Lithium Miners News For The Month Of May 2023

Summary

- Lithium chemical spot prices surged higher and spodumene spot prices were flat the past month.

- Lithium market news - Samsung SDI & GM $3B EV battery plant in USA. Hyundai and SK On EV battery cell production JV in USA. Tesla lithium refinery groundbreaking.

- Lithium company news - Albemarle OK's up to $1.5B lithium hydroxide plant expansion in Australia, signs Strategic supply Agreement with Ford. SQM announces long-term lithium supply agreement with Ford.

- Allkem and Livent to merge and create a leading Global Integrated Lithium Chemicals Producer. DFS confirms NAL value with A$2.2B NPV8%. Piedmont Lithium Tennessee Project (LiOH refinery) DFS result of NPV8% US$2.5 billion and post-tax IRR of 32%.

- Lithium Americas approves agreement providing for separation into two leading lithium companies - Lithium Americas & Lithium Argentina. LAC - Biden administration says Nevada lithium mine can proceed.

- I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Fahroni

Welcome to the May 2023 edition of the lithium miner news.

The past month saw a huge recovery in China spot lithium carbonate prices (up 44%). China EV sales have been doing very well which has lifted lithium demand and run down cathode and battery inventories.

May saw plenty of very positive news from the lithium market and the lithium producers. We also saw the groundbreaking of the Tesla (TSLA) lithium refinery in Texas.

Lithium price news

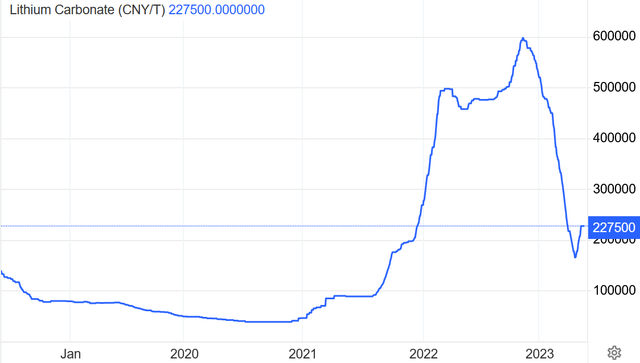

Asian Metal reported during the past 30 days, the 99.5% China delivered lithium carbonate spot price was up 44% and the China lithium hydroxide price was up 14.7%. The Lithium Iron Phosphate (Li 3.9% min) price was up 8.96%. The Spodumene (6% min) price was down 0.57% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) average price of USD 4,120/t, as of May 24, 2023.

China lithium carbonate spot price 5 year chart - CNY 227,500 (~USD 32,197) (source)

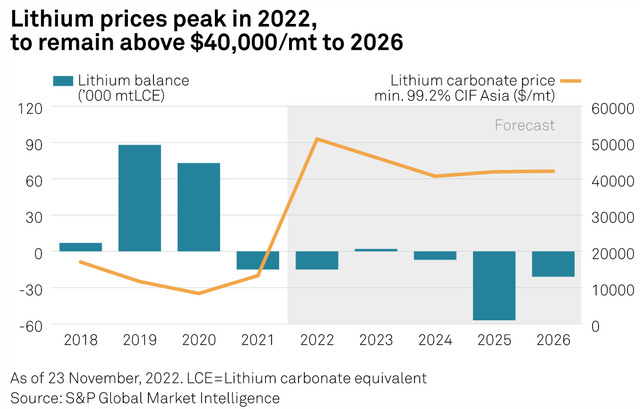

SPGlobal lithium price forecast as of Nov. 2022 (source)

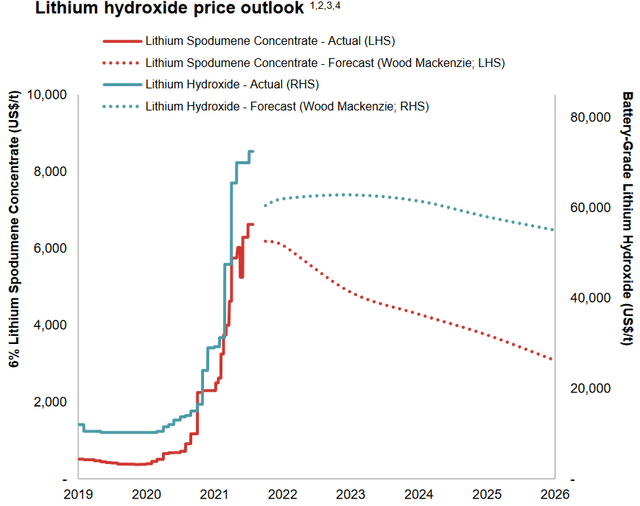

Wood Mackenzie's lithium price forecast - July 2022 (Source)

Lithium demand versus supply outlook

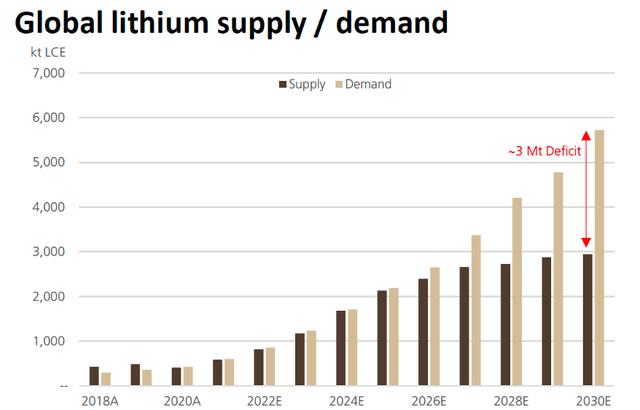

2022 - UBS lithium demand v supply forecast to 2030

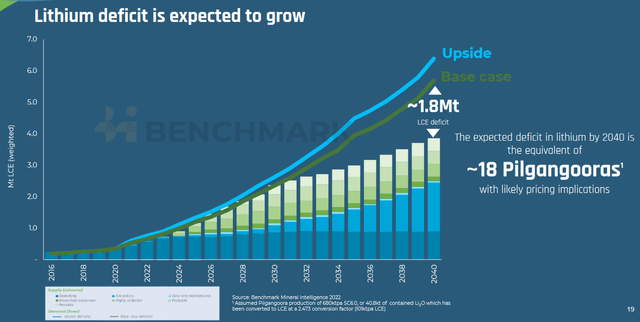

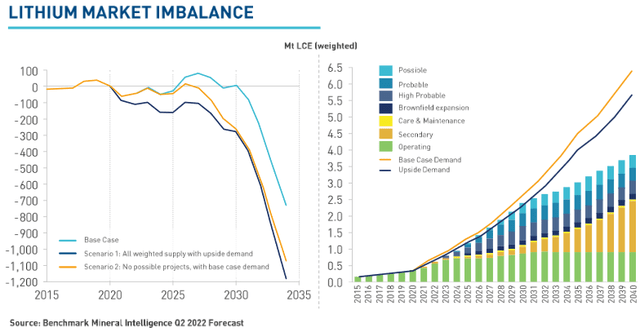

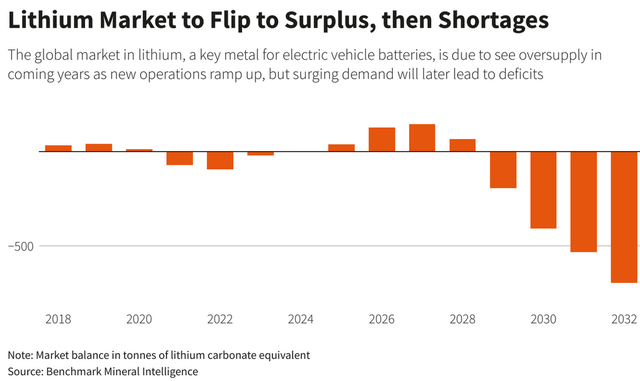

Lithium demand v supply forecast by Benchmark Mineral Intelligence (mid 2022 forecast)

