MGV: Value Likely To Underperform, Consider Alternative Strategy

Summary

- A low beta value category may not be a good choice before a potential bull run.

- The performance of value ETFs such as Vanguard Mega Cap Value Index Fund ETF Shares is likely to be hampered by high valuations and pressure on value-rich sectors like healthcare.

- Instead, investors might pursue high-beta growth ETFs, which are more likely to benefit from the upward trend.

John Kevin/iStock via Getty Images

It might not be the best time to buy low-beta value-focused ETFs like Vanguard Mega Cap Value Index Fund ETF Shares (NYSEARCA:MGV) ahead of a possible uptrend. This is because some of the most important value-rich sectors, such as healthcare, finance, and energy, are vulnerable to a variety of risks, including a sharp drop in earnings. Furthermore, their valuations, which are already above the 5-year high, do not support significant upside movement. Therefore, investors looking to profit from the broader stock market upside might consider other options like growth-focused ETFs.

Bull Market and Value Category Outlook

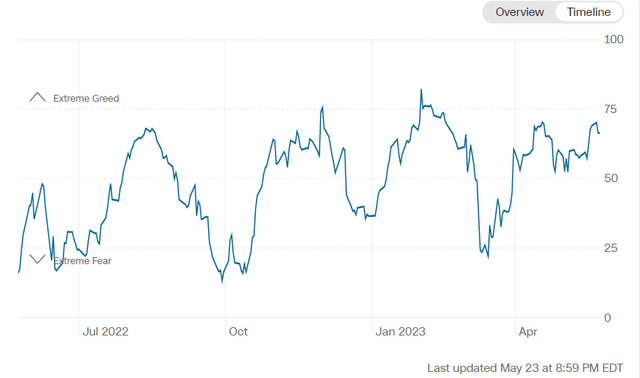

CNN Fear & Greed Index (CNN.com)

According to CNN's fear and greed index, after reaching extreme fear in October 2022, sentiment improved late in the year and turned into extreme greed in the first quarter of 2023. Although confidence fell in late March as a result of a few regional bank failures, it quickly recovered in April and is now hovering near extreme greed levels.

Strong investor sentiment is supported by the improvement in future fundamentals. The market now seems to be confident that the Fed will be able to reduce inflation without sending the economy into a deep recession, suggesting a soft landing and, most likely, the best scenario for stocks to continue their upward trend. Despite the fact that inflation slowed in April to its lowest point in two years and CME data hints at a pause in June, I believe the Fed will most likely increase rates once more in June to add more pressure on the economy before leaving them unchanged in the third quarter. This is because the Fed is still a long way from reaching its inflation target. Whatever the outcome, it seems that the Fed's cycle of interest rate increases is almost at its peak, and stock markets have already felt the effects of one of the fastest rate hike cycles in four decades. Additionally, since markets typically follow expectations and ignore short-term uncertainty, it is likely that the recent uptrend isn't a bear market rally. Moreover, a pause in rate hike policy and potential stability in business activities will support the formation of a bull trend in the second half.

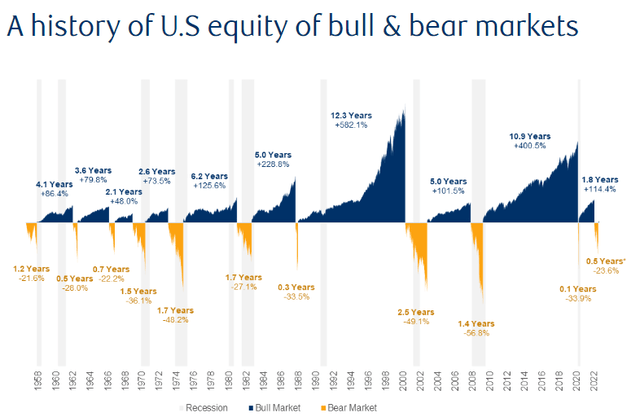

RBC Global Asset Management (Seeking Alpha)

Historical trends also show that after each bear market, the market forms a bull run that can last a decade or more. Given my prediction for the end of the recent bear market and the likelihood of a bullish run ahead, value ETFs such as MGV may not be the best choice. Although value stocks typically perform well in both bull and bear markets, the current market environment doesn't seem to be in their favor. This has started to show in MGV's share price, which is in negative territory so far in 2023 compared to the broad market index's high single-digit gain. Whereas, growth-focused ETFs like Schwab U.S. Large-Cap Growth ETF (SCHG), Vanguard S&P 500 Growth Index Fund ETF Shares (VOOG), and Invesco Nasdaq 100 ETF (QQQM) generated double-digit gains.

Why Value-Focused MGV Likely to Underperform?

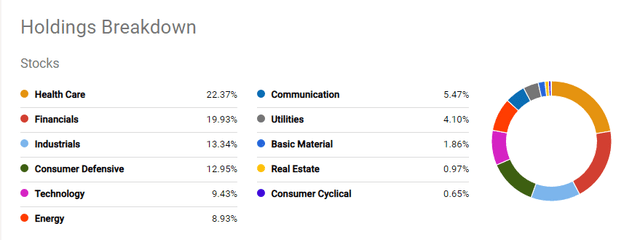

MGV Holding Breakdown (Seeking Alpha)

The S&P 500's value category includes a large number of stocks that are spread across all eleven sectors. MGV's portfolio, for example, is made up of 146 stocks, with the healthcare, financial, and energy sectors accounting for roughly half of the portfolio. These three sectors have been in negative territory so far this year and are likely to remain under intense pressure for a variety of reasons. For example, the healthcare selector is down about 5% year to date due to declining revenue and earnings. As demand for coronavirus-related drugs and testing tools has declined, healthcare companies have been finding it difficult to maintain revenue and earnings growth. Furthermore, inflation and slowing economic conditions have hampered their growth potential.

