I See Opportunity In STAAR Surgical

Summary

- STAAR Surgical is on the cusp of an acceleration in earnings and growth courtesy of its entrance into the US market.

- It is profitable, generates positive cash flow, and has zero real debt.

- It's not cheap, but growth stocks never are in the true sense of the term.

- As earnings grow and the valuation unwinds, there is a path to 17% per annum in annual returns over the next 10 years.

- STAA is a buy for investors interested in interesting growth stories.

Sharamand

Most of my writing on Seeking Alpha has centred around the more conservative, value and high yield orientated part of the market. However, there is another side to me, a growth side. In our business we have multiple portfolios that clients can invest in and as you'd imagine one of them is income and value focused hence the recent articles on value names like International Flavors & Fragrances (IFF) & CRH plc (CRH) and income names like NextEra Energy Partners (NEP), HASI (HASI), Segro plc (OTCPK:SEGXF) & Runway Growth Finance (RWAY) and then of course the more conservative steady companies too like Reckitt Benckiser (OTCPK:RBGLY), Haleon (HLN) and SJW Group (SJW).

Today though I'd like to delve a bit into the part of the market that can get your heart racing, those types of companies that can become multiples larger than they currently are and in doing so create the kind of returns that seem like fantasy. There are a bunch of these companies out there. We're all looking for the next Amazon (AMZN), Alphabet (GOOG), Netflix (NFLX) or Microsoft (MSFT) for example. We all hanker for returns like investors have seen in shares like Nvidia (NVDA) this year or Tesla (TSLA) in more recent times, so why not look around and try to find companies that could 'literally' change our lives?

This as you can imagine is a different level of investing, high growth stocks come with their own risk labels and to try and reduce that one must play by a very specific set of rules. I have a 'recipe' I like to follow for investing in these names which I find helps me sleep better and reduces my reflex function for when volatility strikes, which tends to happen often in this space of the market.

More than meets the eye at STAAR Surgical (NASDAQ:STAA)

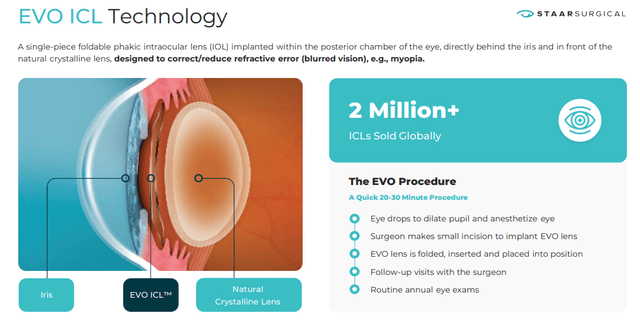

Staar Surgical is one such opportunity in my book, it develops, manufactures, and sells implantable collamer lenses for the eye. They compete with LASIK and PRK in the vision correction industry and have proven that when it comes to corrective ophthalmic options there are real and perhaps even better ones out there than laser eye surgery. This is how it's done:

EVO Technology (Company presentation)

Although not a business that's easily recognisable by name this company is not a newly minted AI corporation or a tech startup. STAA has been in business for over four decades and have sold over two million lenses over this period.

This is a US business however less than 10% of net sales comes from the USA at present, in fact, most of the company's business is done outside of the USA and more specifically in Asia with China and Japan its biggest markets. The reason behind this is quite simple. Its lenses have just recently been approved for use in the US market; in an ironic twist the Chinese (and other markets in Asia and Europe) approved the use of STAAR's products sooner than the US did (around 2015). It was in March 2022 that the FDA approved their EVO/EVO + VISIAN Implantable Collamer Lens (ICL) and Toric Implantable Collamer Lens (TICL) providing US consumers with a serious alternative to both LASIK and PRK.

