DHT Holdings Is Riding Some Volatile Spot Rates In The VLCC Market

Summary

- After crashing earlier this year, VLCC spot rates rebounded some in May, after DHT's earnings report.

- The roll-off of three lower-rate charters should help the company in the 2H.

- While on the fence, I rate the stock a "Hold."

joeygil

DHT Holdings (NYSE:DHT) is riding a volatile market for VLCC rates, but a recent rebound in rates and the rollover of low time charters could bode well for the stock.

Company Profile

DHT owns a fleet of crude oil tankers. It currently operated a fleet of 23 VLCCs, or Very Large Crude Carriers, which have a cargo-carrying capacity of between 200,000-320,000 dead-weight tons. The average age of the fleet is under 10 years.

16 of DHT's vessels are on the spot market, while 7 are on time charters. Three, however, are expiring at the end of Q2 2023. The company sold 3 vessels in 2022.

Opportunities and Risks

As I noted in my recent write-up of Ardmore Shipping (ASC) and Frontline (FRO) as well, geopolitical events have been influencing the tanker and refined product shipping markets. DHT and FRO operate crude tankers, while ASC operates refined product vessels. The Russian oil price cap imposed by Western nations following the Russia-Ukraine war has had a big influence on routes and rates. Russia has shifted its crude oil sales to Asian destinations like China and India, which are longer routes. This in turn has forced Europe to also get its crude from elsewhere, also often leading to longer routes.

To avoid Western sanctions, Russia has also been using what is referred to as a ghost fleet of tankers to help them bypass sanctions. Rystad analyst Viktor Kurilov told the Financial Times that the country would need over 240 of these tankers to keep its current exports flowing. Russia has also reportedly partaken in ship-to-ship oil transfers as well as blending the oil with those from other destinations.

In addition, China's re-opening is also having a big impact on crude demand. Global oil demand is predicted to hit a record 101.9m barrels per day led by China. China oil demand exceeded 15 million barrels a day for the first time in March, and the country is projected to account for 40% of crude's growth this year.

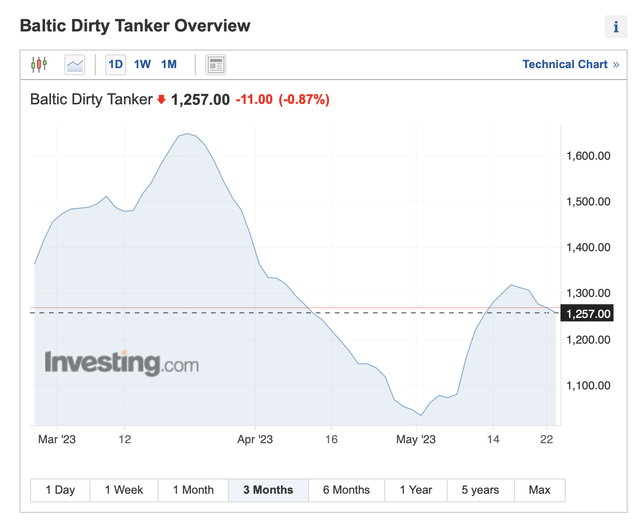

That said, mid-sized crude tankers and refined product vessels have been the bigger beneficiary of the new trade patterns caused by the Russian-Ukraine war. Meanwhile, VLCC rates plunged following OPEC+ cut in productions. Rates got a boost recently with Asian refiners turning to the U.S. for supply, although some experts think the increase will be short-lived.

Discussing the state of the market on its Q1 earnings call, CEO Svein Harfjeld said:

"As you're all aware, the conflict between Russia and Ukraine disrupted trade patterns which draw premium earnings for our smaller siblings. With a slightly longer retrospect following the COVID setback, it has been a fairly steady and positive development. Importantly for DHT in particular, the graph on the left shows VLCCs handling close to 50% of seaborn crude oil on a nominal basis. Unsurprisingly, and due to its size and competitive cost of transportation, it represents about 70% when measured on a ton-mile basis. The VLCC is a true workhorse of the crude oil transportation markets. And we think it's reasonable to expect this to prevail going forward. These are extraordinary times from a geopolitical perspective on our businesses, as one would, impacted. We shall not offer you any geopolitical analysis or act as an oil market expert. That would be beyond our capacity. However, lifting the beams a bit, the 3 basic pillars for our business are positive. We have a growing demand for oil because increasing transportation distances and basically no new supply coming on. We think we are in the early innings of experiencing the benefits of these pillars. And it would likely continue to be volatile and seasonal.

"OPEC+ surprised the market with its announcement a month ago. War, sticky inflation and increased interest rates, falling refining margins, raising concerns about demand and certain financial turmoil are all tempering near-term expectations. Maybe OPEC+ was ahead of the curve by trying to reduce the impact on oil price now and targeting a higher price for the forecasted recovery later this year, our 2 cents only. China is however opening up and increasing consumption. And we do have a sense that nonOPEC supply will step up to compensate at least for parts of these impacts, and that will mean longer transportation distances. The tanker market has historically been prone for disruptions. As we speak, there are tankers involved in seizures in the Middle East Gulf. A certain significant flag state issued a security alert to its members. And we understand some owners sailing under this flag had concerns about entering the area. If this plays out, it can abruptly decrease supply of ships in this highly important loading area. This certainly has risked the upside in the freight markets."