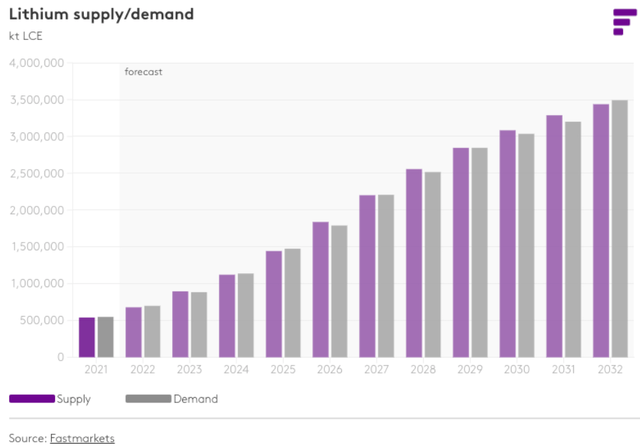

Fastmarkets lithium demand v supply forecast (as of 2022) (Source)

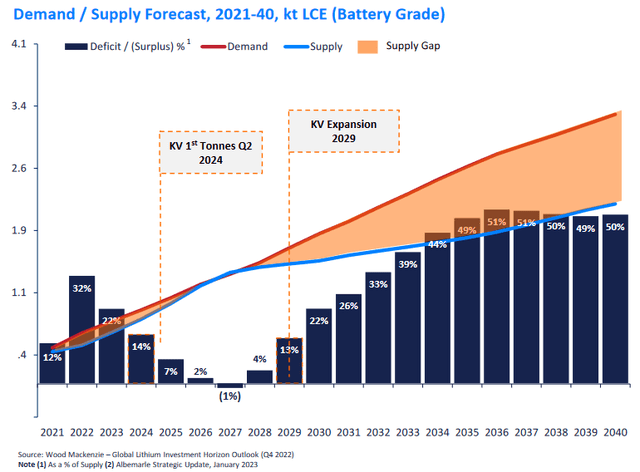

BMI (Q2, 2022 forecast) - Lithium demand to exceed supply mostly this decade

Lithium demand v supply chart (kt LCE battery grade) (deficits forecast every year with only a slight surplus in 2027) (source)

Liontown company presentation courtesy of Wood Mackenzie & Albemarle

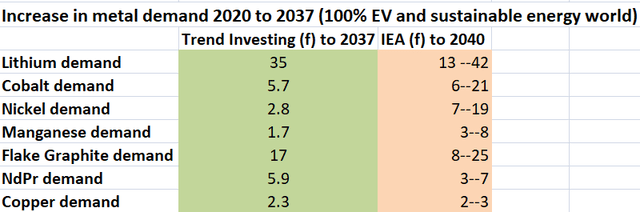

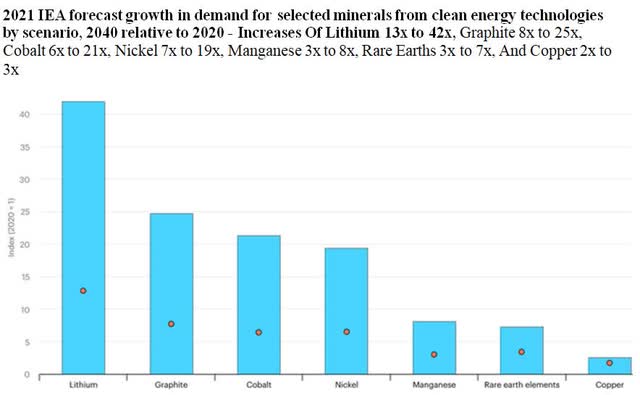

Trend Investing v IEA demand forecast for EV metals (Trend Investing) (IEA)

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 - Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

Rio Tinto forecasts lithium emerging supply gap (October 2021) - 60 new mines the size of Jadar will be needed

BMI demand growth 2022-2035 (in mtpa) for critical metals. Number of new mines required by 2035 - 78 new lithium mines needed

Lithium market and battery news

An article missed last month, on April 11 Nikkei Asia reported:

Sumitomo Metal to produce lithium with rapid-extraction tech. Joint investments eyed in Argentina and Chile for crucial battery material.

On April 13 Reuters reported: "Japan's Mitsubishi Corp looks to invest in nickel, lithium projects."

On April 23 Nikkei Asia reported:

Japan to subsidize half of costs for lithium and key mineral projects. Push to reduce reliance on China for crucial materials in EV batteries and motors.

On April 24 Reuters reported:

Argentina's lithium pipeline promises 'white gold' boom as Chile tightens......Mignacco estimated that Argentina's current 40,000 tonnes of lithium carbonate production could triple by 2024-2025 to 120,000 tonnes, which could take it past China and closer to Chile which currently produces some 180,000 tonnes per year.

On April 25 Reuters reported: "Samsung SDI, GM to build $3 bln joint EV battery plant in US."

On April 25 Hyundai Motor reported: "Hyundai Motor Group and SK On to establish EV battery cell production joint venture in US."

On April 26 Kitco reported:

Germany to dedicate $2.2 billion to secure supply of critical commodities - report.....The goal is to expand access and rely less on China. The raw materials Germany would be interested in securing include copper, cobalt, lithium, silicon, and rare earths. Germany is developing "a raw materials fund to support raw materials projects at home and abroad".....

On April 29 Reuters reported:

Lithium prices bounce after big plunge, but surpluses loom. Lithium prices rebounded this week for the first time in five months after tumbling from record highs, but new supply of the key mineral for electric vehicle (EV) batteries coming on stream is likely to weigh on the market next year...... A global market deficit is expected for 2023 as a whole, but surpluses are likely from next year, rising to 145,693 tonnes by 2027, before sinking into a deficit again from 2029, said Caspar Rawles at Benchmark Mineral Intelligence.