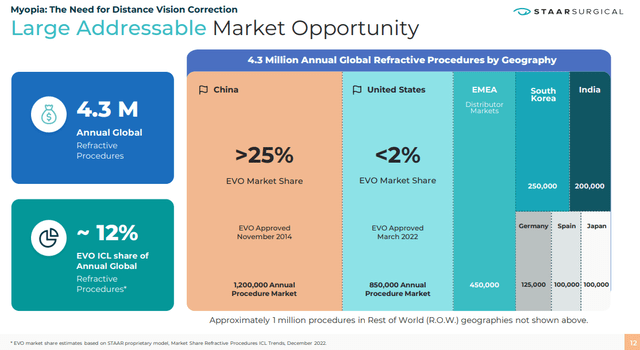

This was a major event for the company as the USA is the number 2 market in the world for Refractive procedures. The company estimates that there are around 4.3m procedures that occur annually around the globe with China and the US accounting for just over 2m of them or a whopping 48% of the global total. China has been the company's bread and butter market for a long time now and they have a market share of over 25% in the country but the US promises to be massive for them if they can crack it.

Refractive surgery stats (Company presentation)

Why now

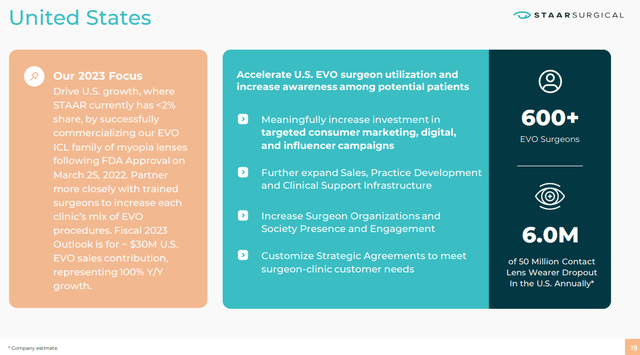

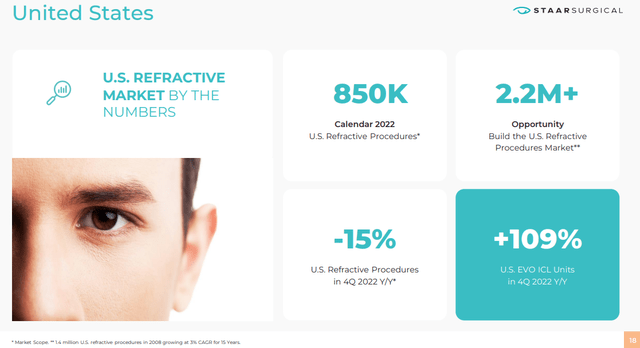

The US is currently a small market for STAA due to the delay in FDA approval primarily and secondly because clients and practitioners alike have tended to prefer the LASIK option. There have been over 30 million LASIK procedures done globally to date, however, Lasik procedures peaked in the US at around 1.5m per annum pre the financial crisis and since then have fallen back quite sharply. The market has yet to recover to is pre 2007/8 highs and as can be seen above the current run rate has been around the 850k per annum mark. The reason for that is that despite the success of LASIK the side effects have put many people off. Dry eyes, night halos and in some cases continued discomfort even after procedures are mostly to blame. This negative feedback has kept many away from the market and glasses and contact lenses have remained popular. As a person that's worn contact lenses before I can tell you that although life changing it doesn't come without issues, scratchiness, dry eyes, irritation, and infection are commonplace here too and this in itself has meant that the number of people using contact lenses has also begun to fall off in recent years. The company estimates that around 6m people in the US alone fall out of the contact lens market annually due to these issues. So, what's a potential patient to do? Well now you can look to STAAR to help solve your problem! So, the company has a huge challenge and concomitant opportunity ahead of it. Pounce on the stagnation of the LASIK market (which has lost massive volume since peaking and remained stagnant for a decade) and the fall off in contact lens usage and the returns could be significant.

