Victoria's Secret Is Too Cheap To Pass Up

Summary

- The business has had a bad financial year, and I don't like the $245 million buyback when debt ballooned by $289 million.

- That written, I think the market is being excessively pessimistic here. The obligations schedule lightens pretty dramatically next year.

- We're told to buy when others are fearful. The market is very fearful at the moment in my view, so I'm adding to my position here.

NeonShot/iStock via Getty Images

Shares of Victoria’s Secret and Co. (NYSE:VSCO) have lost about 25% of their value since I added to my position last July. That’s obviously painful, but if the company is going to thrive in the future, the current drop in price may present an opportunity. The company’s about to report earnings again, so I thought I’d review the name before then to see if it makes sense to buy more, hold, or take my lumps and move on. That was the approach I recently took with The Gap Inc, and I’m glad I did. So I’m going to review the latest Victoria’s Secret financials, focusing on solvency, to see whether I think this is a sustainable business. I’m also going to assess the buyback activity, given that the company has spent $245 million of owner capital on the same. I’m going to compare the various risks here to the valuation to see if it makes sense to buy or not. At the end of this, I’ll be able to answer whether I consider this to be a “buy, hold, or sell.”

I’m absolutely obsessed with making the lives of my readers as pleasant as possible. Trying to make your lives enjoyable is the first thought that I have in the morning, and the last thought I have before fading off every night. One of the innovations I’ve come up with is the “thesis statement” paragraph that I put near the beginning of each of my articles. This allows you to get into the article, get the gist of what I’m saying and then get out before you are exposed to too much “Doyle mojo.” You’re welcome. I’m of the view that the next financial year will be challenging for the firm, but things will improve pretty dramatically in 2024 and beyond. Given that, I think the fact that the company spent $245 million on buybacks last year was a mistake. It would have been much better had debt not increased by 29% in my view. In spite of this, the shares are even more cheaply priced, and I think the market is being too pessimistic here. For that reason, I’m going to add to my stake. This ends the thesis statement. If you read on from here, that’s on you.

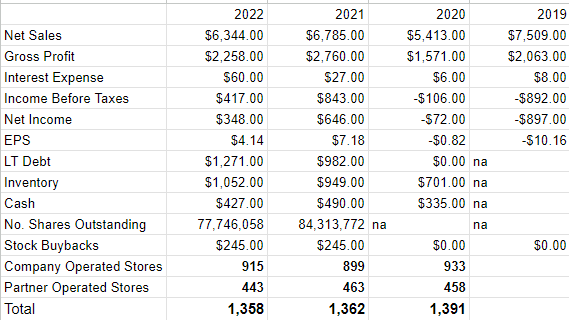

Financial Snapshot

The financial year 2022 wasn’t great for Victoria’s Secret. Revenue and net income were down by about 6.5%, and 18.2% respectively. Most of the drop of the bottom line came as a result of a slowdown in sales. For example there was a $502 million, or 18.2% drop in gross profit. Of particular note, in my view, was the spike in interest payments, up from $27 million last year to $60 million during the most recent year. That represents a 122% jump in interest expenses. As you may have heard, interest rates are relatively elevated at the moment, and so this is very much on my radar. The fact that long term debt crept up by over 29% over the past year makes this a particularly urgent exercise in my view.

Assessing Solvency

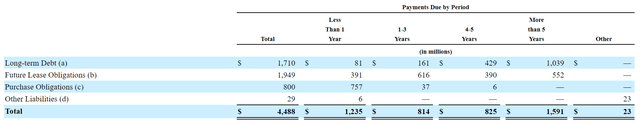

I’m as much of a fan of accrual accounting as the next finance nerd, but when it comes to working out whether a company has sufficient resources to pay its bills, it’s all about cash. For that reason, in the following analysis, I’ll compare the likely sources and uses of cash, to see how much coverage there is. Let’s start with the obligations. I’ve plucked the following schedule of contractual obligations from page 48 of the latest 10-K for your viewing pleasure:

Victoria's Secret Financial Obligations (Victoria's Secret 2022 10-K)

We see from this that over the next year, the company is “on the hook” as the young people say, for $1.235 billion. Over the next two years that figure drops to about $407 million annually, and $412.5 million in the years after that. The obvious question is: how likely is it that the company will be able to cover these obligations?