Reuters courtesy Benchmark Mineral Intelligence

On May 8 Tesla Blog reported:

Tesla lithium refinery groundbreaking. Today, we are breaking ground on Tesla's in-house lithium refinery, located in the greater Corpus Christi area of Texas. Once complete, the facility will represent an investment of >$1B in Southwest Texas. This investment is critical to our mission to accelerate the world's transition to sustainable energy and represents our efforts to aggressively increase the supply of battery-grade lithium hydroxide available in North America.....In the future, we expect this facility to also process other intermediate lithium feedstocks, including recycled batteries and manufacturing scrap.

On May 13 Bloomberg reported:

Macron Flags $7.3 billion in battery investments in France. Taiwan's ProLogium will build EV battery plant in Dunkirk. Orano and China's XTC to produce battery cathode materials.

On May 15 the Buenos Aires herald reported:

Argentina gets "nod" from US to increase lithium trade fivefold - Buenos Aires Herald. A US-led alliance of 13 global powers intended to plan critical minerals supply was launched today. Argentina was invited to participate in the first meeting of the Mineral Security Partnership, a strategic program created less than a year ago by the main global powers to guarantee the supply of what they call "critical minerals", such as lithium.......The Economy Ministry led by Sergio Massa views this meeting as a US "nod" to improving trade relations with Argentina.

On May 15 Bloomberg reported:

Korea's battery makers embrace LFP cells as China strides ahead...... Korea's three key battery makers - LG Energy Solution Ltd., Samsung SDI Co. and SK On Co. - are leaning into so-called lithium-iron-phosphate (LFP) battery technology as fast as they can......The most "passionate" player appears to be SK On, Kang said, as it tries to boost its market share......LG Energy Solution and Samsung SDI also both said in their latest earnings calls that they're developing LFP cells for EVs. LG plans to build an LFP plant in Arizona for energy storage systems while Samsung joined a Korean government-led project to make LFP batteries by 2026......One innovative method employed by Contemporary Amperex Technology Co. Ltd., the world's largest battery maker, is a so-called "blending technology," mixing nickel-cobalt-manganese batteries (NCM) and lithium-manganese-iron-phosphate (LMFP) to boost energy density, according to an April 27 report from the Korea Institute for International Economic Policy. The technology is expected to be applied to a new battery called M3P, the report said.

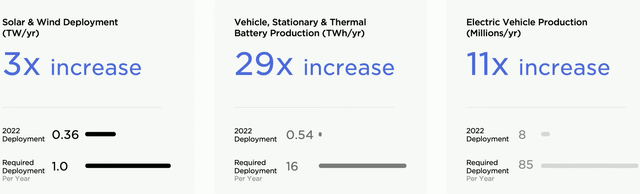

On May 16 Tesla held their 2023 Shareholder Meeting. You can view the full official video here (Elon Musk starts talking at the 27 min 15 sec mark). Below is a key slide and some key quotes.

Elon stated (32 min mark): "The faster we can make battery packs, the faster we can move to a sustainable energy economy. That's the fundamental limiting factor." Elon discusses Megapacks.

Elon stated (52 min mark): "The Tesla Megapack is now more competitive than a natural gas peaker plant......growing faster than our vehicle sales....I think long term......stationary battery pack activity will be in excess of 500 GWh a year...the demand is quasi infinite."

Note: Bold emphasis by the author.

Tesla Master Plan 3 summary (from Tesla 2023 shareholder meeting) - Solar & wind production needs to increase by 3x/yr, battery production by 29x/yr, BEV production by 11x/yr (source)

Tesla 2023 shareholder meeting

On May 16 Reuters reported:

Sinomine suspends Zimbabwe lithium ops over authorities' concerns..... halted operations for a week after unspecified administrative concerns raised by the authorities......The Chinese miner has invested a further $200 million to expand existing operations at Bikita, including the construction of two lithium processing plants to produce 250,000 tonnes of spodumene concentrate and 480,000 tonnes of petalite per year. Spodumene is another key battery mineral, and petalite is a lithium mineral used in the glass and ceramic industries.

On May 17 Electrive reported:

LG Chem to greatly expand battery materials business. South Korean chemical company LG Chem has revealed its plans to increase its battery materials sales more than six-fold by 2030. The company's new business strategy will expand its portfolio beyond cathode materials......LG Chem plans to build the largest cathode materials factory in the US in Tennessee.

On May 22 Seeking Alpha reported: "Ford unveils supply chain agreements to bolster EV efforts." Lithium supply agreements with Nemaska Lithium (50% Livent), EnergySource Minerals, Albemarle, Compass Minerals and SQM.

On May 24 Bloomberg reported:

Emerging lithium supplier Argentina says it's close to US deal under IRA. Argentine officials say they're nearing an IRA exemption......The country's only two producers as of now, Livent Corp. and Allkem Ltd., are set to merge to become the world's third-biggest lithium company focused on supplying the US.

On May 24 Yicai Global reported:

Sodium batteries need to grow up more before dethroning lithium, CPCA says. Sodium batteries, which replace lithium with cheaper sodium, can be mass-produced but still, there is no price advantage to lithium-ion batteries, the China Passenger Car Association and Kerui Consulting wrote in a recent report. It is hard for carmakers to be motivated to choose sodium because the supply chain and the techniques are not mature while prices of lithium iron phosphate batteries have been falling, the report added. As there was a tight supply of lithium carbonate and prices were high last year, industry players were scrambling to accelerate mass production of sodium batteries but that need is not so urgent anymore, Xu Xing, deputy head of engineering research at lithium battery maker Gotion High-tech, said to Yicai Global recently.

Lithium miner news

Albemarle (ALB)

On May 3 Albemarle announced:

Albemarle to double Lithium Hydroxide output in Australia. Investment to deliver on global growth strategy; highlights critical role of Australia in lithium supply chain.....Albemarle Corporation (ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, announced today its decision to build two additional processing trains at the leading-edge Kemerton lithium hydroxide plant in Western Australia. The additional trains will be wholly owned and operated by Albemarle and would increase the facility's production by 50 kilo-tonnes per annum (50,000 metric tonnes per annum). Operating at full capacity, the Kemerton plant would produce up to 100 ktpa (100,000 metric tonnes per annum) of lithium hydroxide, supporting the manufacturing of an estimated 2.4 million electric vehicles annually. This investment, combined with the existing two trains at Kemerton owned by Albemarle's MARBL joint venture, represents the biggest investment by any company in downstream processing of lithium in Australia and would make Albemarle the largest producer of lithium in Australia.

On May 3 Albemarle announced: "Albemarle reports net sales increase of 129% for first quarter 2023." Highlights include:

- "Net sales of $2.6 billion, an increase of 129%.

- Net income of $1.2 billion, or $10.51 per diluted share, an increase of 389%.

- Adjusted diluted EPS of $10.32, an increase of 334%.

- Adjusted EBITDA of $1.6 billion, an increase of 269%.

- Selected U.S. lithium processing facility location in Richburg, South Carolina.

- Signed definitive agreements with Mineral Resources Limited ("MinRes") to restructure the MARBL Lithium Joint Venture in Australia and separately for MinRes to invest in Albemarle's conversion assets in China.

