LyondellBasell: Delivering On Its Strategy, Without Sacrificing Shareholder Returns

Summary

- LyondellBasell's share price delivered strong returns, even in the face of continued headwinds and business restructuring.

- The management is focused on making long-term investments in key areas while at the same time streamlining the business.

- LYB is still attractively priced, even after considering margin pressures, and is now offering a dividend yield of 5.6%.

- Looking for a portfolio of ideas like this one? Members of The Roundabout Investor get exclusive access to our subscriber-only portfolios. Learn More »

Bim

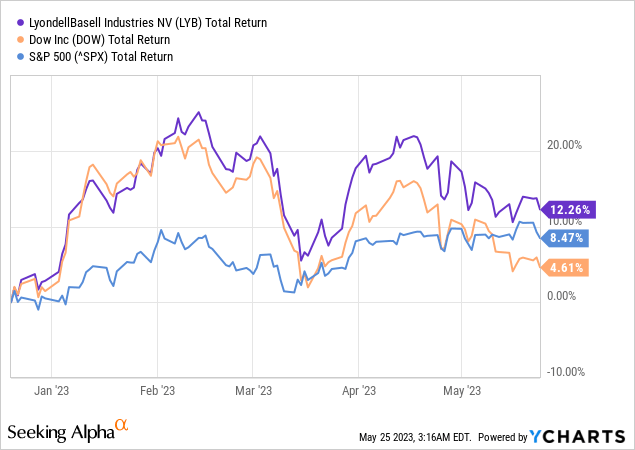

In spite of the ongoing challenges for capital-intensive businesses, LyondellBasell Industries' (LYB) share price is performing better than expected.

Although less than six months is not a long enough period to draw any solid conclusions, since I first covered LYB the stock has delivered a total return of 12%. Thus outperforming the broader equity market and one of its major peers - Dow Inc. (DOW).

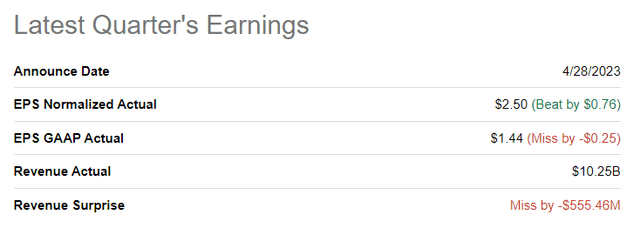

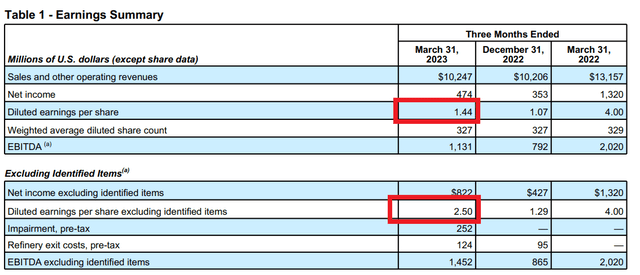

Within that period, LYB also reported somewhat mixed results for the first three-month period of 2023 by missing the consensus estimates both on the top and bottom line.

Nonetheless, as I have mentioned before, LyondellBasell's share price was already pricing-in a challenging 2023 and that was enough for the market to put more emphasis on the better than expected Non-GAAP earnings.

LyondellBasell Earnings Release

The positive note within the outlook was also well-received, and the 5% dividend increase provided a much-needed boost in confidence that the business is heading in the right direction.

In the near-term, the company expects typical seasonal trends to drive modest improvement in global demand. Increased summer demand for transportation fuels should provide support for oxyfuels and refining margins. Delays in the start of North American polyethylene capacity additions across the industry are expected to reduce new market supply and support polyethylene margins.

Source: LyondellBasell Earnings Release

Focusing On What Matters

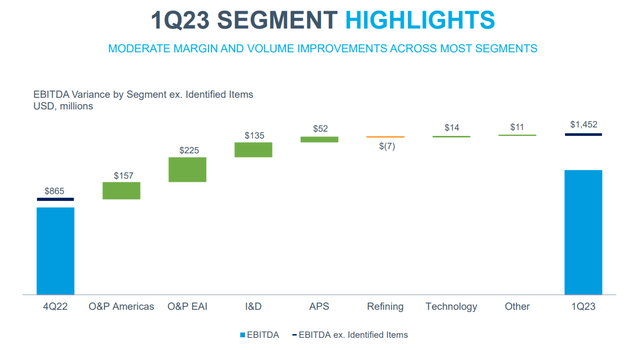

During the last quarter, profitability improved across all business units with the exception of Refining, which is a business that will be closed down this year as management focuses its attention on more strategic areas.