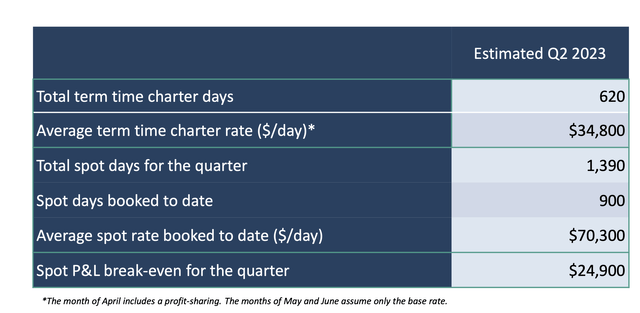

Overall, tanker spot rates fell hard in March through early May, but there has been a rebound since DHT's earnings call. DHT has 65% of its spot days booked at an average rate of $70,300 per day. It also has three time charters that will roll off at low rates during Q3. One vessel will be re-chartered out and have both a base-rate and a profit share component.

It's also worth noting that DHT's ships do have low breakeven points. The company estimates that its average breakeven for its fleet is rates of $27,500, and $24,600 for its vessels on the spot market. Cash breakeven rates are $18,500 and only $12,800 for spot market vessels.

As I noted when looking at FRO, the VLCC order book is at its lowest level in decades. There are also a lot of older vessels that would typically be scrapped.

When it comes to risks, spot rates are the biggest risk the company faces. Rates for VLCC ships have been extremely volatile and are likely to remain that way for the foreseeable future. Spot rates are likely to be influenced by the global economy as well as geopolitical issues.

Meanwhile, the bullish thesis on a low VLCC order book and older vessels needing to be scrapped could run into issues if vessels make their way to Russia's ghost fleet instead of being scrapped, something DHT noted is happening. This could add a bit of uncertainty to the supply-demand balance of ships, which could overestimate the current number of VLCCs, as well as impact spot rates.

Dividend

Last year, DHT implemented a policy of distributing 100% of net income back to shareholders. It paid out a 23-cent dividend earlier this month.

Currently, DHT's booked rates for Q2 are significantly higher than Q1, so the company should be able to pay a strong distribution next quarter. About 75% of its days were booked when it reported earnings earlier this month.

From there it gets a bit murky given how volatile spot rates have been.

Valuation

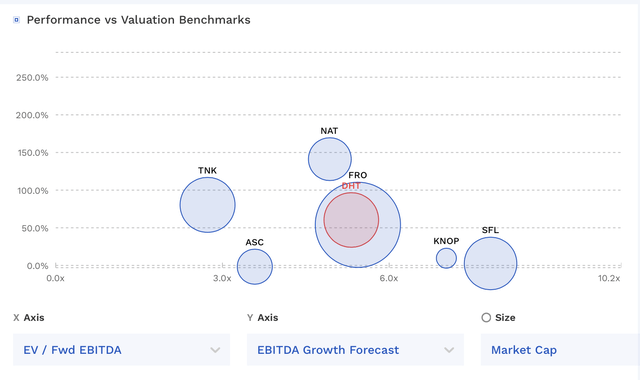

DHT trades at 5.3x the 2023 EBITDA of $299.3 million and 4.5x the 2024 EBITDA consensus of $350.3 million.

On a PE basis, it trades at 7.8x EPS estimates of $1.03. Based on the 2024 consensus for EPS of $1.38, it trades at 5.8x.

With 3 ships coming off low charter rates starting in the 2nd half, DHT could see a boost of about $30,000 a day (based on March rates), which for three ships would be about an $8.1 million, or 5 cents per share, jump in earnings per quarter, or $32.4 million annualized. Based on analyst estimates, it appears they are expecting rates similar to March, which would add $10 million, or 6 cents per share, to the quarterly earnings of its 16 spot vessels compared to Q1 levels.

DHT stock trades towards the middle of other marine shipping companies.

DHT Valuation Vs Peers (FinBox)

Conclusion

DHT is an interesting name. The company currently isn't in the best maritime shipping market given its ties to VLCCs; however, the market is still solid and spot rates have rebounded this month following its earnings release. Spot rates are likely to remain volatile given the current geopolitical issues and uncertain economy. However, crude demand still appears to be on the rise due to China re-opening.

DHT also has the benefit of 3 charters at lower rates rolling off in the second half. Barring a collapse in rates, this should be a boost to the company. At the same time, it does trade at a lower multiple than many other shippers based on 2024 estimates, given the impact of those ships rolling off lower contracts.

Longer term, I like the low order book for VLCCs and aging fleet. However, the Russian ghost fleet, whose size is not fully known, does throw some wrinkles into the equation.

Overall, I'm on the fence with DHT, and how it performs will depend on if rates can remain strong. I'm going to with a "Hold" rating, but I see its merits. Currently, I prefer ASC in the maritime shipping space as it's in a more attractive niche at the moment and is one of the most inexpensive names in the space.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.