Debunking Common Myths From REIT Bulls

Summary

- Equity REITs are widely preferred by retail investors mainly due to attractive dividend yields and simple business models.

- The underlying simplicity creates favorable dynamics for REIT analysts to also apply superficial analysis and many heuristics to support their bull thesis.

- The recent drawdowns in REIT space have lead to even more bullishness in the REIT analysis despite deteriorating prospects.

- In my opinion, some of the bullish argumentation is unjustified, and both current and prospective REIT investors should factor in more diversified assumptions into their valuations.

- In the article below, I list 3 common misconceptions that are currently dominant in the REIT bull front.

SinArtCreative

Equity real estate investment trusts, or REITs, are favored by retail investors and the general Seeking Alpha audience. The key features making equity REITs so attractive are high dividend yields, stable and predictable cash flows, and straightforward business models.

REITs provide great return characteristics (factor exposures) for dividend seeking investors and investors, who seek safer asset classes than equities, but with greater long-term return potential than fixed income. Namely, REITs offer an exposure to high current income in combination with a potential for capital appreciation and income growth.

In the past year, the broader equity REIT market has suffered a lot. The price decline has made dividend yields more attractive and multiples more appealing. This, in turn, provides substantial support for REIT bulls to make further "buy" recommendations referring to historically high dividend yields and great opportunity for entry.

Considering that there is a great demand for optimistic analysis on REITs and looking at the content of typical "REIT bull thesis," I think there is a significant merit to introducing more diversity into overall REIT analysis.

The objective function of this article is to highlight some of the most common misconceptions (according to my views) in the REIT analysis, and prove with facts and examples that certain bull arguments lack solid basis.

I want to underscore that I am a long-term REIT bull, and that several, carefully chosen REITs constitute a notable share of my overall investment portfolio.

Myth #1 - REITs are cheap

Since the FED switched gears from dovish to hawkish monetary policy in 2022, the REITs have suffered significant price declines. At the same time, most REITs have managed to maintain stable funds from operations ("FFO") generation or even increased it. As a result, valuation multiples have dropped making the entire bull thesis more appealing relative to where the REITs were just a couple of years ago.

In my opinion, such assumption is fundamentally wrong. And here are the facts.

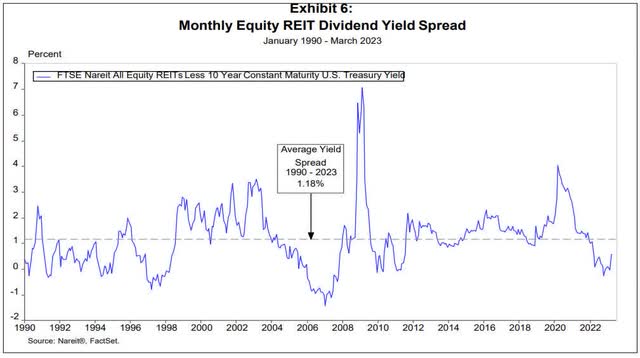

In this chart we can see that currently REITs are yielding way below U.S. 10 YR Treasuries and even below their historical (relative) levels. In most instances, when REITs traded at negative spreads to Treasuries, significant price corrections followed. Granted, there are two potential drivers of the correction - changing bond yields or changing REIT yields. However, no one of us is currently in the position to claim with full certainty as to which variable will be the key driver in this case.

Furthermore, if we consider shorter duration fixed income instruments (e.g., T-bills), the prevailing REIT yields become even less attractive.

Now, many REIT analysts are pinpointing to current multiples being significantly below historical averages. The main problem with this argumentation is that the notion of higher interest rates and its inherent effects on the valuations is neglected.

To make a bit more objective comparison, I have taken a look at REIT multiples back in 2006, when the REITs were booming and FED funds rate stood at ~5%. I know, currently REITs are not in vogue, hence the 2006 multiples should be higher.

Unfortunately, not.

The current P/FFO multiples are slightly higher for many REIT sectors. For example: (December, 2006 vs now)

- Industrials - 17.7x vs 19.9x

- Manufactured homes - 15.5x vs 19.8x

- Diversified - 15.5x vs 23.5x

- Specialty - 12.7x vs 19.0x.

Obviously, there are some exceptions pertaining to retail, office and healthcare, which are totally reasonable given the secular shifts in the underlying business models.

Myth #2 - Cash flows are stronger than ever

Many REIT analysts highlight the continuously strong cash flow generation by REITs and stable near-term consensus FFO estimates. This is only partially true.

The key elements explaining some favorable momentum in the FFO are rent escalators, favorable lease spreads, and previously initiated investment projects coming online. All these forces are oftentimes sufficient to offset the cost inflation in OpEx and support growth in the FFO.

There are several dynamics taking place, which will inevitably render negative impact on the future FFO. I will mention the most important one (with most severe impact) that tends to be neglected by bulls.

