in grades after multiple years of record production from the ultra high-grade Swan Zone. Plus, as discussed in previous updates, lower production is being exacerbated by lower throughput, with the Victorian EPA placing operating constraints on the mine to minimize low frequency noise, with primary surface fans unable to operate from midnight to 6 AM.

Northparkes Operations (Northparkes Website)

Moving over to Northparkes, the lower contribution in Q1 wasn't surprising, with Triple Flag noting that output would be back-end weighted in 2023, with a deferral of ore from the much higher grade E31 North open-pit that should start up in late 2023. When combined with a shipment that was executed but not settled by the end of Q1, the quarterly contribution was the weakest in two years at just ~2,700 GEOs (Q1 2022: ~3,700 GEOs). Finally, RBPlat also had a slow start with just ~1,500 GEOs and Cerro Lindo also had a tough quarter with inclement weather, which resulted in overflowing rivers because of Cyclone Yaku in Peru. Fortunately, production has resumed after a brief shutdown by Nexa Resources (NEXA) but this will affect upcoming deliveries.

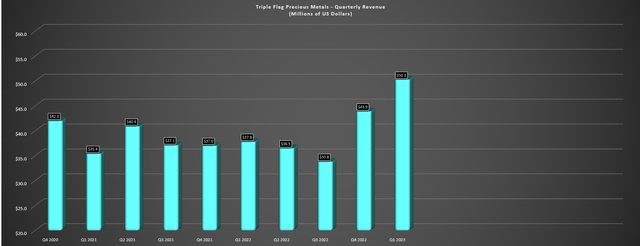

Triple Flag - Record Quarterly Revenue (Company Filings, Author's Chart)

To summarize, it was a tough Q1 for Triple Flag's top contributors, but the Maverix portfolio saw the opposite and balanced this weakness, and just as importantly, several of Maverix's contributions came from Tier-1 jurisdictions, translating to higher production with a more favorable jurisdictional profile (Western Australia, Queensland, Zacatecas, Arizona, Nevada, Nova Scotia, Northern Chile). And as shown above, Triple Flag reported record revenue of $50.3 million (+33% year-over-year), record cash flow of $38.9 million ($0.20 per share), and 42% of revenue from silver, well above its peer group and only behind that of Wheaton Precious Metals (WPM).

Recent Developments

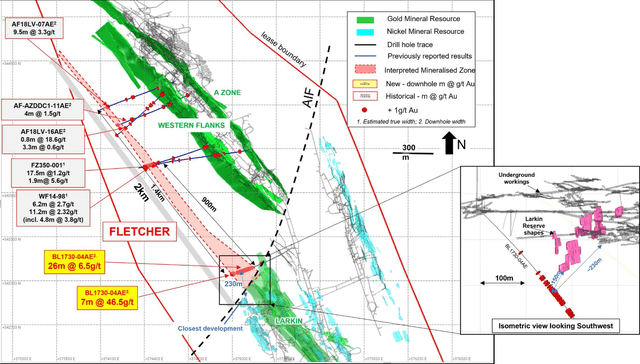

As for recent developments, which are arguably far more important than any quarterly performance as they dictate the future for a royalty/streaming company's assets, it was another solid quarter with highlights across the portfolio. Starting with Beta Hunt, the strike length of the Fletcher Shear Zone [FSZ] which is parallel to the Western Flanks Zone has been extended to ~1.4 kilometers, with an impressive 7 meters at 46.5 grams per tonne of gold intersected on the southern end of the FSZ. Not only are these grades and thicknesses among some of the best we've seen at Beta Hunt to date, which has the potential to translate to higher feed grades in the future, but the results reinforce the view that FSZ is a Western Flanks analogue, and as noted, Western Flanks is the largest and most prolific shear zone at Beta Hunt.

Triple Flag holds a 3.25% GRR at Beta Hunt, and 1.5% NSR on all gold production and nickel production.

Beta Hunt Fletcher Shear Zone (Karora Website)

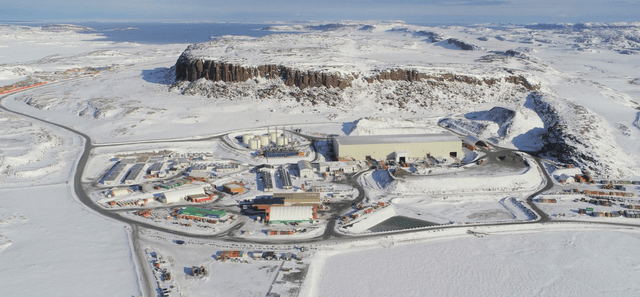

Moving over to Hope Bay (Nunavut) which is not yet in production after being placed in care and maintenance last year, drill results could be quite encouraging, with 6.4 meters at 15.0 grams per tonne of gold intersected at Doris which has expanded the vertical size of the BCO fold hinge, while the BCO Zone was also extended south along strike and down plunge with 4.8 meters at 17.1 grams per tonne of gold. For those unfamiliar, Agnico Eagle (AEM) continues to be confident that this is a 350,000-ounce per annum plus asset, and is drilling aggressively at Hope Bay with this non-operating asset making up a substantial portion of its 2023 exploration budget ($30.6 million of ~$328.4 million total budget for exploration/project expenses).

