Formula One: Popularity Driving Growth

Summary

- Renewed revenue growth has been driven by a strategic initiative to target new customers.

- Netflix's Drive to Survive, new tracks globally, and digital expansion are key growth drivers that have been highly successful.

- F1 looks to have reached its race limit annually, which is a small concern, meaning growth must be driven by value rather than scale.

- F1's EBITDA-M is 20%, with scope for improvement to c.25% in the coming years.

- Our valuation implies a 5% upside, which is not sufficient to garner a buy rating.

Marzia Camerano/iStock Editorial via Getty Images

Investment thesis

Our current investment thesis is:

- F1 is a fantastic business on a growth trajectory as its current owners look to rapidly accelerate interest in the sport.

- Margins are improving as sponsorship/TV deals increase in value.

- Steady Long-term looks reasonable given the large fanbase, breadth of constructors, and historic importance of F1 as a sport.

- Our valuation suggests there is no material upside remaining, suggesting caution.

Company description

Formula One Group (NASDAQ:FWONK) engages in the motorsports business internationally. It holds commercial rights for the world championship, a nine-month-long motor race-based competition in which teams compete for the constructors' championship and drivers compete for the drivers' championship.

Formula One is considered the pinnacle of motorsport, with over 70 annual seasons and some of the world's leading manufacturers, including Ferrari (RACE), McLaren, Aston Martin (OTCPK:AMGDF), Renault (OTCPK:RNSDF), Honda (HMC), and Mercedes (OTCPK:MBGAF) (With Porsche (OTCPK:POAHY) due to join and Volkswagen (OTCPK:VWAGY) strongly rumored). This has allowed the sport to garner a large fan base which is highly sticky, making it lucrative for both ownership and teams.

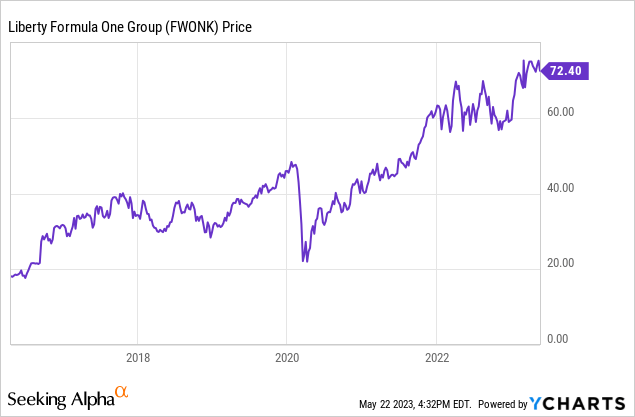

Share price

F1's share price has gained over 250% since its listing, reflecting a rapid increase in the sport's popularity and an aggressive expansion under new ownership.

Financial analysis

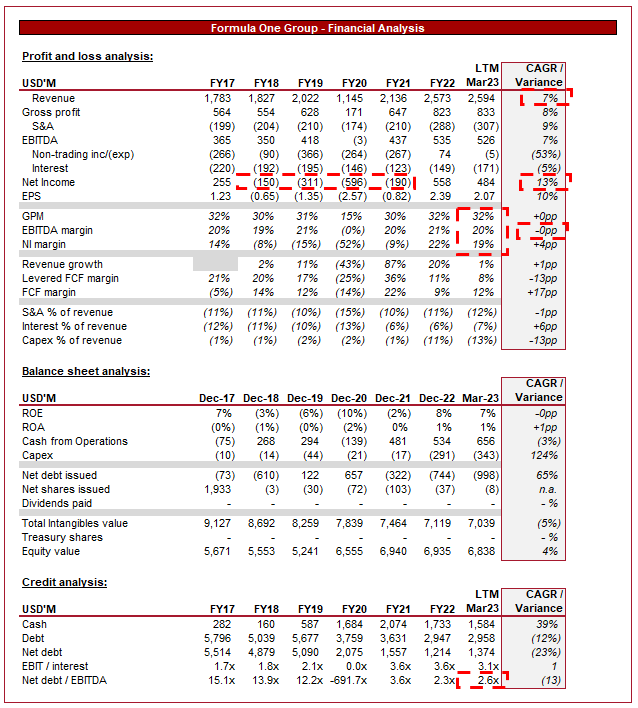

F1 Financials (Tikr Terminal)

Presented above is F1's financial performance for the last decade.