Refinancing and incremental cost of financing stemming from debt rollovers.

There are quite many REITs, which currently enjoy very favorable terms on their debt financing instruments. This stems from either well-timed hedging instruments or fixed interest rate loans/bonds. Some REITs have also spread out debt maturities far in the future. All this helps protect FFO from surging interest costs.

However, it is very important to recognize that sooner or later these REITs will face the reality and become subject to higher interest costs that are in line with market levels. As a result, FFO will suffer causing multiples to go up (if prices remain stable) and payout ratios to tighten.

Here are two great and rather popular examples on how some REITs still enjoy very attractive financing terms.

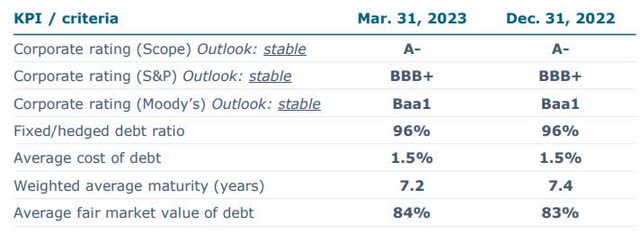

As of Q1, 2023, Vonovia SE (OTCPK:VONOY, OTCPK:VNNVF) had average cost of financing at only 1.5%. Strong hedges in combination with fixed rate debt instruments explained this. However, looking at the prevailing market cost of financing levels for VONOY, the interest rates stand at 5-5.5% territory (judging from VONOY's bond YTMs).

Vonovia ALEXANDRIA REAL ESTATE EQUITIES, INC.

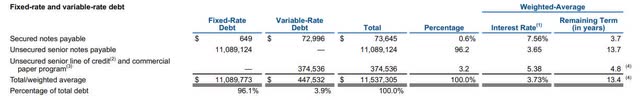

Alexandria Real Estate Equities, Inc. (NYSE:ARE) is another example, which enjoys favorable financing terms, well below the market levels. In the context of recent debt financing and the corresponding interest rates being closer to 6%, it is clear that ARE will gradually face more challenges on the FFO front.

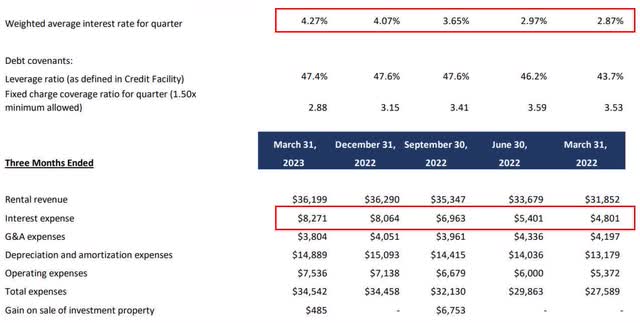

In my opinion, the Global Medical REIT Inc. (GMRE) example depicts the impact of converging cost of debt levels pretty well.

From this table above, we can see how dramatic the effect is on the total interest expense from relatively slight uptick in the average cost of debt. And GMRE is in general considered low levered REIT with net debt to EBITDA of ~6.5x.

Myth #3 - Balance sheets provide a significant margin of safety

This is another common misconception by the bulls that many REITs carry fortress balance sheets, which, in turn should provide protection from recessionary or refinancing risks.

I would argue that currently the state of play in the overall REIT capital structures is bad. This is only logical in the context of almost a decade of ultra-low interest rate environment that has incentivized companies to assume loads of cheap debt to magnify the returns from low yielding / high priced assets.

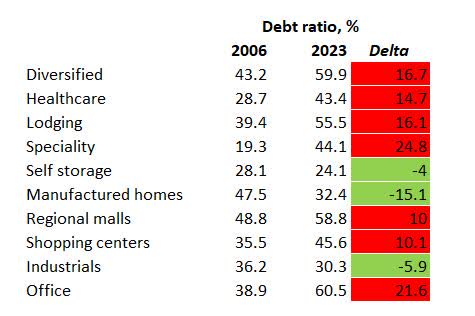

Let me quickly revert back to 2006 data and compare REIT sector-wide debt ratios. Again, the picture is not that positive.

Nareit

Against the backdrop of tightened lending standards and more conservative lending policies (especially among regional banks) towards commercial real estate sector, the indebted balance sheets can impair the REIT prospects even further.

In closing

Investors that are currently invested in REITs or contemplate to do so, should view REIT prospects through the lens of high conservatism as many return-driving factors are structurally against favorable return potential.

In my opinion, REITs in general are not cheap right now and the probability is high to experience further drawdowns. This is not the time to systematically buy REITs and follow an overly optimistic crowd of REIT bull. This is the moment to exercise caution and carefully cherry pick REITs that are already strongly punished, but possess the right characteristics to weather 'higher-for-longer' conditions. And there are not many of these.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GMRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.