I note that the company has about $427 million of cash at the moment. Additionally, they generated an average of $654 million in cash from operations in each of the past three years, and invested about $282 million in the business. Given the above, I’m of the view that it’s almost certain that the company will need to borrow more money this year, and will be in a much better position to start paying down debt in 2024 and beyond. In light of this, I feel a sudden urge to write about the $245 million of owner capital that management spent on buybacks.

The Buyback

Given the current state of the capital structure, I’d like to spend some time writing about the company’s decision to spend about $245 million of shareholder capital on stock buybacks. When I assess these things, I try to be as balanced as possible. I won’t characterise a buyback as successful simply because the company happened to manage to buy the stock at a price below the current market price, and I won’t consider the enterprise to be a flop simply because the company paid over the current stock price for retired shares. I judge whether a buyback was a success or not based on the valuation at which the shares were retired. Additionally, I want to consider whether or not it made sense to buy the shares back in light of what else the company could have done with the capital. With that out of the way, let’s get into the details.

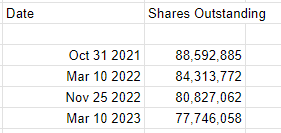

It’s a sad fact about GAAP accounting that the following analysis will be approximate only. This is because the company’s fiscal year ended on January 28 of this year, whereas we only have share count figures according to the following table, prepared by me for your enjoyment and edification.

Victoria's Secret Share Count (Victoria's Secret SEC filings)

So we know that between the end of January 2022 and the end of January 2023, the company spent $450 million on buybacks. We know that about six weeks after the end of FY 2022 the company had 84.3 million shares outstanding. We know that about six weeks after the end of FY 2023, the company had about 77.75 million shares out. I’m going to assume an average constant “per month” retirement of about 547,310 shares retired per month. I think this is the best I can come up with based on the facts available, but I feel a need to point out the discrepancy in timing, to let you know that my figures may not be precise at this point.

Given the above, I’m going to go with the assumption that the company spent approximately $245 million to retire approximately 6,567,714 shares. Using the arithmetic skills so lovingly beaten into me by the nuns at Holy Spirit School many, many decades ago, I can work out what the company spent (approximately) per unit price paid by the company for one share of stock. I’ve determined that these shares were retired at an approximate price of $37.30. Feel free to check my work for yourself. I only ask that if you get a different result from me, please refrain from traveling to my location to hit me with a small ruler the way Sister Winnifred did many years ago.

When I look at the stock, below, I’ll determine whether or not the company bought back the shares at a good or bad valuation.

But Wait, There’s More

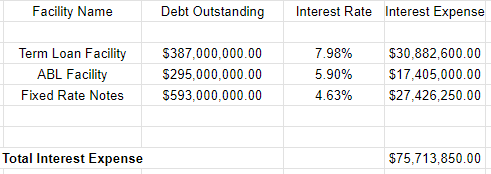

I wouldn’t be the obsessive person I am if I didn’t make one last point about the state of the capital structure in light of these buybacks. I’ve gathered the following data from the most recent financials.

Victoria's Secret Debt and Interest Rates (Victoria's Secret 2022 10-K)

The company is set to spend just under $76 million on interest on an annualized basis. Given that I’m of the view that the firm will need to add to the debt levels from here, this interest expense will rise from current levels. I know I haven’t officially reached the “assessing the buybacks” section of the article yet, and I hope I’m not giving away the surprise, but I am of the view that that $245 million would have been much better spent knocking down debt.

Even given the above, I am willing to add to my position, because the company is still profitable. I don’t think management is on the side of the small shareholder, but I’m willing to remain invested if the valuation is compelling enough.

Victoria's Secret Financials (Victoria's Secret investor relations)

The Stock

Those who follow me often know that I have talked myself out of compelling trades with words like “compelling enough.” I admit to being a bit of a coward when it comes to buying high flyers, but I’m of the view that it’s better to miss out on upside than lose capital. I’ve been alive long enough to know that unpredictable things happen, tastes shift, and if you don’t account for the unpredictability of the world in your investments, you’re going to be flattened on occasion. It’s not fun being flattened, so I’d rather miss out on some gains than risk too much.