USA focus/opportunity (Company presentation)

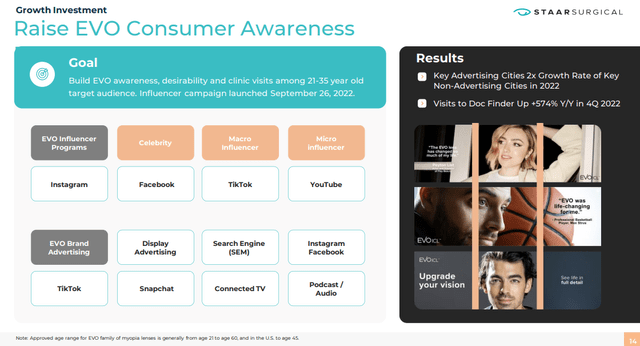

And they are doing that, smart marketing campaigns with celebrities such as Joe Jonas, Peyton List and Max Strus are getting the brand noticed. As are various advertising campaigns across social media both in the USA, China, and other markets.

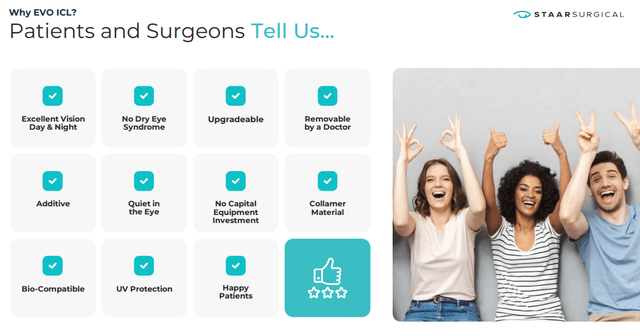

Advertising campaigns (Company presentation)

The message is that the solution is quick, elegant, and reversable. It has no negative side effects like LASIK and is a non-irritant, unlike contact lenses. It even provides UV protection. It's also suitable for short sightedness (Myopia) and from presbyopia (requires reading glasses). They can even solve for astigmatism. My sense is that with the benefits outweighing those of both LASIK and contact lenses there is a real shot that this technology becomes the procedure of choice to correct vision and with that comes massive potential upside. Both patients and surgeons speak very highly of the product too…

Feedback data (Company presentation)

The opportunity

STAAR is a market leader, it has very little competition and its now finally on the cusp of rapid growth and profitability. Regulatory approvals are mostly over the hump thanks to the ability to finally access the US market and regulators are also becoming increasingly comfortable with the use of these products which are driving their global adoption and acceptance. In Europe for example, the use of these lenses was expanded to include the broadest of age groups 21-60 years old and on top of that it also expanded the use of lenses to a narrower cornea.

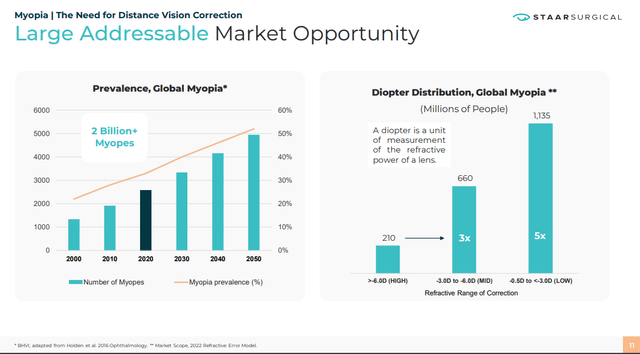

With people spending more and more time in front of screens it is taking a toll on our eyesight. More and more people are suffering from a degeneration of vision. There are estimates out there of over 2bn people that suffer from near sightedness and a further 1.7bn that require reading glasses. This is the size of the market opportunity we're talking about here.

Total addressable market (Company presentation)

On top of this China has in fact made it a mission to correct this. China estimates that about 450m people or roughly 1/3 of the population suffers from near-sightedness. They are now pushing for innovative solutions to address vision problems. STAAR has jumped on this opportunity and in cooperation with a single distributor in the country now sells their lenses successfully in China. So successfully in fact that their market share in the country has rocketed from 2% in 2015 to over 25% now. Agreements in China date back years with clients like Aier Eye Hospital group (SHE:300015), the largest refractive surgery provider in the country rolling out their lenses across their portfolio since 2016.