Revenue

F1's revenue has grown at a CAGR of 7%, which partially reflects the impact of Covid-19, but is nevertheless a strong performance given the maturity of the sport.

F1 earns revenue primarily through hosting races, sponsorships, and TV rights. For this reason, the key commercial consideration of this business is understanding how interest is being developed, as well as the value per race.

F1 has been in a transitionary period since it was acquired by Liberty Media. Bernie Ecclestone ran F1 fantastically well for decades, propelling it to the pinnacle of motorsport. However, he can be criticized for not doing more to develop the sport in the last decade of this tenure, primarily through targeting new customers. F1 was seen as a sport for the rich, which Liberty clearly saw as an opportunity.

Digital transformation has had a profound impact on F1. The increasing use of digital platforms, social media, and streaming services has transformed fan engagement, content consumption, and sponsorship opportunities. Since the acquisition, F1 has launched a YouTube pre/post show, it uploads highlights to YouTube following races and creates extensive content on Instagram/TikTok, among many other things. The largest factor, and in our view the biggest growth driver in recent years has been the launch of the hit Netflix (NFLX) show "Drive To Survive". This has captured a large fanbase who developed an interest in F1 through personalities. Netflix has essentially turned F1 into a reality TV show and as the history of TV has shown, the casual consumer is glued to their seats.

Furthermore, we have seen product innovation as a means of driving interest. F1 has launched "Sprint races", which are shorter races before the "main race", at several circuits throughout the year. The intention of this is clear, attract casual fans who are unable/willing to watch a feature-length race. Further, we have seen rule changes targeting harmonization among teams, the objective being to create tighter action between teams.

F1 has traditionally focused on its European roots, racing at historic tracks across the region, which has the impact of restricting races beyond this. In recent years, F1 has chosen to expand to regions / tracks that lack historical importance, for commercial reasons. A glaring example of this is the Middle East, which now has multiple races. The strategy is logical, European tracks are run for profitability and so cannot come close to matching the financial might of Petro nations investing in their domestic tourism industry. Further, the sport can benefit from reaching new markets that may not have a race in the region. Liberty has continued this strategy, adding multiple new US races, as well as expanding further globally. Management now looks more focused on the US than previously, which is logical given the success of Drive To Survive and the dollar size of the market.

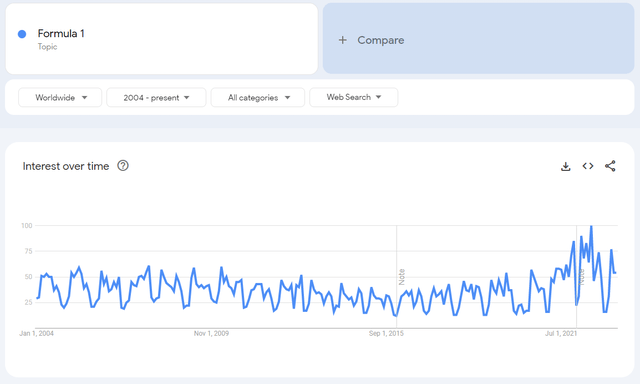

The benefits of the various expansion strategies are illustrated in the following graph, with F1 reaching a peak Google (GOOG) popularity rating in recent years. Further, we see the decline at the end of the Bernie era, and the subsequent increase following the takeover.

Our concern here is that fans/teams are turning against this strategy. Given the finite number of races that can be held (due to logistics among other things), management must replace existing tracks to add new ones. This has worked so far as poor-performing / unpopular tracks have been removed and Management has incentivized teams to allow the number of races to increase. We believe a limit has been reached, however. No additional races can be added without a revolt by teams (especially given the sprint races added) and the next track which looks to fall off the calendar is the historical Spa Francorchamps, which is among the greatest circuits on the calendar.