With that sermon done I need to remind you of the fact that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits selling women’s intimate, and other apparel, and beauty products worldwide. The stock, on the other hand, is a speculative instrument that gets traded around based on long-term expectations about the business, expectations about the future demand for such things, emerging ideas about “body positivity” etc. Also, when we look at the business, we’re forced to look mostly at financial statements which are, by their nature, "backward-looking." The stock, on the other hand, is a forecast about the distant future, so there's an inevitable tension between the backward facing financials and forward-facing forecasts.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of "stocks" as an asset class, and that will impact individual stocks to some degree.

So, to sum up, the business sells women’s garments, while the stock bounces up and down based on the crowd's ever-changing views about the future. The crowd is capricious, because the shares are much more volatile than anything that happens at the actual business. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given name, because those expectations are easier to beat.

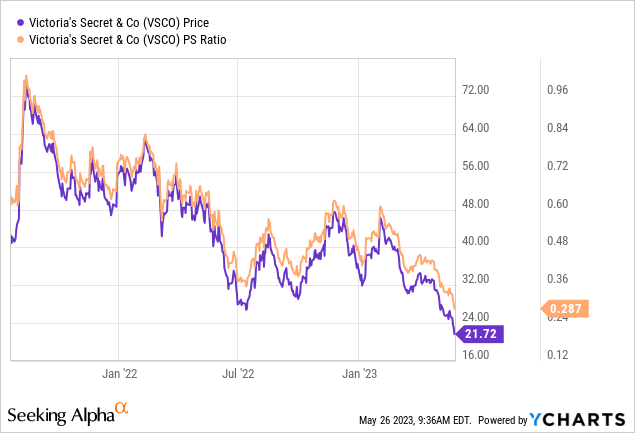

Another way of writing "down in the dumps about a given stock" is "cheap." I like to buy cheap stocks because they tend to have more upside potential than downside. This is because much of the bad news has been wrung out of the price. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. Now this doesn’t always work out perfectly. It’s possible to buy long before all bad news has been wrung out of the price. In this instance, I was wrung by an additional 25%, which isn’t as enjoyable an experience as you might think. Anyway, I previously found Victoria Secret shares compelling because the market was paying only $0.374 for $1 of sales. Fast forward to the present, and the market’s skepticism has grown, as evidenced by the fact that it’s willing to pay 23% less, or $0.287 for $1 of sales.

Source: YCharts

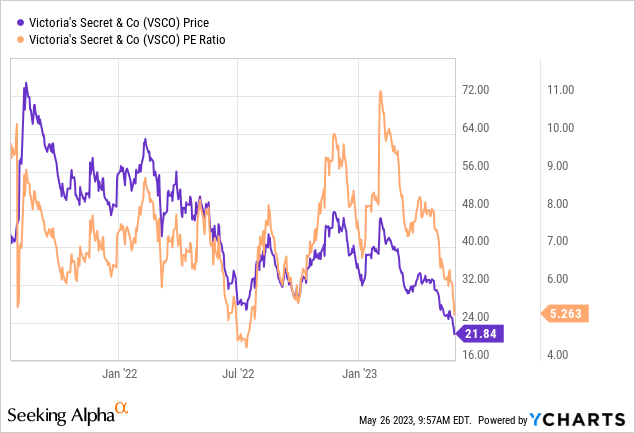

Additionally, I think it's worth noting that the shares are trading very near the low end of their earnings range, per the following:

Source: YCharts

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is "thinking" about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book "Accounting for Value." In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is "thinking" about a given company's future growth. This involves isolating the "g" (growth) variable in this formula. In case you find Penman's writing a bit opaque, you might want to try "Expectations Investing" by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently "expecting" about the future. Applying this approach to Victoria’s Secret at the moment suggests the market is assuming that this company will be bankrupt in five years. Now, I think this will be a challenging year for the business, but I see cash flows improving pretty dramatically in 2024 and beyond. Given that, I’m willing to add to my stake here.

And Finally: Assessing the Buyback

To refresh your memory in case you forgot, the company spent about $245 million in order to retire about 6.56 million shares, at an approximate average price of $37.30. At that price, the company bought the shares at a price to sales ratio of about $0.492, which, in fairness, is elevated, but not massively expensive. I remain of the view that the company should have paid down debt with this capital, but I don’t consider the price paid for the stock to be excessive.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.