The US is an obvious opportunity to springboard the company into relevance and perhaps increase is profile considerably. As the second largest market where market shares are still low the upside here could be explosive. Refractive surgeries are considered and elective lifestyle improvement and so aren't paid for by health insurance companies at present. Exposure to developed markets that can support the payment of these surgeries is crucial to its success and the US market is such a place.

Let's not forget the rapid growth they're seeing in other parts of the world too of course, India, Japan and Europe also offer massive opportunities for growth in the medium to long term and the company isn't ignoring them. The US it must be said though as its home market must be considered low hanging fruit and so a lot of attention is being placed on it.

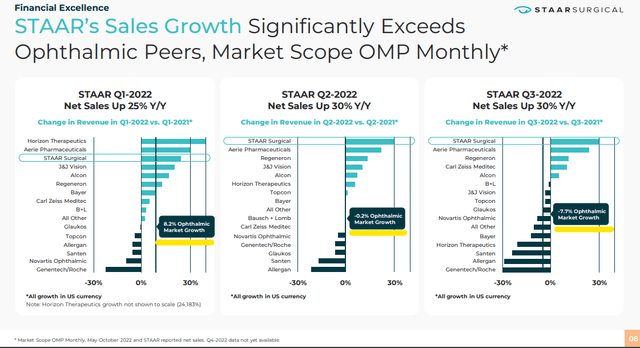

On top of this it has a healthy head start in the space so we can also consider it a first mover. With approved products, a high allocation of cash to R&D, sales & marketing and the international commercialization of its lenses (it has a presence in over seventy-five countries currently) it's on track to grow the market and grow faster than the market and there is evidence for that.

Company growth ahead of peers (Company presentation)

The numbers

We can't talk about any potential investment without looking at the numbers. So, let's dig in a bit here.

USA market stats (Company presentation)

STAAR surgical has been growing steadily and I'd expect its growth to accelerate as its adoption in the US becomes more mainstream. Admittedly, off an incredibly low base we are seeing signs of life in this market. In Q4 2022 growth in the US shot up to over 100% despite the absolute number of refractive surgeries declining by 15% year on year over the same period. Earnings for Q1 2023 were out on the 3rd of May and this is how they looked:

Net sales grew by 16% to $73.5m (in constant currency growth was 20%). ICL sales grew by 20% to $70.6m (in constant currency this figure was 23%) The change in Japanese Yen and the Euro are the reasons for the difference. ICL units were also up 20% but what struck me as promising was the following excerpt from results,

"Strength in our business during the quarter was broad-based across APAC, EMEA and the U.S. In China, ICL procedure volumes increased strongly in the first quarter of 2023 with end-market procedures reaching a record level. We are maintaining a keen focus on execution against our targeted priorities and anticipate accelerating sales momentum as we move through the year. We are therefore raising our outlook for fiscal 2023 net sales from $340 million to approximately $348 million, which includes approximately $3 million of Other Product sales in the first quarter. Our updated outlook represents 28% global ICL sales growth year over year."

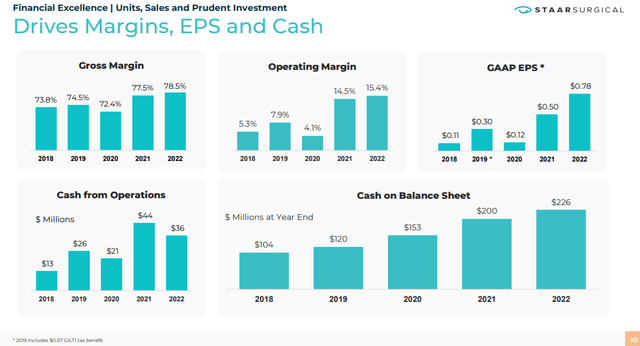

Over and above this margin expanded too. Gross profit margins (GPM) rose to 78.3% from 77.9%. Yes, you read that right, this company has a GPM of almost 80%. Even a medical device company with an entrenched monopoly like Intuitive Surgical (ISRG) can't boast gross margins that high. Operating expenses also pushed up as general & administrative expenses, selling & marketing expenses and R&D were lifted to help the company with its push into the US and its other growth programs in the other markets it participates in.