- Reached final investment decision to build Kemerton trains III & IV.

- Adjusting 2023 guidance to reflect current lithium market pricing; Net sales are now expected to increase approximately 35% to 55% year-over-year and adjusted EBITDA now expected to range from (5%) to 15% year-over-year."

On May 3 Seeking Alpha reported:

Albemarle Non-GAAP EPS of $10.32 beats by $3.26, revenue of $2.58B misses by $160M..... FY2023 guidance: net sales of $9.8B - $11.5B vs. consensus of $10.88B; Adjusted EPS of $20.75 - $25.75 vs. consensus of $26.84.

On May 11 Seeking Alpha reported:

Albemarle.....upgraded at KeyBanc, seeing improving Chinese demand.... upgraded the stock to Overweight from Sector Weight with a $270 price target.

On May 15 Seeking Alpha reported:

Albemarle raised at Baird as lithium leader in cost and ability...... Baird upgraded the stock to Outperform from Neutral with a $288 price target, raised from $222.

On May 22 Albemarle announced:

Albemarle establishes Strategic Agreement with Ford Motor Company....to deliver battery-grade lithium hydroxide to support the automaker's ability to scale electric vehicle (EV) production. Albemarle will supply more than 100,000 metric tons of battery-grade lithium hydroxide for approximately 3 million future Ford EV batteries. The five-year supply agreement starts in 2026 and continues through 2030. Both Albemarle and Ford are committed to supplying the U.S. EV supply chain via lithium hydroxide domestically produced in the United States or originating in a country with a U.S. Free Trade Agreement.

Sociedad Quimica y Minera S.A. (SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV

On May 17 Sociedad Quimica y Minera S.A. announced: "SQM reports earnings for the three months ended March 31, 2023." Highlights include:

- "SQM reported net income(1) for the three months ended March 31, 2023 of US$749.9 million compared to US$796.1 million for the same period the year before. Earnings per share totaled US$2.63 for the first three months ended March 31, 2023.

- Revenues for the three months ended March 31, 2023, reached US$2,263.9 million."

On May 22 Sociedad Quimica y Minera S.A. announced: "SQM announces long-term lithium supply agreement with Ford Motor Company....."

Upcoming catalysts:

H2, 2023 - Chile Congress to vote regarding Chile nationalizing lithium. In May 2022 the idea was rejected.

Q4, 2023 - Mt Holland spodumene production to begin (SQM/Wesfarmers JV).

Q4, 2024 - 50ktpa Lithium hydroxide [LiOH] refinery (SQM/Wesfarmers JV).

Investors can read SQM's latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTCPK:GNENF) (OTCPK:GNENY)

On May 23 The China Project reported:

Ganfeng Lithium has announced mass production of solid-state batteries. China's largest lithium mining company has transformed itself into a battery manufacturer, and is now the very first company to announce mass production of revolutionary solid-state batteries.....

Investors can read the latest Trend Investing article on Ganfeng Lithium here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

On May 17 Reuters reported:

Tianqi Lithium exec sees more sector mergers and acquisitions.....The Allkem Ltd and Livent tie-up has raised expectations for more mergers and acquisitions among producers of the key metal in electric vehicle batteries, for which demand is expected to soar more than five-fold by 2030 amid the energy transition.

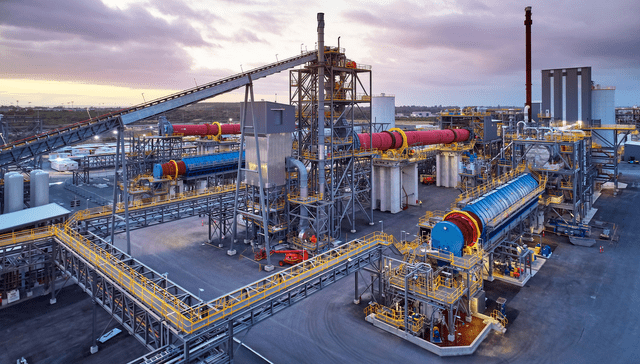

Kwinana lithium refinery JV (51% Tianqi: 49% IGO) in Western Australia

Pilbara Minerals [ASX:PLS] (OTCPK:PILBF)

On April 27 Pilbara Minerals announced:

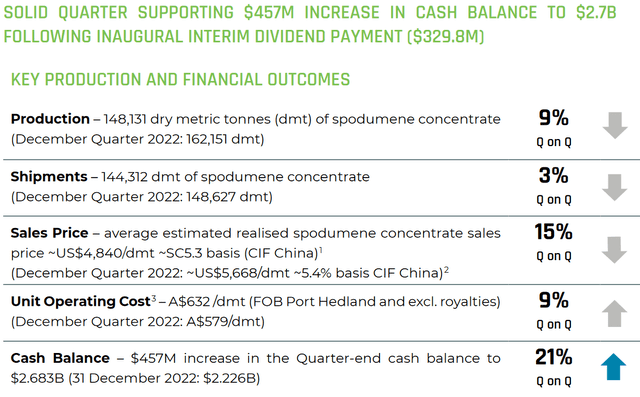

March 2023 Quarterly Activities Report. Solid quarter supporting $457m increase in cash balance to $2.7b following Inaugural Interim Dividend payment ($329.8m)....

OTHER KEY OUTCOMES• Inaugural fully franked interim dividend paid of 11 cents per share following record half year FY2023 operating performance of $1.24B net profit.• Final Investment Decision made to increase nameplate production capacity of the Pilgangoora Project to ~1,000,000 tpa of spodumene concentrate (P1000 Expansion Project).• POSCO Pilbara Downstream JV secured (non-recourse to Pilbara Minerals) KRW600B (US$460M) debt facility to fund the expected balance of capital and commissioning costs for the 43,000 tpa Lithium Hydroxide Monohydrate Chemical Facility in South Korea.• Entered a new 10-year $250M debt facility with Export Finance Australia and Northern Australia Infrastructure Facility to support the P680 Expansion Project.• Existing debt facilities re-financed on improved terms with a new US$113M 5 year debt facility through a syndicate of new and existing lenders.• Major construction package awarded to Primero Group for the P680 Expansion Project.• Several executive appointments made to bolster leadership team to support next stage of growth.• Downstream partnering initiatives commenced for P1000 product to maximise value.

Summary of March 2023 Quarterly Activities results (source)

Upcoming catalysts:

- Late 2023 - P680 Expansion Project set to begin production.

- Late 2023 - Plan to commission production of POSCO/Pilbara Minerals (18%, option to increase to 30%) JV LiOH facility in Korea.

- Q3, 2025 - P1000 Expansion Project set to begin production.