LyondellBasell Industries Investor Presentation

As a matter of fact, over the past 12-month period and after years of losses, the Refining segment is now experiencing a period of improved profitability as industry inventories for fuels remain low. This might seem like a poor timing for exiting the business, but streamlining the business to areas where LYB has stronger competitive advantages is far more important for long-term holders.

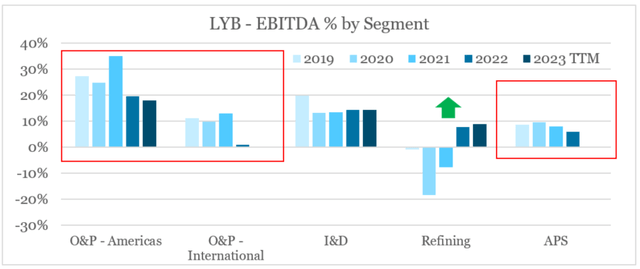

In the meantime, margins in other major segments remain below their historical averages, with the Olefins & Polyolefins - International being a key business unit that is now entering a second year of zero to negative margins. The Advanced Polymer Solutions (APS) segment on the other hand has been impacted by a recent change in reporting, which involved moving the Catalloy and polybutene businesses into the O&P Americas and O&P International segments.

Prepared by the author, using data from SEC Filings

As I mentioned above, these developments have already been priced-in and LYB's management is now expecting a modest improvement in key international markets as 2023 progresses.

Looking ahead, we expect slightly better seasonal demand in the second quarter. Our operating rates will reflect that improvement, targeting approximately 85% of capacity for the O&P EAI assets. While Europe remains a challenging environment, especially for durable goods, we are focusing on serving customers and optimizing our assets to deliver highest value.

Source: LyondellBasell Q1 2023 Earnings Transcript

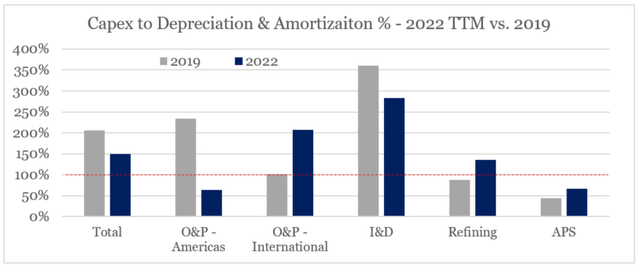

Investments in O&P International segment are also prioritized as management focuses on profitability. The level of investments is evident when we compare LYB's Capex to Depreciation & Amortization ratios in 2019 to 2022. In 2019 the ratio stood at roughly 100% and suggested that the company was mostly sustaining existing operations, but in 2022 the ratio is now more than 200%.

Prepared by the author, using data from SEC Filings

One key area of investment has been the company's MoReTec Recycling, which is a process where post-consumer plastic waste is turned to molecular form for use as feedstock for new polymer materials.

LyondellBasell (NYSE: LYB), one of the largest plastics, chemicals and refining companies in the world, today announced the successful start-up of its MoReTec molecular recycling facility at its Ferrara, Italy, site. LyondellBasell's proprietary MoReTec advanced recycling technology aims to return post-consumer plastic waste to its molecular form for use as a feedstock for new plastic materials.

Source: lyondellbasell.com

The technology would also be implemented at the company's Houston hub.

I have alluded to that before, that we are looking at the refinery to also deploy an investment in terms of MoReTec our own technology. So -- but the first one, to be very clear, will be in Cologne.

Source: LyondellBasell Q1 2023 Earnings Transcript

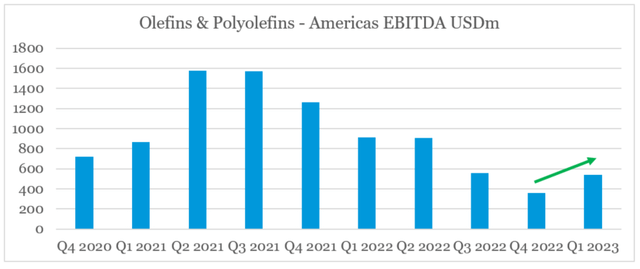

At the same time, in the largest O&P Americas segment, profitability seems to have already bottomed during the last quarter of 2022 as headwinds from weaker demand and higher costs are dissipating.