The impacts of this are far-reaching and complex. Firstly, if the number of races cannot increase, revenue to an extent is capped. Management must find increasing gains from other avenues while improving take from existing races. This is extremely difficult to do beyond an inflationary level. Secondly, the majority of these new tracks are inferior to the ones they are replacing. The Florida GP is fantastic for marketing and the finances of F1, but the races are incredibly boring due to a bad track. The upcoming Las Vegas GP will be more of the same (Street Circuits are easier to build but difficult for overtaking). This may lead to fans becoming disillusioned and walking away.

From our analysis, it is clear that Liberty is seeking several avenues to develop F1's revenue-earning capabilities. We have only touched on a few specific examples but they are seemingly working. Our only concern is that with restrictions around the number of races, there is pressure to continually develop an interest in the sport to increase the value of TV rights/sponsorships.

Margin

F1's current margins are quite attractive, with an EBITDA-M of 20% and a NIM of 19%.

Outside of marketing and the number of races, F1's cost base is relatively fixed. Given that we have reached a near-term maximum for the number of races, value creation can be highly accretive. This is especially the case given that TV rights/Sponsorships are sold for several years at a time. With the increased popularity in F1, the coming renewals will be at significantly higher levels while the cost to deliver does not materially deviate from inflation.

For this reason, we expect EBITDA evolution in the region of 3-8% in the coming years. In the near term, we could see a dip as the Imola GP was canceled last week, resulting in one-off costs to the business and reduced revenue from the race. Conversely, we will see an uptick in next year's results assuming no other cancellations.

Balance sheet

F1 is moderately financed, with a ND/EBITDA ratio of 2.5x. This reduces any solvency risk, with sufficient cash to cover any downside risk. Capex commitments have increased in recent years, which will act as a drag on near-term cash while F1 continues expansion.

Outlook

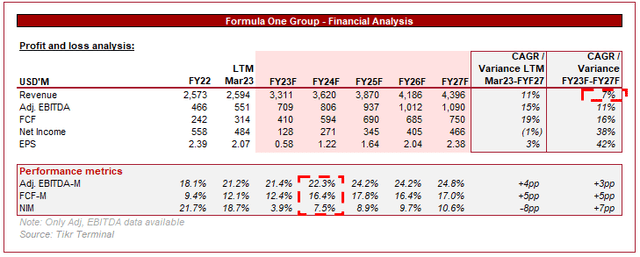

Wall Street outlook (Tikr Terminal)

Presented above is Wall Street's consensus view on the coming 5 years.

Growth is expected to remain on its current trajectory, which given the commercial profile of the business, looks reasonable.

Margin improvement is also forecast, with Adj. EBITDA improving from 18.1% to 24.8% by FY23. Again, this aligns with our current expectations.

Valuation

F1's current valuation is racey, with an LTM EBITDA multiple of 34x and an NTM EBITDA multiple of 26x (Unclear if NTM EBITDA reflects the missed Imola race).

This valuation reflects positive sentiment around the business, with investors expecting continued strong growth and margin improvement. For this reason, we must be careful to assess if any upside remains.

In order to value F1, we have conducted a DCF valuation. Our key assumptions are:

- Revenue growth between 7-10% in the coming 5 years, before a perpetual growth rate of 3%.

- Margin and FCF improvement toward the 25% level in line with analyst forecasts.

- An exit multiple of 22x, reflecting what will be a highly profitable, resilient business.

- A discount rate of 9%.

Based on this, we imply an upside of 5%, which is similar to analyst' target upside of 8.3%.

Final thoughts

I have been a fan of F1 for most of my life and I can safely say the sport has never been so popular or "cool" as it is now. From a commercial perspective, Liberty has done a fantastic job, with much of its strategy being a modernization exercise. We see good scope for future growth as the improved interest is further monetized with accretive returns. The key risk we see is that if interest begins to slow, we may see a share price reaction as investors reduce future cash flow expectations.

With only a 5% upside at its current price, we suggest caution, with limited upside visibility currently.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.