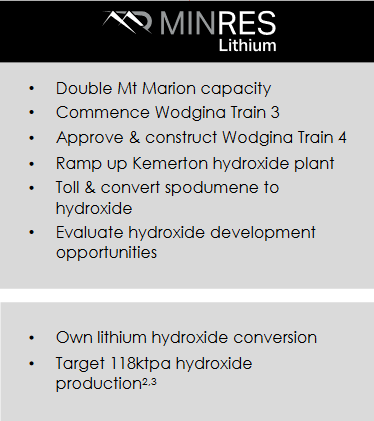

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mineral resources lithium assets include Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (50% ALB: 50% MIN). The 50ktpa Kemerton Lithium Hydroxide refinery trains 1 & 2 (85% ALB: 15% MIN) to take feed from Greenbushes. Qinzhou (25ktpa) and Meishan (under construction - 50ktpa) conversion plants in China (50% ALB: 50% MIN) will take feed from Wodgina.

On April 26 Mineral Resources reported: "Quarterly exploration and mining activities report January to march 2023 (Q3 FY23)." Highlights include:

- "......A total of 7,666 tonnes (attributable) of lithium battery chemicals was converted, stable qoq, with 5,925 tonnes (attributable) sold, down 14% qoq.

- The average realised lithium battery chemicals revenue was US$56,996/t (exclusive of China VAT), down 14% qoq.

- The Mt Marion expansion progressed and remains in line with the initial budget of $120 million. Completion of the expansion is now anticipated to commence from mid-May.

- Mt Marion FY23 volumes are expected to be at the lower end of spodumene concentrate guidance of 160-180k dmt (SC6 equivalent) and lithium battery chemicals sold guidance of 19.0-21.3kt. This reflects the impact of a delay in the plant expansion and mine sequencing, resulting in the drawdown of contact ore stockpiles. Accordingly, Mt Marion FY23 spodumene FOB cost guidance has been revised to $1,200-$1,250/t (SC6 equivalent) (previously $850-900/t).

- Wodgina remains on track to achieve FY23 spodumene shipped guidance of 150-170k dmt (SC6 equivalent) and lithium battery chemicals production guidance of 11.5-12.5kt. Reflecting current marketing arrangements and market dynamics, FY23 lithium battery chemicals sold guidance is expected to be 5.0-6.0kt (previously 8.5-9.5kt).

- During the quarter, MinRes entered1 into binding agreements with Albemarle Corporation (ALB) (Albemarle) to restructure the MARBL Joint Venture and investment in lithium conversion assets in China. Subject to receipt of regulatory approvals, MinRes expects the Australian part of the MARBL JV restructure to complete in the June quarter. The transaction effective date of 1 April 2022 for the change in ownership interests remains......."

On May 12 Mineral Resources reported: "Norwest Energy takeover bid closed."

Investors can read the latest Trend Investing article on Mineral Resources here.

MinRes' production expansion targets - Includes doubling Mt Marion capacity from 450-900ktpa in July 2023 and Wodgina from 500ktpa to 750ktpa (Train 3 adds 250ktpa) by mid 2023

MinRes

Livent Corp. (LTHM)[GR:8LV]

On May 2 Livent Corp. announced:

Livent releases first quarter 2023 results. First quarter revenue was $253.5 million, up 16% and up 77% from the fourth quarter of 2022 and the prior year's quarter, respectively. Reported GAAP net income was $114.8 million, compared to $82.7 million and $53.2 million in the previous quarter and the prior year's quarter, respectively, or 55 cents per diluted share. Adjusted EBITDA was $157.4 million, 46% above the previous quarter and roughly three times the prior year's quarter, and adjusted earnings per diluted share (1) were 60 cents. Continued strength in customer demand supported higher average realized prices across all products in the first quarter.....The development of Nemaska Lithium, an integrated lithium hydroxide project located in Québec, Canada in which Livent is a 50% shareholder, continues to advance as expected.....Livent has increased its guidance for 2023 financial performance and continues to expect significant growth following record 2022 results. For the full year, Livent now projects revenue to be in the range of $1,025 million to $1,125 million and Adjusted EBITDA to be in the range of $530 million to $600 million. This represents growth of 32% and 54%, respectively, at the midpoints versus the prior year. This guidance remains based on a projected 20% higher total volumes sold on an LCE (3) basis versus 2022. Additionally, the company expects to achieve higher average realized pricing across its portfolio of lithium products, partially offset by higher anticipated costs.

On May 10 Livent Corp. announced: "Allkem and Livent to create a leading Global Integrated Lithium Chemicals Producer. Allkem and Livent announce definitive agreement to combine in an all-stock merger of equals valuing the combined company at US$10.6 billion (A$15.7 billion)." Highlights include:

- "Creates a leading global lithium chemicals producer, with pro-forma CY'22 combined revenue of approximately US$1.9 billion2 and adjusted EBITDA of approximately US$1.2 billion.

- Immediately enhances business-critical scale and global capabilities from closing, strengthening the ability to serve customers with a more resilient supply chain.

- Vertically integrated business model allows enhanced operational flexibility and potential for greater value capture across the value chain.

- Geographically adjacent, high quality, low-cost asset portfolio in Argentina and Canada creates opportunities to both accelerate and de-risk the development of a strong pipeline of attractive growth projects expected to deliver production capacity of approximately 250ktpa LCE by CY'27E3......

On May 10 Seeking Alpha reported:

Livent to merge with Australian lithium miner Allkem in $10.6B deal.......Under the deal terms, Allkem (OTCPK:OROCF) shareholders will receive the right to one share of a new public holding company for each existing Allkem share, while Livent (LTHM) shareholders will receive 2.406 shares in the new company for each existing Livent share. Allkem (OTCPK:OROCF) shareholders will own ~56% of the new company, with Livent (LTHM) shareholders owning the rest. The companies expect ~$125M in annual run-rate operating synergies and ~$200M in one-time capital savings.....

On May 11 Seeking Alpha reported:

Livent adds two analyst upgrades with merger seen as strong strategic fit......In raising Livent (LTHM) to Overweight from Sector Weight with a $30 price target, KeyBanc's Aleksey Yefremov said he expects demand for lithium in China will improve.......B. Riley upgraded Livent (LTHM) to Buy from Neutral with a $32 PT, believing the merger offers several compelling advantages: greater scale, resource diversification and strong cost synergies due to asset proximity. BofA's Matthew DeYoe maintained his Buy rating on Livent (LTHM) while ticking his PT up to $29 from $27.....

On May 22 Livent Corp. announced: "Ford and Nemaska Lithium enter long-term lithium hydroxide supply agreement." Highlights include:

- "Ford to become Nemaska Lithium's first customer and will use lithium hydroxide produced at the Bécancour facility for manufacturing its electric vehicle batteries.

- Both companies share a commitment to the development of a sustainable and socially responsible North American battery supply chain."

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

See May 10 Livent news above re their planned merger with Allkem.

On May 4 Allkem announced: "James Bay drilling update - New high grade Zone identified in NW." Highlights include:

- "Discovery of an additional swarm of spodumene-bearing pegmatite dykes located directly northwest of known mineralization ("NW Sector").

- Highlighted intercepts include 125m @ 1.70 Li 2O from 68m in drill hole JBL-23-048, and 72m @ 1.89% Li 2O from 11m in drill hole JBL-23-024.....