Prepared by the author, using data from SEC Filings

How Is It Priced?

Having said all that, LYB appears to be doing the right steps toward turning the business around, without sacrificing investments in future growth and securing its competitive advantages. This makes LyondellBasell an excellent roundabout investment for long-term investors. For more information on the roundabout investment process, you can click on the link at the end of this article.

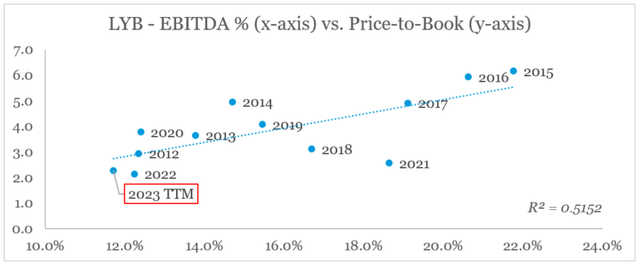

Given all the recent margin headwinds, LYB is also trading at levels that are pricing in even further weakness in profitability. As we see in the graph below, the company's current Price-to-Book ratio suggests that EBITDA margins should be below 12%, which is the lowest level for the past decade.

Prepared by the author, using data from Seeking Alpha

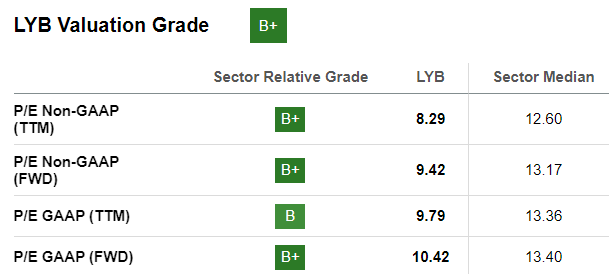

LYB's conservative pricing is also corroborated by the company's low earnings multiples, even when compared to the broader sector.

Seeking Alpha

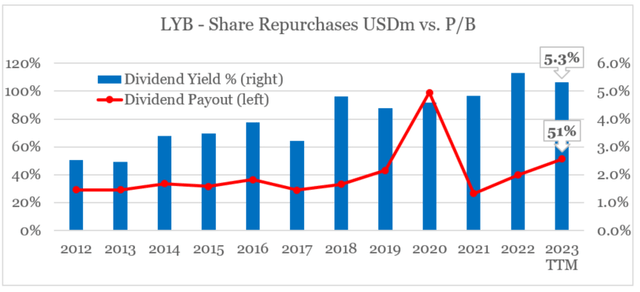

Lastly, LYB's dividend yield of 5.3% (5.6% on a forward basis) makes the company an excellent choice for anyone looking to build a passive income portfolio. Moreover, the payout ratio is also not very far off from the historical average, which would make it easier for the company to sustain its annual payments even in the case of a prolonged recession.

Prepared by the author, using data from Seeking Alpha

Conclusion

After reporting its quarterly results and outperforming both the broader equity market and its major peer, LyondellBasell remains as a solid roundabout investment. Management continues to invest heavily into streamlining the business and solidifying its competitive advantages. At the same time, LYB is still very attractively priced and is offering a forward dividend yield of 5.6%.

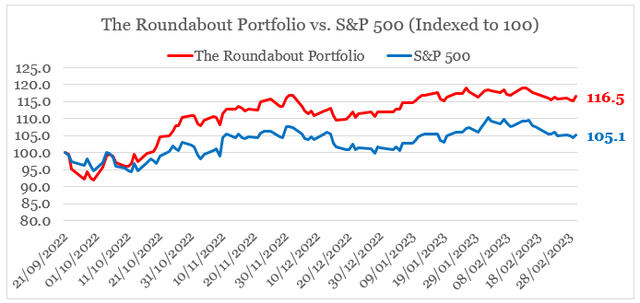

Looking for similarly well-positioned high quality businesses?

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.