According to FactSet data, the healthcare sector's earnings fell 16% year-on-year in the first quarter. For example, Johnson & Johnson (JNJ), one of MGV's largest holdings, reported negative GAAP earnings per share in the first quarter. Its stock has dropped nearly 12% year to date. Merck (MRK), another major holding in MGV's portfolio, reported a 34% drop in Q1 non-GAAP earnings per share, and its total sales fell 8.9% year-on-year. Similarly, AbbVie (ABBV) reported a significant decrease in revenue and earnings for the first quarter. According to FactSet, 2023 could be one of the most difficult years for the healthcare sector, with full-year earnings likely to fall by 10%.

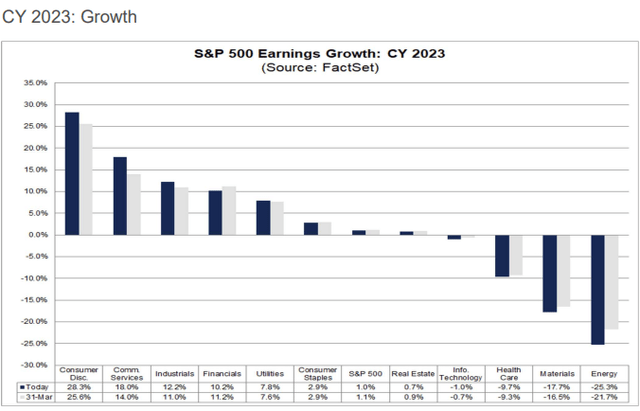

FY 2023 Earnings Forecast (FactSet.com)

Despite prospects for earnings growth, the financial sector, which accounts for 20% of MGV's portfolio, has been under significant stress due to liquidity issues, increased provisions for credit losses, and bad debts. The S&P 500 financial sector is down about 6% year to date, with a high risk of more downside in the coming quarters. A number of regional banks have already failed, and many others are experiencing liquidity problems and increasing provisions for credit losses. The poor performance of the energy sector is another headwind for value-focused ETFs. Oil prices plunged almost by 40% from the previous high with expectations for challenging conditions in the quarters ahead. FactSet data shows that the energy sector will experience a staggering 44% earnings decline for the second quarter and more than a 24% decline for the entire year. I expect a significant price correction for energy stocks in the coming months. Although consumer defensive, technology, and industrial stocks account for a quarter of MGV's portfolio weightage, their performance may only marginally offset the negative impact of the portfolio's largest contributors. As a result, the poor outlook for the largest portfolio members will continue to stymie the value category's overall performance in the coming months.

Valuation and Quant Rating

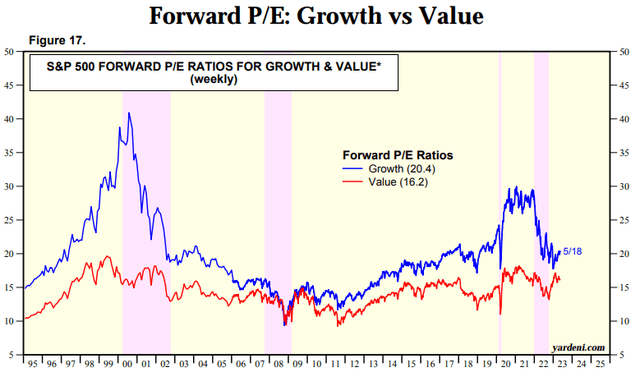

Value Vs Growth Forward PE (Yardeni.com)

Despite the fact that the forward PE of the value category appears to be trading well below growth, it still looks expensive considering historical averages and the financial outlook. The forward price-to-earnings ratio of the value category is currently around its two-year average and remains above the five and ten-year averages. There is also limited room for upside in the value category due to a lack of earnings support.

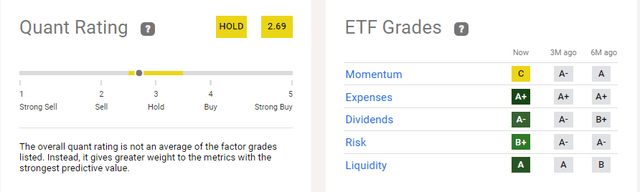

The quant rating also indicates a soft outlook. MGV received hold ratings with a quant score of 2.69. Regarding expense ratio, dividend quality, and liquidity, the ETF appears solid. However, momentum and risk were the most significant factors for a low quant grade. The C grade for momentum indicates that the ETF's share price has underperformed in recent months and that the trend may continue. A high-risk factor score also indicates that MGV's portfolio is vulnerable to a variety of risks.

In Conclusion

During bear markets, value categories generally outperform. They also gain upside momentum in bull markets, but pressure on the financial, healthcare, and energy sectors suggests that value-focused ETFs like MGV may have a difficult year ahead. Instead, chasing growth-focused ETFs like SCHG, VOOG, and QQQM that have the potential to generate solid returns during a bull run may be a wise strategy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.