- Infill and delineation drilling in the eastern portion of the deposit has confirmed both continuity and lithium grade of spodumene-bearing pegmatite dykes."

Upcoming catalysts include:

- Q2, 2023 - Olaroz Stage 2 expansion production followed by a 2 year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- Mid 2024 - Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

- ?2025 - James Bay production targeted to start.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) (plan to change name to AMG Critical Materials N.V.)

On May 3 AMG Advanced Metallurgical Group NV announced:

AMG's lithium operations continue to drive record earnings.....first quarter 2023 revenue of $451 million, a 12% increase versus the same period in 2022. First quarter 2023 EBITDA of $118 million was more than double the EBITDA of $55 million for the first three months of last year, and represents an all-time high for AMG's quarterly EBITDA.......Dr. Heinz Schimmelbusch, Chairman of the Management Board and CEO, said, "I am pleased to announce that AMG will change its name, subject to the approval of our shareholders in the upcoming Annual General Meeting, from AMG Advanced Metallurgical Group N.V. to AMG Critical Materials N.V. We have also achieved new record earnings and operating cash flow.

Upcoming catalysts:

- H2, 2023 - Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing total production capacity to 130ktpa.

- Q4, 2023 - Lithium hydroxide facility in Bitterfeld-Wolfen Germany to be commissioned. First module to be 20,000tpa LiOH.

- 2025-2028 - German LiOH facility expansion plan with Modules 2-5 (100,00tpa LiOH).

You can view the latest company presentation here or the Trend Investing article here.

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On April 28 Sayona Mining announced: "March 2023 quarterly activities report." Highlights include:

Québec, Canada

- "First commercial grade spodumene (lithium) concentrate produced at NAL operation.

- NAL restart achieved on time and within budget, making Sayona North America's leading hard rock lithium producer.

- Large scale drilling program planned with Jourdan Resources of over 50,000m at NAL and Jourdan's adjacent Vallée Lithium Project (earn‐in claims).

- C$50 million capital raising (flow‐through shares) to advance Québec lithium projects."

Western Australia

- "Approvals obtained for drilling campaign at Mallina Lithium Project; statutory and heritage approvals secured for Tabba Tabba Project."

Post‐Quarter

- "Definitive Feasibility Study (DFS) confirms NAL value with A$2.2B NPV (8% discount).

- Major resource expansion for Moblan Lithium Project, with estimated Measured, Indicated and Inferred Resource of 51.4 Mt @ 1.31% Li2O (sensitivity analysis at 0.55% Li2O cut‐off grade), representing one of the single largest lithium resources in North America."

Upcoming catalysts include:

- 2023 - Spodumene production ramp up at NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium (PLL) [ASX:PLL]

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of the North American Lithium [NAL] Project in Canada and 50% of the Ghana Lithium Project.

On May 1 Piedmont Lithium announced: "Piedmont Lithium completes Definitive Feasibility Study of Tennessee Lithium Project - Revised." Highlights include:

Study demonstrates robust project economics, positive impacts of the Inflation Reduction Act

- "Feasibility indicates results of NPV8 of US$2.5 billion and post-tax IRR of 32% for the 30-year project.

- Average annual steady state EBITDA and after-tax cash flow increased to US$376 and US$317 million, respectively.

- Project economics demonstrate positive impact of America's pro-EV policies.

- Innovative Metso:Outotec technology to provide improved sustainability profile over conventional conversion.

- Development-ready site with infrastructure, workforce, customer proximity, and cooperative government.

- Zoned for industrial use, reducing number of permits and approvals required to commence construction.

- Availability of low-cost, clean, reliable energy with TVA's net-zero by 2050 aspiration.

- Permitting and project financing activities advancing with goal of commencing construction in 2024."

On May 22 WFAE 90.7 reported:

Gaston County lithium mine may not start production until 2027....... "Our current first production target of 2027 best fits our expectations in terms of permitting, project financing, equipment deliveries, estimated construction schedules, and development timelines for other projects in our global portfolio."

Upcoming catalysts include:

- Late 2024 - Ghana Project (50% PLL) targeted to begin.

- 2026 - Tennessee Lithium hydroxide project targeted to begin.

- 2023-25 - Carolina Lithium (100%) - Permitting, off-take or project funding announcements.

You can view the company's latest presentation here, recent CEO interview here, or a Trend Investing article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% owns the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China's Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a "high potential for additional resources from 500km2 covering 100s of pegmatites." Fully funded and starting mining with a planned H1 2023 production start.

On April 26 Core Lithium Ltd. announced: "Quarterly activities report for the three months ended 31 March 2023." Highlights include:

Operations

- "Construction of the Dense Media Separation (DMS) plant at Finniss was completed.

- First concentrate production was achieved in February 2023.

- Maiden 3,500 tonne spodumene concentrate parcel produced and transported to Darwin port in March and early April. Full mining activities resumed at Grants open pit following wet weather interruptions.......

Corporate and Financial

- "Quarter ended with $97.8 million in cash, excluding April 2023 cash receipts from 18,500t Yahua sales contract prepayments.

- First revenue of $20.1M recognised for DSO shipment in January 2023.

- Chief Financial Officer, Doug Warden, appointed and commenced in April.

- Corporate head office relocation to Perth, WA, announced."

On May 11 Core Lithium Ltd. announced: "Maiden Finniss concentrate shipment to depart Darwin Port, BP33 granted mining authorisation."

On May 19 Core Lithium Ltd. announced: "Approval for BP33 underground mine early works." Highlights include:

- "Early works funding of $45-50M has been approved for BP33, the next proposed mine at Finniss, to complete development of a box-cut and preliminary site establishment.

- A Northern Territory based contractor has been appointed to undertake early works.

- Final BP33 project scope and capital cost estimate will now be determined using the recently announced increased Mineral Resource.

- Final Investment Decision for BP33 is expected by end Q1 CY24."

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- 2023 - Ramp up of spodumene production from Finniss.

Sigma Lithium Resources [TSXV:SGML] (SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On April 27 Sigma Lithium Resources announced: "Sigma Lithium trucks green lithium and tailings to Vitoria Port in preparation of 15,000 tonne shipment of each product in May." Highlights include:

- "Sigma Lithium's first trucks loaded with Battery Grade High Purity Sustainable Lithium ("Green Lithium") and its dry stacked, zero chemicals high purity tailings ("Green Tailings") successfully arrived at the Company's two separate warehouse locations at Vitoria Port.

- A total of 10 trucks were loaded on schedule this week, starting on Monday, April 24: 4 trucks with approximately 146 tonnes of Green Lithium. 6 trucks containing Green Tailings to be upcycled into Battery Grade Lithium Concentrate.

- On Wednesday, April 26, the trucks started to arrive at Brazil's Vitoria Port, recently selected for its enhanced logistics capabilities. Vitoria Port is best suited for Sigma Lithium's increasing export operational scale, resulting from the successful market receptivity for its Green Tailings.