These higher expenses ate into EPS with the company delivering $0.05 in earnings per diluted share vs $0.19 in the prior year quarter. Adjusted net income in Q1 settled at $8.7m vs $14.4m in the prior year quarter.

Importantly the company had cash, cash equivalents and short- and long-term investments available for sale of $217.3m on the balance sheet. (Six percent of market cap) and zero 'real' debt.

This is a company that's always been run very conservatively and unlike many 'growth' stocks out there is not loss making, debt ridden and full of things like stock-based compensation.

The thing about growth stocks is…

You can't value them like established and mature businesses because most of their cash and earnings are being redistributed straight back into the company. This is not uncommon in the growth space in fact it's a feature and you must look beyond it well into the future to appreciate the impact this can have on the value of the business long term. I'll illustrate the point.

In the case of STAAR they generated $73.5 million in net sales in Q1 2023. They then spent almost 36% of that on selling & marketing, 24.7% went to General & Admin expenses and 14% went into R&D. Put differently of the $57.5 million in gross profit earned they spent $54.7m of that on the items above. This then left just $2.8m in final operating income. They earned almost the same amount in interest income ($1.822m) from their cash over the period.

So, on the surface here you see a company delivering just $2.7m in net income after all of this in the quarter which translates into a paltry $0.05 in earnings. At the current price of $59.00 that would imply a PE of almost 300x earnings assuming they earned 20c for the full year. (Not my base case)

With its guide of $348m in net sales for this year that would also imply a price to sales of about nine times at present which again doesn't screen as cheap.

What you need to do in this space is look at some historic trends, make some bold extrapolations into the future and then scale them back with a healthy dose of realism and scepticism.

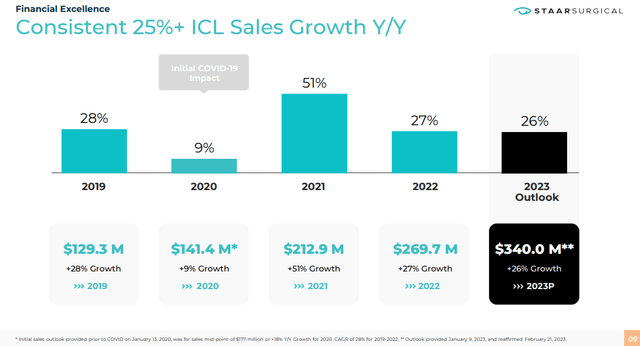

Financial performance over time (Company presentation)

So, we have a steady sales growth history of over 25% per annum over the last 4 years with a forecast of 26% for 2023. Can we expect this sort of growth rate to continue for the next 5 years? Yes, is my answer with traction in the US and ongoing success in the other countries STAA operates in I'd suggest this is doable. (Even conservative). Looking at seeking alpha screens forecasts look like this going forward:

Revenue Forecasts (Seeking Alpha)

Assuming this is accurate, and the company maintains its current trajectory as can be seen below we're likely to see a considerable increase in earnings going forward.

Earnings stats (Company presentation)

I'd also suggest that growth in the expense line on general and administrative, selling and marketing and R&D will also rise to ensure the company builds its brand, its moat and keeps up its momentum. We're assuming here that the business will more than double in size over the next five years and although they are the top dog in the ICL space now if they do keep succeeding it won't go unnoticed by the competition so this spend will be important to it retaining its competitive positioning. The point here is that earnings power will remain constrained if they do that because they'll keep putting cash back into to business to fund growth.

