JPRE In A Shifting Real Estate Landscape: Assessing Risks And Opportunities

Summary

- We are now well into this tightening cycle, and we've not yet seen much stress in the real estate sector, despite some pressure building up in the regional banking sector.

- If we assume more pain is ahead, one of the best catalysts is probably the deteriorating fundamentals of many REITs.

- A declining return on invested capital relative to the cost of capital and a maturity wall hitting with rates at 5% is the perfect mix to generate higher volatility.

FangXiaNuo/E+ via Getty Images

Investment Thesis

This article examines the current state of the real estate sector, with a specific focus on JPMorgan Realty Income ETF (NYSEARCA:JPRE). The real estate industry has been underperforming lately, indicating concerns about an impending recession. The cyclical nature of the sector is attributed to its dependence on borrowing and vulnerability to interest rate fluctuations. In addition, factors such as declining return on invested capital and upcoming maturities in the real estate sector are raising concerns about potential distress. Lastly, valuations don't provide any margin of safety. Many REITs are yielding less than a 10-year government bond today while being far more risky, especially if the economy slows down from here.

About JPRE

JPRE is an exchange-traded fund that focuses on providing investors with exposure to the real estate sector while aiming to generate a steady income stream. The fund's strategy revolves around investing in a diversified portfolio of income-generating real estate investment trusts (REITs) and other real estate-related securities.

One of the main perks of JPRE is its emphasis on delivering consistent income to investors. By investing in a range of REITs, which typically generate rental income from properties, the fund aims to provide a regular cash flow through dividends. This can be particularly appealing for income-oriented investors seeking stable returns.

However, it's important to note that investing in JPRE does come with certain downsides. The performance of the fund can be influenced by factors such as interest rate movements, economic conditions, and changes in real estate market dynamics.

The table below summarizes JPRE's top holdings. For further information on this product, it's very important to check JPRE's prospectus.

Deteriorating Fundamentals, Expensive Valuations

The real estate sector has been pricing a recession for quite some time now as illustrated by its level of relative underperformance compared to the broader equity market. JPRE is no different and it's so far down more than 3% year-to-date after a dreadful 2022. Since its inception in mid-2022, the fund underperformed the S&P 500, by over 23 percentage points, as illustrated below.