Hope Bay Project (Company Presentation)

Regarding resource growth from the aggressive 2022 exploration program at Hope Bay, Hope Bay saw 272,000 ounces of inferred resources added to its mineral inventory, with inferred ounces increasing to ~1.95 million ounces at an average grade of 5.49 grams per tonne of gold. Meanwhile, M&I ounces increased to ~1.13 million ounces at 3.58 grams per tonne of gold, up from ~967,000 ounces at 3.43 grams per tonne of gold in the year-ago period. Assuming a 2026 restart and a ~250,000-ounce production profile in the ramp-up phase, Hope Bay would contribute ~2,500 ounces, with the potential for 3,500 to 4,000 ounces of gold per annum ($6.6 million to $7.6 million in annual revenue) if Agnico is able to achieve its goal of 350,000 to 400,000 ounces for this asset.

Finally, at Pumpkin Hollow in Nevada, Nevada Copper (OTCPK:NEVDF) recently completed a bought deal offering of $35 million which is part of an up to $115 million financing package to restart the underground mine with a goal of ending the year at ~5,000 tons per day (nameplate capacity). This has been a disappointing asset to date with limited contribution to Triple Flag, but with up to $45 million in additional funding to support the ramp-up of the underground mine and the exercise of Pala warrants which reduces debt $82 million, Triple Flag investors can be encouraged by the prospect of a successful turnaround here. Just recently, Nevada Copper awarded Small Mine Development LLC a ~20,000-meter underground lateral development contract, and progress continues to be made with vent shaft construction complete, Ore Pass 2 rehabilitation complete, and the installation of the monorail complete for the underground dewatering system.

Pumpkin Hollow Progress (Nevada Copper Presentation)

Valuation

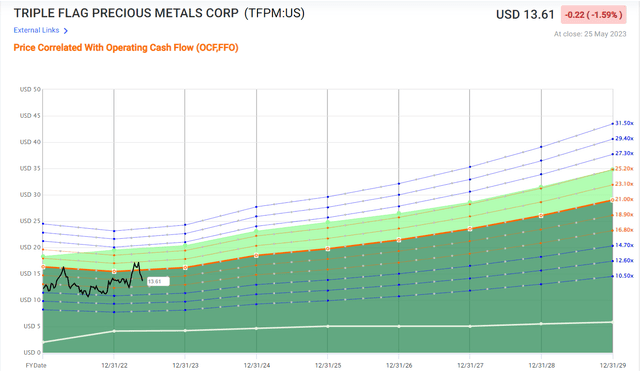

Based on ~208 million fully diluted shares and a share price of US$13.60, Triple Flag trades at a market cap of ~$2.85 billion and an enterprise value of ~$2.92 billion. This valuation remains at the upper end of Triple Flag's peer group, with its two peers in the ~100,000-ounce GEO per annum range trading at an enterprise value of ~$2.3 billion. Given the quality of Triple Flag's portfolio (with added depth from the MMX acquisition), its scale, and its solid execution to date, a premium is justified relative to other royalty/streaming peers that have made some missteps over the past 12 months. So, using what I believe to be a fair multiple of 21.0x forward cash flow to reflect its position as a diversified royalty/streamer with ~60% of net asset value tied to Tier-1 ranked jurisdictions, I see a fair value for the stock of US$18.50.

Triple Flag - Current Multiple & Forward Projections At Different Cash Flow Multiples (FASTGraphs.com)

While this represents a significant upside from current levels and investors are also collecting a ~1.50% dividend yield ($0.20 per share annualized), I prefer a minimum 33% discount to fair value to justify starting new positions in mid-cap royalty/streaming names to ensure a margin of safety is present. So, while the fair value estimate (18-month price target using FY2024 estimates) suggests that the stock could justify trading at new all-time highs, I don't see enough margin of safety yet to justify going long the stock just yet. That said, if we were to see further weakness, I would expect this to provide a low-risk buying opportunity. Plus, as the company's scale grows, I would expect it to command a higher multiple, suggesting material long-term upside for patient investors.

Summary

Triple Flag has done a solid job of delivering on its promises since going public and while a bold move, the Maverix Metals deal was a brilliant play to deploy capital with modest share dilution to more than double the size of its portfolio and add multiple high-quality development-stage assets plus a few solid producing assets. And while a weaker silver price in 2022 made it more difficult to grow revenue and cash flow per share, 2023 is off to a solid start despite only a partial quarter from Maverix contributions, and we should see meaningful growth in annual revenue and cash flow per share with the benefit of stronger metals prices and multiple new contributors in the portfolio. So, for investors looking for a low-risk and high-reward way to get leverage to precious metals prices, I would expect further weakness in TFPM to provide a buying opportunity.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.