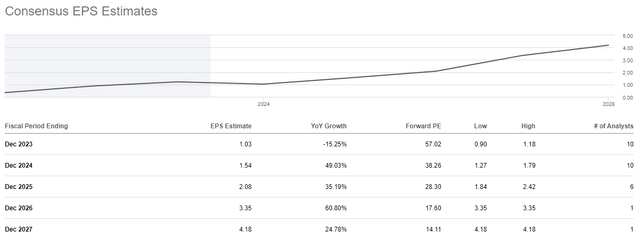

Even in this scenario analysts are expecting earnings to grow substantially. As per seeking alpha screens the outlook is currently as follows:

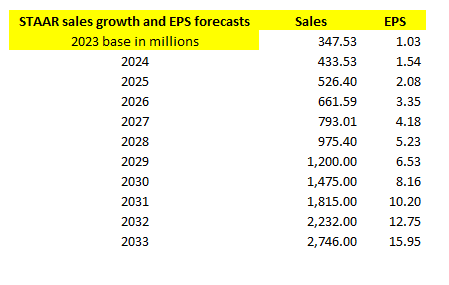

Its PE as you can see unwinds quickly and so does its price to sales. So, in 2027 its price to sales would be 3.5 and its PE would sink to fourteen times earnings. (Just one person providing forecasts for 26/27, bear that in mind)

What would the state of market be like then? Well, this is where you need to extrapolate a bit. The US market is currently running at 850k procedures per annum. They have less than 2% of that market now. What will their market share be in 5 years? 10%? 20%? More than that? At the same time if the market takes to the product and the overall market starts recovering back to its pre-crisis highs of 1.5m procedures per annum and they still maintain similar market shares of 10/20% then we could be talking about 150k to 300k procedures per annum in only the USA. To date the business has sold 'just' 2m ICL's across the globe. You see where I'm going with this? The company believes that the US can maintain over 2m procedures per year as its 'true market opportunity'.

So fast forward not just five years from now but 10 years from now and you have the potential for the following:

China 450m people suffer from short sightedness as per Chinese government and they are pushing for action to resolve this.

US potential market of 2m people per year that might choose refractive procedures.

Rest of world? Well with 2bn people worldwide suffering from short sightedness and 1.7bn requiring reading glasses the market size is massive.

Now in context this company has sold around 2m ICL's globally so far in its history.

In ophthalmology one procedure is one eye, so each patient requires two units (usually)

One percent of the Chinese market is 4.5m patients, which equates to 9m units. Would it be completely unfathomable to think they could get to a 10% market share there over the long run? 10% is hardly monopolistic? And its below current run rates of 25% market share, so I'm actually assuming here that they give back some share over time (being conservative). That would imply a market opportunity in China of 90m units.

How about the USA? Well, its home turf so I'd expect solid traction now that it's got approval there. Ten percent of the US market means 85k patients (170k units) per annum at current rates, 150k (300k units) per annum at previous peak rates and 200k (400k units) per annum at what the company thinks is market potential rate. Again at 10% market share they're not 'cleaning up the market'.

The numbers can get a bit eyewatering from here but, they could do just in China and the US every year what they've done in their entire history so far i.e., 1m patients per year or 2m units. Ironically, that would still be a fraction of the market and of the opportunity ahead of them.

That's precisely why growth stocks always look expensive people make such assumptions and then the price trades at a premium as it starts to reflect this potential.

Last year the company delivered sales of $284.4m, had a gross margin of 78.5% and had full year net income of $ 0.78 per share. Seeking Alpha forecasts out to FY2027 expect earnings of $4.18 per share on turnover of $793m.

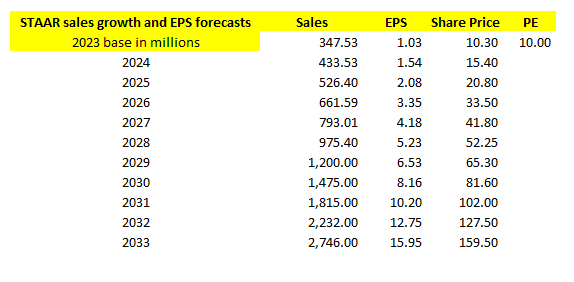

Maintaining those kind of growth rates out to 2033 means revenues of around $2.75bn by that time and EPS of roughly $15.95.