Refinitiv Eikon Refinitiv Eikon

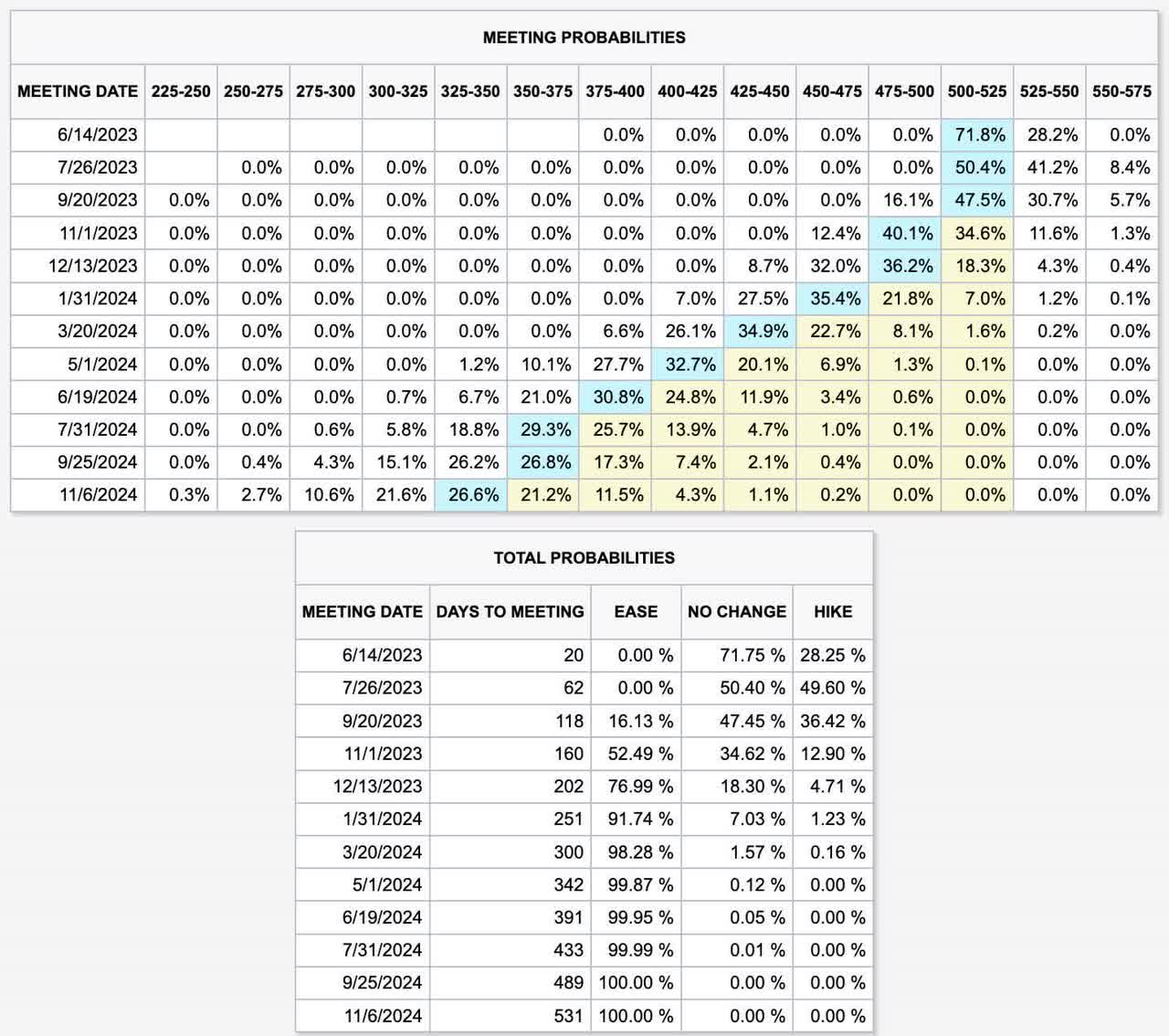

Given the cyclical nature of the real estate industry, it's important to pick inflection points when investing in this asset class in order to maximize your risk-reward ratio. A key component of what makes this sector cyclical is its dependence on borrowing which makes it vulnerable to interest rate swings. In the past 18 months, we've seen the fastest hiking cycles in recent history, with no clear indication that the Fed will pivot and lower rates anytime soon. The SOFR curve is now showing a probability of cuts at the September 2023 meeting. Still, given the resilience of the US economy, and the statements made by Fed officials expressing their commitment to hold interest rates unchanged for the remainder of the year, it's hard to see a scenario where rates would move meaningfully lower over the next six months in my opinion.

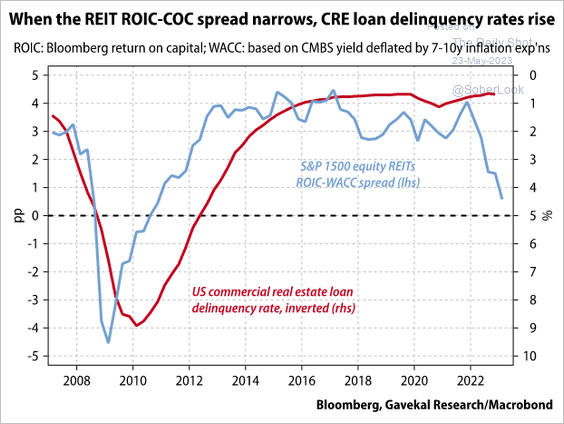

This comes at a moment in time when we have not seen much pain in the real estate sector. Interestingly enough, the regional banking sector was the first sector to really feel the pain of a tighter monetary policy while real estate stocks have fared much better than regional banks so far. However, it's important to note that we've seen the return on invested capital decline since early 2022 relative to the cost of capital for many REITs. This is usually a very good leading indicator of the upcoming pick up in US real estate delinquency rates, which have so far remained resiliently low.