- The Company remains on track to achieve full Phase 1 production capacity of 270,000 tonnes per annum by July 2023."

On May 11 Sigma Lithium Resources announced:

Sigma lithium and Brazilian Government Officials ring Nasdaq opening bell to celebrate the launch of Lithium Valley Brazil initiative.....

Upcoming catalysts:

- 2023 - Ramp up of spodumene production from Grota do Cirilo.

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy initially plans to ramp to 2,000tpa lithium carbonate starting mid-2023.

On April 27 Argosy Minerals announced: "Quarterly activities report - March 2023." Highlights include:

- "2,000tpa operation commissioning and ramp-up phase works progressing, with ramp-up toward continuous production operations targeted from end Q2-CY2023.

- Current production trials have produced over 10 tonnes of battery quality lithium carbonate product (average 99.79% purity) from batch operations during commissioning and ramp-up works.

- Advancing formal progress with strategic arrangements for off-take and capital funding for 10,000tpa operation expansion.

- Pre-development works progressing for 10,000tpa operation expansion.

- Resource expansion & production well drilling works progressing - targeting to materially expand current JORC Indicated Resource, and increase project mine-life & future annual production capacity......

- Argosy progressing toward becoming the 2nd ASX-listed battery quality lithium carbonate producer.

- Strong financial position with cash reserves of ~$30.7 million at 31 March 2023."

On May 1 Argosy Minerals announced: "Rincon 2,000tpa Li2CO3 operational update." Highlights include:

- "Current production trials produced ~13.5 tonnes of battery quality lithium carbonate product from batch operations during commissioning and ramp-up works...."

Upcoming catalysts:

- End of Q2-CY2023 - Rincon Lithium full ramp-up toward steady-state production targeted, 2,000tpa operation.

Investors can view the company's latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Lithium Americas [TSX:LAC] (LAC) - Plan to split to form two companies - Lithium Americas and Lithium Argentina (source)

On May 15, Lithium Americas announced:

Lithium Americas approves agreement providing for separation into two leading lithium companies. Lithium Americas intends to file circular with details on the Separation by end of June 2023; Separation will be presented to shareholders for approval at AGM expected for July 31, 2023.....The Separation will establish an Argentina focused lithium company ("Lithium Argentina") and a North America focused lithium company ("Lithium Americas (NewCo)"). Lithium Argentina will own Lithium Americas' current interest in its Argentina lithium assets, including the 44.8% interest in Caucharí-Olaroz, the 100%-owned Pastos Grandes project and the 65% interest in the Sal de la Puna project. Lithium Americas (NewCo) will own the 100%-owned Thacker Pass lithium project in Humboldt County, Nevada, as well as the Company's investments in Green Technology Metals Limited (ASX:GT1) and Ascend Elements, Inc.

On May 15, Lithium Americas announced: "Lithium Americas reports first quarter 2023 results." Highlights include:

Argentina

Caucharí-Olaroz

- "Mechanical construction completed to target first lithium production in June 2023......

- Additional purification processing equipment necessary to achieve battery-quality lithium carbonate is expected to be completed in H2 2023, following the start of pre-commercial production.

- Ramp up to 40,000 tonnes per annum ("tpa") of battery-quality lithium carbonate is targeted to be complete in Q1 2024.

- As of March 31, 2023, $834 million of the $979 million total expected capex has been spent (on a 100% basis).

- As of March 31, 2023, the Company expects its remaining funding requirement to be less than $50 million for capital costs, value added taxes and working capital to reach positive cash flow.

- Development planning for Stage 2 expansion of at least 20,000 tpa of lithium carbonate continues to progress to align with completion of Stage 1."

Pastos Grandes Basin

- "The Company continues to advance the Pastos Grandes' $30 million development plan, targeting completion of the plan and a construction decision in Q4 2023.

- The geophysics program has been completed. Roads and drilling pads are under construction.

- On April 20, 2023, the Company completed its acquisition of Arena Minerals and its 65% ownership interest in the Sal de la Puna project, adjacent to the Pastos Grandes project in Salta, Argentina."

United States

Thacker Pass

- "On March 2, 2023, the Company announced the start of construction activities at Thacker Pass following receipt of notice to proceed from the Bureau of Land Management ("BLM")......

- On February 22, 2023, the Company announced that it received a Letter of Substantial Completion from the U.S. Department of Energy ("DOE") Loans Program Office for its application for the DOE's Advanced Technology Vehicles Manufacturing Loan Program ("ATVM Loan Program").

- The Company expects the DOE ATVM Loan Program conditional approval process to be completed in 2023 and if approved, to fund up to 75% of the total capital costs for construction of Phase 1.

- The Company has approved a construction budget of $125 million through Q3 2023 with additional capital spend expected following completion of the DOE ATVM Loan Program process.

- On February 6, 2023, the US District Court, District of Nevada ("Federal Court") ruled favorably for the Company in the appeal filed against the BLM by declining to vacate the Record of Decision ("ROD")."

Corporate

- "As at March 31, 2023, the Company had $604 million in cash and cash equivalents and short-term bank deposits, with an additional $75 million in available credit...

On May 22 Nevada Appeal reported:

Biden administration says Nevada lithium mine can proceed. The Biden administration says it has completed a court-ordered review that should ensure construction continues at a Nevada lithium mine, despite legal challenges brought by conservationists and tribal leaders.

Upcoming catalysts:

- H2 2023 - Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 - Thacker Pass construction to progress. Waiting on a potential DOE ATVM Loan.

- H2, 2026 - Phase 1 (40,000tpa LCE) lithium clay production from Thacker Pass Nevada (full ramp to 80,000tpa by ?2028).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado ("JEMSE") (a company owned by the Government of Jujuy province).

Lithium miner ETFs

- Sprott Lithium Miners ETF (LITP) - A pure play lithium ETF

- Global X Lithium & Battery Tech ETF (LIT)

- ProShares S&P Global Core Battery Metals ETF (ION)

- The Amplify Lithium & Battery Technology ETF (BATT)

Global X Lithium & Battery Tech ETF (LIT) 10 year price chart (source)

Seeking Alpha

Trend Investing lithium demand v supply model forecasts

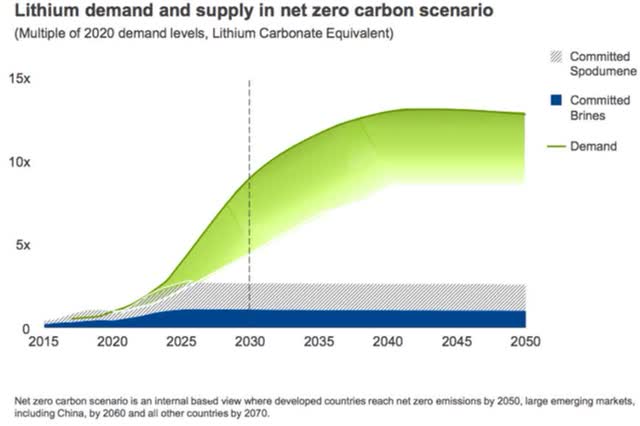

Our recently updated model forecast (due to surging stationary energy storage demand) is for lithium demand to increase 5.0x between end 2020 and end 2025 to ~1.8m tpa, and 10.6x this decade to reach ~4.9 m tpa by end 2029 (assumes electric car market share of 30% by end 2025 and 60% by end 2030). These figures may be a bit lower if sodium-ion batteries take significant market share in stationary energy storage or low end vehicles.