Extended Sales and EPS forecast (Analyst)

This is the fun part, where would the share price at that time? What would you value a company at that has grown revenues by 23% per annum for 10 years and EPS at 25% per annum for the same period? Ten times earnings?

Share price extrapolation (Analyst)

This is exactly why investing in growth stocks can be so confusing and why many people miss them and the returns they can deliver. Assuming all these 'wild assumptions' I'm making turn out to be accurate and the company then fetches ten times earnings in 2033 you could expect a share price of $159.50 vs $ 59.00 today. That's 170% over 10 years or a simple average of 17% per annum vs a long-term market average return of 9%.

In today's money however at ten times earnings its worth just $10.30 so you are wildly overpaying for this business at $59.00 per share. The problem is that growth investors see the potential in the company and so are willing to pay a premium to get access to the growth engine. It's highly unlikely that unless the wheels fall entirely off the company or the economy that you'll see that $10 price point. Companies with this sort of potential always seem expensive on a PE basis that's why Amazon (AMZN) still trades on a PE of 75 despite delivering a return of 757% over the last 10 years!

Is my assumption above outlandish?

Last year the company delivered 516k units or served 258k patients. The forecast in the Q1 guidance is for growth of 28% in sales which if carried into ICL units would imply volume of 660k units this year.

To get to our 10-year forecast of $2.75bn in revenue would mean roughly 2.62m procedures per annum by 2033. Sounds like a lot but they're doing 660k this year already, so we'd need the number of patients to continue to grow at a steady clip over the next 10 years. It's possible.

In the US they managed just 15k Units last year (7500 patients) off a current annual base of 850 000 patients.

As you can see there are a whole lot of ifs and buts when it comes to growth investing but at the end of the day you don't have be right to make a ton of money you just have to be in the ballpark. I compared STAAR to Intuitive Surgical earlier in the note not because they're comparable from a product perspective but from a potential market dominance perspective there may be some parallels. Perhaps we could look at the growth and valuation of a company like this to see where we might land up with STAAR?

Over the last 10yrs ISRG has grown revenue by an average of around 14% per annum, profits have grown by about 17% per annum. Its average PE over the last 10 years has been over fifty times earnings and its share price return has been an eyewatering 444%.

My assumptions for STAAR might seem outlandish but at the same time I'm expecting the PE to drop to ten times in 10 years? What if it doesn't? what if it settles at twenty times? after all, ISRG has grown earnings and revenues by a slower pace than I'm expecting and its currently at fifty-five times?

Of course, my assumptions could be wrong and maybe growth is slower than I thought. Could still fetch twenty times earnings if its long-term growth rates are 15% per annum? Maybe my growth forecasts are too low, and my PE assumption is too low which means my 10-year target price of $159.50 is way too low?

The moral of the story is we don't know what the future could bring but with so much optionality and opportunity for a company like this, you don't have to be right on the figures but right on the trend. IF the trend is there alongside the market size, the scope and the opportunity then you can make some crazy assumptions and even if you're not exactly on point but you've caught the wave the returns can be extremely satisfying.

For what it's worth I do think these assumptions are conservative. I'd only expect a company like STAAR to trade at ten times earnings once it's saturated its opportunity and it becomes a cash cow with an entrenched base and consistent or slow and steady growth. That seems too far into the future to contemplate right now in my view.

Conclusion

STAAR surgical is a high growth stock that is on the cusp of an acceleration in growth thanks in part to its eventual entry into its home US market. Unlike many other growth stocks, its profitable and debt free. It also has over 6% of market cap in cash on its balance sheet.

With a massive growth runway ahead of it I'd suggest this is a stock worth owning for the long run. Due to the volatility inherent in stocks like this I'd start my position small and add to it incrementally over time as the thesis plays out. I rate STAA a buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.