Bloomberg, Gavekal Research, DailyShot

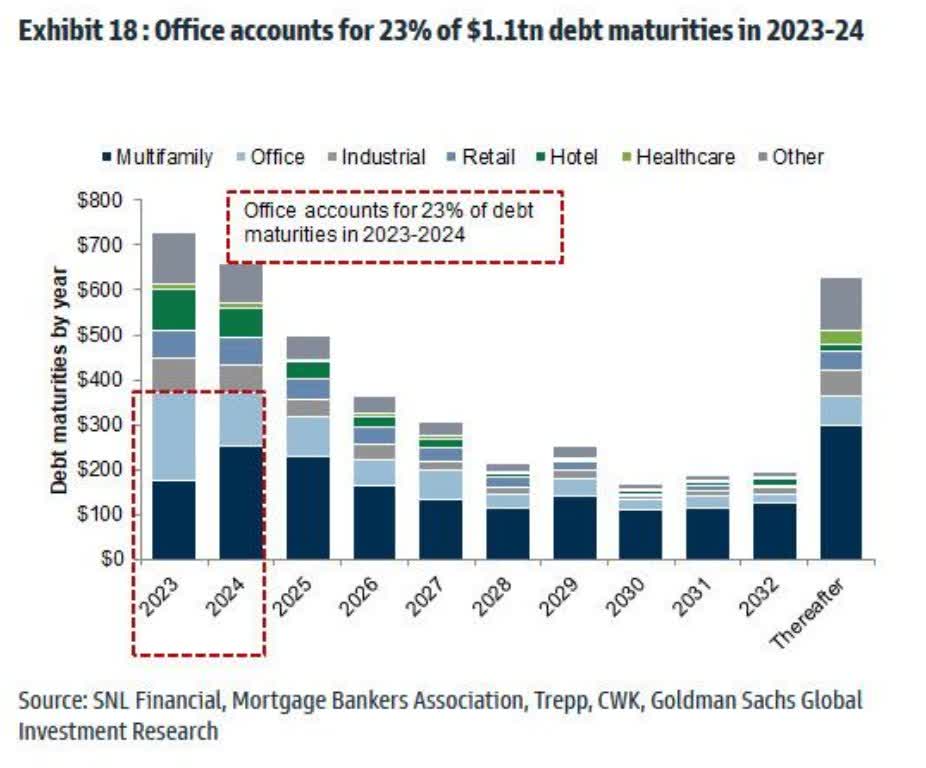

Delinquencies shouldn't be analyzed in a vacuum. In my opinion, they reflect a system that remains capital rich, at least for now. However, the real estate sector is about to hit a wall of maturities in 2023 to 2024 and if rates stay elevated and financing dries up, this could definitely shake some of the weaker players out.

SNL Financial, GS, et al.

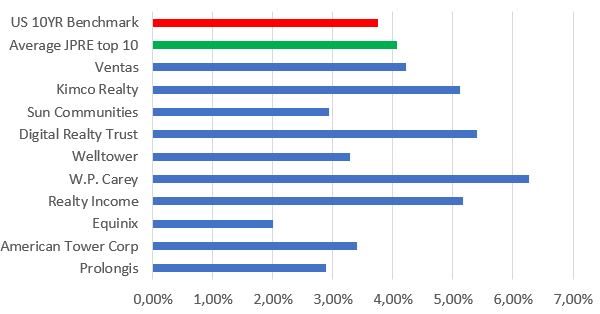

Another issue that I see when it comes to REITs is that they are fundamentally mispriced in my opinion. 10-year U.S. government bonds yield today north of 3.7% (and I suspect they're heading to 4%) whereas the average dividend yield on the top ten JPRE holdings is just slightly above 4%. Equity investors today are therefore inadequately compensated for the risk involved and I don't find the value proposition of many of these REITs enticing enough to justify these valuations relative to a risk-free asset.

Market data from Morningstar, Refinitiv

All in all, the macro picture is not quite bullish at the moment in my opinion, and adding equities here, particularly cyclical ones, is not a very prudent approach. I believe that real estate this time will be no different compared to previous cycles and the current equity risk premium offers a very little margin of error for bulls at these levels. In recent months, we have seen very low levels of volatility in the equity markets but if it starts picking up again, I'm confident that we're going to see lower prices on JPRE.

Key Takeaways

The sector's cyclical nature can be attributed to its reliance on borrowing and susceptibility to fluctuations in interest rates. We are now well into this current tightening cycle and we've not yet seen much stress in this sector, despite some pressure building up in the regional banking sector. If we assume more pain is ahead, one of the best catalysts is probably the deteriorating fundamentals of many REITs. A declining return on invested capital relative to the cost of capital and a maturity wall hitting with Fed Fund Rates at 5% is the perfect mix to generate higher levels of volatility.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.