Note: A Nov. 2020 UBS forecast is for "lithium demand to lift 11-fold from ~400kt in 2021 through to 2030."

- Trend Investing - Exclusive: Lithium Demand V Supply Update - April 2023

Conclusion

May saw lithium chemical spot prices surge higher (China spot carbonate up 44%) after recent heavy falls. Lithium spodumene spot prices were flat.

Highlights for the month were:

- Samsung SDI, GM to build $3 bln joint EV battery plant in US.

- Hyundai Motor Group and SK On to establish EV battery cell production JV in US.

- Argentina's lithium pipeline promises 'white gold' boom as Chile tightens.

- Germany to dedicate $2.2 billion to secure supply of critical commodities - report.

- Reuters: BMI - Lithium prices bounce after big plunge, but surpluses loom.

- Tesla lithium refinery groundbreaking in Texas.

- Tesla Master Plan 3 says we will need a massive 240 TWh of energy storage for a 100% renewable energy economy. Tesla 2023 shareholder meeting - Solar & wind production needs to increase by 3x/yr, battery production by 29x/yr, BEV production by 11x/yr.

- Macron Flags $7.3 billion in battery investments in France.

- Japan to subsidize half of costs for lithium and key mineral projects.

- Argentina gets "nod" from US to increase lithium trade fivefold. Emerging lithium supplier Argentina says it's close to US deal under IRA.

- Korea's battery makers embrace LFP cells as China strides ahead.

- LG Chem to expand battery materials business more than six-fold by 2030.

- Sodium batteries need to grow up more before dethroning lithium, CPCA says.

- Albemarle OK's up to $1.5B lithium hydroxide plant expansion in Australia. Albemarle establishes Strategic supply Agreement with Ford Motor Company to deliver battery-grade lithium hydroxide.

- SQM announces long-term lithium supply agreement with Ford.

- Ganfeng Lithium has announced mass production of solid-state batteries.

- Allkem and Livent to merge and create a leading Global Integrated Lithium Chemicals Producer. Ford and Nemaska Lithium (50% Livent) enter long-term lithium hydroxide supply agreement. Allkem James Bay Project drills 125m @ 1.70 Li 2O from 68m.

- First commercial grade spodumene (lithium) concentrate produced at NAL operation (SYA: PLL). DFS confirms NAL value with A$2.2B NPV8%.

- Piedmont Lithium Tennessee Project (LiOH refinery) DFS result of NPV8% US$2.5 billion and post-tax IRR of 32% for the 30-year project.

- Sigma Lithium trucks green lithium and tailings to Vitoria Port in preparation of 15,000 tonne shipment of each product in May.

- Lithium Americas approves agreement providing for separation into two leading lithium companies - Lithium Argentina & Lithium Americas. Biden administration says LAC's Nevada lithium mine can proceed.

As usual all comments are welcome.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Trend Investing

Trend Investing subscribers benefit from early access to articles and exclusive articles on investing ideas and the latest trends (especially in the EV and EV metals sector). Plus CEO interviews, chat room access with other professional investors. Read "The Trend Investing Difference", or sign up here.

Trend Investing articles:

This article was written by

The Trend Investing group includes qualified financial personnel with a Graduate Diploma in Applied Finance and Investment (similar to CFA) and well over 20 years of professional experience in financial markets. Trend Investing searches the globe for great investments with a focus on "trend investing" themes. Some focus trends include electric vehicles and the lithium/cobalt/graphite/nickel/copper/vanadium miners, battery and plastics recycling, the online data boom, 5G, IoTs, AI, cloud computing, renewable energy, energy storage etc. Trend Investing was recently selected as the leading expert consultancy for a U.S government project on the EV supply chain and to the Board of Directors of the Critical Minerals Institute.

Trend Investing hosts an Investing Group service called Trend Investing for professional and sophisticated investors. The service is information only and does not offer advice or recommendations - see Seeking Alpha's Terms of use .

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GLOBAL X LITHIUM ETF (LIT), AMPLIFY LITHIUM & BATTERY TECHNOLOGY ETF (BATT), ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], ASX:AKE, ASX:PLS, ASX:MIN, LIVENT (LTHM), ADVANCED METALLURGICAL GROUP NV (AMS:AMG), TSX:LAC, ARGOSY MINERALS [ASX:AGY], ASX:LTR, ASX:LLL, ASX:CXO, ASX:SYA, ASX:PLL, ASX:NMT, ASX:1MC, SIGMA LITHIUM [TSXV:SGMA], VULCAN ENERGY RESOURCES [ASX:VUL], GALAN LITHIUM [ASX:GLN], SAVANNAH RESOURCES [XETRA:SAV], LITHIUM SOUTH DEVELOPMENT CORP. [TSXV:LIS], CRITICAL ELEMENTS LITHIUM [TSXV:CRE], WINSOME RESOURCES [ASX:WR1], INTERNATIONAL LITHIUM [TSXV:ILC], GLOBAL LITHIUM RESOURCES [ASX:GL1], EUROPEAN METAL HOLDINGS [ASX:EMH], EUROPEAN LITHIUM [ASX:EUR], FRONTIER LITHIUM [TSXV:FL], METALS AUSTRALIA OPTIONS [ASX:MLSOD], GREEN TECHNOLOGY METALS [ASX: GT1], AVALON ADVANCED MATERIALS [TSX:AVL], SNOW LAKE LITHIUM (LITM), PATRIOT BATTERY METALS [TSXV:PMET], OCEANA LITHIUM [ASX:OCN], MINREX RESOURCES [ASX:MRR], LOYAL LITHIUM [ASX:LLI], PATRIOT LITHIUM [ASX:PAT], ARGENTINA LITHIUM & ENERGY [TSXV:LIT], LITHIUM IONIC CORP. [TSXV:LTH], ATLAS LITHIUM (ATLX), LATIN RESOURCES [ASX:LRS], MIDLAND EXPLORATION [TSXV:MD], BRUNSWICK EXPLORATION [TSXV:BRW], AZIMUT EXPLORATION [TSXV:AZM], COSMOS EXPLORATION [ASX:C1X], MEGADO MINERALS [ASX:MEG], OMNIA METALS GROUP [ASX:OM1], ERAMET [FRA:ERA], FREY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is for ‘information purposes only’ and should not be considered as any type of advice or recommendation. Readers should "Do Your Own Research" ("DYOR") and all decisions are your own. See also Seeking Alpha Terms of Use of which all site users have agreed to follow. https://about.seekingalpha.com/terms

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.